Despite the price being not fully confirmed, Shiba Inu’s latest on-chain snapshot is conveying a message that “is easy to ignore if you just look at the chart exchange-related activity is changing” and it is in reversing ways that often precedes tradable recovery. It is the most loudest indicator of exchange outflow acceleration, and it’s the largest one in a to know what an individual can do.

Shiba Inu gains strengh

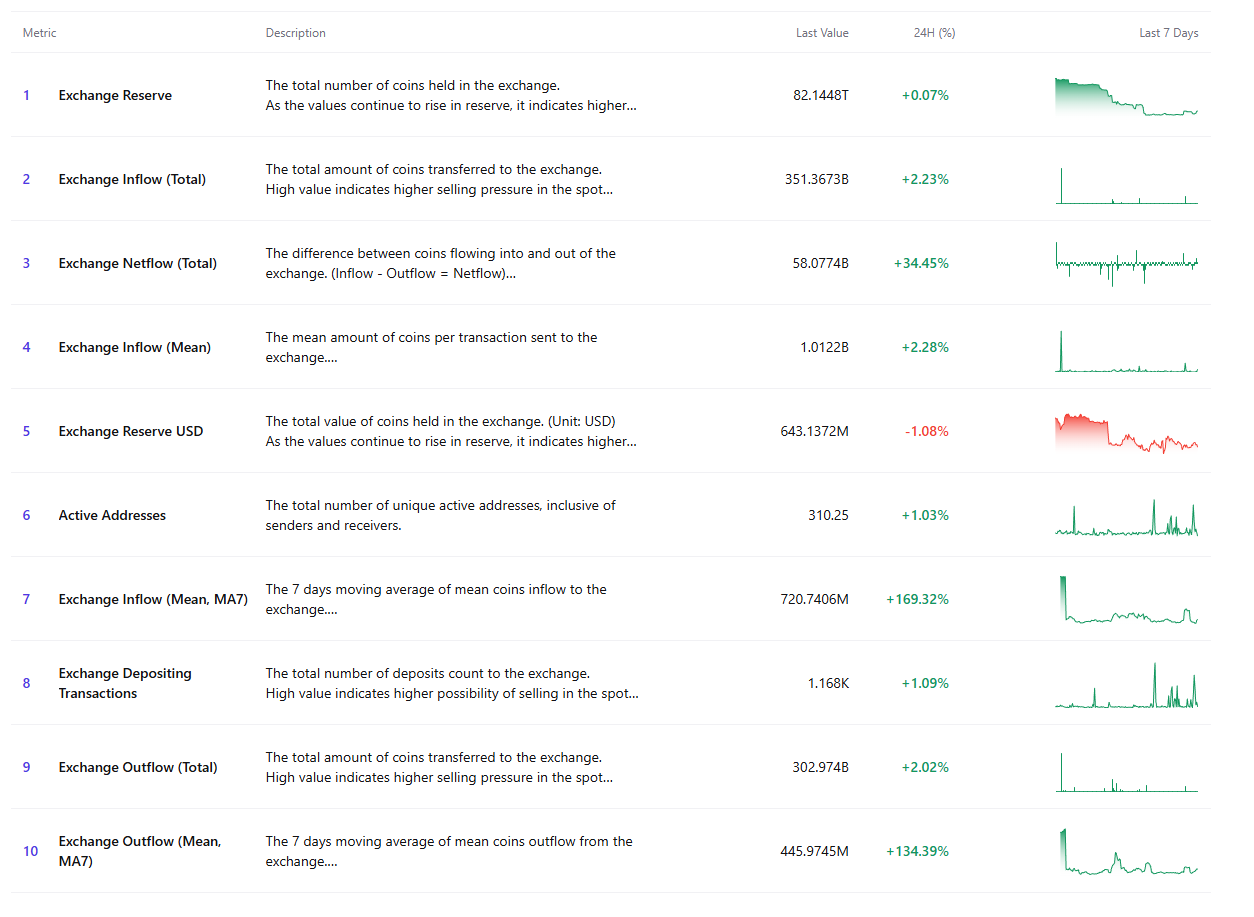

A total outflow of exchanges in the last seven days has risen by +134%, and overall (302 billion+++2) is also up. A. , 02%) has been quoted as saying ‘It is not true that this means we have a second-hander and it will be an important part of our life? Rather, just like that, more SHIB is leaving exchanges (usually correspond to less immediate sell availability and greater hold position) are generally associated with this type of offer. When combining those and more active addresses (310) are added to that, s become increasingly active. +1, 25, +1. That’s the market you have, if not quit and still participate in (or continue to do) for 03 per cent. The inflow side of the is still alive, but it remains alive.

net flow – inflow (influence minus outflow) to 58. +34 (+74 billion), 0774 bn) (0774 Bn). Four-four percent) and 351 billion (+22) total exchange inflow (4%), while. 23 per cent) . It’s not a clear-cut one-way bullish signal, because some participants are clearly sending tokens to exchange for the token (which may indicate distribution attempts or hedging).

Reserves plummeting

Yet it needs context; flow is more important than headlines, and flows are a matter of context. The most common metrics you would like to lead are outflows and their moving averages (which are growing rapidly). One of the most encouraging facts is that while the coin-denominated reserve is essentially flat, the exchange reserve in USD is marginally lower.

If position is subtly improved and price remains suppressed, that can be a combination of that when it comes to positioning but still with price. Zoom out to see the chart SHIB is still in a wider downtrend and remains under strong moving-average resistance, but it’s trying to establish based base with. support line that tilts slightly upward at least partially?

When this is maintained, the price can begin reclaiming the faster averages and may eventually lead to strength in on-chain coins leaving exchanges. Ultimately, the market is not overjoyed but the plumbing looks more attractive than the candles. Unless these outflow-heavy conditions continue, SHIB has a real chance at regaining leg – as long as the buyer provides follow through rather than short spiky capital injections.

Thanks for reading +134% for Shiba Inu (SHIB): 9 out of 10 Metrics Bullish for Once