July 2025: Remember the name. Bitcoin didn’t just break records; it shattered them, soaring past $120,000 in a dizzying climb. Fortunes weren’t just made; they were minted overnight. For countless long-term believers, this wasn’t just a rally; it was the culmination of unwavering faith, transforming ordinary investors into instant millionaires.

July was a month of extremes: scorching gains overshadowed by unprecedented liquidation losses. Open Interest swelled to dizzying heights, a ticking time bomb for traders. Beyond Bitcoin and Ethereum, a swarm of altcoins now lurk as potential wrecking balls, ready to unleash chaos on derivatives markets as volatility spikes.

1. Solana (SOL)

Solana’s surging popularity is reflected in a massive influx of capital. Open Interest on Solana hit $7.9 billion in July, according to Coinglass. That’s the highest level since January 2025, when SOL was hitting record highs of $294, signaling renewed investor confidence and bullish sentiment.

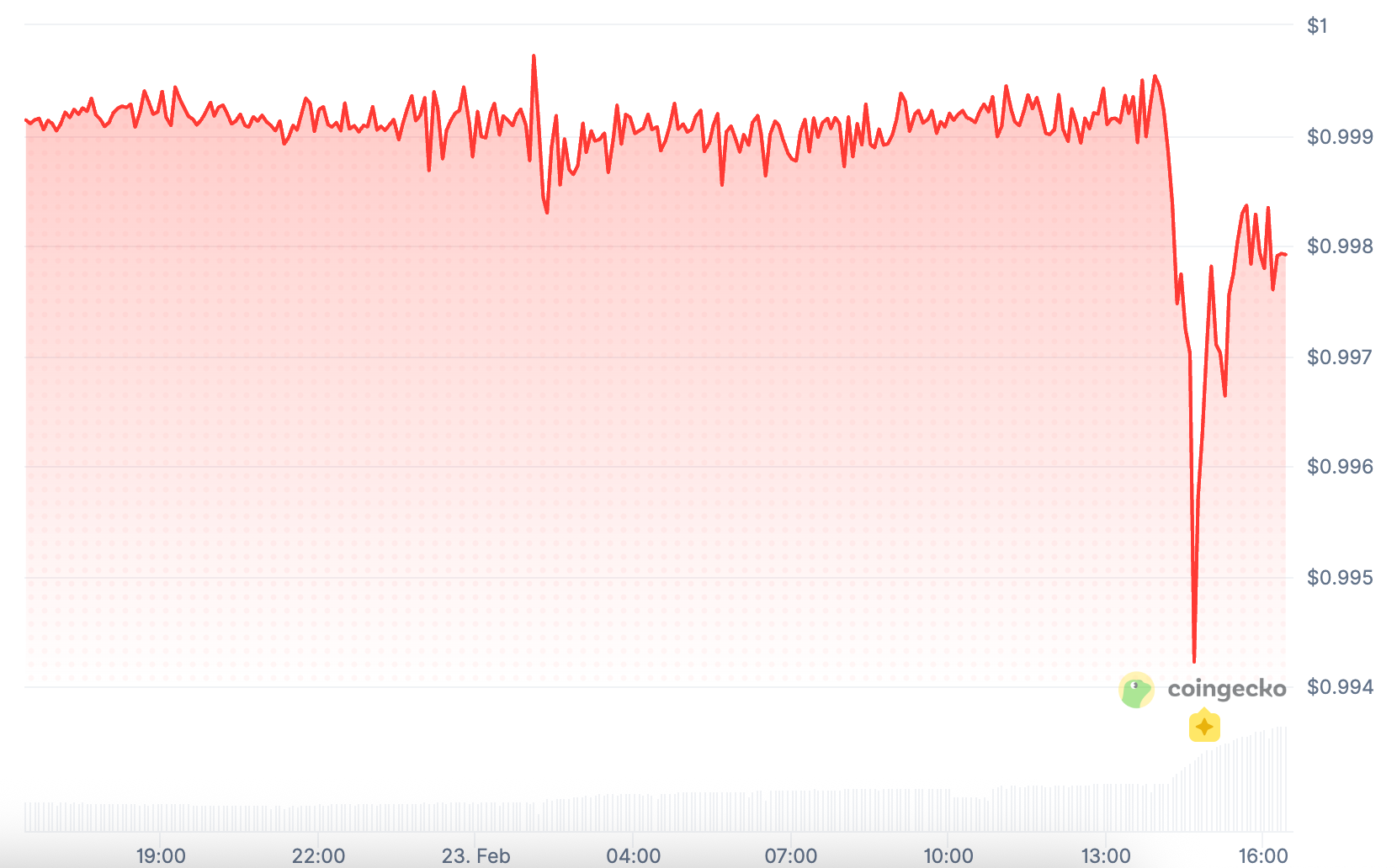

SOL’s liquidation map paints a stark picture: bulls are betting big. A sea of long positions dwarfs the shorts, revealing a market leaning heavily on continued upward momentum. Leverage is maxed, and wallets are open, all fueled by the expectation of imminent gains. But is this confidence justified, or a precarious perch before a potential plummet?

SOL teeters on a knife’s edge. A plunge below $150 could trigger a $1 billion long-squeeze. Prepare for a potential 10% bloodbath from its current $167 perch.

Solana Exchange Liquidation Map. Source: Coinglass

Solana’s future just got a whole lot murkier. While technical indicators whisper of a bullish five-year surge, a dark cloud looms. FTX, under immense pressure from creditors, just unleashed nearly 190,000 SOL tokens – a $31 million wave – onto the market. Will this tidal wave crash Solana’s nascent recovery, or can the ecosystem weather the storm? The fate of SOL hangs in the balance.

2. XRP

XRP is making waves, as its Open Interest surges to $7.6 billion mid-July, breathing down the neck of its January peak – a mere $250 million separates the two. Is a breakout brewing?

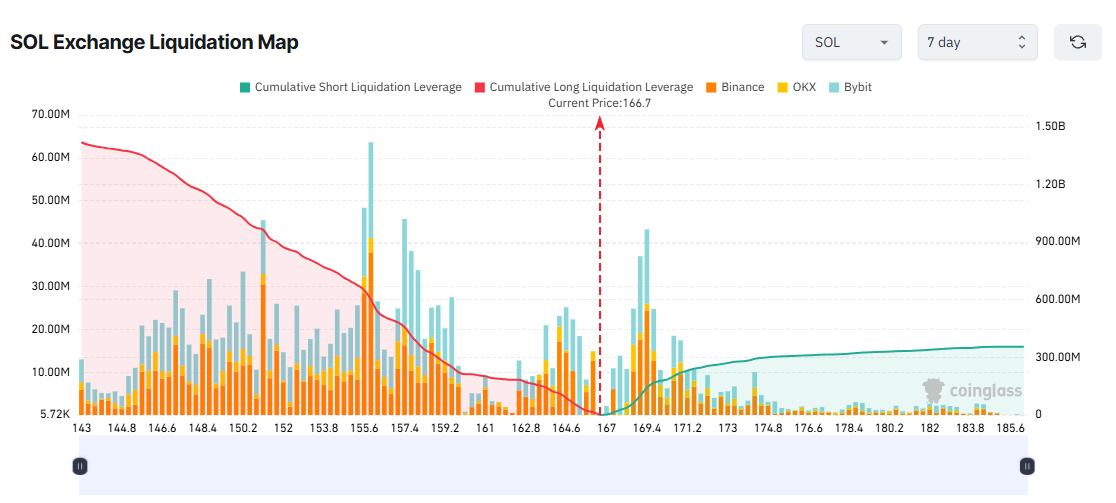

XRP’s liquidation map paints a bullish picture, hinting at further price surges. The sheer disparity between long and short liquidations reveals that short-term traders are betting big on continued upward momentum.

XRP Exchange Liquidation Map. Source: Coinglass

XRP teeters on a knife’s edge. A drop below $2.50 could trigger a $500 million long position liquidation cascade. Buckle up, because XRP’s history is paved with volatility: gut-wrenching 20-30% price swings are practically its signature move.

Furthermore, recent analysis suggests XRP’s rally may be losing momentum, as some traders could be preparing to take profits.

3. Hypeliquid (HYPE)

Hypeliquid (HYPE) blazed through July, hitting a record $2.1 billion in Open Interest! Are the bulls stampeding? Signs point to YES! The Long/Short volume ratio – plus the whales (top accounts on Binance and OKX) leaning heavily LONG (ratio >1) – paints a picture of short-term bullish domination. Get ready for a potential HYPE surge!

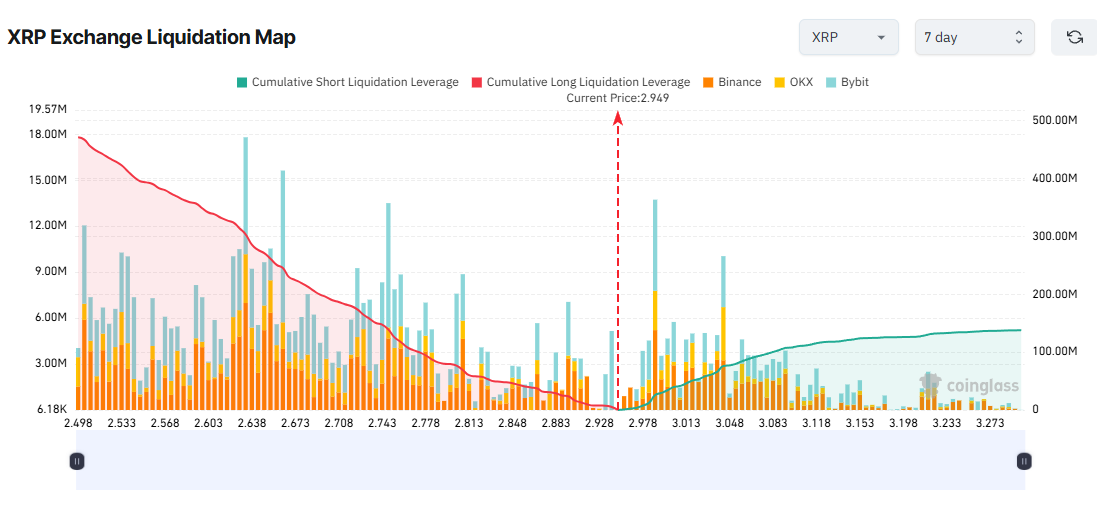

HYPE is on a six-day tear, smashing records with a fresh peak at $49.8. But beware the Icarus effect! Bulls are charging hard, loading up on long positions. This frenzy could fuel a sharp reversal, leaving leveraged traders vulnerable to a painful liquidation.

HYPE Exchange Liquidation Map. Source: Coinglass

The liquidation map shows that over $60 million in cumulative long positions could be liquidated if HYPE drops below $43.

HYPE danced in lockstep with Bitcoin this July. Now, with BTC soaring past $122,000, the stakes are higher than ever. A Bitcoin stumble could send HYPE tumbling into a liquidation abyss.

The Crypto Derivatives Market is Hotter Than Ever

Bitcoin’s Wild Week: Futures Trading Blows Spot Volume Out of the Water!

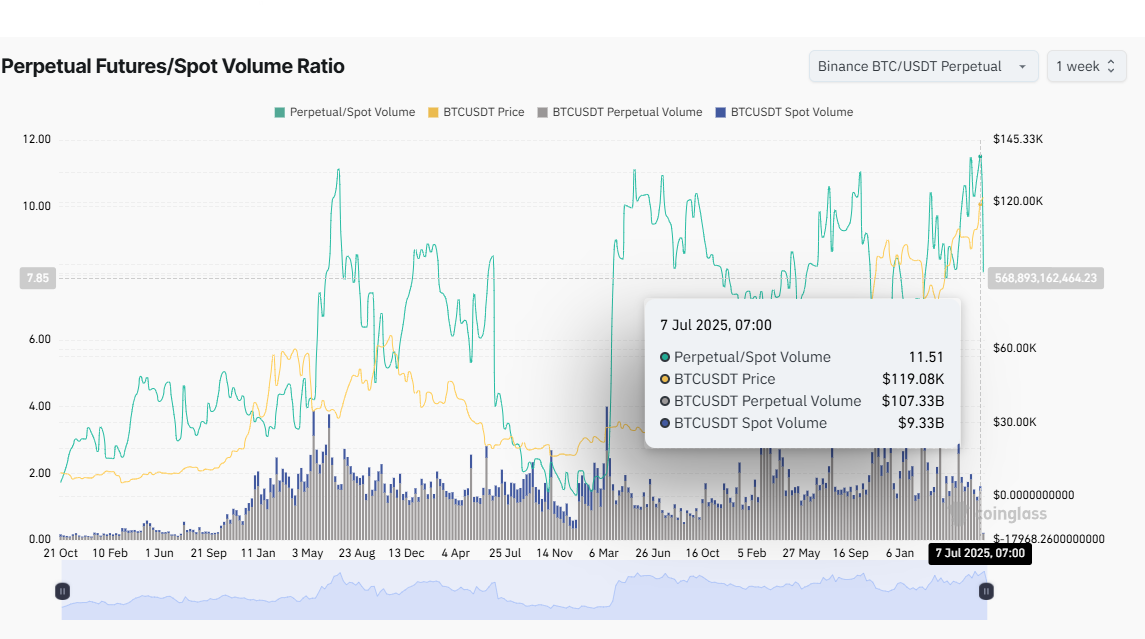

Coinglass reports a seismic shift: last week, Bitcoin futures trading volumes exploded, dwarfing spot trading by a staggering 10x! The Perpetual Futures/Spot Volume Ratio smashed records, hitting an all-time high of 11.5. Is this a sign of institutional frenzy or a dangerous game of leverage?

Bitcoin Perpetual Futures/Spot Volume Ratio on Binance Weekly. Source: Coinglass

Crypto’s pulse is racing: on July 14th, open interest surged past $187 billion, painting a new all-time high. This colossal figure reveals the sheer volume of outstanding crypto contracts still in play, a breathtaking testament to the market’s feverish activity.

It reflects investor participation in both altcoins and Bitcoin at the moment.

Bitcoin Open Interest. Source: Coinglass

While the bull market rages, a shadow lurks: traders are flocking to derivatives over spot markets. This surge in leveraged positions isn’t a sign of strength, but a flare warning of potential, devastating liquidations on the horizon.

“In the past 24 hours, 127,894 traders were liquidated. Total liquidations reached $732.59 million,” Coinglass reported.

The bloodbath continues: Crypto liquidations have exploded past $700 million in the last 24 hours, with short sellers bearing the brunt of the carnage.

Thanks for reading 3 Altcoins at Risk of Major Liquidations in July