The crypto stocks are soaring higher, the first being Circle (CRCL), which jumped over 18% today alone and is more than 400% since the IPO. The rusty kind of secret: explosive adoption of USDC and strategic cross-chain expansion. Coincidentally, Coinbase (COIN) and Robinhood (HOOD) are also riding the wave, showing a powerful comeback for crypto-linked equities.

The two stocks are flashing green for now, but is this rally going to hold on? The COIN is enjoying its newly launched products along with the regulatory tailwind from across the Atlantic. Meanwhile, HOOD is flirting with all-time highs after its outrageous 102%-plus year-to-date surge. Both these public-listed companies are sitting on some crucial technical tests. Will the bulls hold the reins, or are these stocks hitting the zenith? Investors are now holding their breaths to witness whether the momentum can drive on.

Circle Internet Group (CRCL)

Circle is aggressively trying to expand its empire of stablecoins onto two critical battlegrounds: seamless network integrations and explosive cross-chain growth. In their latest power move, they are bringing native USDC support to the XRP Ledger (XRPL), a conductivity that really killed the painstaking bridges. Now, developers or institutions can just directly use the blazing-fast, ultra-low-cost USDC transfers of the XRPL, with the possibilities for DeFi completely wide open.

May was by far the hottest month firms in the stablecoin bridge space besides Circle, which launched the Cross-Chain Transfer Protocol (CCTP) that broke records with a huge $7.7 billion in volume an 83% surge that completely overshadowed April.

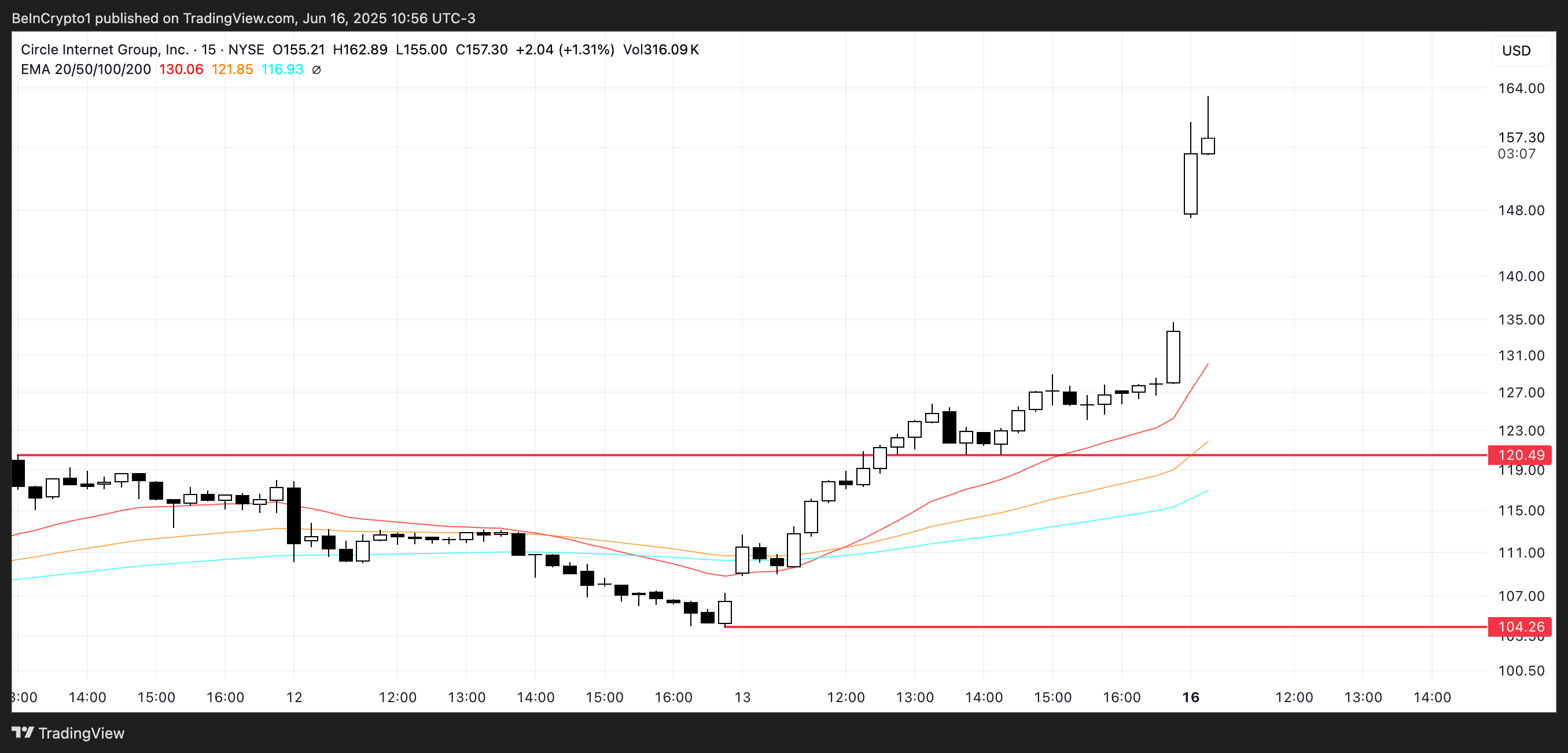

CRCL Price Analysis. Source: TradingView.

This must be one spectacular skyrocket for Circle’s stock, CRCL. In the aftermath of the IPO, its shares have climbed some 404%, following an 18% jump in the first-day trading. Investors’ bets are heavily on Circle.

The company’s refusal of Ripple’s $5 billion acquisition offer, combined with its expanding institutional partnerships, has fueled bullish sentiment.

Circle (CRCL) is in the news lately. Around the $158 range on the price scale, there are some Wall Street stargazers seeing possibility in the prices climbing to $300 given the dominance Circle holds in the realm of stablecoins. However, if the upward thrust sputters, a safety net awaits near $120, marking a critical support level to watch.

Coinbase Global (COIN)

Coinbase (COIN) is gaining renewed attention as it continues to strengthen both its product offerings and global regulatory presence.

Attention Shopify merchants! Just a few spicy partners-shaped ingredients entered the pot: Seamless USDC stablecoin payments from within the Base-powered checkout offered by Coinbase, Stripe, and Shopify. There is no need to enter into complicated configurations so you can accept payments in crypto. You can get paid in USDC or immediately convert it into your local currency-how wonderful! Now, crypto commerce is something real!

Coinbase is getting ready to enter the European market. According to sources from Luxembourg, the company stands to receive a full-fledged EU crypto license, the golden ticket under the new MiCA rules. Obtaining the license from one member state will open doors for the crypto exchange across the European Union.

COIN Price Analysis. Source: TradingView.

With rising investor enthusiasm, Coinbase (NASDAQ: COIN) stock rose by 2.7% today. The record revenue growth of 76% year-over-year and introduction of new products at their State of Crypto Summit have spurred this rally. Rosenblatt Securities, continuing their bullish view on the stock, have maintained a “Buy” rating with a price target of $300. Is Coinbase going to dominate the digital asset space?

This surge supports the bullish, resurgence theory for Coinbase, which may easily break out above $265 and head to $277. For this, the momentum has to hold; presently, the low volume has created talk of a fantastic buying opportunity and must not be worrying.

Robinhood Markets (HOOD)

Robinhood is defying gravity! The stock is soaring a whopping 102% this year, comes near all-time highs, and has left all other fintech stocks behind.

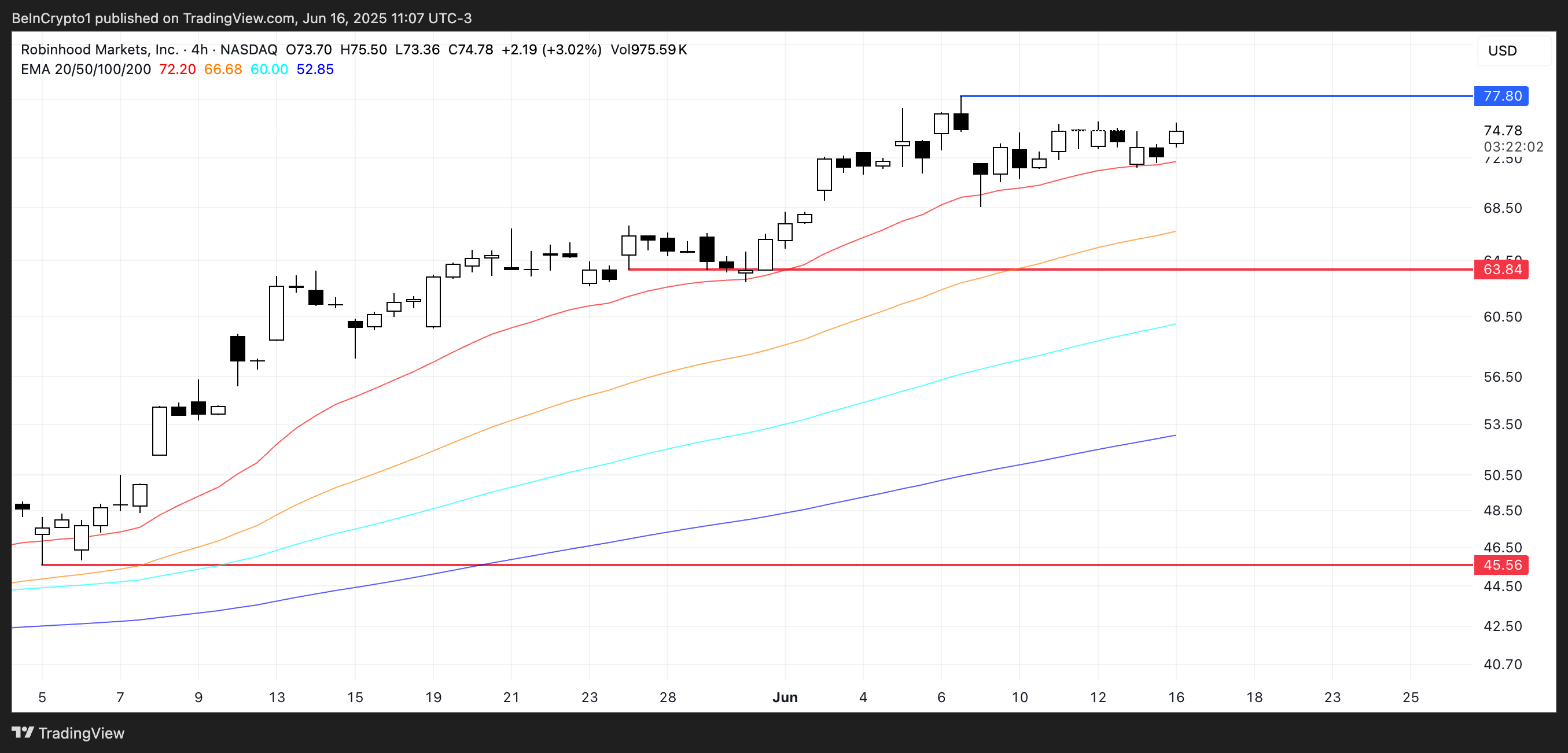

Its Exponential Moving Averages (EMAs) remain firmly bullish, with short-term averages well above the long-term ones, signaling strong underlying momentum.

“Robinhood’s stock price is flirting with a major breakout. If the momentum sustains, it would rapidly move to test the resistance at $77.80. A break above this level would engage bullish energy toward the $80 mark, thereby engraving new all-time highs and consolidating the upward trajectory into the sky.”

HOOD Price Analysis. Source: TradingView.

However, despite the bullish structure, investors should monitor key support levels closely.

The $63.84 support zone is critical if broken, it would likely signal a loss of momentum and a potential trend reversal.

In that case, HOOD could decline sharply, with $45.56 as the next significant downside target.

Thanks for reading 3 US Crypto Stocks to Watch Today