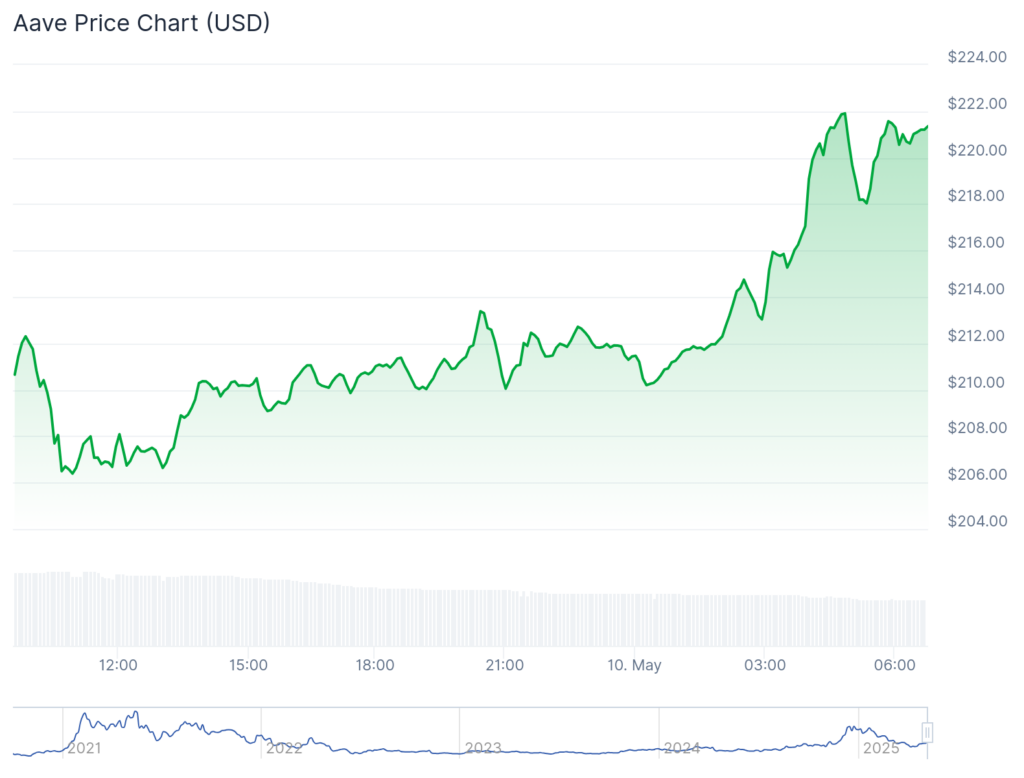

A Saturday price surge pushed AAVE price to levels not witnessed since early March, with exchange reserves fast depleting and lending tightening on its decentralized empire.

No! No holding things down for AAVE. From a low of $221.91 on April 7th, the almost-defied DeFi darling has surged 95% to push beyond $3.3 billion in market capitalization. And that is no mere growth: it’s a statement!

That sly siren song of AAVE doesn’t fail to pull in investors. CoinGlass latest data reveal a surge in the accumulation of AAVE, with Ethereum as the prime mover. ETH’s almost daring breach of the $2,400 barrier, a level never seen since last February, maybe the catalyst that brought eyes to the scene and money into the scene for AAVE.

AAVE keeps on with its exchange exodus! Wallets were absorbing AAVE at accelerated rates. Exchange balances thus fell to 4.76 million, having lost 110,000 AAVE in a week-wiping off 29.74% of total exchange supply. This draining liquidity suggests AAVE holders are holding tight, meaning strong confidence in the token’s future. With less AAVE freely available for sale, there is naturally more potential for upward price pressure.

You might also like:

Arkham integrates portfolio management platform Haruko

AAVE isn’t just playing in the DeFi sandbox; it’s building the castle. The recent surge solidified AAVE’s reign by a 35% leap in total value locked (TVL) in one month. The AAVE TVL has soared to more than $24.2 billion, besting the likes of Lido (LDO) to the tune of $21.6 billion, which is respectable but comparatively smaller. That is not growth; that is a power move into the DeFi realm.

Its rise to power and profitability in the crypto world that leaked $244 million in earnings this year alone shows how much of a colossus it has become.

Exhausted from just sitting and collecting dust for your crypto? Aave captures this untapped earning power of an asset and turns it into an active income stream. Envision a bank that is decentralized where you are the lender receiving interest while others borrow money at almost the same price. Welcome to Aave, where your crypto starts working for you.

AAVE price technical analysis

AAVE price chart | Source: crypto.news

Once again, AAVE staged a dramatic comeback, having bottomed out at $113.50 on the 7th of April. Instead of run-of-the-mill corrections, the price just shot upwards to levels unseen since early March. Piercing through the 50-day EMA unceremoniously, AAVE proceeded to smash the $1,000-mark, which acts as a psychological barrier, thus having greater implications about the changing momentum.

“Buckle up, traders! The RSI level is spitting out the maximum overbought signal at 75, while the MACD has just broken through the zero line, suggesting another power shift. Is this the eye of a storm, or the born hour of a big one?”

The coin is now putting up a fight for a comeback after withstanding a December-to-April storm within a falling wedge. Soon, bulls will be aiming to restore it back to $400, the level it last conquered in December, and this is merely the beginning of the rally.

The stage is set for explosive growth, as an 83%-plus leap could be witnessed. But beware: $170 is the line in the sand-point, and if it happens to fall below, the bulls shall be truly stampeded.

Read more:

SEC’s Hester Peirce wants crypto sandbox: Wormhole legal chief has concerns

Thanks for reading AAVE climbs 95% since April lows tight supply sparks rally