By Francisco Rodrigues (All times ET unless indicated otherwise)

Bitcoin

BTC

$117,819.17

Defying the pre-Fed jitters gripping the crypto world, [Coin Name] stands strong as the market braces for today’s monetary policy reveal and a barrage of economic data.

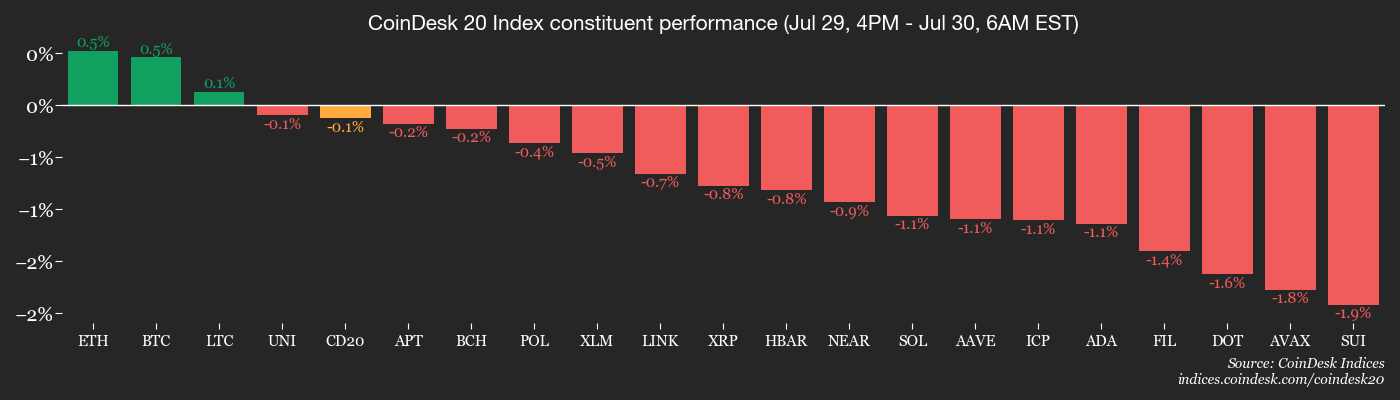

The CoinDesk 20 stumbles, shedding 1.6% as Bitcoin holds steady near $118,300. Meanwhile, even Ether’s 10th birthday couldn’t spark joy, with the crypto pioneer dipping 0.8% – a worrying whisper of fading altcoin allure. Is the party over for the rest?

The Fed’s poised to hold steady – think near-certainty, confirmed by both Wall Street’s FedWatch whispers (98% probability) and the prediction markets’ digital bets (97% odds). But don’t get too comfortable. A storm of macroeconomic unknowns is brewing. Keep a close eye on Friday’s unemployment numbers; they could shake things up. And remember Trump’s ticking tariff time bomb, threatening to detonate on the same day, potentially impacting economies across the globe.

The Fed’s rate decision arrives under a cloud: Trump’s hawkish pressure for cuts amplified by whispers of discord within its own ranks.

Good news for crypto ETF investors: The SEC has greenlit in-kind redemptions for spot Bitcoin and Ether ETFs. Think of it as a smooth, direct swap – authorized participants trade ETF shares straight for crypto, cutting out the cash middleman. This smart move promises to tame volatility and streamline transactions, making the ride a whole lot smoother.

Bitcoin and Ether ETFs are on a tear! Spot Bitcoin ETFs have sucked in over $6 billion this month alone, while Ether ETFs aren’t far behind, gobbling up $5.4 billion. According to SoSoValue, Ether ETFs are riding an impressive 18-day wave of inflows, proving crypto’s hot streak is far from over.

The Ethereum blockchain anniversary sees the network enjoying significant adoption as it adapts to innovations in the industry.

Forget fleeting trends. Ethereum isn’t just playing the crypto game; it’s building the stadium. Imagine a future where clear regulations, stablecoin infrastructure, the power of DeFi, real-world asset tokenization, and ETF investments all flow through one central hub. That hub? Ethereum. According to Bitwise, it’s not just chasing the next big thing; it’s becoming the bedrock for institutional finance’s crypto future.

Under new Chair Paul Atkins, the SEC’s recent decision marks a pivotal shift, hinting at a sunnier outlook for crypto. But the market remains a high-wire act: institutional interest surges while macroeconomic headwinds threaten to blow it all down. Proceed with caution.

What to Watch

- CryptoJuly 31st, 12 PM:Tune in LIVE as Bitwise CIO Matt Hougan and Bitzenship founder Aleesandro Palombo dissect Bitcoin’s audacious bid to become the world’s next reserve currency. Is dedollarization a pipe dream, or is Bitcoin the disruptor we’ve been waiting for?

[REGISTER NOW Don’t Miss Out!]

August 1st marks a pivotal moment for the Helium Network (HNT), now soaring on the Solana blockchain. Prepare for liftoff as the HNT halving event slashes the annual token supply to a leaner 7.5 million – igniting scarcity and potentially, the network’s value.

- Aug. 1: Hong Kong’s Stablecoins Ordinance takes effect, introducing a licensing regime to regulate stablecoin activities in the city.Bretton Woods Labs is set to unleash BTCD on August 1st, a gamechanger poised to redefine stablecoins. This isn’t just another digital dollar; BTCD claims to be the first stablecoin fully backed by Bitcoin itself. Launching on the Elastos (ELA) mainnet – a unique blockchain fortified by Bitcoin’s mining power and guided by the Elastos Foundation – BTCD promises a blend of stability and decentralized security.

FTX Claimants, Mark Your Calendars! August 15th is the crucial record date for the next distribution of funds. If you hold allowed Class 5 Customer Entitlement, Class 6 General Unsecured, or Convenience Claims, and you’ve met all pre-distribution requirements, ensure your details are up-to-date. Don’t miss out on this important milestone!

- Aug. 18: Coinbase Derivatives will launch nano SOL and nano XRP U.S. perpetual-style futures.

- Macro

- July 30, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases (preliminary) Q2 GDP growth data.

- GDP Growth Rate QoQ Est. 0.4% vs. Prev. 0.2%

- GDP Growth Rate YoY Est. 0.2% vs. Prev. 0.8%

- July 30, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases (Advance Estimate) Q2 GDP data.

- GDP Growth Rate QoQ Est. 2.4% vs. Prev. -0.5%

- GDP Price Index QoQ Est. 2.2% vs. Prev. 3.8%

- GDP Sales QoQ Prev. -3.1%

- PCE Prices QoQ Est. 2.9% vs. Prev. 3.7%

- Real Consumer Spending QoQ Prev. 0.5%Get ready for a potential marketmoving event!The Bank of Canada will unveil its latest monetary policy decision and release its quarterly Monetary Policy Report on July 30th at 9:45 a.m. ET.

Want to hear it straight from the source?Tune in to the press conference at 10:30 a.m. ET.

[Livestream Link]Don’t miss out!

- Policy Interest Rate Est. 2.75% Prev. 2.75%

- July 30, 1:30 p.m.: Uruguay’s National Statistics Institute releases June unemployment rate data.

-

Unemployment Rate Prev. 7.8%

-

July 30, 5:30 p.m.: Brazil’s central bank, Banco Central do Brasil, announces its monetary policy decision.

- Selic Rate Est. 15% vs. Prev. 15%

- July 31, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases June unemployment rate data.

- Unemployment Rate Est. 6% vs. Prev. 6.2%

- July 31, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases June consumer income and expenditure data.

- Core PCE Price Index MoM Est. 0.3% vs. Prev. 0.2%

- Core PCE Price Index YoY Est. 2.7% vs. Prev. 2.7%

- PCE Price Index MoM Est. 0.3% vs. Prev. 0.1%

- PCE Price Index YoY Est. 2.5% vs. Prev. 2.3%

- Personal Income MoM Est. 0.2% vs. Prev. -0.4%

- Personal Spending MoM Est. 0.4% vs. Prev.-0.1%

- July 31, 11 a.m.: Colombia’s National Administrative Department of Statistics (DANE) releases June unemployment rate data.

- Unemployment Rate Est. 9.1% vs. Prev. 9%

- July 31, 2 p.m.: Colombia’s central bank, Banco de la República (BanRep), releases its monetary policy decision..

-

Policy Rate Est. 9% vs. Prev. 9.25% Midnight struck, August 1st, and the economic landscape shifted. A new wave of U.S. tariffs crashed down on imports from nations unable to secure trade deals by the deadline. Businesses brace for impact as rates surge, primarily hitting the 1520% mark.

-

Aug. 1, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases July employment data.

- Non Farm Payrolls Est. 110K vs. Prev. 147K

- Unemployment Rate Est. 4.2% vs. Prev. 4.1%

- Government Payrolls Prev. 73K

- Manufacturing Payrolls Est. 0K vs. Prev. -7K

- Aug. 1, 9 a.m.: S&P Global releases July manufacturing and services data for Brazil.

- Manufacturing PMI Prev. 48.3

- Aug. 1, 9:30 a.m.: S&P Global releases July manufacturing and services data for Canada.

- Manufacturing PMI Prev. 45.6

- Aug. 1, 9:45 a.m.: S&P Global releases (final) July manufacturing and services data for U.S.

- Manufacturing PMI Est. 49.5 vs. Prev. 52.9

- Aug. 1, 10 a.m.: The Institute for Supply Management (ISM) releases July U.S. services sector data.

- Manufacturing PMI Est. Est. 49.5 vs. Prev. 49

- Aug. 1, 10 a.m.: The University of Michigan releases (final) July U.S. consumer sentiment data.

- Michigan Consumer Sentiment Est. 61.8 vs. Prev. 60.7

- Aug. 1, 11 a.m.: S&P Global releases July manufacturing and services data for Mexico.

- Manufacturing PMI Prev. 46.3

- Aug. 1 p.m.: Peru’s National Institute of Statistics and Informatics releases July consumer price inflation data.

- Inflation Rate MoM Prev. 0.13%

- Inflation Rate YoY Prev. 1.69%

- Earnings(Estimates based on FactSet data)

- July 30: Robinhood Markets (HOOD), post-market, $0.31

- July 31: Coinbase Global (COIN), post-market, $1.39

- July 31: Reddit (RDDT), post-market, $0.19

- July 31: Strategy (MSTR), post-market, -$0.10

- July 31: Sequans Communications (SQNS), pre-market

- Aug. 5: Galaxy Digital (GLXY), pre-market, $0.19

- Aug. 4: Semler Scientific (SMLR), post-market, -$0.22

- Aug. 7: Block (XYZ), post-market, $0.67

- Aug. 7: Coincheck (CNCK), post-market

- Aug. 7: Hut 8 (HUT), pre-market, -$0.08

- Aug. 8: TeraWulf (WULF), pre-market, -$0.06

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

Token Events

- Governance votes & calls

- Euler DAO is voting to activate currently disabled fees in the Euler Lending protocol. Voting ends July 30. NEAR Protocol Poised for Major Economic Shift: Inflation Cut on the Table.

The NEAR blockchain could be in for a significant shake-up! A proposal to slash NEAR’s inflation rate in half, from 5% to a leaner 2.5%, is currently up for vote. With the clock ticking towards the August 1st deadline, two-thirds of NEAR’s validators hold the power to reshape the token’s economic future. If approved, expect the change to potentially roll out as early as late Q3, impacting yields and tokenomics across the NEAR ecosystem. Is this the dawn of a new era for NEAR? Stay tuned.

Compound DAO is at a crossroads, poised to elect its next Security Service Provider (SSP). The fate of smart contract security rests in the hands of delegates as they weigh proposals from ChainSecurity, Certora, and Cyfrin. Will ChainSecurity’s eagle-eyed audits prevail? Or will Certora’s formal verification techniques win the day? Perhaps Cyfrin’s innovative approach will sway the vote? The deadline for decision: August 5th. Your vote, your voice, secures the future.

- Unlocks

- July 31: Optimism

OP

$0.6868 + Aug. 1: Sui

SUI

$3.7138 + Aug. 2: Ethena

ENA

$0.5600 + Aug. 9: Immutable (IMX) to unlock 1.3% of its circulating supply worth $13.51 million. + Aug. 12: Aptos

APT

$4.4305 * Token Launches + July 31: PlaysOut (PLAY) to be listed on Binance Alpha, MEXC, and others.

Conferences

On September 10th, Washington D.C. becomes ground zero for crypto policy discussion. CoinDesk’s Policy & Regulation conference (formerly State of Crypto) is your exclusive access point. Engage directly with key public officials shaping crypto legislation and oversight in an intimate, oneday setting designed for general counsels, compliance officers, and regulatory executives.

Limited seats available. Unlock your 10% discount with code CDB10 before August 31st and secure your place at the table. Don’t just react to the future of crypto define it.

- Aug. 6-7: Blockchain.Rio 2025 (Rio de Janeiro, Brazil)

- Aug. 6-10: Rare EVO (Las Vegas)

- Aug. 7-8: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh City, Vietnam)

- Aug. 11: Paraguay Blockchain Summit 2025 (Asuncion)

- Aug. 11-13: AIBB 2025 (Istanbul)

- Aug. 11-17: Ethereum NYC (New York)

- Aug. 13-14: CryptoWinter ‘25 (Queenstown, New Zealand)

- Aug. 21-22: Coinfest Asia 2025 (Bali, Indonesia)

Token Talk

By Oliver Knight

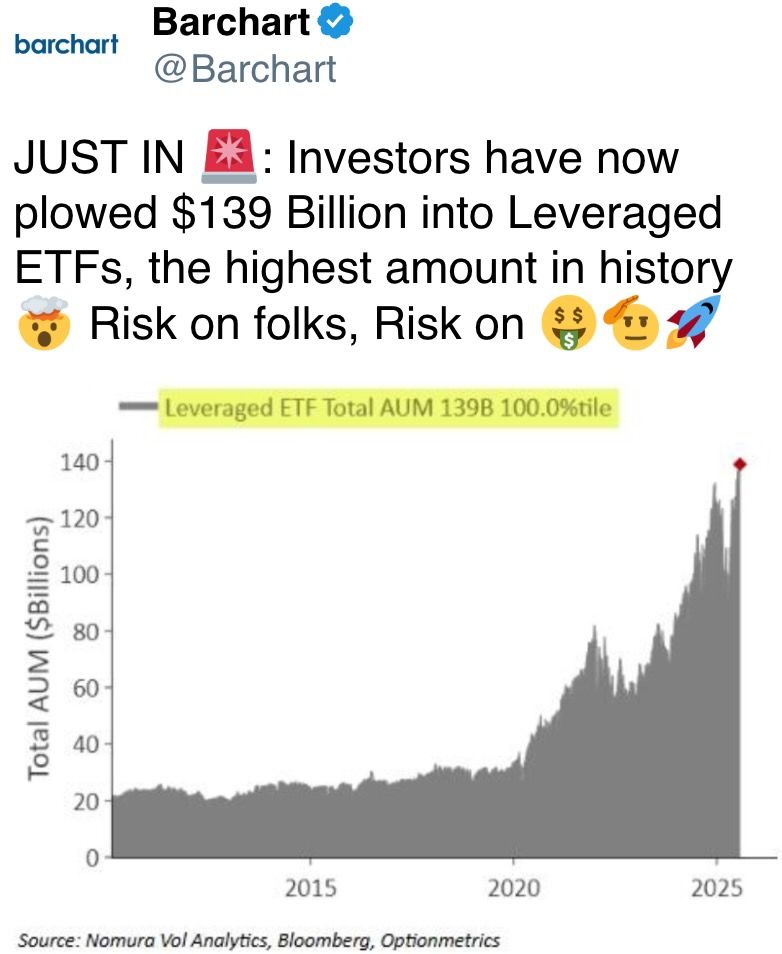

Last week, the crypto arena witnessed a shift: Bitcoin took a breather, and altcoins seized the spotlight in a long-anticipated surge.

“Past altcoin surges were marathons; this one felt like a sprint. Where previous rallies stretched for weeks, even months, this burst of exuberance fizzled out in mere days, leaving the market breathless and searching for its footing.”

The crypto market’s recent bloodbath has spared few, with meme coins taking a particularly brutal beating. FLOKI, FAR, and WIF have each shed over 20% in the last week, a chilling snapshot of widespread double-digit losses plaguing the digital asset landscape.

Altcoin dreams on hold? CoinMarketCap’s altcoin season indicator is flashing warning signs, mirroring the doldrums of early this year. With institutional investors laser-focused on Bitcoin, altcoins might be stuck in the shadows for now.

“But picture this: Bitcoin shatters its ceiling, rockets past $130,000beforeit even thinks about pausing for breath. That’s not just a breakout; it’s a seismic shift. Suddenly, last week’s altcoin rally looks like a mere dress rehearsal for the main event – a full-blown altcoin supernova.”

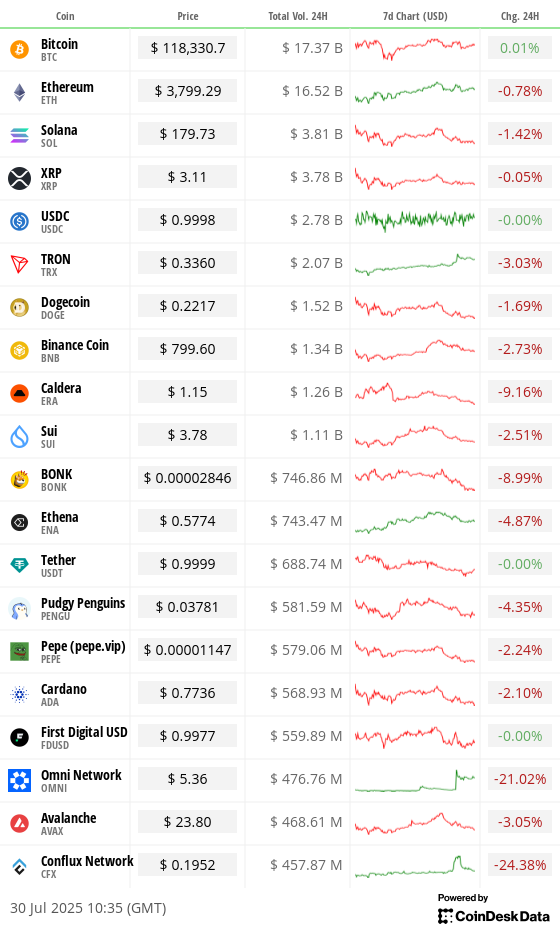

Derivatives Positioning

Crypto markets just took a $300 million bath! BTC, SOL, ETH, and XRP futures are bleeding, with open interest plunging in the last 24 hours. Buckle up, volatility is here.

BTC and DOGE are flashing green! Funding rates are hitting a fever pitch, hovering around 10% annually – leaving other top cryptos in the dust. This bullish blaze suggests traders are loading up on these meme-worthy assets like there’s no tomorrow. Buckle up, could be a wild ride!

Improved:Even the crypto elite aren’t immune. The top 25 tokens, ranked by market cap, are facing a wave of selling, with open interestadjusted volume screaming “bear market.”

- On Deribit, BTC short-term puts traded at a slight premium while ETH options showed call bias across all tenors.

- Block flows over Paradigm featured butterfly strategies and risk reversals in BTC.

Market Movements

- BTC is up 0.23% from 4 p.m. ET Tuesday at $117,740.73 (24hrs: +0.00%)

- ETH is up 0.28% at $3,774.875 (24hrs: -0.89%)

- CoinDesk 20 is up 0.28% at 3,961.08 (24hrs: -1.38%)

- Ether CESR Composite Staking Rate is up 3 bps at 2.93%

- BTC funding rate is at 0.002% (2.19% annualized) on KuCoin

- DXY is unchanged at 98.82

- Gold futures are up 0.12% at $3,385.20

- Silver futures are down 0.26% at $38.19

- Nikkei 225 closed unchanged at 40,654.70

- Hang Seng closed down 1.36% at 25,176.93

- FTSE is down 0.21% at 9,117.40

- Euro Stoxx 50 is up 0.22% at 5,391.08

- DJIA closed on Tuesday down 0.46% at 44,632.99

- S&P 500 closed down 0.30% at 6,370.86

- Nasdaq Composite closed down 0.38% at 21,098.29

- S&P/TSX Composite closed up 0.49% at 27,539.88

- S&P 40 Latin America closed up 1.02$ at 2,599.74

- U.S. 10-Year Treasury rate is unchanged at 4.332%

- E-mini S&P 500 futures are unchanged at 6,409.25

- E-mini Nasdaq-100 futures are up 0.12% at 23,481.00

- E-mini Dow Jones Industrial Average Index are unchanged at 44,808.00

Bitcoin Stats

- BTC Dominance: 61.65% (0.28%)

- Ether to bitcoin ratio: 0.03214 (-0.12%)

- Hashrate (seven-day moving average): 896 EH/s

- Hashprice (spot): $58.88

- Total Fees: 5.07 BTC / $599,372

- CME Futures Open Interest: 140,340 BTC

- BTC priced in gold: 35.5 oz

- BTC vs gold market cap: 10.04%

Technical Analysis

Gold. (TradingView)

- Gold has put in fourth straight monthly candle with a long upper shadow (wick), marking bull failure above $3,400.

- The repeated rejection above $3,400 calls for reassessment of the bullish view and signals potential for a price pullback.

Crypto Equities

- Strategy (MSTR): closed on Tuesday at $394.66 (-2.26%), +3.03% at $406.60 in pre-market

- Coinbase Global (COIN): closed at $371.44 (-2.12%), +3.19% at $383.30

- Circle (CRCL): closed at $181.64 (-2.01%), +3.15% at $187.36

- Galaxy Digital (GLXY): closed at $26.76 (-9.59%), +9.39% at $29.27

- MARA Holdings (MARA): closed at $16.61 (-3.21%), +3.25% at $17.15

- Riot Platforms (RIOT): closed at $13.6 (-6.27%), +6.4% at $14.47

- Core Scientific (CORZ): closed at $13.19 (-4.04%), +4.32% at $13.76

- CleanSpark (CLSK): closed at $11.73 (-2.49%), +2.64% at $12.04

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $24.91 (-4.67%), +4.05% at $25.92

- Semler Scientific (SMLR): closed at $36.6 (-6.75%), +7.92% at $39.50

- Exodus Movement (EXOD): closed at $31.63 (-4.76%), +8.13% at $34.20

- SharpLink Gaming (SBET): closed at $19.08 (-8.82%), -0.1% at $19.06

ETF Flows

Spot BTC ETFs

- Daily net flows: $80 million

- Cumulative net flows: $55.03 billion

- Total BTC holdings ~1.3 million

Spot ETH ETFs

- Daily net flows: $218.6 million

- Cumulative net flows: $9.64 billion

- Total ETH holdings ~5.67 million

Source: Farside Investors

Overnight Flows

Chart of the Day

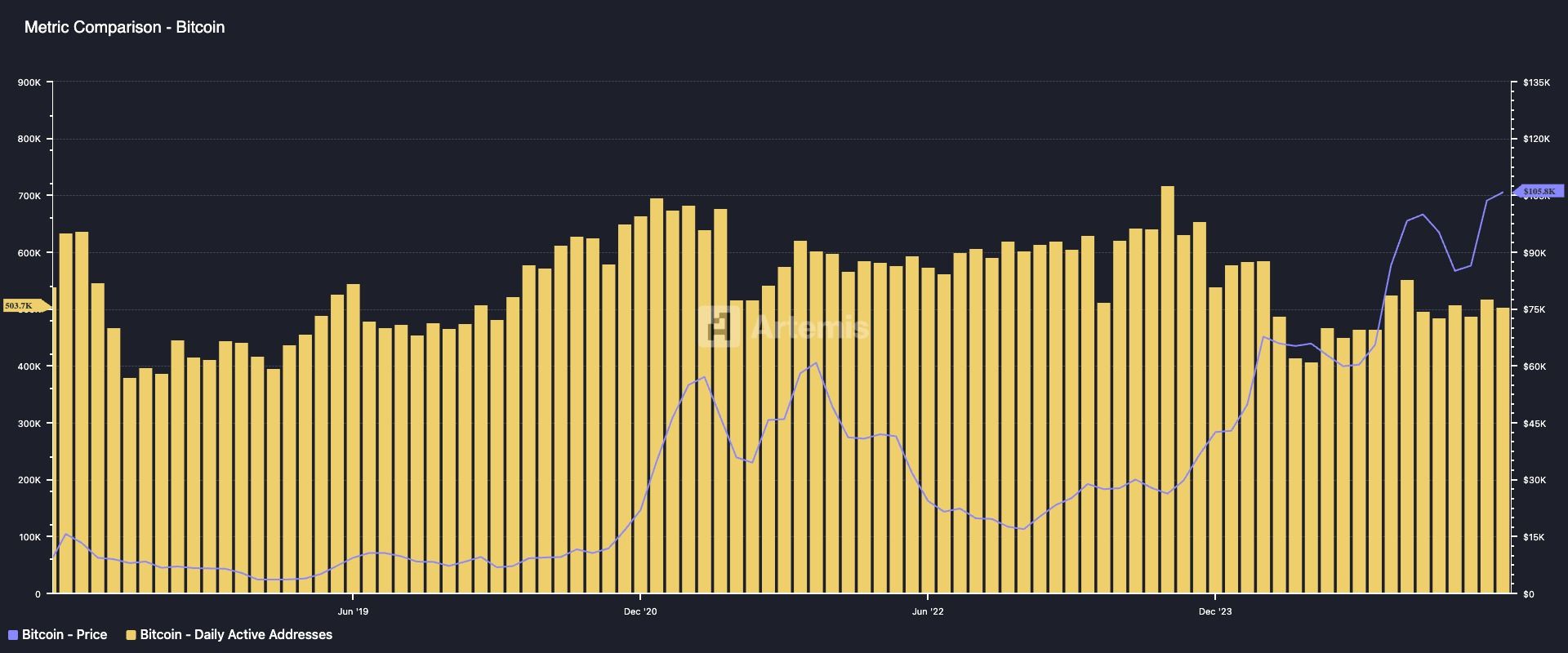

Bitcoin: daily active addresses vs price on monthly basis. (Artemis)

- While BTC’s price hit record highs in July, active addresses held well below the peak in September.

- The discrepancy shows that the price rally is mainly driven by corporate treasury adoption and not on-chain activity.

While You Were Sleeping

XRP Rockets Past Solana on Kraken Futures as Price Hits Stratosphere

XRP is stealing the spotlight. A jaw-dropping 40% price explosion has launched XRP futures trading volume on Kraken past Solana for the first time. This surge, fueled by newfound legal clarity in the US and shifting political winds, hints at a resurgence of confidence in the digital asset. While Solana still reigns supreme in global open interest a sign of significant speculative bets XRP’s Kraken coup marks a pivotal moment in the ongoing crypto narrative. Is this a fleeting victory, or a sign of things to come?

The digital world’s foundation is cracking. A chilling new report exposes the aging cryptographic systems that underpin cryptocurrency and online security as dangerously vulnerable. Think of it as digital rust, eating away at the locks protecting your data. The clock is ticking, with nearterm exploits already emerging and a catastrophic quantum computing apocalypse looming just 515 years away. This quantum threat could shatter the publickey encryption, currently the internet’s strongest defense, instantly turning digital assets into sitting ducks. The warning is clear: shore up the crypto infrastructure before the walls collapse.

ARK Invest Doubles Down on Ether with $15.3M BitMine Immersion Play

Cathie Wood’s ARK Invest is betting big on the future of Ether, scooping up another $15.3 million worth of BitMine Immersion (BMNR) shares. Despite BMNR’s recent rollercoaster – a steep drop from a $135 high to Tuesday’s $32 close (down 8.9%) – ARK added a hefty 477,498 shares across three of its ETFs, signaling unwavering confidence in the cryptofocused firm. Is this a strategic dip buy, or a longterm play on Ether’s evolving landscape?

A fragile peace hangs over the ThaiCambodian border after renewed clashes reignited old tensions around the contested Preah Vihear temple. As Thai and Cambodian officials gather Monday, shadowed by Malaysian observers, the question remains: can they finally bury the hatchet? Beneath the surface, a toxic mix of national pride and political maneuvering threatens to plunge the region back into conflict, leaving the ancient stones of Preah Vihear caught in the crossfire. Lasting calm feels agonizingly distant.

Footsie Flies High, But Is Britain Really Booming? The FTSE 100’s record-breaking 2025 might paint a rosy picture, but scratch beneath the surface. Its ascent isn’t necessarily a testament to UK economic vigor. Think global giants, defensive plays, and a pound struggling for traction. The real story? The Footsie’s strength could be masking underlying weaknesses in the British economy.

Kremlin’s Fortress App: Is “Max” Russia’s Answer to Silicon Valley?

Russia is erecting a digital iron curtain. “Max,” a state-sponsored super app blending chat, payments, and government services, is Moscow’s newest weapon in its tech war. Forget Facebook, ditch Google; the Kremlin is betting big on homegrown platforms to sever ties with the West.

In the Ether

Thanks for reading Altcoin Rally Fizzles as Ether Turns 10: Crypto Daybook Americas