By Omkar Godbole (All times ET unless indicated otherwise)

Bitcoin’s price lull is casting a shadow on altcoin season dreams. The once-roaring crypto market, fueled by Bitcoin’s surge, now faces a stark reality: the party’s on pause, leaving altcoin enthusiasts longing for the days of exponential gains.

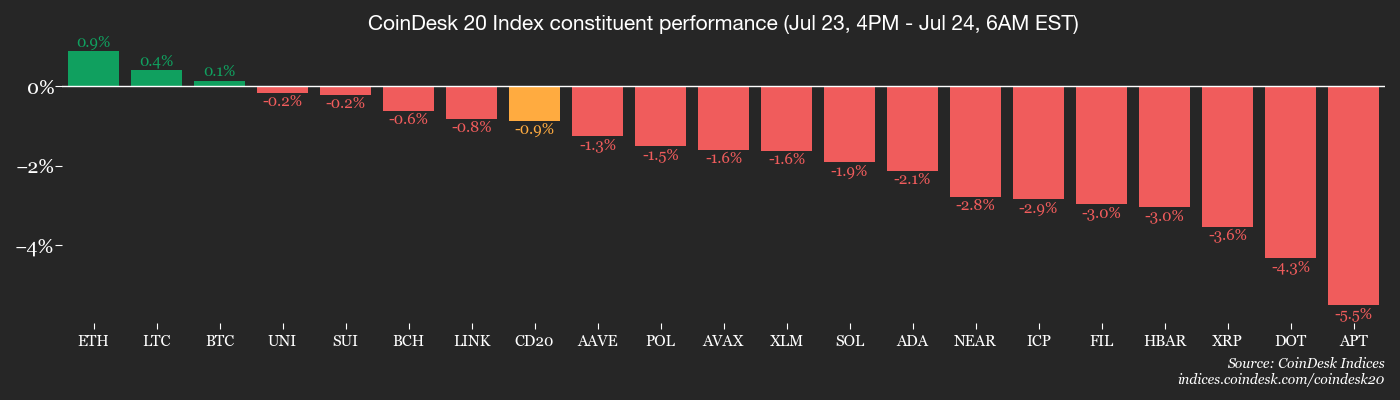

Altcoins are bleeding red. XRP took a brutal double-digit hit, leading the charge downhill, while SOL wasn’t far behind with an 8% plunge. The broader altcoin market, as tracked by the CoinDesk 80 Index, is down over 7%. Even Bitcoin and Ether, usually bastions of relative stability, couldn’t escape the carnage, with the CoinDesk 20 Index dropping 4%. What’s fueling this altcoin apocalypse?

The crypto market just hit turbulence. Forget a dip, we’re talking a near 4% market cap plunge in the last 24 hours. Bitcoin’s stall sent altcoins, previously the market’s rocketing stars, crashing back to earth. FxPro’s Alex Kuptsikevich reports a brutal altcoin bloodbath: a staggering 48 of the top 100 are hemorrhaging double-digit losses, while a meager three cling to growth. Is this a buying opportunity or the start of something darker?

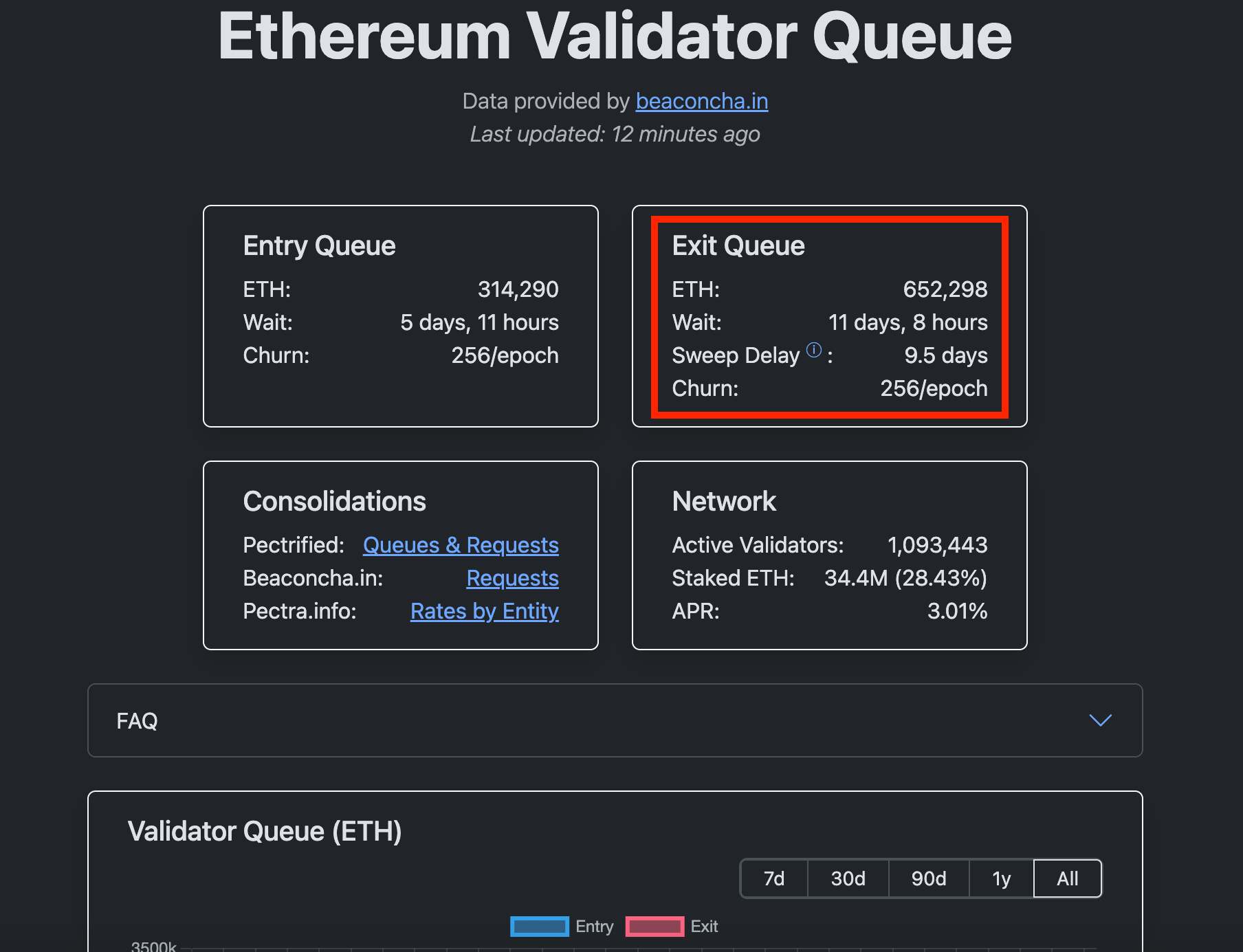

Whispers of a $2 billion Ethereum tidal wave are sweeping through crypto circles. The unstaking queue is packed, with over 475 validators poised to pull their ether from the depths. Is this a controlled release, or are we bracing for a deluge? Some veterans are flashing back to January’s mass exodus, a moment that foreshadowed a market peak. (Chart of the Day section holds the key). Buckle up; things are about to get interesting.

Ether staking yields losing their luster? Blame the rocket-high borrowing rates on DeFi giants like Aave. Looping strategies, once yield-boosting darlings, are now struggling to compete, triggering a mass exodus from staking.

Imagine a financial merry-go-round: you spin ETH into gold by leveraging your staked crypto. Deposit your Liquid Staking Tokens (LSTs) or Liquid Restaking Tokens (LRTs) on platforms like AAVE as collateral and borrow ETH. Now, the real trick: transform that borrowed ETH back into more LSTs and LRTs, then deposit them again, restarting the cycle. The magic? When your staking rewards outpace your borrowing expenses, you’re not just spinning, you’re winning.

But now, the tide is turning. As borrowing gets pricier, the yield-chasing game is flipping. Traders are scrambling to unwind leveraged positions: paying back those loans, ditching LST/LRT plays, and sprinting back to the safety of plain old ETH.

“Ethereum’s DeFi ecosystem just felt a seismic tremor. Degen Station on X pinpointed the epicenter: ETH borrowing rates spiking to a dizzying 18% since July 16th. This wasn’t just a blip; it triggered a frantic exodus from leveraged ETH positions on Aave. Suddenly, negative yield spreads made those complex loops unprofitable. Picture a stampede – traders desperately repaying loans, abandoning LST/LRT plays, and scrambling to reclaim their ETH. The result? Depegs and a chaotic traffic jam in the queue.”

Staking queues are overflowing, yet seasoned traders are exploiting the chaos, snapping up discounted LSTs and LRTs for future Ether redemptions, inadvertently deepening the bottleneck. Despite this, the hunger for new staking positions remains insatiable. The bottom line? Don’t mistake those long unstaking lines for a sign of impending doom.

Tether Hints at U.S. Comeback: CEO Paolo Ardoino Signals Stablecoin Return for Payments, Banking, and Trading. The sleeping giant of stablecoins may soon awaken on American soil.

The currency markets held their breath, with major pairs locked in a standoff against the U.S. dollar. One exception: the Aussie. AUD/USD surged, breaching the 0.66 mark like a kangaroo clearing a fence. Now, all eyes are glued to see if this breakout has legs. A stumble here could signal a wider retreat from risk, sending shivers down the spines of investors.

Stay Alert!

What to Watch

- Crypto

- July 28: Starknet (STRK), an Ethereum layer-2 validity rollup (zk-rollup), launches v0.14.0 on mainnet.July 31st, Noon ET:Is Bitcoin poised to dethrone the dollar? Join Bitwise CIO Matt Hougan and Bitzenship founder Aleesandro Palombo for a live, noholdsbarred discussion on Bitcoin’s ascent as a potential global reserve currency in an era of dedollarization. Don’t miss this critical analysis of the shifting financial landscape.

Secure Your Spot: [Registration Link]

-

Macro

-

Main Refinancing Operations (MRO) rate Est. 1.9% vs. Prev. 2.15%

- July 24, 9:45 a.m.: S&P Global releases (flash) July U.S. data on manufacturing and services activity.

- Composite PMI Prev. 52.9

- Manufacturing PMI Est. 52.6 vs. Prev. 52.9

-

Services PMI Est. 53 vs. Prev. 52.9

-

July 25, 8:30 a.m.: The U.S. Census Bureau releases June manufactured durable goods orders data.

- Durable Goods Orders MoM Est. -10.8% vs. Prev. 16.4%

- Durable Goods Orders Ex Defense MoM Prev. 15.5%

-

Durable Goods Orders Ex Transportation MoM Est. 0.1% vs. Prev. 0.5% Midnight, August 1st: A trade war ignites. The hammer falls on nations failing to meet the U.S. negotiation deadline, unleashing a tariff storm. Prepare for price surges – duties now soar from a stinging 10% to a crippling 70%, hitting everything from everyday essentials to luxury imports.

-

Earnings(Estimates based on FactSet data)

- July 29: PayPal Holdings (PYPL), pre-market, $1.30

- July 30: Robinhood Markets (HOOD), post-market, $0.31

- July 31: Coinbase Global (COIN), post-market, $1.39

- July 31: Reddit (RDDT), post-market, $0.19

- July 31: Sequans Communications (SQNS); pre-market, N/A

- Aug. 5: Galaxy Digital (GLXY), pre-market, $0.19

- Aug. 7: Block (XYZ), post-market, $0.67

- Aug. 7: Hut 8 (HUT), pre-market, -$0.08

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

Token Events

- Governance votes & callsRocket Pool’s future hangs in the balance! The DAO is on the cusp of greenlighting Saturn 1, a game-changing upgrade that could redefine the protocol. A supermajority – 75% of the DAO – holds the key. This isn’t just another vote; it’s about embracing groundbreaking transaction designs and potentially funneling revenue directly to the pDAO treasury. The clock is ticking! Cast your vote before July 24th to shape Rocket Pool’s destiny.

Aavegotchi DAO faces a pivotal moment. A proposal on the table could drastically reshape the project: liquidate its 16 million GHST treasury to Rongming Investment for $3.2 million USDC. The potential deal involves dissolving the DAO and rewarding active members with distributed funds. Rongming envisions global expansion for Aavegotchi, but Pixelcraft retains control of the IP. The future hangs in the balance as the vote concludes on July 25th. Will Aavegotchi embrace venture capital or forge a different path?

Lido DAO is poised to revolutionize staking. Forget relying solely on node operators, a groundbreaking proposal is on the table: automated validator exits triggered directly through the execution layer! This isn’t just a patch; it’s a comprehensive system boasting diverse authorization pathways, fail-safes for emergencies, and pre-set limits to thwart abuse. The potential impact? A more decentralized, resilient, and reactive staking landscape. Cast your vote before July 28 and shape the future.

GnosisDAO faces a pivotal decision: should it commit $30 million annually to Gnosis Ltd., now a non-profit, safeguarding the future of the Gnosis Chain? This quarterly infusion would fuel a 150-strong team, the engine behind vital infrastructure, innovative products like Gnosis Pay and Circles, strategic business development, and seamless operations. The fate of Gnosis Chain hangs in the balance. Cast your vote before July 28.

Aavegotchi DAO is about to unleash a trio of upgrades to its dApp! Get ready for Wearable Lendings, Gotchi Batch Lending, and a BRS Optimizer. The future of Gotchi evolution hangs in the balance – cast your vote before July 29th!

NEAR Protocol Poised for a Major Economic Shift?

A pivotal vote is underway within the NEAR Protocol ecosystem that could slash its inflation rate in half, from 5% to a more conservative 2.5%. This isn’t just a tweak; it’s a potential game-changer.

Validators, the gatekeepers of the network, hold the power. A two-thirds majority in favor is the magic number needed to set this proposal in motion. If approved, expect the change to ripple through the NEAR economy by late Q3.

The clock is ticking. Validators must cast their votes before August 1st. Will they opt for a lower inflation future? The NEAR community awaits the verdict.

- July 29, 10 a.m.: Ether.fi to host a bi-quarterly analyst call.

- Unlocks

- July 25: Venom

VENOM

$0.2059 + July 28: Jupiter

JUP

$0.5474 + July 31: Optimism

OP

$0.6958 + Aug. 1: Sui

SUI

$3.7293 + Aug. 2: Ethena

ENA

$0.4807 + Aug. 9: Immutable (IMX) to unlock 1.3% of its circulating supply worth $13.36 million. + Aug. 12: Aptos

APT

$4.6837 * Token Launches + July 24: Uranium.io (XU3O8) to be listed on KuCoin, MEXC, Gate.io, and others. + July 24: Aspecta (ASP) to be listed on Binance Alpha, OKX, KuCoin, BingX and others. + July 24: Rent (REKT) to be listed on Binance.US

Conferences

Body:

On September 10th, Washington D.C. becomes ground zero for crypto policy innovation. The CoinDesk Policy & Regulation conference (formerly State of Crypto) isn’t just another event; it’s a curated huddle of the industry’s sharpest legal minds, compliance gurus, and regulatory trailblazers. This exclusive, oneday summit connects general counsels and compliance officers with the very public officials shaping crypto legislation and oversight. Secure your spot now. Space is extremely limited. Don’t just observe the future of crypto regulation shape it.

- July 24: Decasonic’s Web3 Investor Day 2025 (Chicago)

- July 25: Blockchain Summit Global (Montevideo, Uruguay)

- July 28-29: TWS Conference 2025 (Singapore)

- Aug. 6-7: Blockchain.Rio 2025 (Rio de Janeiro, Brazil)

- Aug. 6-10: Rare EVO (Las Vegas)

- Aug. 7-8: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh City, Vietnam)

Token Talk

By Shaurya Malwa

PENGU waddled its way to the top, soaring to an all-time high of $0.044 and snatching the Solana meme token crown back from BONK. The rally, a perfectly timed tribute, coincided with the fourth birthday celebrations of the beloved Pudgy Penguins NFT crew.

The token price exploded overnight, surging 21% and shattering January’s $0.042 record. This latest leap caps off an impressive run, leaving previous highs in the dust.

South Korea’s crypto frenzy is sending PENGU soaring! A tidal wave of Won-denominated trades now accounts for a whopping 38% of all PENGU volume, a dramatic surge from just 32% earlier this month. This isn’t just demand; it’s a K-wave propelling PENGU to new heights.

- Open interest in PENGU futures is at a record high, indicative of expectations of further volatility. Pudgy Penguins are waddling to new heights! The NFT collection’s floor price has surged to a frosty 16.2 ETH, nearly doubling and proving a powerful link: a thriving NFT ecosystem equals serious token value.

“PUMP’s post-ICO fizzle has left a sour taste, fueling a flight to fresher memes on Solana. Enter PENGU, riding a wave of newfound momentum as investors chase the next big splash in the memecoin ocean, leaving PUMP in its wake.”

“More than just a digital asset, this token has become the ultimate mood ring for the meme market. Its high liquidity, easy access across exchanges, powerful cultural resonance, and strategic alliance with a premier NFT project, all combine to make it the definitive barometer of internet virality.”

Derivatives Positioning

Crypto markets bled red overnight, and open interest in BTC, ETH, XRP, and SOL perpetuals followed suit. But here’s the kicker: funding rates remain stubbornly positive. What does this tell us? The recent dip isn’t a stampede of bears charging in. It’s more like a bullish bonfire, fueled by leveraged longs scrambling for the exits as prices falter. Existing longs are capitulating, rather than new shorts entering the market.

“BTC futures on the CME are flashing a bullish signal: the annualized three-month basis has surged to nearly 9%, a level not seen since May. Despite this surge, open interest remains stubbornly range-bound, hinting at a potential powder keg awaiting a spark.”

ETH futures are flashing green! While open interest on CME dipped slightly from its all-time high of 2.08 million ETH to 1.87 million ETH, the basis just smashed through 10% – a level not seen since late May. This surge suggests traders are betting big on Ethereum’s upward trajectory, signaling a renewed wave of bullish confidence in the market.

Bitcoin traders are buying downside protection on Deribit, with short-term puts seeing increased demand as anxiety over a potential price plunge intensifies. Meanwhile, Ether options maintain a confident, bullish outlook across all expiration dates, signaling continued optimism. Defying expectations, XRP risk reversals are flashing green, stubbornly clinging to bullish sentiment despite yesterday’s brutal price crash.

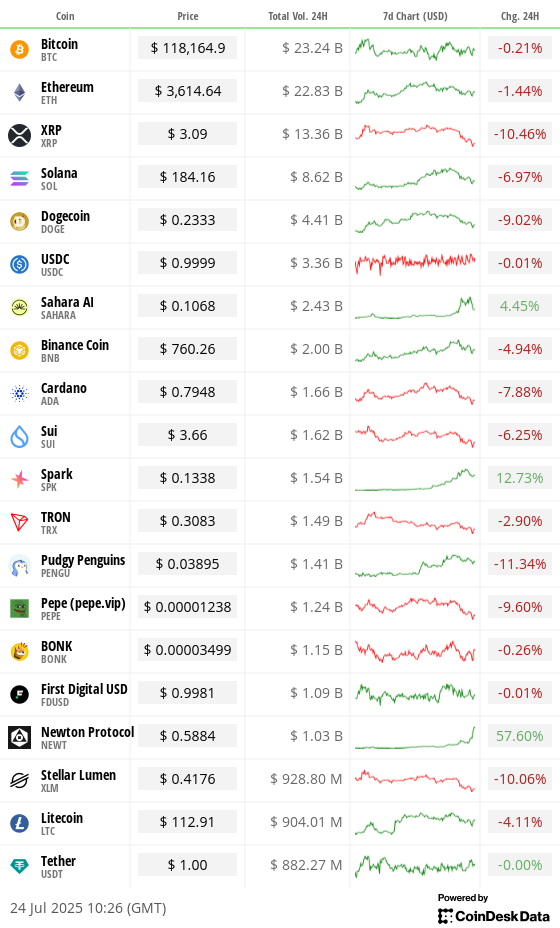

Market Movements

- BTC is up 0.49% from 4 p.m. ET Wednesday at $118,534.04 (24hrs: -0.09%)

- ETH is up 1.9% at $2,607.45 (24hrs: -1.15%)

- CoinDesk 20 is up 0.41% at 3,934.83 (24hrs: -3.55%)

- Ether CESR Composite Staking Rate is down 2 bps at 2.95%

- BTC funding rate is at 0.0091% (9.9645% annualized) on KuCoin

- DXY is up 0.14% at 97.35

- Gold futures are down 0.86% at $3,368.50

- Silver futures are down 0.32% at $39.38

- Nikkei 225 closed up 1.59% at 41,826.34

- Hang Seng closed up 0.51% at 25,667.18

- FTSE is up 1.00% at 9,151.80

- Euro Stoxx 50 is up 0.56% at 5,374.36

- DJIA closed on Wednesday up 1.14% at 45,010.29

- S&P 500 closed up 0.78% at 6,358.91

- Nasdaq Composite closed up 0.61% at 21,020.02

- S&P/TSX Composite closed up 0.19% at 27,416.41

- S&P 40 Latin America closed up 1.86% at 2,639.18

- U.S. 10-Year Treasury rate is up 1 bps at 4.398%

- E-mini S&P 500 futures are unchanged at 6,402.00

- E-mini Nasdaq-100 futures are up 0.33% at 23,387.75

- E-mini Dow Jones Industrial Average Index are down 0.30% at 45,078.00

Bitcoin Stats

- BTC Dominance: 62.1% (0.33%)

- Ether to bitcoin ratio: 0.3055 (unchanged)

- Hashrate (seven-day moving average): 908 EH/s

- Hashprice (spot): $59.59

- Total fees: 4.19 BTC / $496,766

- CME Futures Open Interest: 149,260 BTC

- BTC priced in gold: 35.2 oz.

- BTC vs gold market cap: 9.87%

Technical Analysis

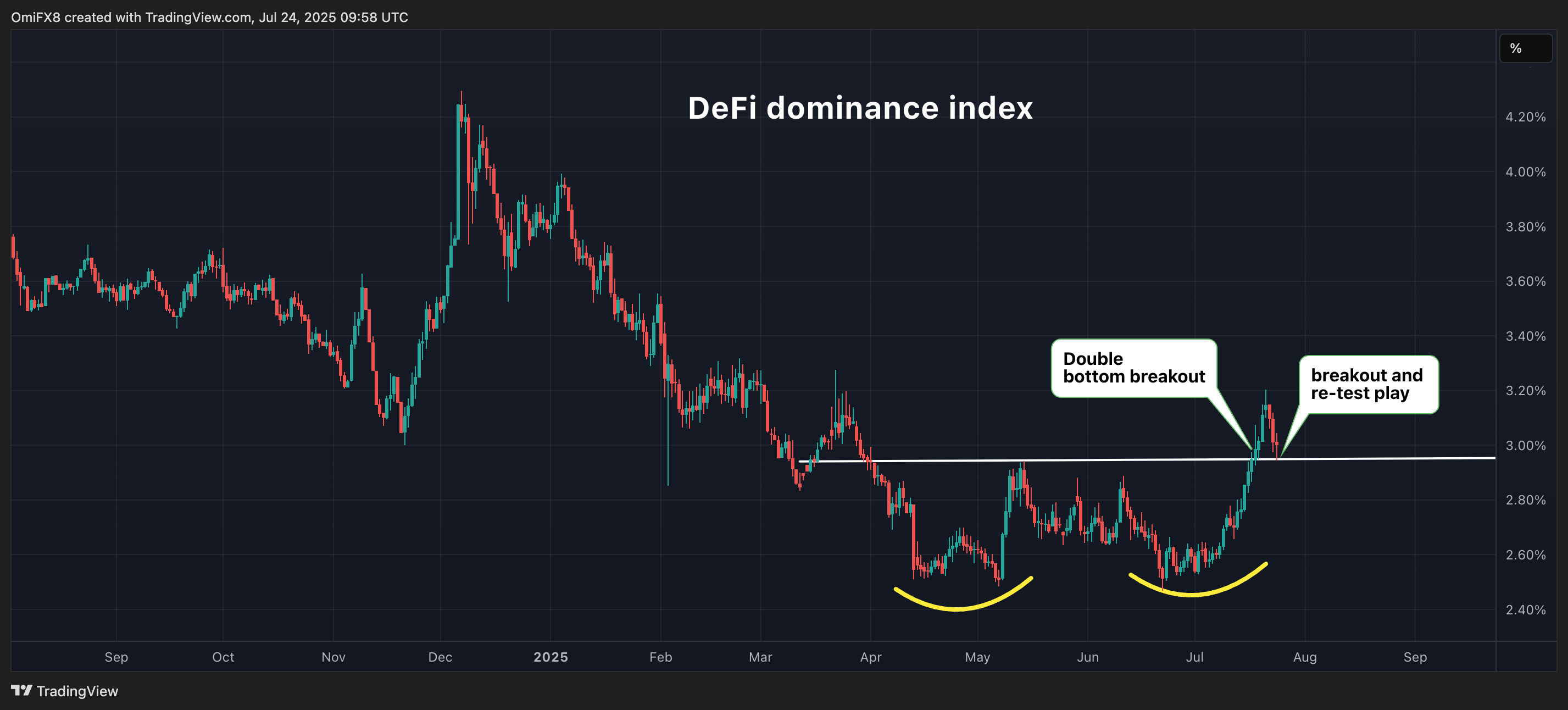

DeFi dominance index. (TradingView)

“DeFi’s dominance is flexing its muscles! The DeFi dominance index is painting a bullish picture, exhibiting a textbook “breakout and re-test” – suggesting a potential surge in DeFi’s share of the crypto pie.”

“Having flirted with the breakout point once more, the index appears to be gathering its strength, poised for a potentially explosive upward surge.”

Crypto Equities

- Strategy (MSTR): closed on Wednesday at $412.67 (-3.22%), unchanged in pre-market

- Coinbase Global (COIN): closed at $397.81 (-1.64%), unchanged in pre-market

- Circle (CRCL): closed at $202.41 (+2.07%), -1.6% at $199.18

- Galaxy Digital (GLXY): closed at $31.03 (+6.6%), -0.1% at $31

- MARA Holdings (MARA): closed at $17.57 (-11.62%), +0.23% at $17.61

- Riot Platforms (RIOT): closed at $14.34 (+0.49%), -0.49% at $14.27

- Core Scientific (CORZ): closed at $13.49 (+0.07%), +0.37% at $13.54

- CleanSpark (CLSK): closed at $12.45 (-3.04%), unchanged in pre-market

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $27.34 (-0.8%)

- Semler Scientific (SMLR): closed at $39.32 (-2.16%)

- Exodus Movement (EXOD): closed at $34.21 (-1.5%)

- SharpLink Gaming (SBET): closed at $25.81 (-5.8%), +0.66% at $25.98

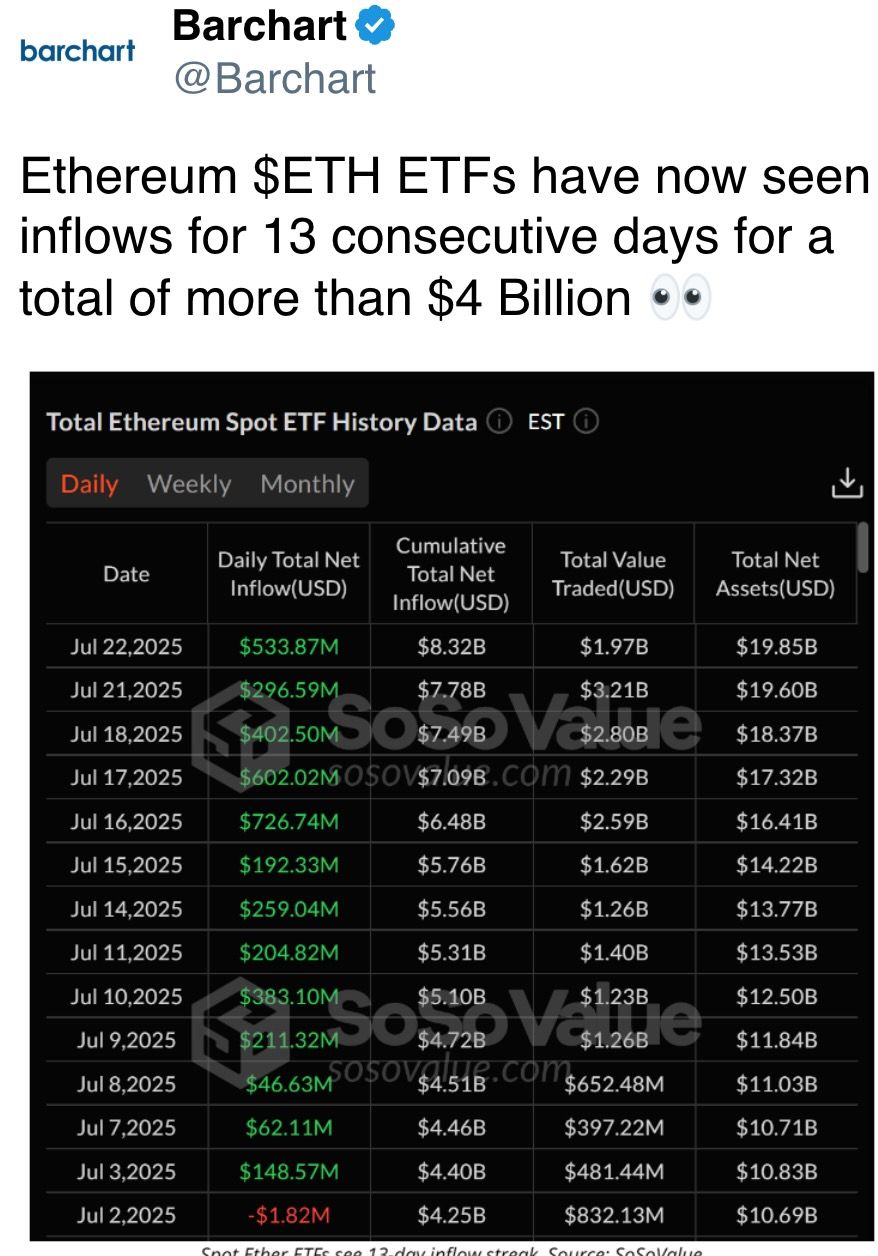

ETF Flows

Spot BTC ETFs

- Daily net flows: -$85.8 million

- Cumulative net flows: $54.44 billion

- Total BTC holdings ~1.3 million

Spot ETH ETFs

- Daily net flows: $332.2 million

- Cumulative net flows: $8.67 billion

- Total ETH holdings ~5.24 million

Source: Farside Investors

Overnight Flows

Chart of the Day

Ether validator queue. (beaconcha.in)

- The queue for unstaking ether now consists of 652,298 ETH with waiting time of over 11 days.

While You Were Sleeping

The fallen crypto empire FTX, once steered by Sam BankmanFried, is continuing its efforts to make amends, having already returned a staggering $6.2 billion to creditors. Sources confirm that another wave of repayments is slated to begin September 30. This time, the distribution will be managed by crypto heavyweights BitGo, Kraken, and Payoneer, signaling a collaborative effort to untangle the remnants of FTX’s collapse and return funds to those affected.

Trump Card or Tax Trap? Crypto Industry Sounds Alarm Over JPMorgan’s Data Access Fees

The crypto world is bracing for a showdown with Wall Street titan JPMorgan. A controversial plan to levy charges on firms like Plaid and MX for connecting bank accounts to crypto exchanges is sparking outrage. Industry leaders warn the move could cripple the vital “fiat onramps” that bridge the gap between traditional finance and digital assets. Plaid, a key player in facilitating these connections, reportedly faces fees so steep they could devour the lion’s share of its revenue, potentially choking off access for millions of users. Will President Trump intervene to block what the crypto community is calling a “punitive tax” that threatens the future of decentralized finance?

Bitcoin’s “Wall Streetization” is complete. Forget crypto’s wild west days; now, institutional traders are calling the shots, importing equity option strategies and fundamentally changing how Bitcoin volatility behaves. The result? Bitcoin’s volatility index is now eerily mirroring the S&P 500 VIX, hitting a record 90-day correlation. This isn’t just a blip; it signifies a deeper shift where Bitcoin’s volatility signals are becoming sentiment gauges, divorced from price action and tightly tethered to Wall Street’s fear barometer. Is Bitcoin becoming just another asset class?

Brace yourself. The crypto market just witnessed a brutal “long squeeze” impacting Bitcoin, Ripple, Solana, and Ethereum. Open interest in futures contracts is plummeting alongside prices, suggesting a painful purge of overleveraged bulls. Positive funding rates, coupled with dwindling futures exposure, indicate these bullish traders aren’t just exiting – they’re being liquidated. Forget a sentiment shift; this looks like a desperate leverage reset.

Content:As EU and Chinese leaders convene, the air crackles with unspoken tensions. Brussels confronts Beijing over its staggering $142 billion trade surplus, a chasm widening with each transaction. Lurking beneath the surface: China’s steadfast ties to Moscow, a constant source of unease for Europe. Beijing, in turn, stands firm, defending its positions and issuing a veiled warning against potential EU tariffs or restrictive supply chain maneuvers. The specter of US influence looms large, casting a long shadow over this delicate dance between economic giants, turning a bilateral meeting into a complex trilateral affair.

Content:As Western sanctions bite, a bustling Chinese border town has become an unlikely economic engine for Russia. A surge in Chinese demand for Russian energy, timber, and grain is fueling China’s manufacturing powerhouse. This strategic pivot sees Beijing stepping in as a critical buyer, reshaping the postsanctions economic landscape and providing a vital artery for the flow of Russian resources.

In the Ether

Thanks for reading Altcoin Season Hope Dim as Traders Unwind Bullish Bets: Crypto Daybook Americas