Arbitrum is becoming the Wall Street of Web3. The RWA market is exploding, fueling a price surge. Imagine a world where real estate, stocks, and bonds trade 24/7 on a decentralized exchange. That’s Arbitrum. Recent data shows over $310 million locked in tokenized assets, signaling a tidal wave of institutional adoption. This isn’t just growth, it’s a revolution.

Arbitrum’s July numbers are in, and the network is exploding: a staggering 30x leap in activity. Forget fleeting meme coins; this isn’t just a flash in the pan. Institutions and serious on-chain users are flocking to Arbitrum, driving a 25% price surge and signaling a fundamental shift in the Layer-2 landscape.

Arbitrum teeters on a knife’s edge! Currently priced at $0.40, it clings precariously to a crucial Fibonacci level. The bulls are gathering strength, eyeing a formidable resistance wall looming at $0.5160. Can they break through, or will Arbitrum face another setback?

Tokenized Assets Make the Bulk of Arbitrum’s Popularity

Arbitrum’s star is blazing in the tokenized asset galaxy. Forget just crypto – think tokenized US Treasuries, equities, even slices of real estate, all finding a vibrant new home on Arbitrum. Pioneers like OpenEden, Spiko, and Ondo are not just participating; they’re forging the future.

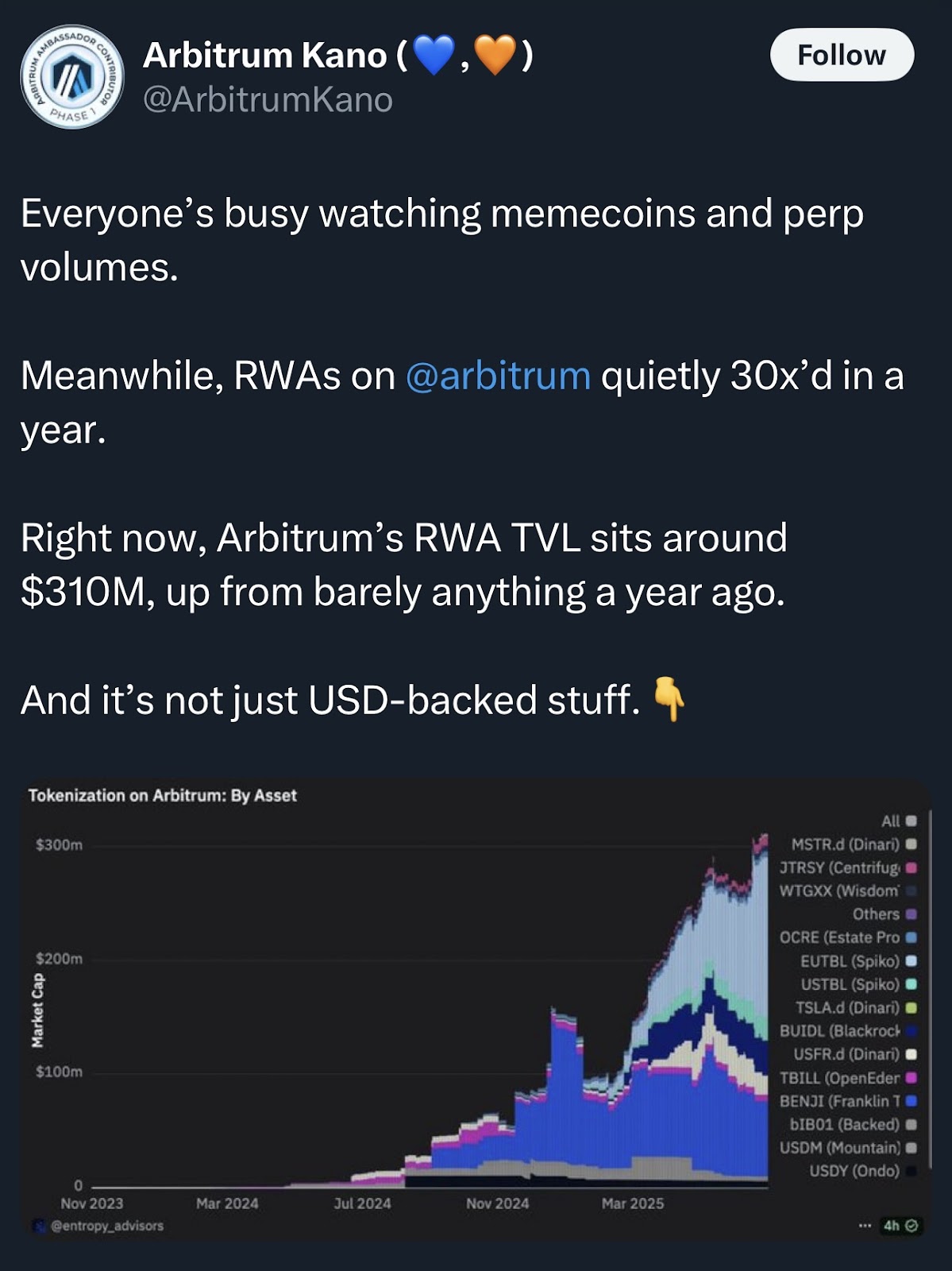

Arbitrum’s real-world asset (RWA) market is ablaze! CryptoBusy tweeted about the “explosion” while ArbitrumKano spotlighted the meteoric rise: a TVL soaring from near zero to a staggering $310 million in just twelve months.

Tokenization on Arbitrum is growing- Source: CryptoBusy

This growth is part of a larger shift.

RWA TVL growing- Source: Arbitrum Kano

Holder Count Remains High

Even during crazy price swings, one thing has stayed consistent: the rising number of ARB holders.

ARB’s holder count just smashed past 2.03 million unique addresses, according to Santiment! Okay, so there was a tiny dip recently, but the overall trend? It’s still screaming bullish!

Holder count increasing still- Source: Santiment

Since early 2025, a relentless ascent signals profound wallet-level conviction, notably flourishing even when price movements flatlined. This reveals a steadfast dedication, unyielding amidst turbulent markets.

Despite market dips, ARB holders are digging in their heels, suggesting a potential upswing is brewing. A sea of holders isn’t just a number; it’s a bedrock of unwavering faith and a powerful undercurrent of demand hinting ARB’s moment is yet to come.

While some short-term exits happened in May and June, the curve has resumed its upward trend, suggesting that confidence remains.

Open Interest Signals Strength

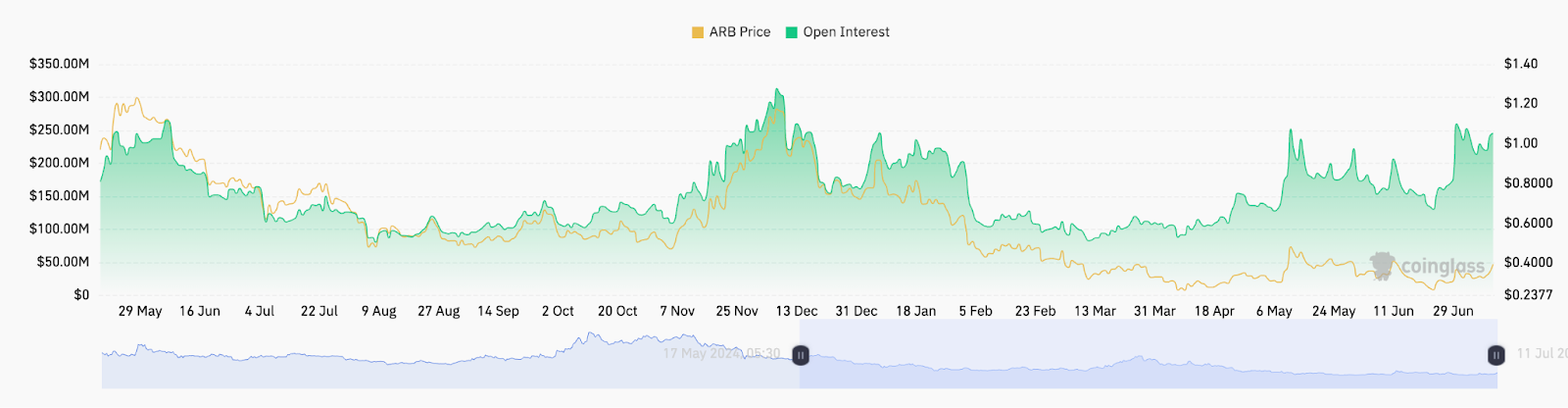

Alongside the tokenization surge, futures markets are heating up. CoinGlass data shows a sharp rebound in Arbitrum open interest.

After months of flat derivative activity, traders are now increasing exposure, possibly betting on a sustained move above $0.42.

ARB open interest- Source: Coinglass

Open interest: it’s the market’s heartbeat. When it surges alongside rising prices, think of it as a stampede of bulls charging into the arena, betting big on a price surge. New money is flowing in, fueling the upward fire.

“Should this key indicator maintain its ascent alongside Arbitrum’s price, anticipate a forceful push towards the critical resistance level ahead.”

Fibonacci Chart Shows $0.5160 as Key Level

Arbitrum’s price chart whispers a tale of Fibonacci’s golden ratio. A spring surge from a $0.25 cradle in early June kissed the $0.51 peak of May, painting a clear canvas for retracement analysis. Keep eyes peeled; Fibonacci’s secrets may soon be revealed.

Arbitrum price chart- Source: TradingView

“Bulls charge past $0.4116, shattering the 0.618 Fibonacci ceiling! Can this momentum sustain? Eyes now lock on $0.45, the 0.786 mark, with $0.5160 looming large as the next battlefield.”

Fibonacci retracement: Unlock hidden market secrets. Imagine a roadmap etched into the price chart, revealing potential turning points. That’s the power of Fibonacci retracements. These aren’t just random lines; they’re projected support and resistance levels based on the famous Fibonacci sequence ratios (0.382, 0.5, and 0.618). Traders worldwide fixate on these levels, anticipating explosive breakouts or strategic profit-taking opportunities. Are you ready to decode the market’s hidden language?

A clean break above $0.45 may push the Arbitrum price toward a full retrace of its May sell-off.

While macro market conditions are still evolving, Arbitrum’s RWA boom, high holder count, and strong technicals create a solid backdrop.

The bull’s last stand? Key support levels to watch: $0.352, a fragile line in the sand, and a deeper safety net at $0.3147, forged in the fires of June’s market battles. Breach either, and the bullish dream could turn bearish nightmare.

Thanks for reading Arbitrum Price Jumps 25% As Institutions Bet on Tokenized Assets