Cathie Wood’s ARK Invest is doubling down on crypto’s comeback, strategically snapping up Coinbase and BitMine Immersion Technologies shares during the market’s recent wobble.

Cathie Wood is doubling down on crypto. ARK Invest scooped up nearly 95,000 Coinbase shares across its ARKK, ARKW, and ARKF ETFs, signaling unwavering faith in the crypto exchange despite market turbulence, Cointelegraph reports.

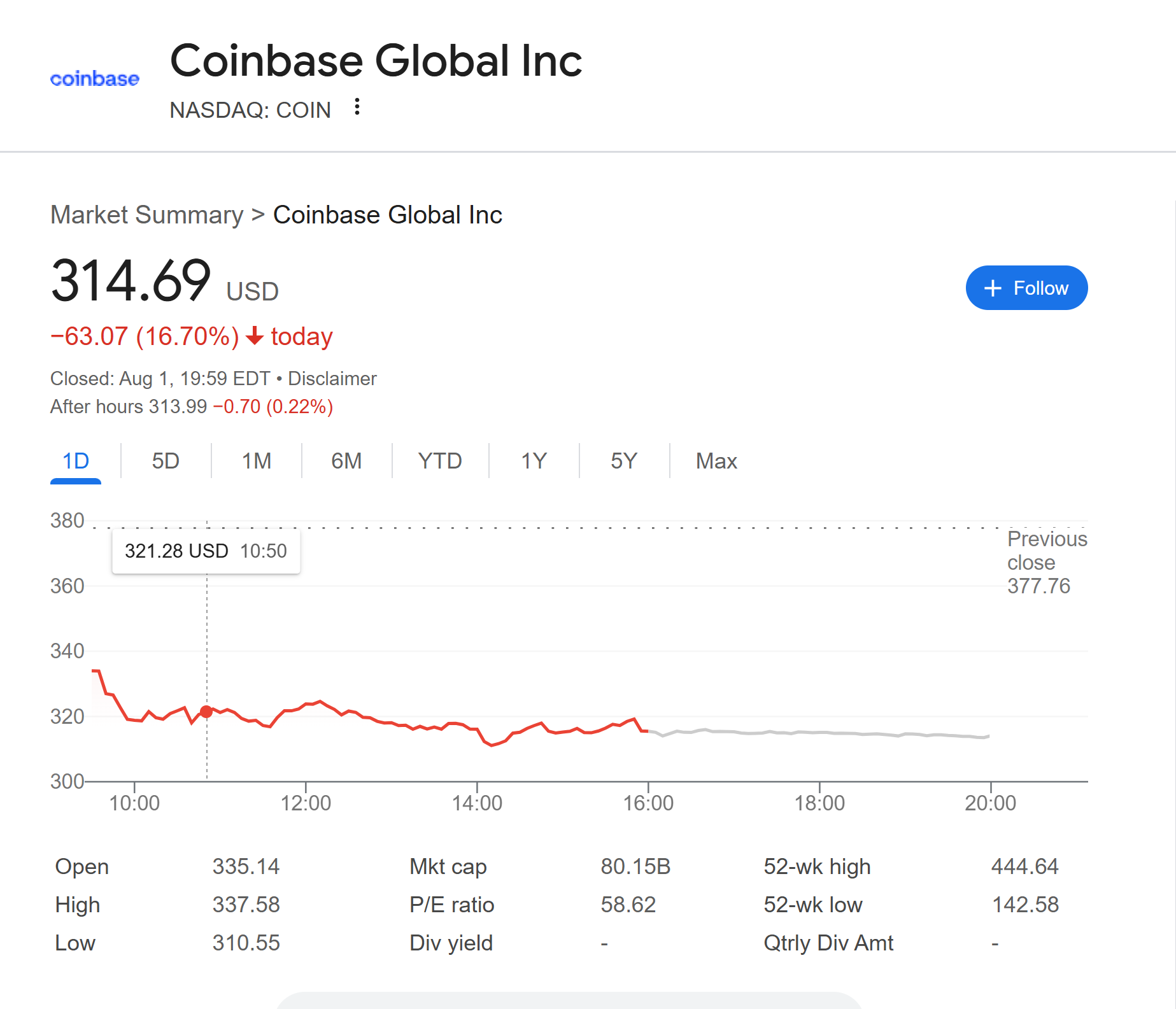

Coinbase’s stock took a brutal hit on Friday, plummeting 16.7% and wiping millions off its market cap. Shares crashed to $314.69, marking the worst single-day slide in recent memory. This freefall, fueled by mounting investor anxiety, saw the stock briefly dip to an intraday low of $310.55, a far cry from its $444.64 peak within the last year. Amidst the chaos, a bold investor seized the opportunity, scooping up roughly $30 million worth of the battered stock. Was it a calculated gamble or a vote of confidence in Coinbase’s long-term prospects?

After a strategic pause, ARK Invest is back in the Coinbase game. This renewed interest follows a period of selling, including Monday’s move where ARKW trimmed its holdings by 18,204 shares. At a closing price of $379.49, that’s almost $7 million peeled off the table. What’s behind ARK’s change of heart? Is this a tactical maneuver or a sign of renewed conviction in the crypto exchange’s long-term potential?

Coinbase closes Friday down by 16%. Source: SoSoValue

Related: ARK Invest adds $20M in BitMine, trims Coinbase, Block, Robinhood holdings

ARK Invest acquires more BitMine shares

Cathie Wood’s ARK Invest is doubling down on crypto infrastructure, making a bold $17 million bet on BitMine Immersion Technologies (BMNR). The disruptive innovation fund scooped up a substantial 540,712 shares across its ARKK, ARKW, and ARKF ETFs, signaling strong conviction in BMNR’s immersion cooling technology for Bitcoin mining. This aggressive move underscores ARK’s continued belief in the future of digital assets and the critical role of efficient, next-generation mining solutions.

BMNR shares took a beating today, plummeting 8.55% to a $31.68 close. The stock’s wild ride included an intraday low of $30.30, a stark reminder of the volatile trading session.

Cathie Wood’s ARK Invest is doubling down on BitMine (BMNR), signaling a bullish stance on the crypto mining company. Following last week’s massive $182 million buy-in, ARK Invest splashed another $20 million on BMNR shares across three ETFs on Monday. Is Wood betting big on BitMine’s future, or is there more than meets the eye in this strategic accumulation?

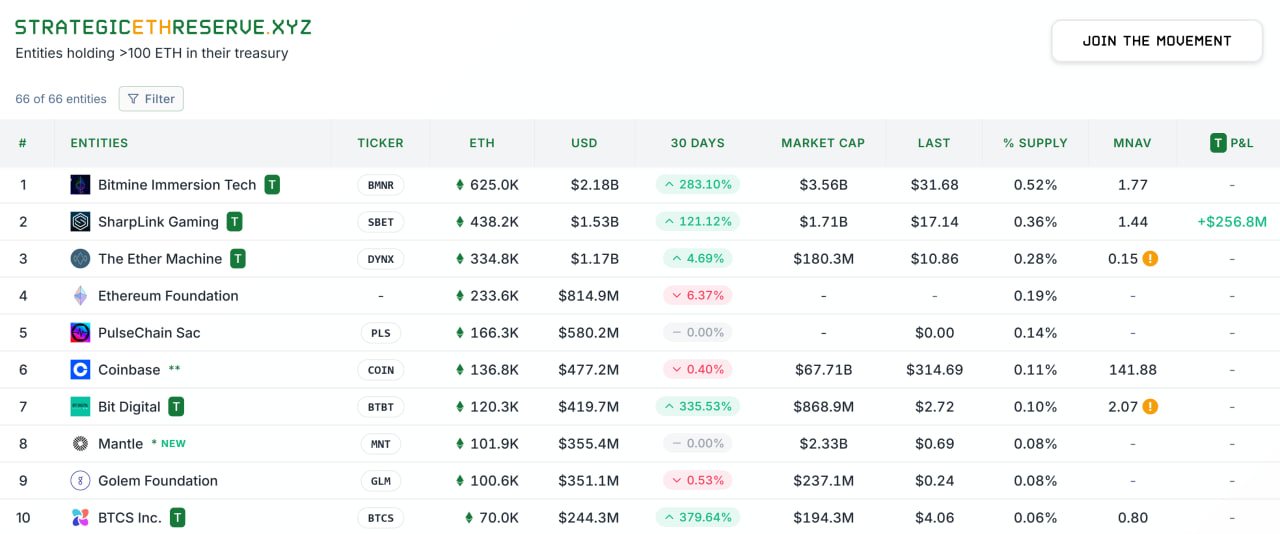

BitMine isn’t just playing the Ether game; they’re dominating it. Fresh off an aggressive strategic shift, BitMine has amassed a staggering 625,000 ETH, vaulting them to the top as the undisputed king of Ether treasuries. Data from StrategicEtherReserves confirms the digital gold rush, placing SharpLink Gaming in a distant second with 438,200 ETH. The message is clear: BitMine is betting big on Ether, and they’re currently holding all the cards.

Top 10 corporate Ether holders. Source: StrategicEtherReserves

Related: Cathie Wood’s ARK partners with SOL Strategies for staking services

Wall Street sinks amid weak jobs data

Wall Street took a nosedive Friday, kicking off August with a jolt as investors grappled with a double whammy: lackluster economic reports and President Trump’s freshly shuffled tariff cards, CNBC reported. The Dow Jones Industrial Average plummeted 542 points, its most harrowing plunge since mid-June, while the S&P 500 and Nasdaq suffered their most brutal sessions in months, leaving traders reeling.

July’s jobs report delivered a gut punch: a paltry 73,000 jobs materialized, shattering hopes and hinting at a labor market on life support. But the bad news doesn’t stop there. Forget the sunny narratives spun from previous months – May and June’s figures have been revised… downwards. The truth? The economic engine is sputtering, and the gears of job creation are grinding to a halt.

Wall Street took a tumble, with bank stocks leading the charge downhill amid growing fears of an economic slowdown. Lending headwinds sent shivers through the sector, dragging down giants like JPMorgan (off over 2%), Bank of America, and Wells Fargo (both plunging more than 3%). The industrial engine sputtered, too, as GE Aerospace and Caterpillar also succumbed to the market’s gloomy mood.

Magazine: Crypto traders ‘fool themselves’ with price predictions Peter Brandt

Thanks for reading ARK Invest scoops up Coinbase BitMine shares amid stock dips