- AVAX price struggles near $18.50 support as long liquidations and bearish pressure grow quickly.

- Open Interest, funding rates, and weak indicators suggest capital is leaving while sellers hold control.

Avalanche (AVAX) stayed on the edge Wednesday with the price falling 2% to reach $18.67. It makes the token cling precariously to a strong support line that has remained in place since mid-April. The fault lines are widening with one false step below this level being the opening to a massive price fall.

AVAX Derivatives: Is the Tide Turning? A chilling wind is blowing across the AVAX derivatives market. Open Interest, the lifeblood for these contracts, fell to a cool one-month low of $445.03 million, as per Coinglass. A shadow seemed to fall during the last 24 hours, with a stark 1.80% dip announcing that capital was fleeing away from AVAX positions. Have investors deserted their faith, or is it only the calm before the next surge?

Source: Coinglass

Downward liquidation figures formed the death mark of extinction of full client conviction. A mammoth $1.38 million, gone with the wind, was liquidated in a single day destroying the long-side. Shorts stood relatively unfazed, only $107,210 having been liquidated. This $1.49 million massacre leads the bulls in despair.

Bearish Bias Strengthens Amid Technical Signals

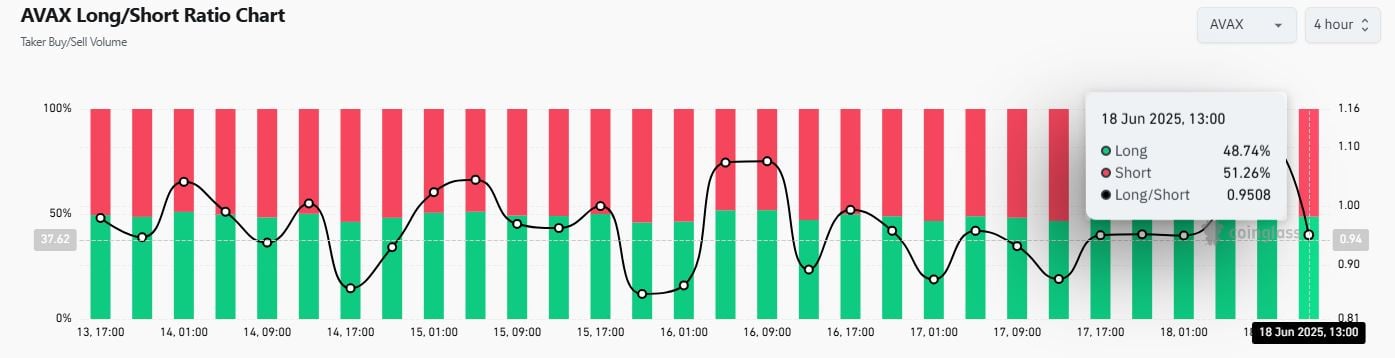

There goes a slight tremor through the market. The bears are flexing, their claws peeping out in the 4-hour long-short ratio at a mere 0.9508 just a whisker below parity. Funding rates of Open Interest cling to the giddy heights of neutral at 0.0045%, suggesting an uneasy equilibrium, an uncoiled spring waiting to snap.

Source: Coinglass

The MACD presents a bearish scenario of unabated descent that cannot be violated. The signal line has been an impregnable fortress while red bars have blossomed ever deeper below the water line, a testimony to the sellers bearing an unrelenting strangle-hold on the market. The RSI at 37 offers a glimmer of hope, so to speak, far from oversold yet miles away from any glimmer of bullish awakening. Buckle up, for the charts are whispering more falls should this downward pressure continue.

The Chaikin Money Flow flirts within a faint lick of danger for AVAX, measuring at -0.08, as it goes on to say that slight capital outflow marginally surpasses inflow. The Balance of Power, on the other hand, offers a stronger disagreement by registering -0.14, having sellers heavily flexing their boxing gloves to completely eclipse the faint cheer of the buyers.

Source: TradingView

Avalanche Risks Slipping to $16.14 or Lower

Is that why AVAX was teetering along the edge this week? It poked just up to $18.13 before casting the faintest shadow of a bounce. But don’t be fooled; the bulls are far from rallying. Long shadows have dominated recent candles, a classic sign of sellers fiercely defending higher ground. The real battleground? $18.50. Precipitate the fall of AVAX beneath that line; brace for impact. Ian Cooper, a trader, has warned of a possible freefall to $16.14, with Bitcoin dragging AVAX to the feared yearly low of $14.66 whenever it slumps downwards. Temporary hiccup? Or is the curtain rising upon doom?

Cooper signaled that AVAX is walking on a tight rope about to tiptoe on a vital support level traced by a line trending downwards. Will the feeble rise to close the bargains? Maybe, depending on what Bitcoin does next. AVAX is in many ways held hostage by the quite uncertain destiny of Bitcoin and altcoin.

What about the price of AVAX digging in at $18.50? Imagine a calmness sweeping over the entire market, bringing back that fresh blood for frenzy buys. And AVAX suddenly would be eying $21.11, where the 50-day EMA would be protecting it. It’s a tempting prize, that depends on a delicate shift in market mood. Sentiment right now is as fragile as spun glass.

Thanks for reading Avalanche (AVAX) Risks Deeper Losses as Investor Interest Fades