It’s been a well-advertised fall from grace for Berachain. Formerly darling of crypto, thanks to an exciting testnet, now the chain data says it all. The wrong reasons are still in the spotlight: confidence is fizzling away faster than a spilled meme coin, which has everyone-the users and analysts alike-thinking about what went wrong.

Such was Berachain’s meteoric rise into the space. Formerly a darling of crypto, with an exciting testnet to back it, the on-chain data now spells doom. The spotlight is still on it, albeit for all the wrong reasons: confidence is evaporating faster than a spilled meme coin, leaving users and analysts agents in a wonder about what went wrong.

Outflows Reach $1.2 Billion as TVL Drops Over 70%

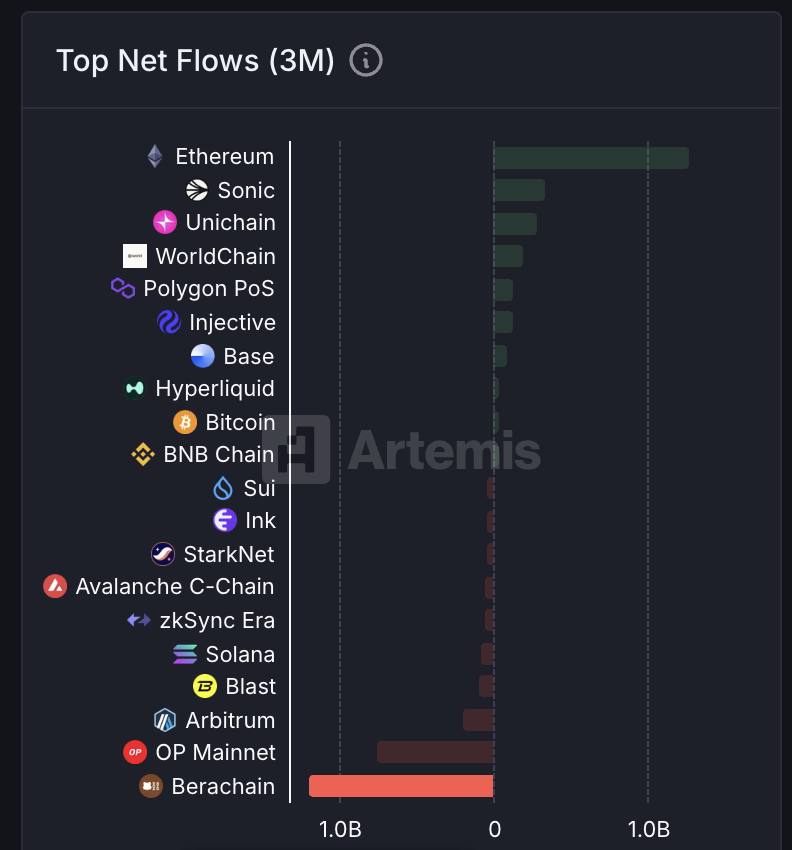

The honeymoon phase for Berachain is now over. Artemis data reveals an unthinkable $1.2 billion exit from the chain within a mere three months. While about $1.69 billion flowed in, the outflow was a torrent of $2.89 billion, thus leaving Berachain bleeding capital and crowned as the undisputed outflow champion.

Berachain is the Leading Chain by Net Outflows. Source: Artemis

As key metrics continue bleeding red, the morale of the Berachain community has dropped painfully. Doubts now permeate what was earlier an optimistic vibe-and many in the community wonder if the initial spark of the platform can stand amidst the immense tide of fleeing funds and sinking enthusiasm.

The honey pot of Berachain seems to be losing its sweetness. Previously abuzz with activity from eager testnet participants, the chain is now undergoing a mass exodus. Almost $1.1 billion has been drained in the last three months in a full bloodbath, with an 82% fall from its all-time high-the crypto analyst Rick uses these to justify that the bear market might have settled forever-there are only echoes left of aggressive power users who farmed potential airdrops. Is this just a lull in activity, or has the bear lost its sting?

The discontent wanders in the air. Remember the testnet buzz? Now, the wind seems to murmur something else. The enthusiasm has ebbed away into a shadow of its past glory as leading actors begin to defect to the glare of competing ventures.

The first ripple of excitement shed itself away. And presently, the buzz is all about marketing smoke and mirrors, with whispers about whether the platform can really make it. Once contained by the community’s unwavering faith, the doubt now exists with much more tacit energy.

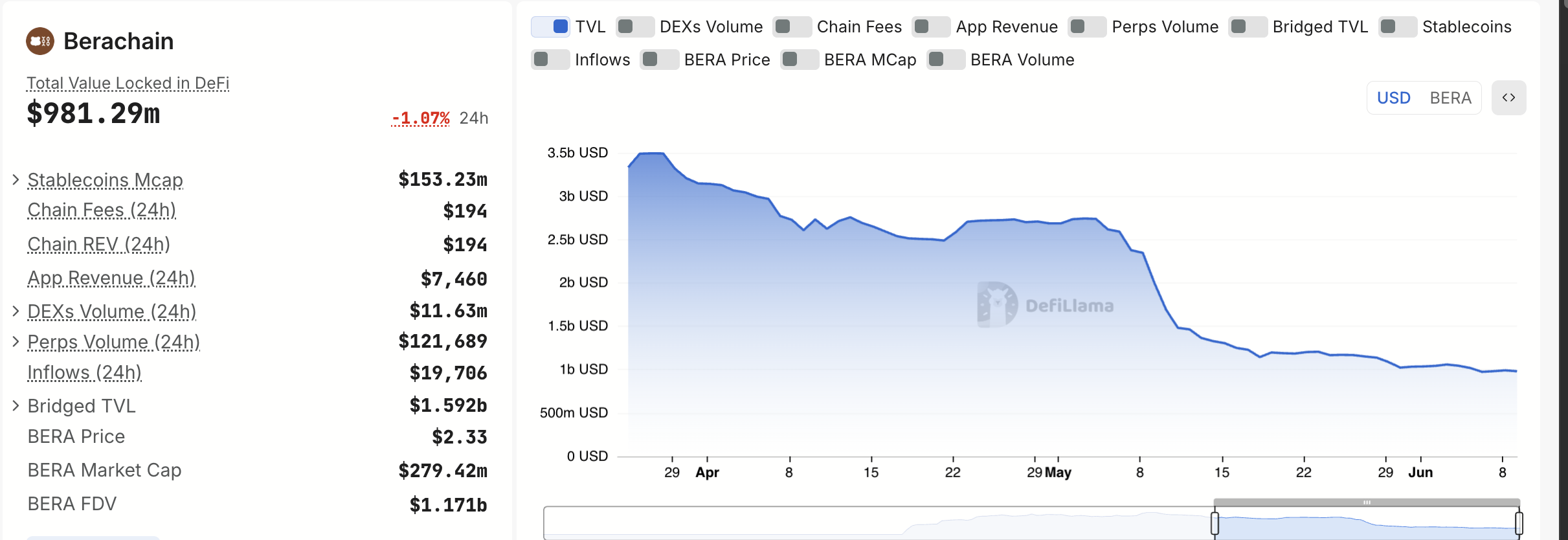

The honey pot of Berachain consequently looks, if such a thing can happen, a shade less sweet than before. DeFiLlama’s TVL dashboard shreds through headlines citing a 70% crash from the peak, a financial landslide into erasing more than just liquidity. This is no small matter, acting as an earthquake of confidence shaking away users and builders alike. With even the data screaming it, the shrinking of Berachain is a fast one. Is this so-called temporary chill before the next bull run, or just the onset of bear market hibernation? Short-term stability is surely under the microscope.

Berachain TVL. Source: DefiLlama

What Lies Ahead for Berachain?

On-chain pulses of Berachain reveal a harsh truth: The tech is solid, but the vibes are off. Whispers of value and growth uncertainties are in the atmosphere; developers and community leaders, the clock is ticking. Transparency is no longer optional it’s a necessity. Swift action, and only that, will stave off the cooling sentiment.

Berachain teeters over a very thin line. With all this lingering negativity, it risks turning into a DeFi phantom, a chain mumbled of but never really embraced. Project leaders and staunch diehard users now face a stark choice: either to go full throttle into engagement…or watch their investments fade away into irrelevance in this fast-changing DeFi landscape in front of them. The time of great action is now before Berachain becomes yet another ghost in the machine.

The story of Berachain is that of a metaphorical warning for the blockchain universe. Faster than funds, community trust disappears. Now, the chain stands at a crossroads, with data and whispers alike warning of a critical test looming ahead.

Thanks for reading Berachain Faces $12 Billion Net Outflow and Steep TVL Drop Amid Community Doubt