TL;DR:

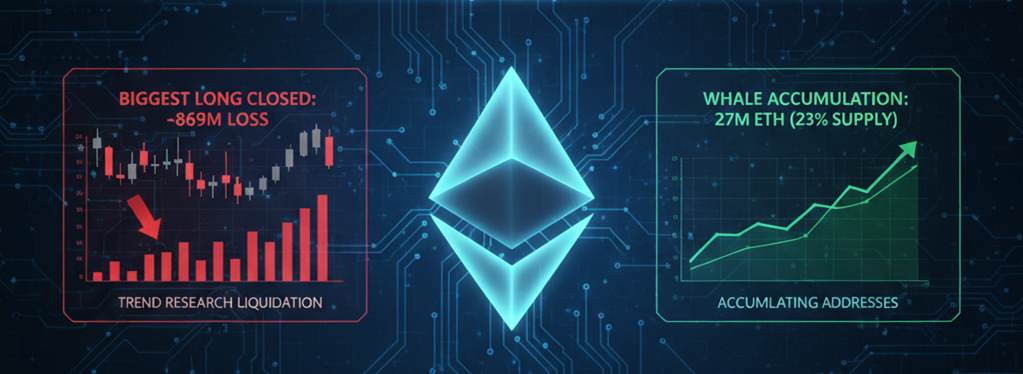

- Trend Research, led by Jack Yi, has permanently closed its $2.1 billion leveraged Ethereum long position.

- The trading firm recorded total losses of $869 million following the price drop toward the critical $1,750 level.

- Despite the leverage collapse, accumulating addresses now control 23% of Ether’s circulating supply.

Crypto industry saw a massive Ethereum liquidation in Asiaafter Trend Research, the company headed by Jack Yi, completely exited its $ETH exposure. Arkham’s data shows that it closed its last position this Sunday, leading to a risk reduction process which intensified amid ill liquidity and extreme volatility.

The move came after days before the total shutdown, Jack Yi posted positive messages predicting Ether would go up to over $10,000. However, a brutal exit led to million-dollar losses due to market pressure and the cost of leverage was also followed by an extreme exit that showed how even the biggest players can succumb to fluctuations in the spot market. ****

On-chain Resilience: Whales Capitalize on Capitulation

Despite the forced institutional closure, **the network’s basic indicators reflect a story of long-term strength and confidence.” So-called ‘accumulating addresses’– which keep balances above 100 $ETH without withdrawals now have 27 million units (about a quarter of the asset’s total capitalization) and nearly one in four. ****

CryptoQuant’s **Recent analysis suggests that “the current price is historically attractive zone for spot capital entry.” This is the only time in Ethereum’s history that it has traded below the real price of these accumulation wallets, a pattern which previously preceded major market recoveries. ** ** .

So, in a multi-year period where leveraged traders are subject to painful liquidations (i.e., “Synthetic investors” continue to absorb the supply available.” Now the market will now be monitoring whether this monopoly of long positions in Asia is the ground for starting an upward trend driven by organic accumulation. ** ** .

Thanks for reading Biggest ETH Long in Asia Disappears Yet On-Chain Signals Remain Bullish