“Why Chamath Palihapitiya is Betting Big on the Market (and Why You Should Pay Attention): The billionaire VC reveals the two financial forces fueling his unwavering optimism.”

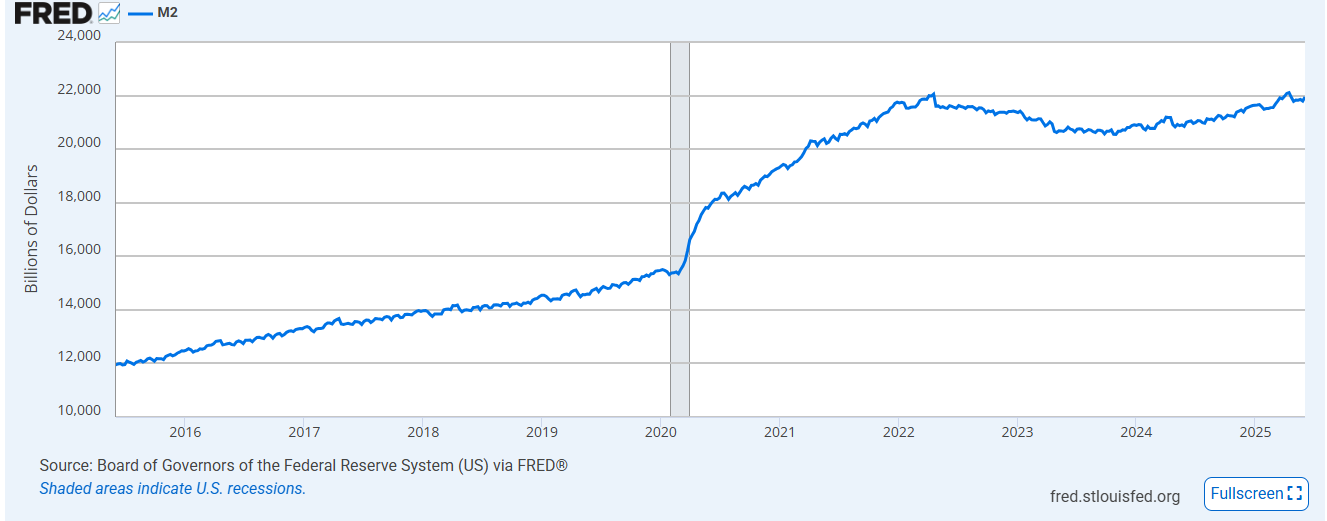

Chamath Palihapitiya dissects the M2 money supply rollercoaster on the latest All-In Podcast, charting a course through its recent ascent.

“Soaring M2 growth? That’s the rocket fuel behind the S&P 500’s gravity-defying climb, according to one billionaire’s playbook.”

“Alright, listen up. Forget the tea leaves and crystal balls. I’m looking at cold, hard data, and it’s screaming “opportunity.” If I were laying down chips, I’d be betting big – levered long, to be precise. We’re talking serious profit potential here. The key? Velocity. Let’s dive into the engine room of the economy: M2. This isn’t just about how much money exists; it’s about how fast it’s moving, changing hands, fueling the fire.”

“The monetary brakes were applied. We tightened the money supply and initially, the market responded. But then, something shifted. As the economic fog cleared and investors glimpsed potential growth on the horizon, capital flooded back in. This influx reignited the equity markets, giving them a jolt of life.”

Source: FRED

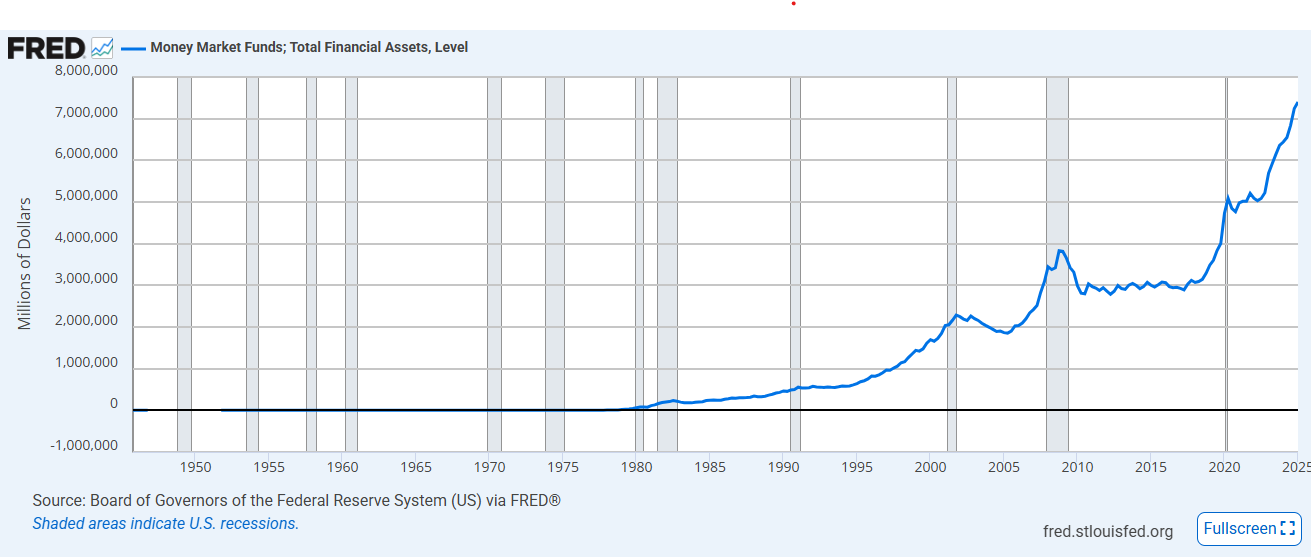

Beyond sprawling estates and tech ventures, the billionaire’s gaze is fixed on a less glamorous corner of the financial world: money market funds. These cash-parking havens, their yields dancing to the Federal Reserve’s interest rate tune, offer a telling glimpse into the economy’s undercurrents, a signal too crucial for the ultra-wealthy to ignore.

Chamath Palihapitiya predicts a market flood: Trillions currently parked in the safety of money market funds are poised to surge into stocks the moment the Federal Reserve signals a rate cut, igniting a potential investment frenzy.

“Trillions upon trillions a veritable Everest of cash is parked in money market funds, a financial army poised for deployment. This isn’t idle money; it’s dry powder yearning for ignition, capital hungry for a worthy investment battlefield.”

Jerome Powell is walking a tightrope. Perched high above the markets, any misstep could plunge the Fed into a political abyss. The data sings a siren song of rate cuts, a tempting solution with a double-edged promise. Cut rates, and brace for impact.

Money market funds are poised for an outflow as investors chase juicier returns elsewhere, simultaneously boosting the velocity of money. This dynamic duo? A bullish forecast for equity markets.

“Perched atop a record peak with rates at 4.5%, and Powell cornered, the market’s compass points north – further upward climb is the likely forecast.”

I think if Powell starts an aggressive cutting program… you could see the S&P 500 at 7,000.”

Source: FRED

As of Monday’s close, the S&P 500 is trading at record-high levels of 6,204.

Generated Image: Midjourney

Thanks for reading Billionaire Chamath Palihapitiya Believes a ‘Free Money’ Trade Has Arrived Says Trillions of Dollars Needs To Find a Home