Forget Bitcoin’s boring beige. Meme coins are throwing a wild party, raiding the blue-chip fridge and dancing on the furniture while the grown-ups watch in disbelief. Crypto’s caught a serious case of FOMO, and Doge’s leading the conga line.

Crypto springs back to life! Risk appetite is roaring as easing geopolitical tensions send shockwaves of optimism through markets. Forget fear – greed is back in vogue. Bitcoin and its digital brethren are riding the wave of a resurgent S&P 500, which shattered the 6,000 barrier for the first time since February, injecting confidence into all asset classes. The real kicker? Oil’s dramatic plunge. Brent crude’s 6% nosedive to $67.14 unwinds the Iran-Israel conflict premium, fueling hopes for continued economic stability and sending crypto bulls into a frenzy.

The crypto market’s pulse quickened today, surging 2.5% to a staggering $3.33 trillion as a wave of investor optimism washed over the digital landscape. Risk appetites are back, and the proof is in the overwhelmingly green charts: a remarkable 98 out of the top 100 cryptocurrencies basked in positive gains over the last 24 hours, painting a vibrant picture of renewed confidence.

Bitcoin consolidates as institutions keep accumulating

Bitcoin price data. Image: TradingView

Bitcoin nudges past $109,507, a seemingly small 3.59% gain that belies a powerful undercurrent. After shaking off a two-day dip, the crypto king is flexing, testing the upper limits of a bearish channel that’s been dictating the narrative since mid-May. Forget weakness; this price action whispers of healthy consolidation, a market taking a well-deserved breath before its next leap.

Bitcoin’s pulse quickens, but not feverishly. The Relative Strength Index (RSI), a key market thermometer, hovers at a healthy 60. Forget scorching rallies; this reading suggests sustainable gains. Think of it like this: the engine’s purring nicely, fueled for another climb. No red flags, just a steady ascent.

Think of the 50-day Exponential Moving Average (EMA) as a velvet rope, subtly holding back the crowd below the current price. It’s where the smart money – institutional investors – often dips in, adding to their positions like seasoned gamblers upping the ante. This EMA, a pulse reading of an asset’s recent history, offers a soft landing. But deeper down, the 200-day EMA lurks, a more formidable fortress. To trigger a real price quake, both of these bastions of support would need to crumble.

The ADX whispers a tale of weak conviction, registering a mere 12. But don’t be fooled! This minor dip occurs amidst a raging bull market, a trend that has been dominant since well before the last halving. Think of the ADX as a trend’s muscle gauge; right now, it suggests a brief pause for breath, not a reversal. Remember, it quantifies thestrengthof the trend, irrespective of whether it’s charging uphill or retreating downhill.

Bitcoin price data. Image: TradingView

Bitcoin’s price action is currently playing out within welldefined boundaries. Bulls are defending the $104,000 level – a critical psychological support – while bears are pushing back at $112,000, a zone that recently rebuffed an upward surge. A break below $104,000 opens the door to a test of the 200day EMA around $96,000, a more formidable support. Conversely, shattering $112,000 sets sights on $115,000, a measured move target that could usher in a new alltime high. This tugofwar will determine Bitcoin’s next major move.

Ethereum battles technical headwinds despite adoption wins

Ethereum price data. Image: TradingView

Ethereum’s bulls are locking horns with bears at $2,559, a defiant 3.16% surge proving this smart-contract titan won’t yield easily, despite technical headwinds. Fueling the fire is Robinhood’s bold move: unleashing 213 tokenized stock contracts on Arbitrum, Ethereum’s layer-2 scaling solution. This isn’t just another partnership; it’s a resounding endorsement from a major player, signaling enterprises are increasingly recognizing Ethereum’s real-world utility, even amidst market volatility.

The technical landscape is a tightrope walk for traders. The RSI, hovering at a bland 54, whispers of a market holding its breath poised, but undecided. Like the eerie calm before a storm, this equilibrium, coupled with an ADX flatlining at a feeble 11, suggests a market devoid of conviction, primed for an explosive breakout in either direction. The suspense is palpable.

The elephant in the room stomps less fiercely now. While the 50-day EMA still clings stubbornly above the 200-day EMA in a bearish posture, the gap between them has narrowed to a whisper. This near-convergence paints a picture of a market stuck in neutral, where traders tiptoe in and out, eking out the smallest of gains in a sideways dance.

Silence before the storm! The Squeeze Momentum Indicator is screaming: volatility is coiled, primed to unleash a violent move. Institutional whales are circling, their bullish appetite sharpening, hinting at an upward explosion. But markets remain dormant, awaiting the catalyst. The Squeeze promises a breakout the only question is: will bulls or bears seize control and detonate the price? Prepare for impact!

The price action is heating up, and the battlefield is clearly marked. First line of defense for the bulls? A psychological stronghold at $2,400. Breach that, and the bears will test the fortified zone around $2,200 – a landscape scarred by previous accumulation wars.

But the bulls aren’t backing down. Their initial assault faces a wall of resistance at $2,600, a rejection zone guarded by the 50day EMA. Overpower that, and the ultimate prize – the breakout target at $2,800 – beckons. The victor will claim the spoils. Place your bets.

SPX6900 rockets higher on technical breakout

SPX6900 price data. Image: TradingView

But enough about boring ol’ Bitcoin and Ethereum: Welcome to the fun meme coin madness of the day.

Against all odds, SPX6900, the meme coin that refuses to be forgotten, is defying gravity. A jaw-dropping 12% leap to $1.27 isn’t just a bounce it’s a resurrection. Traders are stunned as this underdog rockets past giants, claiming the throne as the best-performing cryptocurrency in the top 100. Is this a fluke, or is SPX6900 about to rewrite the rules?

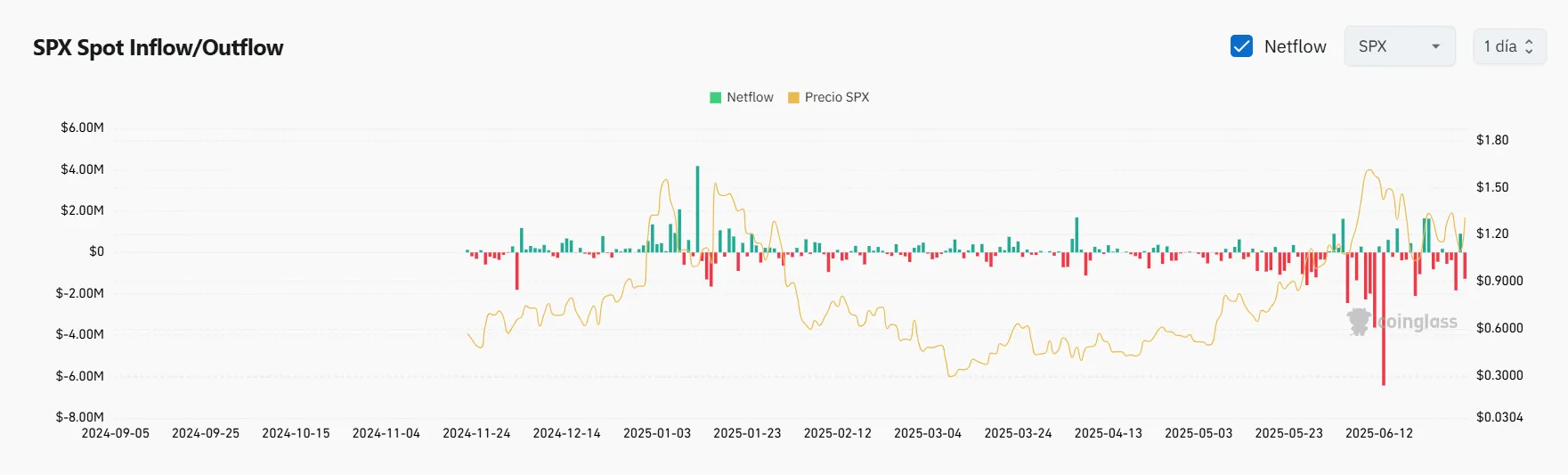

The meme coin bled 10% on July 1st, a red flag waved by ruthless short sellers. But in the crypto world, carnage often signals opportunity. Savvy investors saw the dip as a buffet. On-chain whispers confirm the hunch: whales, their digital appetites whetted, gorged themselves on the cheap coins, private wallets swelling with newfound riches.

Image: Coinglass

Bulls are still in charge. The SPX6900’s RSI, currently at 52, suggests ample upward momentum before overbought conditions kick in and trigger profit-taking. Adding fuel to the fire, the ADX, nearing the pivotal 25 mark, hints at strengthening trend strength. But the real kicker? This meme coin is coiled tight within a triangle pattern, poised for a breakout that could define its destiny. Keep your eyes peeled – this could be the rocket launch we’ve been waiting for.

“$1.10: The battle line is drawn. The 50-day EMA now stands as a firm floor, daring bears to break through. For now, bulls reign supreme, holding price above this crucial level. But the real intrigue lies beneath the surface: the Squeeze Momentum Indicator screams “coiled spring!” Volatility has been choked back, tension is building, and a bullish eruption could be imminent –ifthe other signals align. Watch closely; this market is about to unleash.”

$1.08$1.17: The immediate safety net. Expect a potential price bounce within this zone, offering a temporary reprieve.

$0.92: The fortress. A breach here signals significant bearish momentum, as it represents a prior critical breakdown point.

$1.40$1.50: The first hurdle. Watch for price struggles around this area, marked by indecisive support/resistance wicks from June. A breakthrough suggests bullish intent.

$1.70: The summit. June highs form a formidable barrier. Conquering this level confirms a powerful bullish reversal.

Disclaimer

Think of this as a conversation starter, not the final word. These are simply the author’s personal musings, not a financial roadmap or expert advice.

Thanks for reading Bitcoin and Ethereum Bounce But This Meme Coin Is Stealing the Show: Analysis