During the U.S., Bitcoin continued its breakout on Wednesday with up to $97,800 as high as it rose to $17,000,600 during that week’s peak of bitcoin’ and other -independent cryptocurrency (Bitcoin) infected by Bitcoin last month at an early stage for their latest surge. S, meanwhile. Trading session After finally breaking the $95,000 resistance that capped prices for much of the last two months, broke up with trading sessions after it breached price limits.

The largest cryptocurrency gained 3.5% over the past 24 hours.

Ethereum’s ether ETH$3,356 is the second largest cryptocurrency, while it was also known as Ethereum’s ‘thriller’. Despite bitcoin’s gains, 01 beat bitcoin by 5% to $3,380 its highest price in more than a month – and breaking the key $33,300 level for the first time in 2026.

When the top two cryptocurrencies were simultaneously released, it was widely liquidated in derivatives markets especially among traders who had placed leveraged bets.

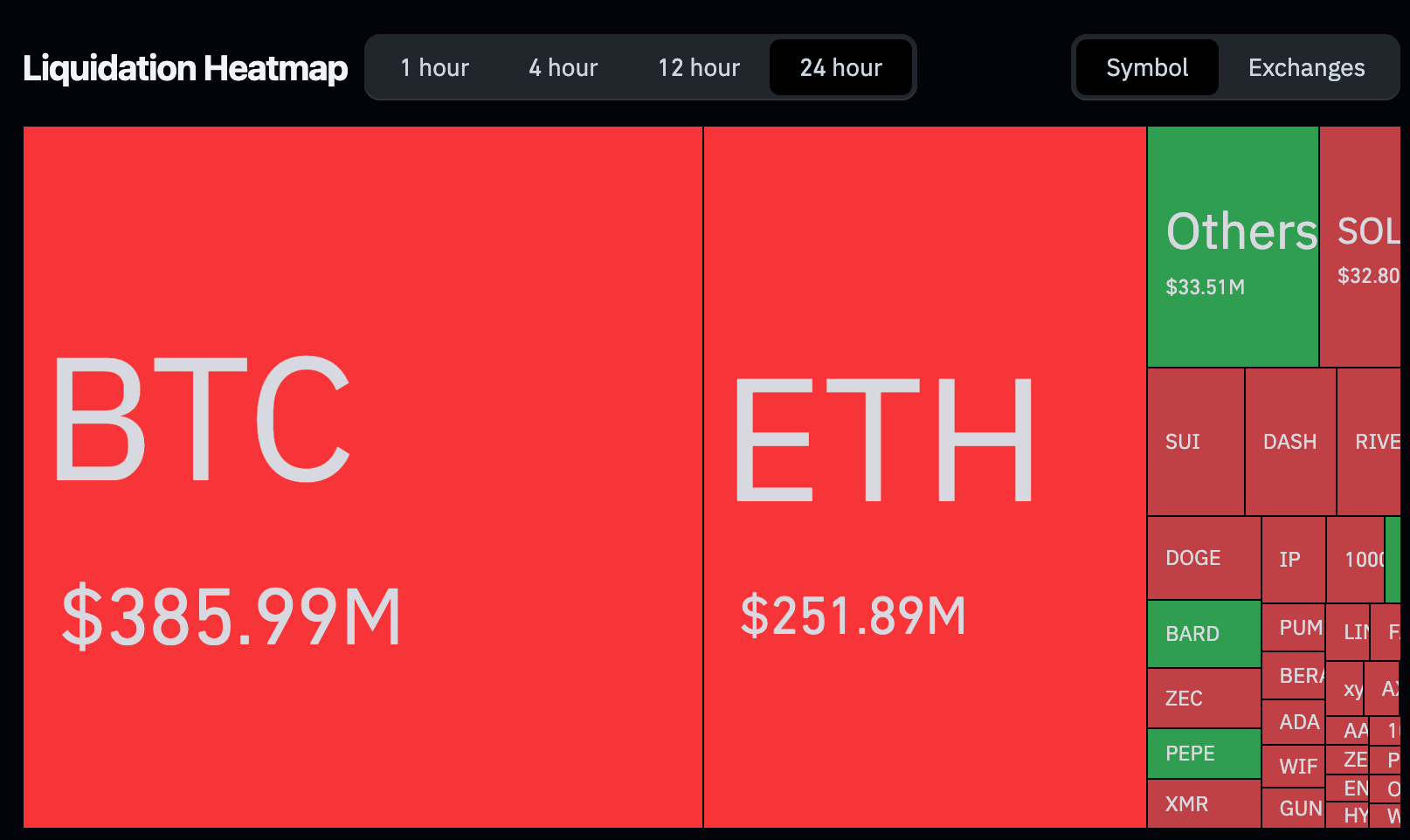

CoinGlass reports that “a total of $700 million worth of leveraged short positions bets on lower prices – were erased from the market” (the statement read ‘The price range for this is about $800 million). There were roughly $380 million bitcoin shorts of that, and more than $250 million from traders shorting ether.

If traders shrewd the bet on an asset’s price decline and suddenly, when it becomes less attractive, a short position is liquidated as those positions are automatically closed by the exchange or broker after they have been placed in that position. This is especially prominent in leveraged trading (such as futures or margin trading) when the trader’s collateral, or Margin, does not cover losses due to violent price movements against their bets.

A meaningful pocket of short positioning was liquidated after the break above $95,000, and [short] cover-driven demand for this is a consequence,” Gabe Selby, head of research at CF Benchmarks said.

Nevertheless, the move may not be based on an important shift as the price rally “appears to be mostly mechanical,” driven by market makers pushing prices higher in order to resolve residual supply-demand imbalances from the prior leg lower — meaning that it is rapidly declining October and November.

Crypto liquidations over the past 24 hours (CoinGlass)

A new record?

But the move to over $95,000 was a key green light for the wider digital asset market to turn risk on Bitcoin, said LMAX Group’s analyst Joel Kruger.

In a note on Wednesday, “This move has revived bullish momentum,” with market participants looking at an increase of more than $100,000 and retesting all-time highs. A large-cap asset portfolio is showing solid breadth, with several large assets after bitcoin’s lead and posting strong gains as risk appetite returns. Paraphrasing ‘It is an important part of my life to be paraphrased.

Bitcoin’s previous all-time high was $126,000 in early October of last year.

Kruger also cited support from traditional markets, where the equity remains firm, and bond yields have stabilized, possibly helping fuel crypto’s upswing.

Kruger said the breakout was caused by “high trading volumes” of trade, indicating that this boom is driven by new demand.” In contrast, funding rates across perpetual market swaps remained low, according to CoinGlass data, meaning that the price rise is not driven by excess speculation.

Still, the rally might have finally started to inject some much-needed bullish signal for crypto traders.

a week above $95,000 in bitcoin, or if I break out of myETH beyond $3,500 would be an important confirmation for ‘new push ups.’ Kruger said the news was “independent on this new level of confidence that is being sent to me by e-mail and other forms of cryptography.”

Read more: U.S. bitcoin buyers are now driving price rally, reversing late 2025 trend

Thanks for reading Bitcoin and ethers sharp breakouts liquidate nearly $700 million short positions