Bitcoin Smashes Through Key Resistance: Is a Bull Run Imminent?

Bitcoin is on fire! The crypto king has obliterated two crucial resistance levels, clearing the path for a potential short-term bull run. Surpassing the $112,000 mark, BTC is etching new price peaks. What exhilarating adventures await traders in this unprecedented rally?

Bulls are stampeding. Gold glitters at a breathtaking $3,370 an ounce. The S&P 500 and Nasdaq Composite are hitting record highs faster than a hummingbird’s wings – three times in four sessions! What’s fueling this frenzy? The Federal Reserve’s holding pattern on monetary policy, and risk assets are loving every minute of it.

Bitcoin shrugged off initial rate hike jitters triggered by a surprisingly robust U.S. jobs report. June’s non-farm payrolls soared, adding 147,000 jobs against an expected 110,000. Despite an initial dip below $109,000, Bitcoin bulls swiftly absorbed the selling pressure, catapulting the cryptocurrency to fresh local highs, showcasing remarkable resilience.

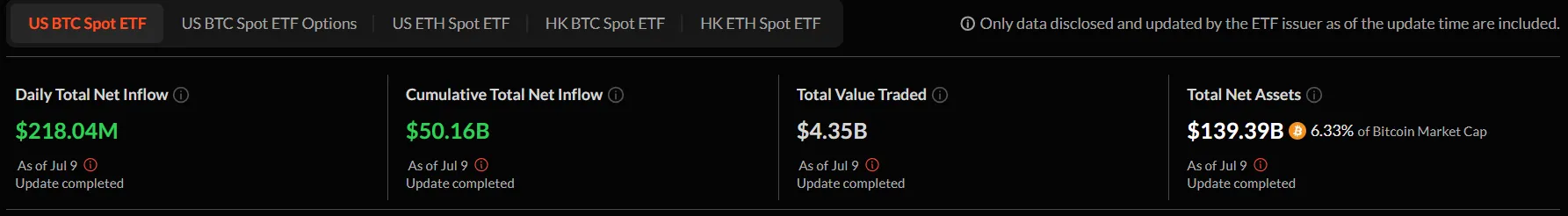

Wall Street’s stamp of approval is the headline. Bitcoin ETFs are shattering records, already topping $50 billion in inflows this July. This insatiable institutional appetite isn’t just padding Bitcoin’s bottom line; it’s rewriting its story, solidifying its transformation from a risky gamble to a cornerstone of modern investment portfolios. Smart money is in, and they’re here to stay.

Bitcoin blasts past resistance, whales load up: Is price discovery next?

Bitcoin charts: Double breakout targets final resistance

Bitcoin Shatters Records: Blasts Through $113K, Unleashing a Torrent of Bullish Momentum After Weeks Trapped in a Technical Tug-of-War.

The 4-hour candles exploded, shattering the symmetrical triangle’s confines. Zoom out to the daily view, however, and the bulls seem to be catching their breath, their advance measured in tentative steps rather than decisive leaps.

While these patterns often hint at potential shifts, this towering candlestick screams confirmation. The breakout is undeniable, flipping even the most cautious intraday indicators to a resounding bullish signal.

Bitcoin price data. Image: TradingView

The four-hour charts are painting a compelling picture: the Average Directional Index (ADX) is surging at 27. Forget sideways shuffling – this screams “trending market.” Think of the ADX as a trend hunter; it sniffs out momentum, not caring whether it’s bullish or bearish. Once it claws its way above 25, a signal flares. Momentum traders, hungry for action, take notice. This isn’t just a blip; it’s the green light for trend-following algorithms to kick into high gear, unleashing a wave of systematic buying.

Bitcoin’s RSI is flashing red, currently simmering at a toasty 75, signaling overbought conditions. Imagine the RSI as a market thermometer; when it spikes this high, veteran traders start reaching for the AC, anticipating a potential cool-off. In Bitcoin’s case, this could mean a correction is brewing after its recent surge. But hold on – Bitcoin’s a rebel. It’s shrugged off even hotter RSI readings in the past, continuing its bullish rampage. Will history repeat, or is a pullback on the horizon?

The Squeeze Momentum indicator has sprung! On the daily chart, the “off” status confirms the volatility rocket has already launched from its compressed state, precisely as anticipated. The initial breakout fireworks have faded, signaling a pivotal moment. Traders, brace yourselves: the market will either continue its trajectory or enter a consolidation phase at these altitudes.

Bulls are flexing their muscles, and the market’s responding in kind. Expect upward momentum to persist, though a temporary pullback wouldn’t necessarily signal danger. Recent dips have been shallow, suggesting underlying strength remains.

Bitcoin’s daily chart is flashing green, a symphony of bullish signals suggesting a breakout. After months trapped in a bearish channel since May’s peak (highlighted by the yellow lines), Bitcoin has finally broken free, hinting at a potential surge.

Bitcoin price data. Image: TradingView

Bitcoin’s got a safety net! A bullish trendline, forged from April’s dip and June’s resilience, is emerging (see the white line on the chart). Watch closely: if this support holds, Bitcoin could be spring-loaded for a rebound. Imagine $110K not as a target, but as thenewfloor by month’s end – a testament to sustained bullish power.

The daily Relative Strength Index (RSI) hovers at a robust 67, signaling a market brimming with bullish energy. This isn’t a sprint towards overbought territory (70+); it’s a marathon runner finding their stride. Buyers are confidently stepping in, fueling upward momentum without triggering the warning bells of an imminent pullback. Think of it as a green light for cautious optimism – the bulls are charging, but they’re not out of control just yet.

The ADX hovers at 12 on the daily chart, a sleeping giant. The trend is a whisper, not a roar, lacking the conviction needed to solidify its direction. Short-term charts are a cacophony of false signals. Yet, this dormancy, this languid ADX reading below the crucial 25 mark post-breakout, hints at something profound: the deceptive stillness before the storm. Seasoned traders recognize this lull as accumulation – a coiled spring preparing to unleash its pent-up energy in a powerful, impulsive surge.

Bitcoin’s chart is screaming “uptrend!” Moving average analysis shows it soaring above both the 50 and 200-period EMAs across various timeframes. What’s even more exciting? The widening gulf between these averages a classic sign of surging momentum. Think of this divergence as a safety net; during dips, it often acts as a dynamic floor, ready to catch Bitcoin before it falls too far.

Key Levels:

- Immediate support: $110,197 (breakout retest level)

- Strong support: $105,000-$108,700 (Support line)

- Projected resistance: $115,000 (measured move target from triangle breakout and the Fibonacci extensions)

What’s next for Bitcoin?

Bitcoin’s poised to shatter records! A perfect storm of bullish signals – technical breakouts, big-money backing, and a favorable economic backdrop – is brewing. But savvy traders, eyes glued to the charts, aren’t popping the champagne just yet. They’re waiting for the ADX to confirm the breakout’s got staying power, signaling true trend strength above 25. And they’re on high alert for RSI divergences – a whisper of warning that new highs might be fleeting. This could be Bitcoin’s moonshot moment, or a cunning head-fake. Trade wisely.

Myriad’s crystal ball is blazing green. Traders on Dastan’s prediction market are betting big: Bitcoin laughs in the face of anything less than $100K this July, with an 81% probability. Short-term, the bulls are charging. Myriad is practically screaming a 90% certainty that Bitcoin will strut above $109,000 by week’s end – a bullish surge that erupted with a 40% overnight gain.

Bitcoin bulls are doubling down! Myriad users are now overwhelmingly confident – a staggering 87%, up from 69% yesterday – that BTC will smash through $115,000beforeit ever dips back to $95,000. The conviction is palpable.

Bitcoin Braces for July Turbulence: Trump’s $3.3 Trillion Gamble and a Crypto Wildcard.

Hold onto your hats, Bitcoiners! July promises a rollercoaster ride. Looming large is the potential impact of the Trump administration’s policies, particularly the infamous “Big Beautiful Bill.” This fiscal behemoth could balloon the U.S. deficit by a staggering $3.3 trillion – historically a rocket booster for scarce assets like BTC.

But that’s not all. Keep a close eye on July 22nd. The White House’s report on crypto executive orders is due, potentially unleashing updates on the U.S. Strategic Bitcoin Reserve. Will it be a game-changer, or a damp squib? This wildcard could send Bitcoin soaring or send shivers down the spines of bulls. Buckle up!

Disclaimer

Think of this as a friendly nudge in the right direction, not a financial roadmap etched in stone. I’m just sharing ideas, not dispensing investment gospel.

Thanks for reading Bitcoin Breaks Into New Price Territory: What Happens Next?