Bitcoin’s been on a tear, surging over 3% in the last two days and flirting with the $11,300 ceiling – the upper limit of its recent holding pattern. But is this rally about to run out of steam? As Bitcoin bumps against the upper Bollinger Band and a stubborn $11,400 resistance level, whispers of exhaustion are starting to circulate. Will Bitcoin shatter through that barrier and launch into new territory, or will the bulls take a breather, paving the way for a temporary pullback? All eyes are on Bitcoin to see which way it breaks.

What’s Happening With Bitcoin’s Price?

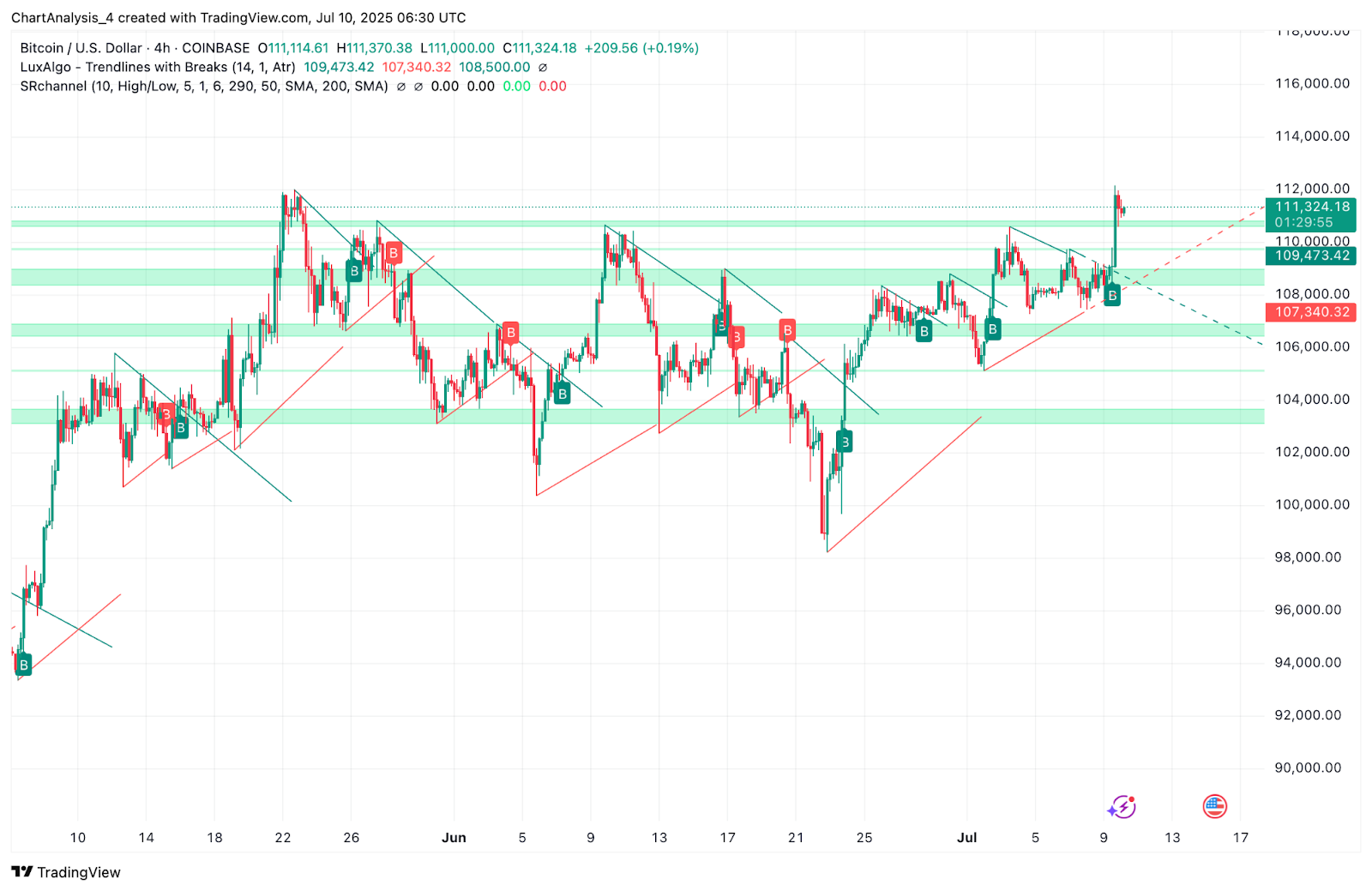

BTC price dynamics (Source: TradingView)

Bitcoin explodes! After consolidating for two weeks in an ascending triangle, Bitcoin blasted through the $110,000 ceiling like a rocket fueled by late-June’s trendline. The surge wasn’t subtle; a volume volcano erupted alongside the breakout, propelling prices into the $111,300–$111,600 stratosphere.

BTC price dynamics (Source: TradingView)

Bitcoin’s dance with the Bollinger Bands intensifies! On the daily chart, BTC’s price is flirting with the upper band around $112,377, but it’s currently facing a stiff rejection at this key level. Will it break through and surge higher, or retreat back into the Bollinger embrace? The battle at $112,377 is one to watch!

Bulls are flexing! An EMA power stack (20/50/100/200) has formed, firmly planted beneath the current price action, painting a vibrant bullish picture. Watch for the fast-moving EMA20, hovering around $108,100, to act as the first line of dynamic defense. Should that level falter, the sturdier EMA50 at $105,770 stands ready to catch the fall.

BTC price dynamics (Source: TradingView)

The $112,400 mark once a springboard in May and June has morphed into a formidable ceiling. Bulls need to smash through this barrier with conviction, or risk the rally fizzling out before it truly ignites.

Why Is The Bitcoin Price Going Up Today?

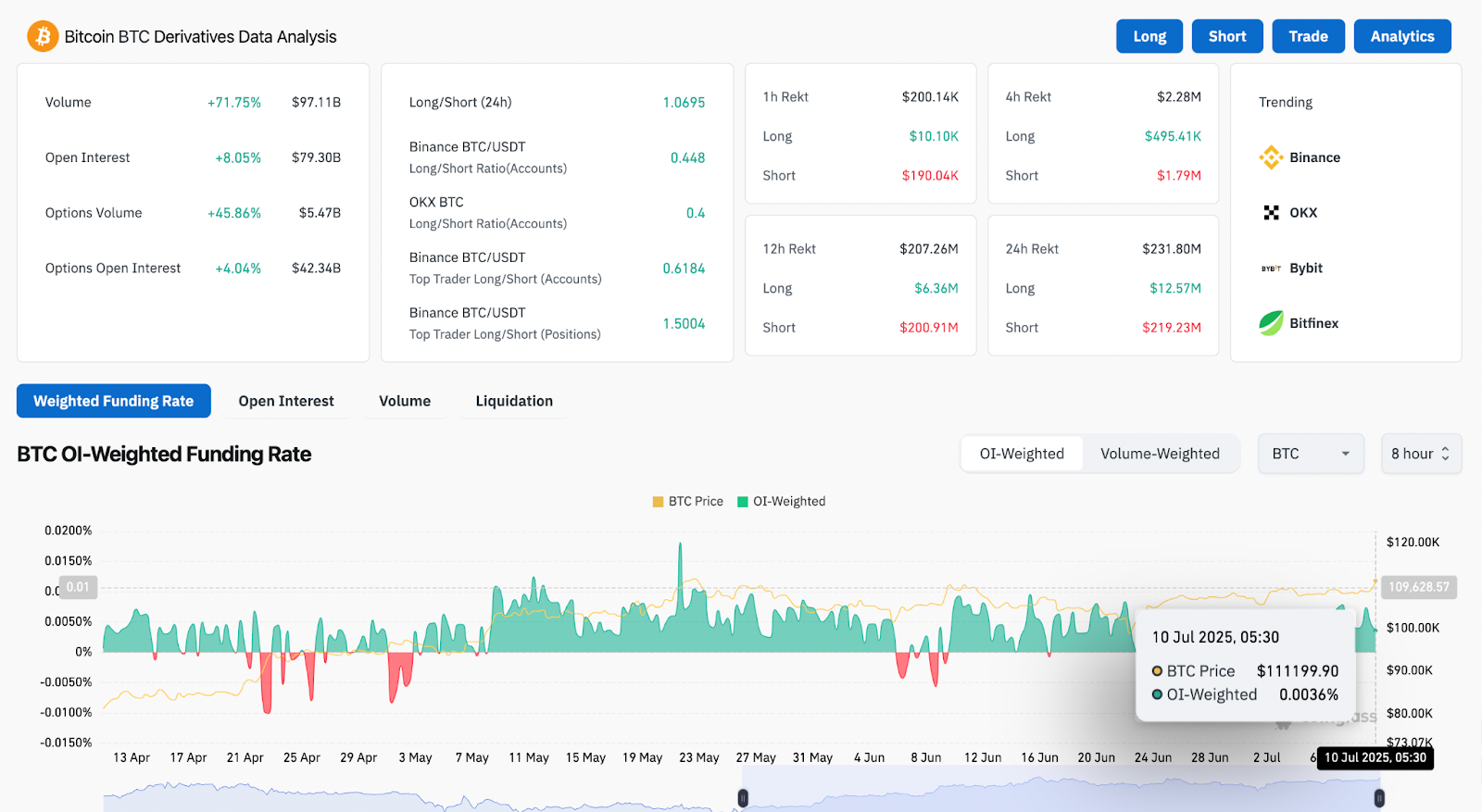

BTC Derivative Analysis (Source: Coinglass)

Bitcoin’s price surge? Buckle up. Derivatives are flooding in, igniting a technical breakout. Data points to a rocket launch, not just a bump.

- Derivatives volume surged 71.75% to $97.11B

- Open interest jumped by 8.05%, reaching $79.3B

- Funding rates remain positive at 0.0036%, reflecting long-biased sentiment

- Binance top trader long/short ratio hit 1.5, indicating aggressive long positioning

Bitcoin’s poised for a breakout! A tight symmetrical triangle formation on the 30-minute chart just cracked near $111,200, signaling a potential surge. While the Volume Weighted Average Price (VWAP) lingers just below at $111,192, providing immediate support, the Parabolic SAR has flipped bullish, with dots now trailingunderthe price. All signs point to upward momentum – buckle up!

Yet, tread carefully. The 4-hour chart whispers warnings: price kisses the rising wedge’s upper resistance, while the RSI’s momentum stalls. $112,226 (pivot R4) and $112,500 loom large – confluence zones ripe for profit-taking, potentially triggering a swift reversal.

Supertrend, DMI, and Bollinger Bands Signal Short-Term Tug of War

BTC price dynamics (Source: TradingView)

“$108,287: The Supertrend’s line in the sand. Holding steady on the 4H chart, it’s the bedrock of a confirmed bullish breakout. Bulls, take note: this level coincides with the old range ceiling, now reborn as a tempting retest opportunity. Will it hold, or will the bears crash the party?”

The bulls are charging! The Directional Movement Index signals an active uptrend with +DI (26.8) dominating -DI (8.5). While the ADX (21.6) confirms rising momentum, this bull run still has room to grow.

Bollinger Bands scream “trend ON!” as they stretch wide on the daily, price clinging desperately to the upper band. This bullish hug usually signals continuation. But beware – a stretched rubber band can snap. If volume doesn’t back this move, expect a swift, albeit temporary, pullback.

BTC Price Prediction: Short-Term Outlook (24H)

BTC price dynamics (Source: TradingView)

Bitcoin teeters on a knife’s edge! Can the bulls muster the strength to shatter the $112,400 ceiling within the next 24 hours? A decisive break is the key to unlocking a surge towards $114,900 – where the formidable R5 pivot resistance and the upper channel boundary await. Fail, and the bears might seize control. The clock is ticking!

Yet, beware the fall! Should this price plateau crumble, brace for a potential retreat, landing somewhere within the $109,000–$108,200 safety net. This zone isn’t just any floor; it’s a triple-layered defense woven from a rising trendline, fortified by Supertrend support, and echoing the ghosts of accumulated gains from that fateful July 7–9 buying frenzy.

“$108,000 is the line in the sand for BTC. Defend it, and the bull run breathes on. But beware: thinning short liquidations and fading momentum paint a precarious picture. Watch the volume – it’s the canary in the crypto coal mine.”

Bitcoin Price Forecast Table: July 11, 2025

| Indicator/Zone | Level / Signal |

| Bitcoin price today | $111,305 |

| Resistance 1 | $112,400 |

| Resistance 2 | $114,900 |

| Support 1 | $109,000 |

| Support 2 | $108,200 |

| EMA Cluster (20/50/100/200) | Bullish stack, lowest at $95,970 |

| Bollinger Bands (Daily) | Upper Band at $112,377 (testing) |

| VWAP (30-min) | $111,192 (price above, bullish) |

| DMI (14) | +DI 26.8 / -DI 8.5 / ADX 21.6 (bullish) |

| Supertrend (4H) | Bullish above $108,287 |

| Derivatives Volume | +71.75% ($97.11B), Long bias |

| Funding Rate | +0.0036% (positive) |

| Parabolic SAR (30-min) | Dots below price (bullish) |

Investing involves risk. This article is for educational purposes only and doesn’t provide financial advice. Coin Edition is not liable for any investment decisions made based on this information. Invest wisely and at your own risk.

Thanks for reading Bitcoin (BTC) Price Prediction for July 11