Bitcoin teeters on a knife’s edge! Crypto oracle Trader Mayne sees a make-or-break moment in the coming days as it battles a critical resistance zone. Will bulls conquer and surge forward, or will this rally fizzle into a disappointing peak? The crypto world watches with bated breath.

Summary

Bitcoin’s fate hangs in the balance. Can it conquer the $98K-$100K fortress? A decisive victory unleashes a year-end rally of epic proportions. Failure, however, plunges the market into a chilling, extended winter.

- “This remains the critical area for me,” Trader Mayne says. “Shattering the $98K–$100K barrier could be the catalyst. Prepare for liftoff – this could be the final, explosive surge of the bull run.”

Bitcoin claws back to its yearly starting line, fueled by what Trader Mayne calls “a sweet spot of trading chances” since its predicted $80,000 bottom. This surge shatters a stubborn downtrend, yet the true trial awaits. Looming overhead is a formidable resistance zone near $98,000, where a long-term daily downtrend line collides with its prior support level – a make-or-break moment for Bitcoin’s next chapter.

Bitcoin’s price is currently dancing on a razor’s edge, right along a critical resistance zone that’s been a graveyard for bullish hopes during this long downtrend. Blast through this barrier, and we could witness the first real structural shift since Bitcoin peaked near $125,000 – a potential rebirth for the bulls.

Bitcoin’s showing signs of life. We’re seeing higher lows, hinting at a potential bullish shift in the short term. A break in the four-hour structure is underway, but the rally hinges on a critical move. As Mayne puts it, “I need follow-through. Show me a higher high.” The market’s poised, waiting to confirm if this is a genuine surge or another false dawn.

You might also like:

XRP price rally stalls as Ripple closes the $1 billion GTreasury buyout

A Lower High Before the Next Bear Market?

Mayne maintains a cautious outlook on Bitcoin, pegging a 70-80% chance of a lower high, not a record-breaking surge. But, should bulls conquer $98K and shatter the prevailing downtrend, those odds shift dramatically to a coin-flip 50-60%. This breakout, he suggests, would validate the weekly cycle low, potentially igniting a final, exhilarating rally before the anticipated 2026 bear market closes in.

According to him, cycle catalysts loom: the Fed’s quantitative tightening tapers off, liquidity springs anew, and even sentiment shifts as seen with Vanguard potentially unlocking IBIT buys.

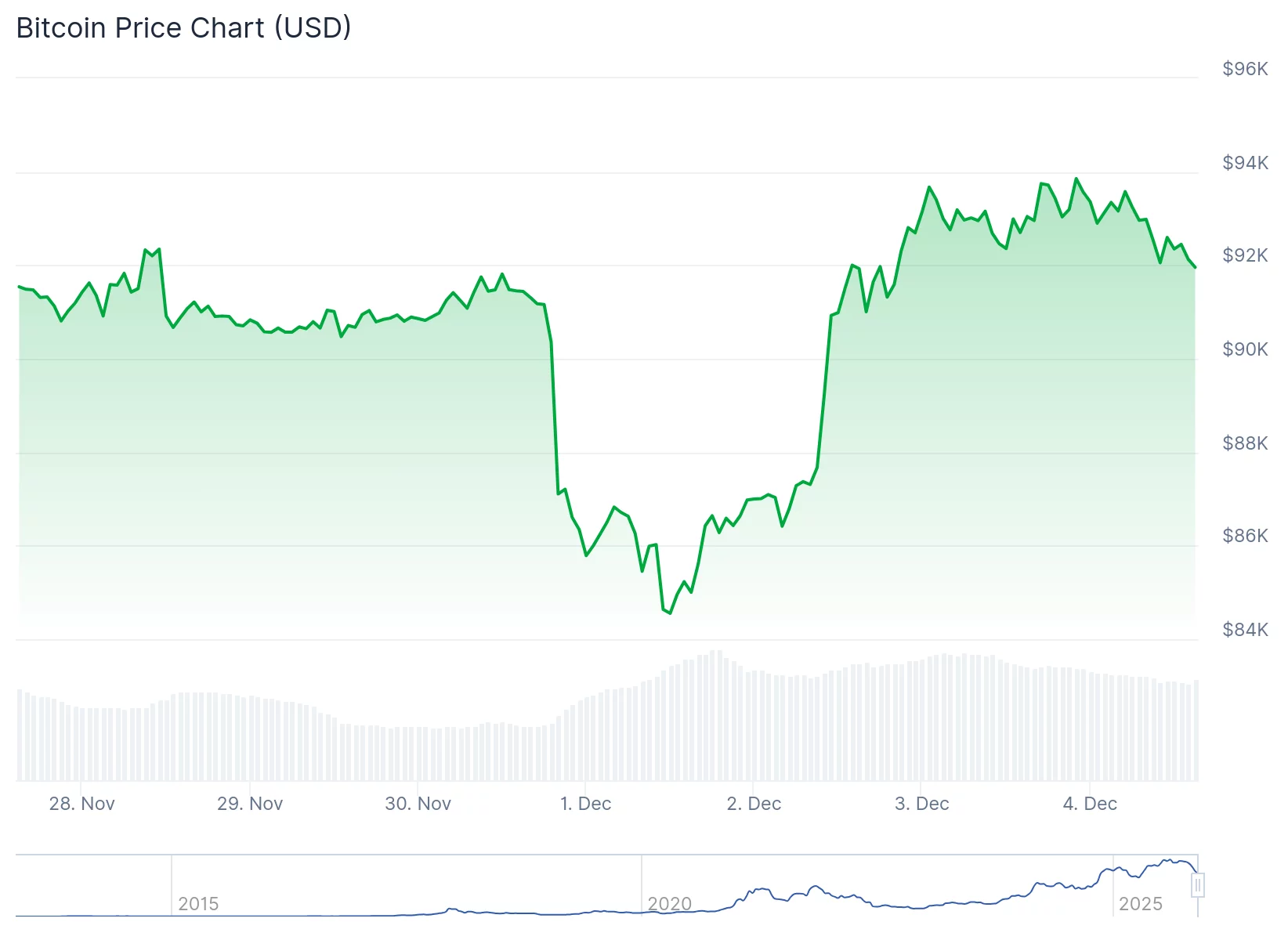

Source: CoinGecko

Bulls crave the clean escape: price launching skyward, leaving doubters in the dust. A jagged dance around the year’s starting line? That’s a bear trap snapping shut, confirming the high is already history.

Mayne’s crystal ball reveals two pivotal tipping points: Shatter the ceiling of the downtrend, and bulls charge forward. Crack the foundation of the short-term uptrend, and the whole house of cards collapses.

Beneath the champagne-cork optimism, Mayne’s voice cuts through: a strategic retreat. His game plan? Cashing in Bitcoin chips as the price flirts with the $100K peak. He anticipates a market rollercoaster, a dizzying climb followed by a plunge back to the $50K–$60K zone. Sell high, brace for impact, that’s the Mayne mantra.

“Any sign of weakness at the yearly open, 98K, 100K, 105–110K derisk, hedge, ready to get the **out,” he said.

If Bitcoin stalls, brace for a potential downturn. One analyst sees a chilling symmetry: “A bear market? Simply flip the script… and the chart.” Get ready to capitalize on the inverse.

Dollar Dynamics Align for Now

Mayne sees a green light for risk assets. His argument hinges on a retreating USD, specifically the dollar index faltering at a critical resistance point. “One more dip,” Mayne urges, “and the path is clear for a rally across the board – stocks, crypto, you name it.”

Bitcoin teeters on a knife’s edge. The $98K-$100K zone? It’s not just resistance; it’s the gateway to a new era. Conquer it, and watch the market transform, beliefs ignite, and cycles realign. But falter, and we might just be staring at the peak in the rearview mirror.

As Mayne put it: “The bulls still have work to do. The bears are still in control.”

Read more:

Cathie Wood’s Tokyo meetup unites two of Ethereum’s biggest bulls

Thanks for reading Bitcoin bulls face make-or-break test at $98k–$100k: Trader Mayne