*****Bitcoin is 12 p, $89,166 per coin. M m is ,. EST on Jan, paraphrasingr. Derivatives markets sent mixed but revealing signals under the surface of 2426, with derivatives trading sending mixed messages. Affluent futures leverage is easing, options traders remain selectively optimistic and liquidation data suggests that excess positioning is still being done off. ** **

Bitcoin Derivatives Paint a Tense Picture

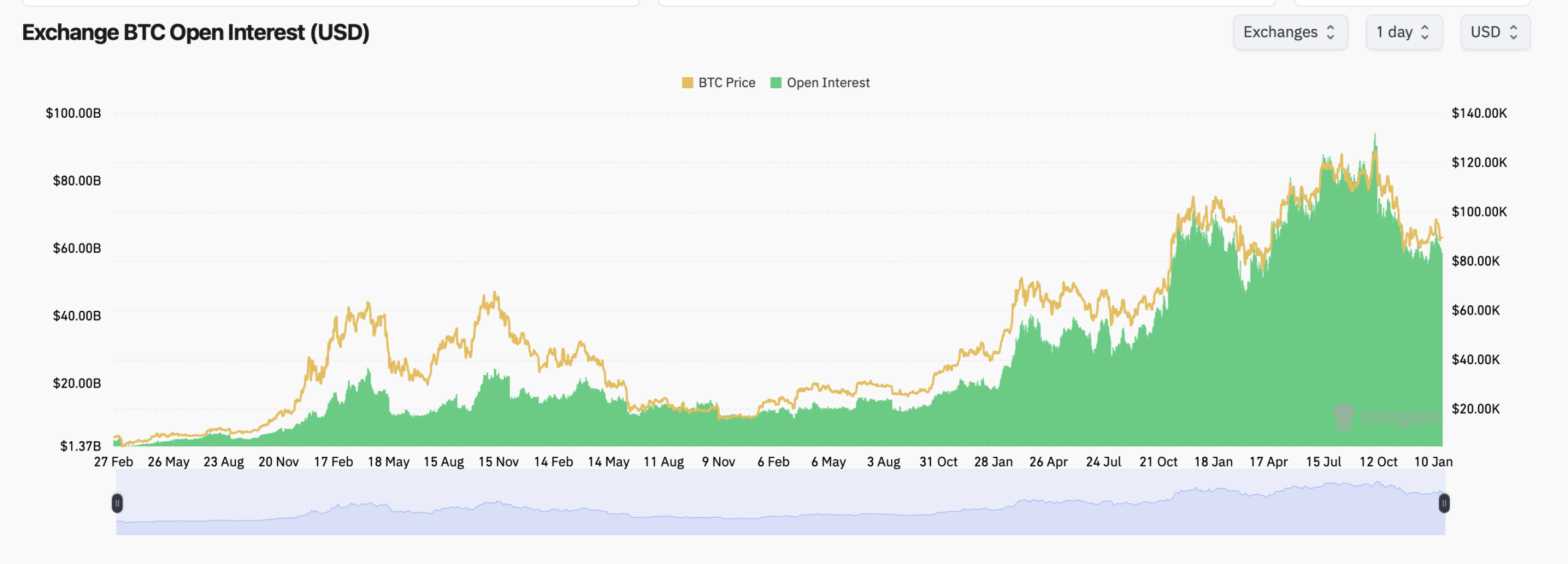

In coinglass, Bitcoin futures are ‘open to everyone who exchanges bitcoin and is open for interest in all exchange. It is about $586,880 BTC, or roughly 656,680 btc (about $488,890) for com. It is 64 billion in notional value for . Open interest ticked up 0 while open interest was at. it dropped 2. per cent over the last hour, 20% of s said it had fallen 2. In the last 24 hours, 89 per cent of those two days have been marked by a more widespread deleveraging trend than aggressive new positioning.

The largest share of future exchanges is Binance with an open interest of about 135,340 BTC, followed by CME (124,740 BCT) closely related to the shares held in futures exchange. CME’s close–19% share still reflects institutional participation, while Binance remains the dominant center for directional retail and proprietary trading activity.

Bitcoin futures open interest as of Jan. 24, 2026.

There are uneven adjustments across venues for short-term futures positioning, which is characterized by the disparity in terms of their positions. In the four-hour window, Bybit and Gate posted significant short-term increases in open interest (see ‘Bybit or Gate) while Binance and CME both recorded modest declines over the same period. A takeawaysTraders are repositioning, not running back in the door of .

Cryptoquant data – liquidation from cryptoquant? com reinforces that message, which is reinforced by . Over the course of mid-January, bitcoin long liquidations soared sharply on several days with many sessions exceeding $300 million and one clearing event reaching $500 million. The price pullbacks coincided with these flushes, suggesting that leveraged longs were caught leaning too hard into local strength.

Short liquidations were relatively muted but still meaningful, with several spikes above $150 million. Long liquidations and short liquidation are correlated with the fact that downside volatility has been doing more damage than upside moves a market still punishes overconfidence.

This cautious tone can be supported by order-flow data. At around 0, the bitcoin taker buy-sell ratio is below neutral. Salesside pressure on aggressive buying continues to outweigh aggressive purchasing, 96, which means sell-side stress. Despite short spikes above parity earlier in the month, recent readings show buyers taking a step back as they take.

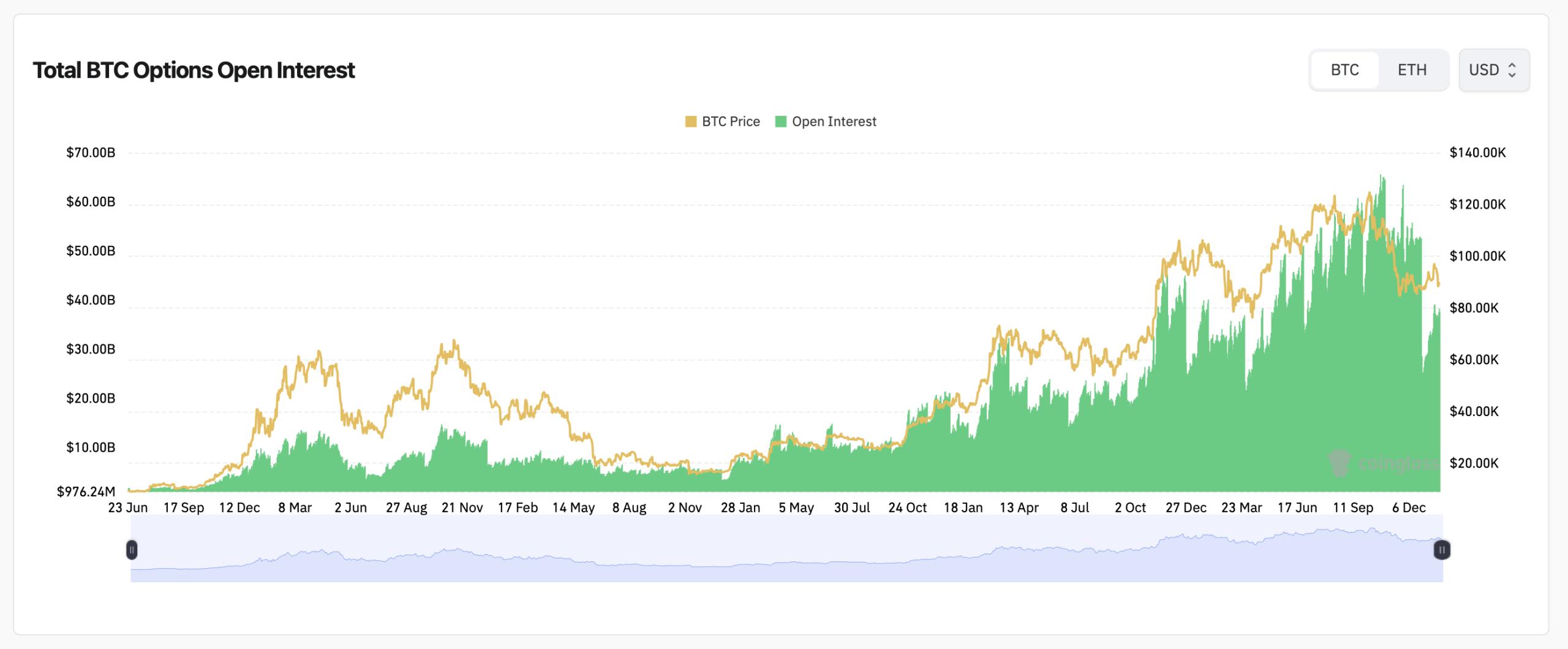

But options markets, but tell a more nuanced story ‘At least the same thing as s. Call account for about 57 total bitcoin options open interest, and overall elevated levels of total Bitcoin options. 7 per cent of the outstanding posts, compared to 42 percent with . Puts 3% for . The call dominance rises to more than 62% on a 24-hour volume basis, signaling traders are still positioning themselves for upside just with defined risk.

Bitcoin options open interest as of Jan. 24, 2026.

In addition to defensive puts clustered below $90,000, Strike concentration is heightened interest for longer-dated calls above $100,000 (especially on Deribit), and more recent calls are considered serious. In this structure, traders say volatility will continue to be a factor in the continued existence of volatility even if near-term price action is still limited.

Also read: Bitwise Launches Bitcoin-Linked Debasement ETF to Counter Declining Dollar Power

A maximum pain levels provide more context for s. max pain on Deribit is near $90,000 for the nearest expiries and Binance’s Max skew slightly higher around the low-to–mid $ 90,00 range. OKX is also displaying a similar gravitational zone near $90,000, which means that options positioning may exert stabilizing pressure at current prices.

bitcoin’s derivatives markets, taken together, reflect a cautious reset rather than outright fear of taken. The futures leverage is cooling, liquidations are easing excess risk and options traders remain selectively constructive betting on volatility, not complacency.

FAQ ❓

- **What is bitcoin futures open interest signaling now?****Bitcoin future’s current interest is declining daily, meaning leverage is being reduced rather than increased. ** **

- Why are long liquidations dominating the market?****Repeated price pullbacks have punished over-leveraged long positions more than shorts.

- Are options traders bullish or bearish?****Options data shows a call-heavy skew, suggesting cautious optimism with defined downside risk.

The price of bitcoin is $90,000 and * *****Max pain levels cluster near $$90,000. What does max pain mean? Is it a short-term stabilizing zone? *****

Thanks for reading Bitcoin Derivatives Flash Caution Signals as Open Interest Slips and Liquidations Rise