Despite the fact that ether- and $XRP-linked products were inflows of bitcoin exchange-traded funds Tuesday, new outflow was evident as investors are positioning across large crypto assets during the latest bout of market volatility.

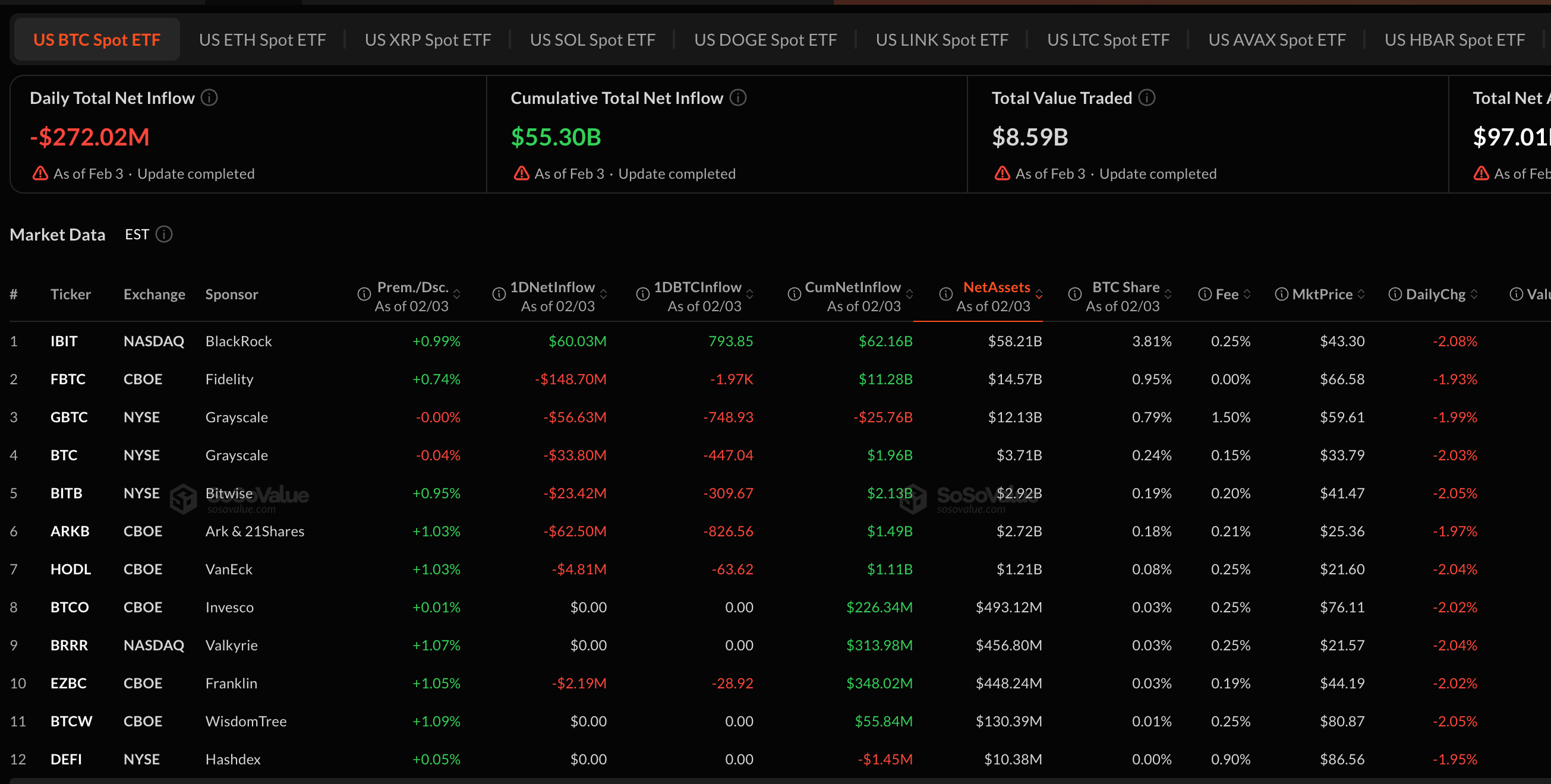

A U-phraser. A , S. On Feb, net outflows of roughly $272 million were recorded in -listed spot bitcoin ETFs. Data collected by SoSoValue, compiled by the company’s data, show that this is an extension of a pattern of distribution which has developed during bitcoin’s recent price swings.

(SoSovalue)

The withdrawals were as bitcoin whipsawed sharply, dipping to $73,000 and rebounding above $76,000 — a move traders blamed on thin liquidity and fast-moving macro headlines.

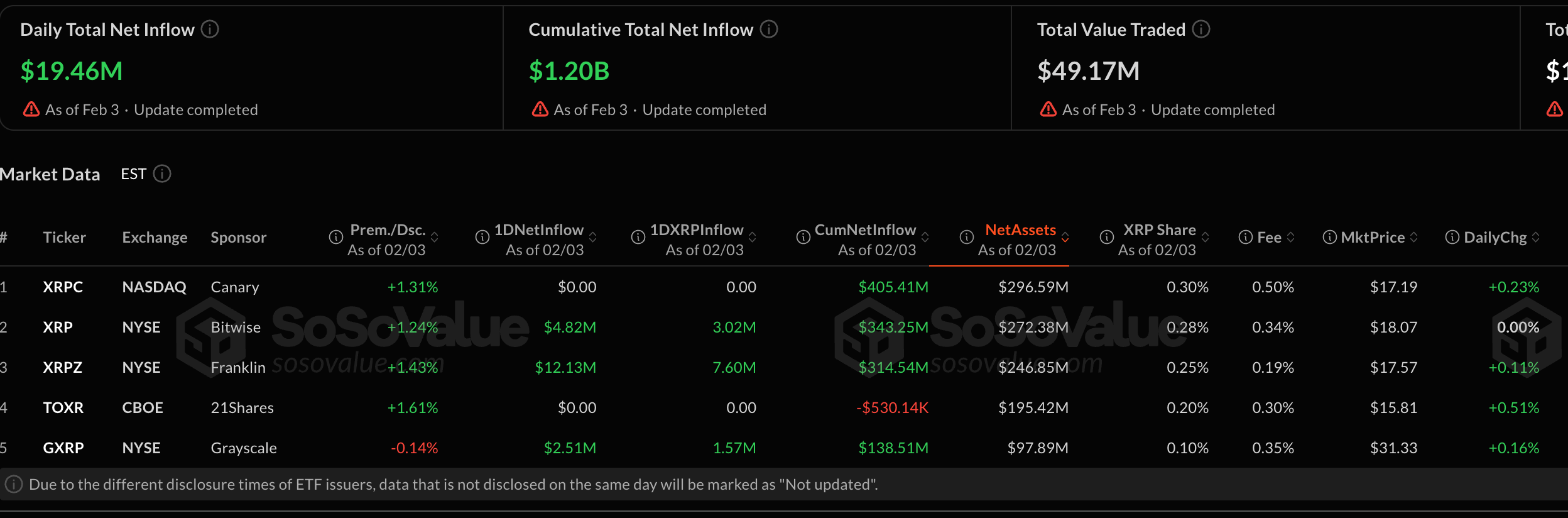

On the other hand, spot ether ETFs posted net inflows of about $14 million on the day while $XRP-focused products attracted nearly $20 million (some investors are rotating exposure rather than exiting crypto markets outright), and some investors were “advanced” by their investments.

(SoSovalue)

The divergence reflects shifting risk preferences rather than a wholesale loss of confidence in digital assets.

Bitcoin has also been trading as a macro-sensitive risk asset, reacting quickly to equity-market stress, tighter financial conditions and concerns about technology valuations.

Tuesday’s sale coincided with a sharp selloff in U.S, as Paul Pettino sold on Tuesday at the same time. S, meanwhile. A new AI automation tool from Anthropic rekindled fears that artificial intelligence could disrupt traditional software business models, leading to software stocks following the announcement of an increase in tech benchmarks across more than one company.

These flows also echoe a wider theme that is seen in markets selective risk-taking rather than blanket risk–off behavior. Bitcoin ETFs have suffered the brunt of near-term de-risking, but capital is moving within the crypto complex, favoring assets seen as offering unique use cases or relative value.

Thanks for reading Bitcoin ETF outflows deepen as ether and XRP funds quietly attract inflows