Bitcoin’s rocket-fueled ascent reached escape velocity today, piercing a new all-time high of $123,218 and catapulting its market cap past the $2.4 trillion mark. But is this the peak before the plunge? Whispers of a looming correction are growing louder as exchange data reveals a sudden surge of BTC flowing in – a potential sign some whales are preparing to cash in their chips after the record-breaking rally.

Bitcoin Exchange Inflows Warn Of Pullback

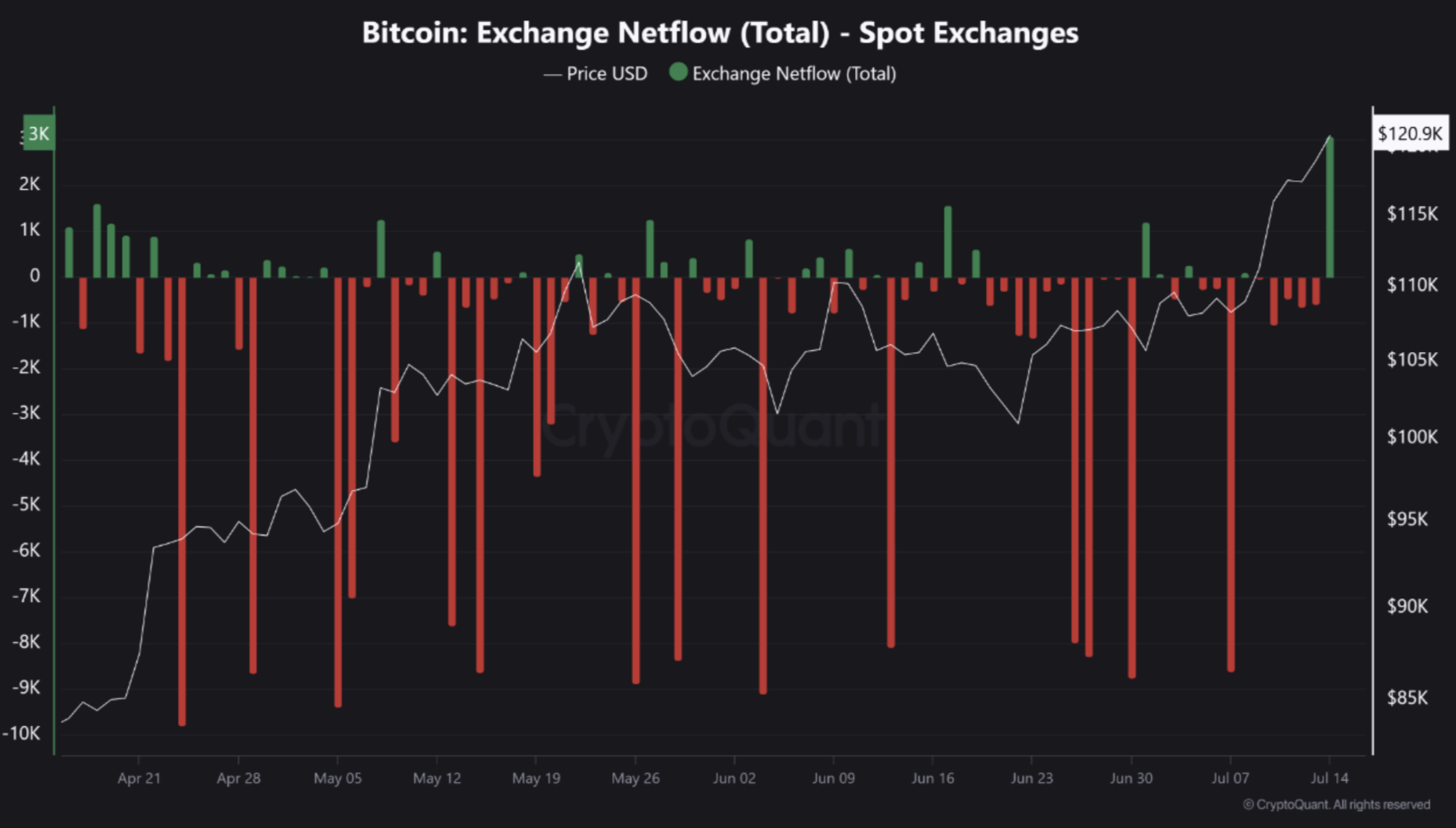

Fresh off its all-time high, is Bitcoin catching its breath? CryptoQuant analyst Tarekonchain suggests a short-term cool-down might be brewing. His Quicktake points to a surge in exchange inflows immediately following BTC’s peak, hinting at potential profit-taking or a shift in sentiment.

An analyst’s chart reveals a surge of crypto rushing into centralized exchanges. Are whales cashing out? The data points to a potential feeding frenzy of profit-taking by short-term investors and savvy large holders alike. Buckle up, volatility could be on the horizon.

“Tarekonchain flagged a potential peak, observing that the blockchain whispers of an imminent price shift. Buckle up, they suggest, because a cooldown or price stabilization might be just around the corner.”

The script is familiar: a dizzying ascent, then the inevitable exhale. Profit-takers cash in, skittish investors bail, and the market searches for solid ground.

However, the analyst tempered the correction warnings: the market’s underlying strength remains undeniable. Veteran Bitcoin holders, unmoved by fleeting price dips, are digging in their heels, signaling unwavering long-term confidence.

Bitcoin ETFs are on a tear! Last week, they raked in a whopping $2.72 billion, proving institutional investors are still hungry for a piece of the crypto pie. This massive inflow signals unwavering confidence and fuels the bullish fire.

Whales Preparing To Sell?

CryptoQuant analyst Crazzyblockk previously sounded the alarm, spotting a surge in Binance whale activity. A telltale spike on the Binance Whale Activity Score suggests that massive wallets are flooding the exchange with crypto.

Brace for impact? Crypto whales unloaded a staggering 1,800 BTC onto Binance in a single day. Over a third of these transactions were colossal, eclipsing the $1 million mark. Is this a calculated maneuver by deep-pocketed investors preparing for a wild ride ahead? The smart money seems to be bracing for volatility.

Crazzyblockk sees two potential aftershocks from the recent influx of big money. One possibility? Whales are poised to cash in, locking in monumental profits after an unprecedented surge.

Or, perhaps, savvy traders are tapping into Binance’s ocean of liquidity, navigating the choppy waters of volatility to hedge their bets or stake new claims. Whatever the motive, this selling surge on Binance could act as an anchor, dragging on Bitcoin’s upward climb.

Bitcoin flirts with $120K as whales splash into the market, but is this party just getting started? While institutional tides rise and crypto leviathans stir, the average Joe & Jane are still on the sidelines. This rally, fueled by big money, might have miles to go before it peaks. Currently, BTC hovers at $119,449, a modest 0.8% uptick in the last day, hinting at a potential calm before another surge. Will retail FOMO finally kick in, or will the whales keep the bull run afloat?

Featured image from Unsplash, charts from CryptoQuant and TradingView.com

Thanks for reading Bitcoin Exchange Inflows Spike After $123000 Peak – Signs Of Short-Term Cooling?