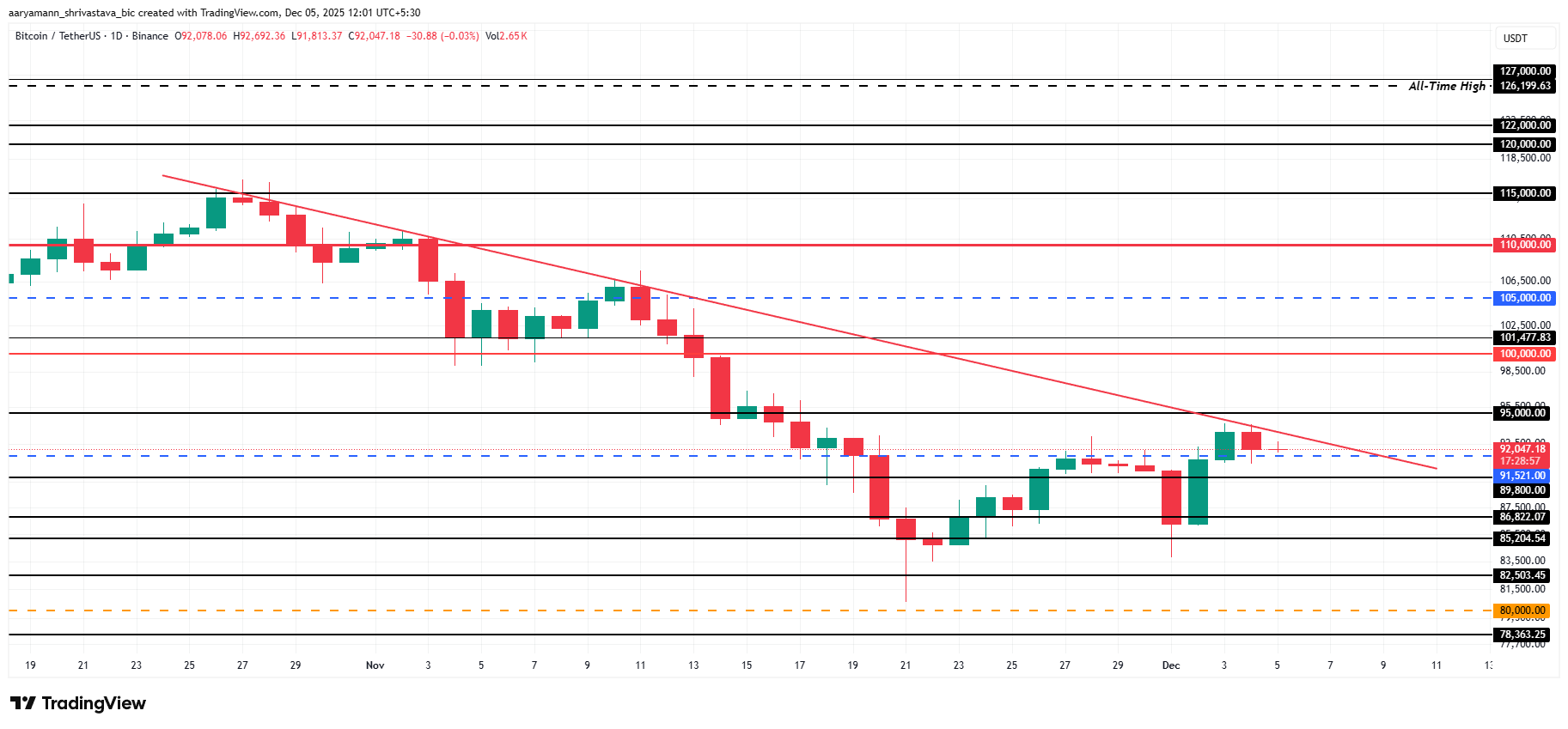

Bitcoin wrestles with a relentless downtrend, trapped for a month beneath an unyielding ceiling. Each attempted breakout crumbles, leaving the crypto king vulnerable. Stripped of its usual macro-market crutches, Bitcoin charts an uncertain course through uncharted waters.

However, investors appear increasingly active, and their accumulation could help stabilize price action if institutional capital joins in.

Bitcoin Holders Are Stepping Up

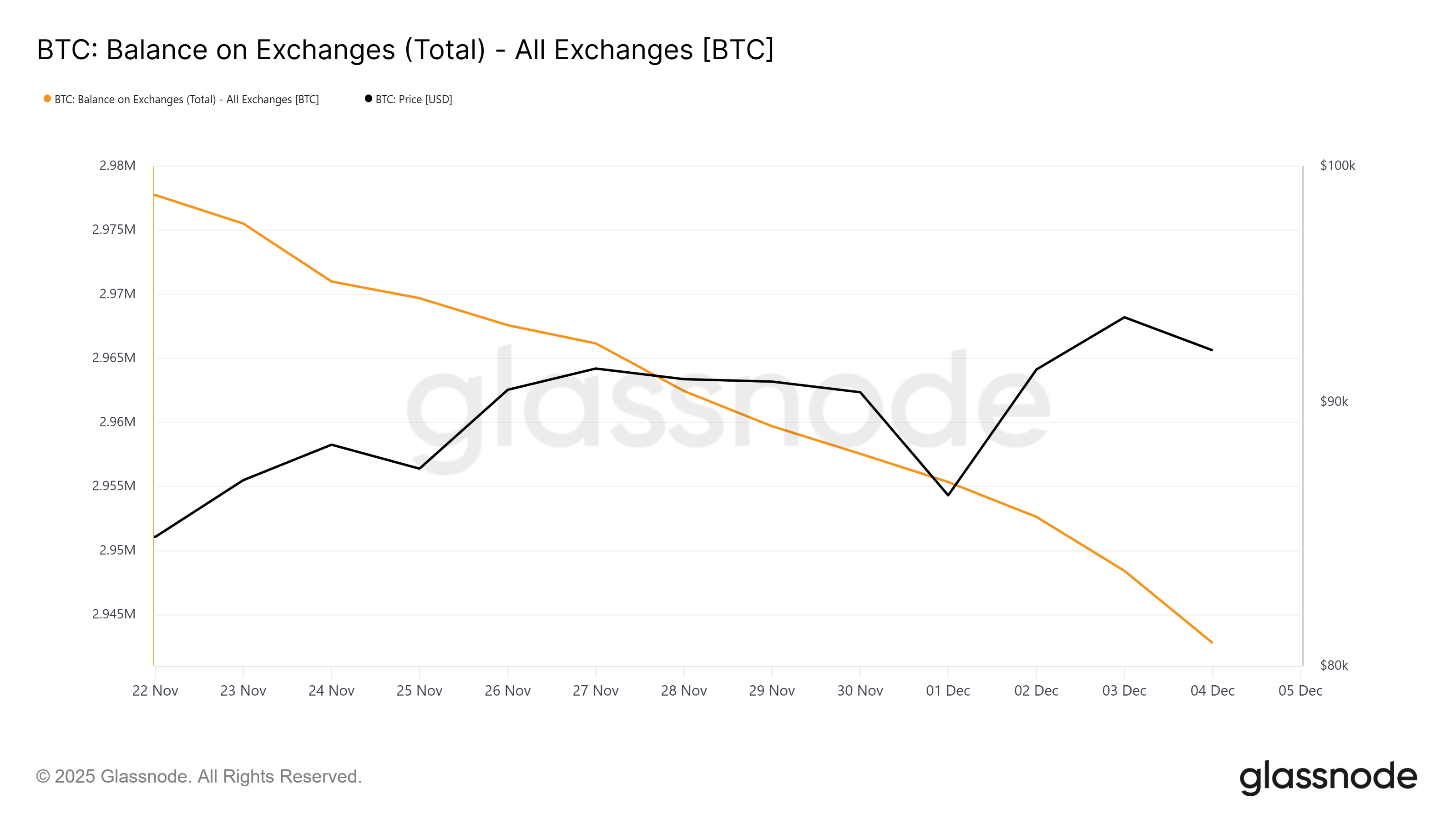

Bitcoin is vanishing from exchanges at warp speed, hinting at a powerful shift in market sentiment. A staggering 23,385 BTC – a cool $2.15 billion – has been yanked off trading platforms in just one week, fueling speculation of a major price surge. Exchange reserves are now scraping levels not seen since January 2021, a period etched in crypto history for its explosive bullish run. Could this be the calm before another bitcoin storm?

Significant Bitcoin exodus from exchanges signals unwavering conviction, even amidst market downturns. These strategic long-term holds starve exchanges of supply, effectively neutering selling pressure and paving the runway for a potential rebound. This powerful accumulation, driven by shrewd investors, acts as a robust bedrock, ready to bolster Bitcoin’s ascent when the broader economic skies clear.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here

Bitcoin Balance On Exchanges. Source: Glassnode

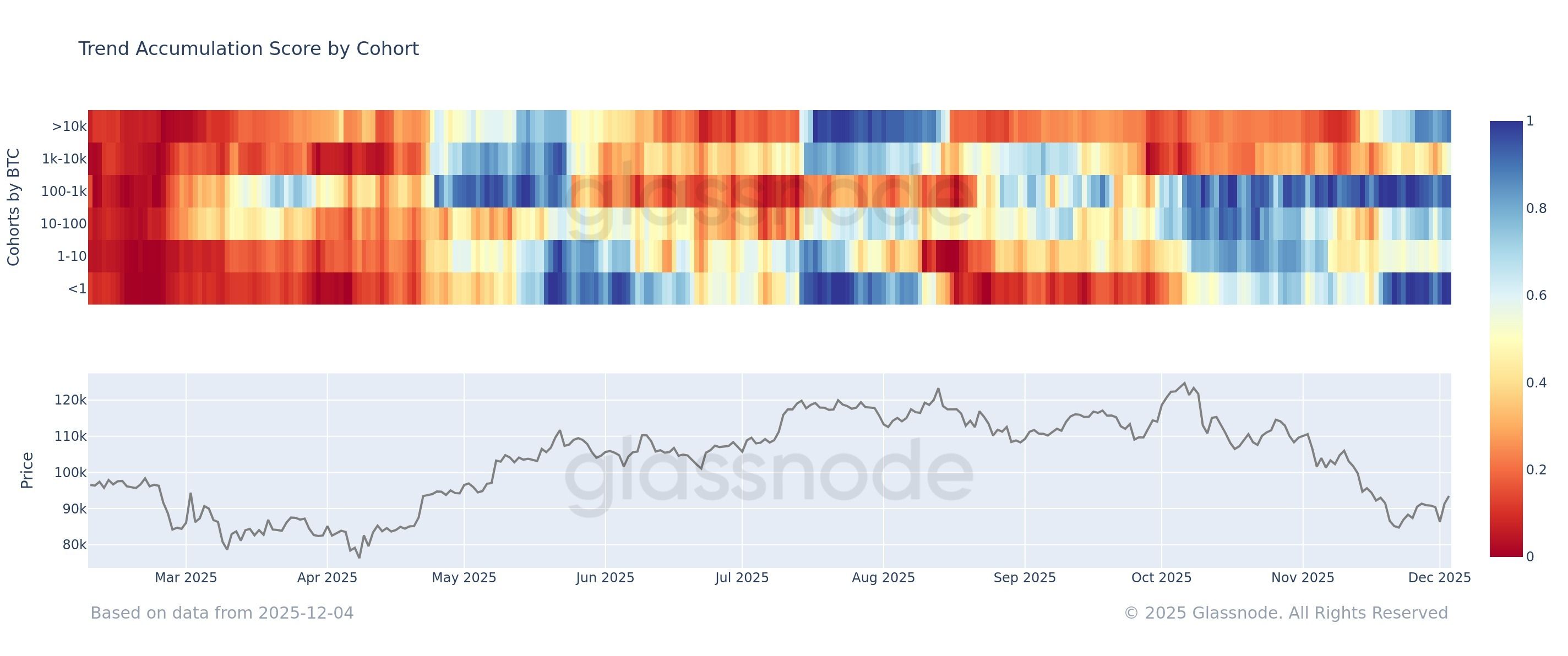

Bitcoin’s pulse quickens: the Accumulation Trend Score hints at something big. The outflow tapers as conviction takes hold. Small-time investors are loading up, while the whales, though more measured, are adding to their stacks. This surge of retail belief and the waning sell-off paint a picture of a market ready to run.

But a shadow of doubt lingers: where are the whales? The big institutional players, the so-called “smart money,” are conspicuously absent. Their hefty investments typically steer the market winds, and their reluctance to jump in now could cap Bitcoin’s potential, preventing a retail-fueled spark from becoming a roaring bonfire.

Bitcoin Trend Accumulation Score. Source: Glassnode

BTC Price Remains Stuck

Bitcoin teeters on a knife’s edge at $92,047, clinging desperately to the $91,521 lifeline. A month-long bearish dragnet continues to suffocate the king of crypto. Escape requires a thunderous breakout, a feat yet to be achieved despite bulls’ valiant but ultimately futile charges. The market holds its breath… will Bitcoin break free, or succumb to the downward pull?

Shattering the downtrend requires Bitcoin to conquer $95,000 and transform it into solid ground. The good news? Silent accumulation whispers of possibility as exchange reserves dwindle. But the true catalyst? A surge of institutional buying. That’s the fuel that ignites Bitcoin’s ascent to $100,000, reigniting the bullish fire.

Bitcoin Price Analysis. Source: TradingView

Bitcoin’s bull run is hitting a wall as major investors hesitate. Without their renewed conviction, BTC risks a sharp descent. Brace for a potential drop below $89,800, with $86,822 looming as the next critical test. A breach here could ignite a wave of fear, pushing recovery further out of reach.

The post Bitcoin Exchange Supply Nears 5-year Low After $2 Billion Buy This Week appeared first on BeInCrypto.

Thanks for reading Bitcoin Exchange Supply Nears 5-year Low After $2 Billion Buy This Week