Data shows the Bitcoin market sentiment has broken into the extreme greed territory following the cryptocurrency’s new high above $111,000.

Bitcoin Fear & Greed Index Has Shot Up Recently

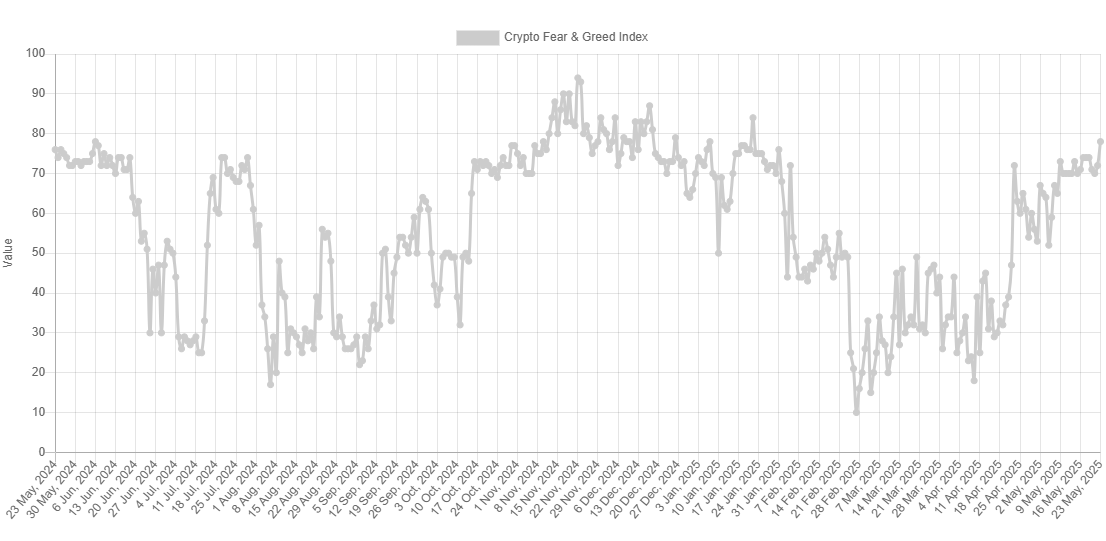

Ever wonder what’s driving Bitcoin’s wild price swings? Look no further than the Fear & Greed Index, a simple gauge of crypto market sentiment. This index, ranging from 0 to 100, reveals whether traders are gripped by fear or fueled by greed. Above 53? Investors are feeling greedy, potentially signaling a market top. Below 47? Fear reigns, often a sign of a buying opportunity. Stuck in the middle? Prepare for a period of market indifference. In short, the Fear & Greed Index is your emotional compass in the volatile world of crypto trading.

Beyond the familiar terrain of fear and greed lie two perilous extremes: the intoxicating heights of “Extreme Greed” (above 75) and the chilling depths of “Extreme Fear” (below 25). Currently, the market dances on the precipice of euphoria, basking in the glow of “Extreme Greed,” as reflected in the latest Fear & Greed Index.

Bitcoin’s wild ride often hinges on a simple truth: extreme emotions are powerful indicators. Think of it as a contrarian’s compass. When euphoria grips the market, and everyone’s screaming “to the moon!”, history suggests a peak is near. Conversely, when despair reigns, and the crypto winter feels eternal, that’s often the signal of an impending bottom. In short, excessive optimism spells trouble, while profound pessimism paves the way for gains.

Imagine a sea of investors, all rushing in one direction, driven by the same wave of euphoria or panic. Now, picture a lone trader, calmly swimming against the tide. That’s the essence of contrarian investing – a strategy built on profiting from the herd’s predictable missteps. As Warren Buffett wisely put it, “Be fearful when others are greedy, and greedy when others are fearful.” These contrarians see opportunity where others see risk, and risk where others see easy money, timing their moves to capitalize on market overreactions.

Bitcoin’s greed gauge is flashing red, suggesting some investors might be eyeing the escape hatch.

While the market’s heartbeat races, the Fear & Greed Index pulses at a ‘mere’ 78. Consider this: the December peak, a dizzying 87, and January’s high of 84. And remember November? The needle nearly broke, hitting a euphoric 94. Is this a calm before another storm, or just a breather before the next surge?

Could the market’s fever pitch be deceptive? Perhaps the bulls still have room to run if investor appetite remains unsated. The real question is: how will Bitcoin and its crypto brethren fare when subjected to this level of avarice? Time will tell if they thrive or crumble under the weight of insatiable greed.

Whale alert! CryptoQuant analyst Maartunn just dropped a bombshell on X: massive amounts of crypto are fleeing Binance wallets. Is this a sign of things to come?

Ever wonder where Bitcoin’s headed? The “Exchange Netflow” indicator is your insider’s look. Think of it as a Bitcoin tide chart, revealing whether Binance, in this instance, is seeing a surge (inflows) or an ebb (outflows) of Bitcoin. Deciphering this flow can offer clues about the market’s next move.

Binance is experiencing a significant exodus. A staggering 2,190 BTC, valued at approximately $237 million, has flowed out of the exchange, signaling a major shift in investor sentiment. Are users losing confidence, or is something else at play? This massive outflow demands attention and begs the question: where is all this Bitcoin going?

This could potentially indicate demand from the big-money investors for HODLing the cryptocurrency in self-custodial wallets.

BTC Price

At the time of writing, Bitcoin is floating around $108,400, up over 4% in the last seven days.

Featured image from Dall-E, CryptoQuant.com, Alternative.me, chart from TradingView.com

Thanks for reading Bitcoin Extreme Greed Is Here—Time To Be A Contrarian?