It seems that Bitcoin’s wild ride is beginning to calm down now. Data reveal its volatility plummeted to a near 10-year low and possibly marks a paradigm shift in its market personality. Observed from Ecoinometrics, Bitcoin’s 30-day realized volatility remains close to rock bottom and less turbulent than 90% of all weeks put together since 2015. Is this the beginning of a peaceful Bitcoin, all while its price continues to appreciate?

Bitcoin’s whirlwind ride has been momentarily stopped. After being dizzyingly up all through May to a new all-time high, volatility plummeted instead. This newfound stability in the action is informing Bitcoin’s picture, maybe leading to the doors being opened to risk-averse institutional biggies who were earlier scared of the highly unpredictable nature of the crypto king.

A New Era of Stability: Bitcoin’s Risk Profile Is Changing

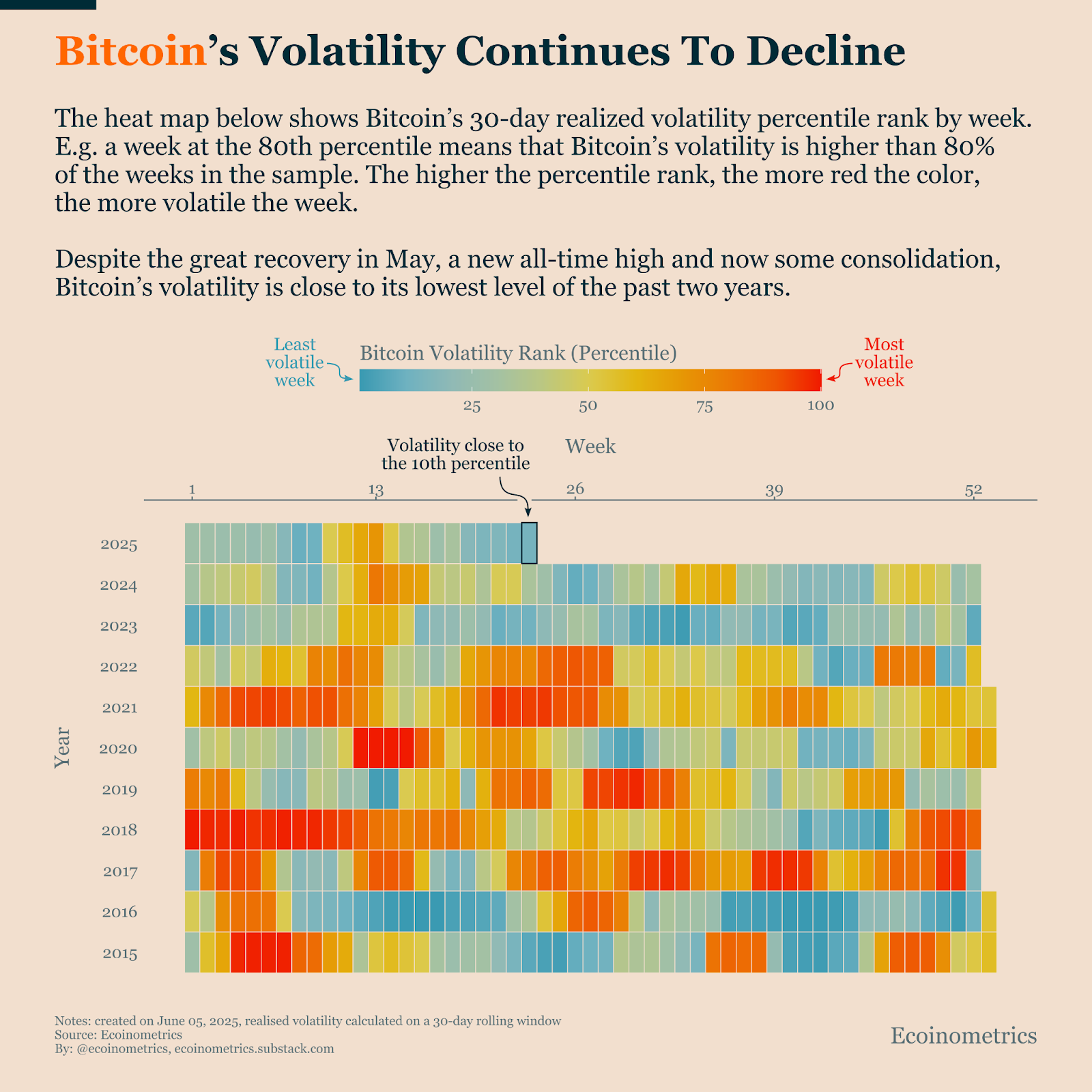

Bitcoin’s weekly volatility, mapped over the past month, provides an essentially comforting view of an environment emerging out of feverish activity into one of relative calm. Heat map percentile changes confirm the cooling trend evidenced by such observations.

Remember the mad market years from 2016-2021? In the extreme chaos and unpredictability of those weeks, our volatility chart was nothing but red. Now, by 2024-end and into 2025, a calming green and blue oasis promises an era of calm steadiness.

Bitcoin’s Volatility Continues To Decline. Source: X

Bitcoin in evolving: Is it at last leaving behind its iron-fist acts for the more measured grasp of a matured financial player? The recent data were inclined toward a yes, suggesting a future where strong returns may not necessarily imply chicken skin-grabbers through roller coaster volatilities.

Related : Bitcoin Asia Rolls Out Free General Admission to Broaden Access to 2025 Conference

For those managing portfolios with risk sensitivities, this is truly a game-changer. Tamed volatility means now Bitcoin can play along with diversified portfolios. Earlier, it was the bad boy-maverick risking too much. This alignment brought on by stability can unleash the massive tide of institutional investment, essentially opening that new chapter of mainstream adoption of digital assets.

Price Action Confirms Bullish Trend Within Ascending Channel

Underneath the placid markets lies a rising bull force. One may say Bitcoin is not floating anywhere at a level of a healthy $107,841 as of June 9, 2025, but building. The weekly chart tells an ensembled tale: an ascending channel carving itself into the data since late 2022-an unmistakable sign of higher highs and higher lows, and charging forth bullish momentum.

BTC/USD Weekly Chart – Ascending Channel Pattern. Source: TradingView.com

Visualize Bitcoin surfing on an endless wave. It’s the ascending channel: a step ladder for upper prices, constructed on firm, upward momentum. And the lifeguard? The 50-week EMA stands near $85,136. Every gut-wrenching drop since mid-2023 has been caught by this dependable safety net, establishing it as much more than an average-walking price; it’s the very foundation of Bitcoin.

Related: Bitcoin (BTC) Price Prediction for June 10: Volatility Builds Near $106K as Bulls Eye Breakout Levels

Watch out for a possible surge! If Bitcoin settles above the previously encountered resistance shoulder, it is set to have a breathtaking 46% upward movement. The prize? Approximately $156,730, bounded by the channel’s ceiling. Keep your eyes glued because the breakout matters!

All investing carries risk. It’s not a quick moneymaking scheme, and we don’t have a crystal ball. Consider this article your starting research point, not an end line. Coin Edition shall not be held responsible for any investment decisions after reading this. Do your homework and tread carefully.

Thanks for reading Is Bitcoin Finally Becoming a “Stable” Asset? The New Data Is Shocking