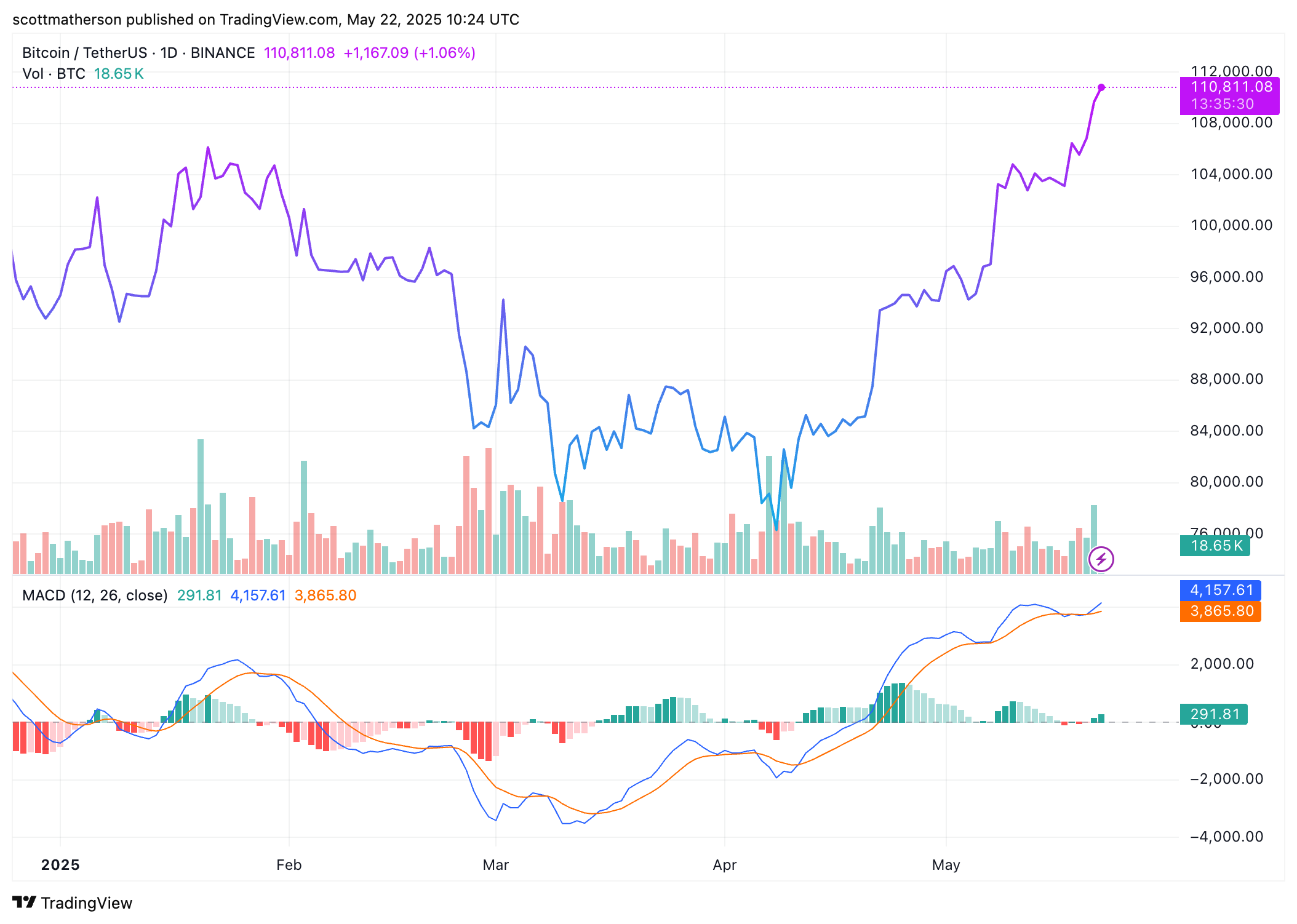

Bitcoin just exploded! After days of separating into a coil-like structure, the soaring price penetrated above $105,503 earlier this week and witnessed an enraptured rally in the last 24 hours. Hold tight as Bitcoin shoots into the air, forging all-time highs with utmost certainty and no intention of slowing down.

According to technical charts, the golden cross-a situation when the 50-day crosses the 200-day-is near, usually a bullish indication. FX_Professor, however, is throwing a wrench into the situation, casting an adverse light on that cross being a reason for celebrations.

Analyst Disputes Golden Cross Hype As Late Signal

The traditional hype coming from Bitcoin’s golden cross appears to have been debunked; thus Forbes editors call it a lagging indicator. To consider it in other terms: the golden cross is not an indicator of a beginning of a bull run; rather, it is a cleaning crew arriving after the party was really over-wrong term for the retail crowd closing in on it-was late into the scene that was already winding down.

Gone are the days of patiently awaiting the golden cross. FX_Professor believes the actual tell exists hidden in “pressure zones.” He picked up on the Bitcoin rise months ago, stating $74,394 and $79,000 as the perfect price zones for early bulls to load up on the coin much before the appearance of a golden cross. When the finally signal appeared, Bitcoin was flying high, leaving latecomers behind.

Think the Golden Cross is your ticket to riches? Hold on. While many see this pattern as a green light to buy, seasoned traders often view it as a rearview mirror, not a crystal ball. It’s less a spark igniting a rally and more an echo confirming one already in motion.

Early Entry Zones And Structure Matter More, Analyst Says

Forget lagging indicators. FX_Professor insists with ultimate importance that price action itself must be mastered with trendlines, pressure zones, and the actual market language as his source. He pulled a Bitcoin chart out from his arsenal utilizing his customized EMAs together with his conceited name for the “parallelogram method.” This was not the errand of chasing crossover signals but rather the act of moving anticipation. Entries on his chart had occurred as early as April, profiting from Bitcoin’s $74,000 bounce off support, weeks before any other established indicator had come screaming to be bought. This is proactive trading versus reactive following.

Much has been written about Bitcoin’s rise toward 113,000; it is more like a self-fulfilling prophecy unfolding before our very eyes. While half of the mountain may have already been traversed, the confirmation of the golden cross is still aligning to give its powerful tailwind to the rally, signaling that this rally has just begun.

Bitcoin: Breathless Ascent Continues.

Just in the last three hours, Bitcoin touched an all-time record high of $111,544. It is now taking a short pause at $110,734. Do not mistake this dip for weakness. Thus, for the unusually strengthened crypto now doing a euphoric 3.1% over the last 24 hours, all eyes and every favor are cast in speculation: Can it break above all-time highs by the close of this week? The bulls are betting on it.

Featured image from Getty Images, chart from Tradingview.com

Thanks for reading Bitcoin Golden Cross In Play – Analyst Reveals Best Course Of Action