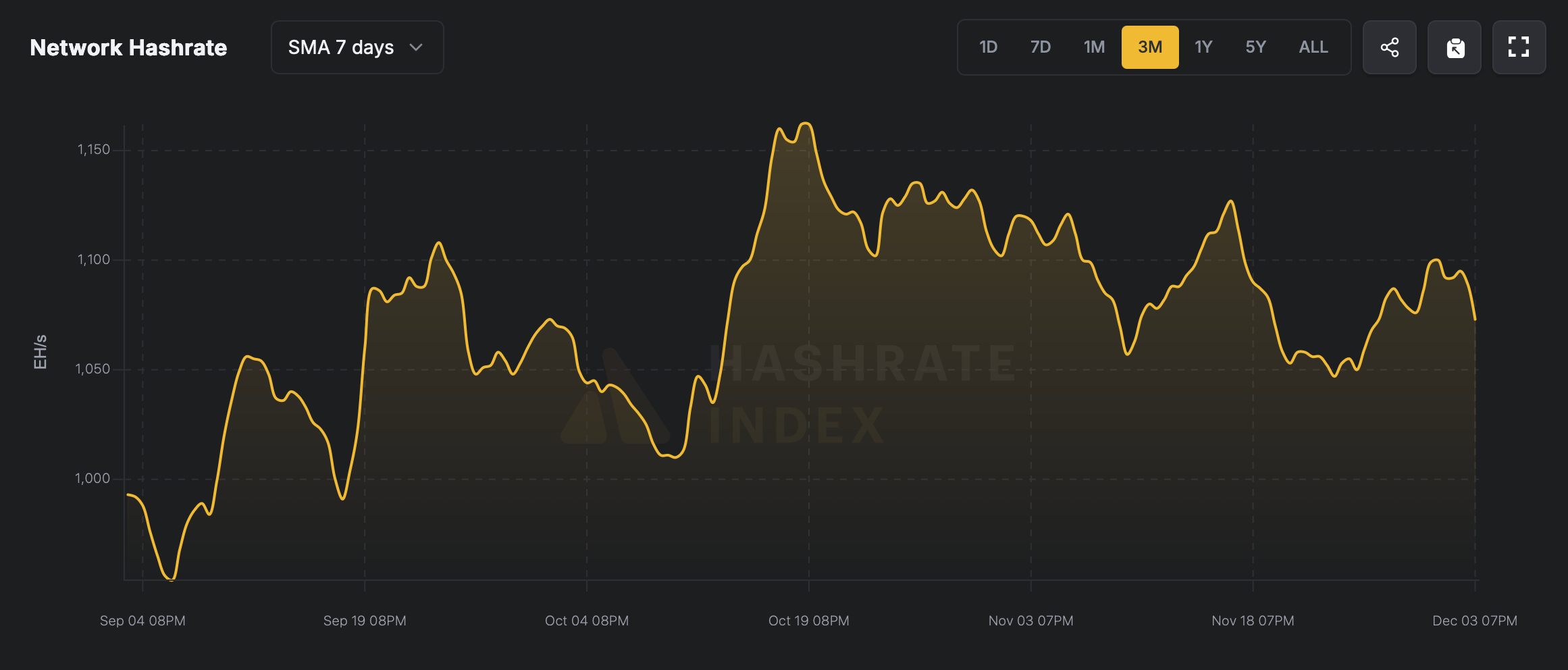

Bitcoin miners are gasping for air, but a surge in hashprice offers a lifeline after a brutal downturn that pushed many to the brink. Despite the revenue plunge, the Bitcoin network’s resilience shines: the hashrate remains a fortress, stubbornly fluctuating between 1,050 and 1,100 exahash per second.

Miners Welcome a Hashprice Rebound

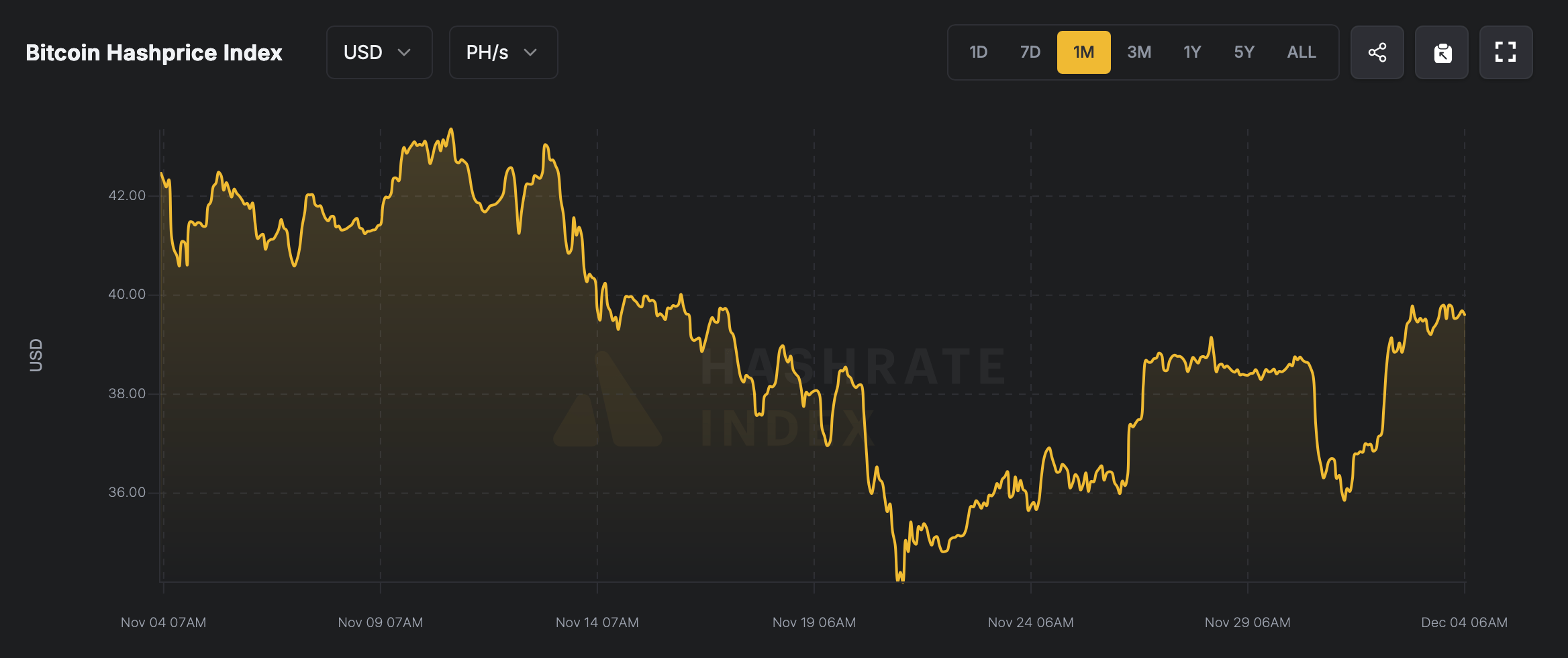

Bitcoin miners, gasping for air after weeks of revenue drought, finally catch a break as BTC prices surge. Remember late November? Hashprice hit rock bottom on the 30th, scraping a measly $36.35 per PH/s, reports Hashrateindex.com.

Imagine your Bitcoin mining rig as a tireless digital workhorse. Hashprice is simply what that horse earns for its labor per unit of computing power (petahash). Think of it as the going rate for digital muscle. Early December saw miners sweating for a meager $35.85 per petahash. But hold on! The tides have turned. Suddenly, miners are flexing their computational biceps for nearly $40 per PH/s. Hashprice is clawing its way back to respectability, nearing that coveted $40 mark.

Bitcoin hashprice over the last 30 days.

Bitcoin’s revenue stream might be experiencing a few rapids, but its digital engine, the hashrate, remains an unshakeable force, anchored firmly above the 1 zettahash per second (ZH/s) line. It’s been so long since it dipped below that mark, it feels like ancient history. This unwavering power means block creation is ticking along like clockwork. Don’t expect a dramatic shift when the difficulty adjusts on December 11; the stability suggests a subtle tweak at best.

Bitcoin’s mining difficulty is poised for a slight adjustment, currently projected to decrease by 1.34%. With half the current 2,016-block epoch remaining, this forecast isn’t set in stone. Block creation is running a hair slower than the ideal ten minutes, averaging 10 minutes and 8 seconds on Wednesday. Should miner profitability increase, expect hashrate to climb, potentially accelerating block times and reshaping the final difficulty adjustment. The race to solve the blocks is on, and the landscape could shift dramatically.

Bitcoin hashrate over the last three months.

Bitcoin miners are feeling the squeeze. Hashprice is down nearly 8% from a month ago, and November marked one of the worst revenue months of the year. So, how are they surviving? Publicly listed miners have a clear advantage, but others are leaning heavily on debt. Many are diversifying, betting big on the future of AI and high-performance computing to weather the storm.

Read more: Charles Schwab Plans Crypto Trading Expansion for First Half of 2026

Bitcoin mining’s relentless energy demands have found an unlikely ally: AI and HPC. By diverting computational power, these technologies provide a crucial revenue boost, bolstering mining operations. Meanwhile, the hardware race intensifies, with ASIC manufacturers relentlessly pushing performance boundaries. Today’s mining behemoths churn out half a petahash, with the coveted 1 PH/s threshold already within reach.

The mining sector walks a tightrope, balancing on grit, ingenuity, and borrowed capital. But fortune favors the bold: a recent surge in hashprice, coupled with diverse income streams and the raw power of next-gen ASICs, has miners flirting with prosperity after a long period of stagnation. Staying static is not an option.

FAQ ❓

Hashprice: Your window into mining profitability. It reveals the daily dollar value a miner extracts for every unit of hashing power – be it a petahash, terahash, or exahash. Think of it as the miner’s bottom line, distilled into a single, crucial metric.

Bitcoin miners felt the chill recently as revenue streams dwindled. A double whammy of softening Bitcoin prices and tumbling hashprice sent earnings spiraling to some of the lowest depths seen all year.

Facing market volatility, Bitcoin miners are displaying remarkable resilience. Beyond simply “staying afloat,” they’re actively adapting, leveraging debt financing to fuel operations and embracing cuttingedge technologies like AI services and highperformance computing (HPC) to diversify revenue streams. This strategic shift ensures their continued profitability and relevance in the everevolving digital landscape.

Mining Machines: Efficiency on Overdrive

The crypto landscape is witnessing an arms race for processing power! Forget incremental gains; manufacturers are unleashing ASIC rigs that redefine efficiency. We’re talking half-petahash units as the new standard, and the mythical 1 PH/s beast is just over the horizon. Prepare for a mining revolution!

Thanks for reading Bitcoin Hashrate Holds Firm Above 1 ZH/s Following a Painful Few Weeks for Miners