- Bitcoin exchange reserves have reached a new low, indicating strong accumulation by long-term holders.

- Price is down below $106K, and if buyers can’t regain control, the price could decline a lot more.

- Analysts expect a possible rebound in early June if the $106K resistance breaks soon.

On exchanges, Bitcoin supply has been drying up faster than an oasis in the desert. According to CryptoQuant, exchange reserves had plummeted to a shocking 2.43 million BTC; this clearly indicates buying by diamond-handed HODLers and deep-pocketed institutions. The relentless outflow amounts to a strong conviction of long-term value in Bitcoin, with less and less coins available for immediate sale.

JUST IN: BTC exchange reserves hit fresh new lows. pic.twitter.com/XxTAGdF6ud

Whale Insider (@WhaleInsider) June 1, 2025

To diminish supply hints at a purposeful build-up by mature investors and institutions as a fort to scapegoat short-term market volatility. Emptying vaults suggest yet another perspective: a rise in preference for the safety of cold storage and the empowering control over self-custody.

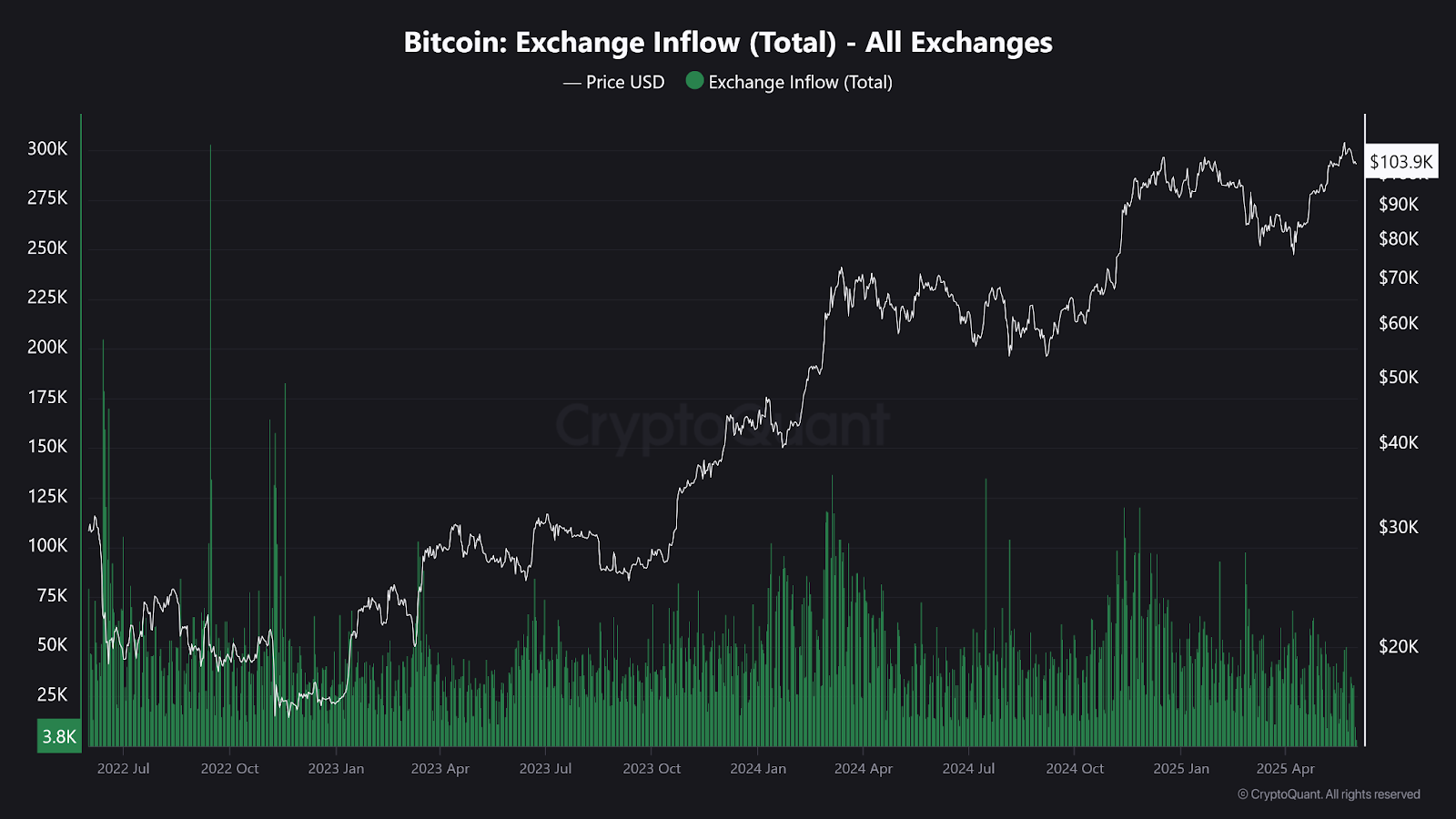

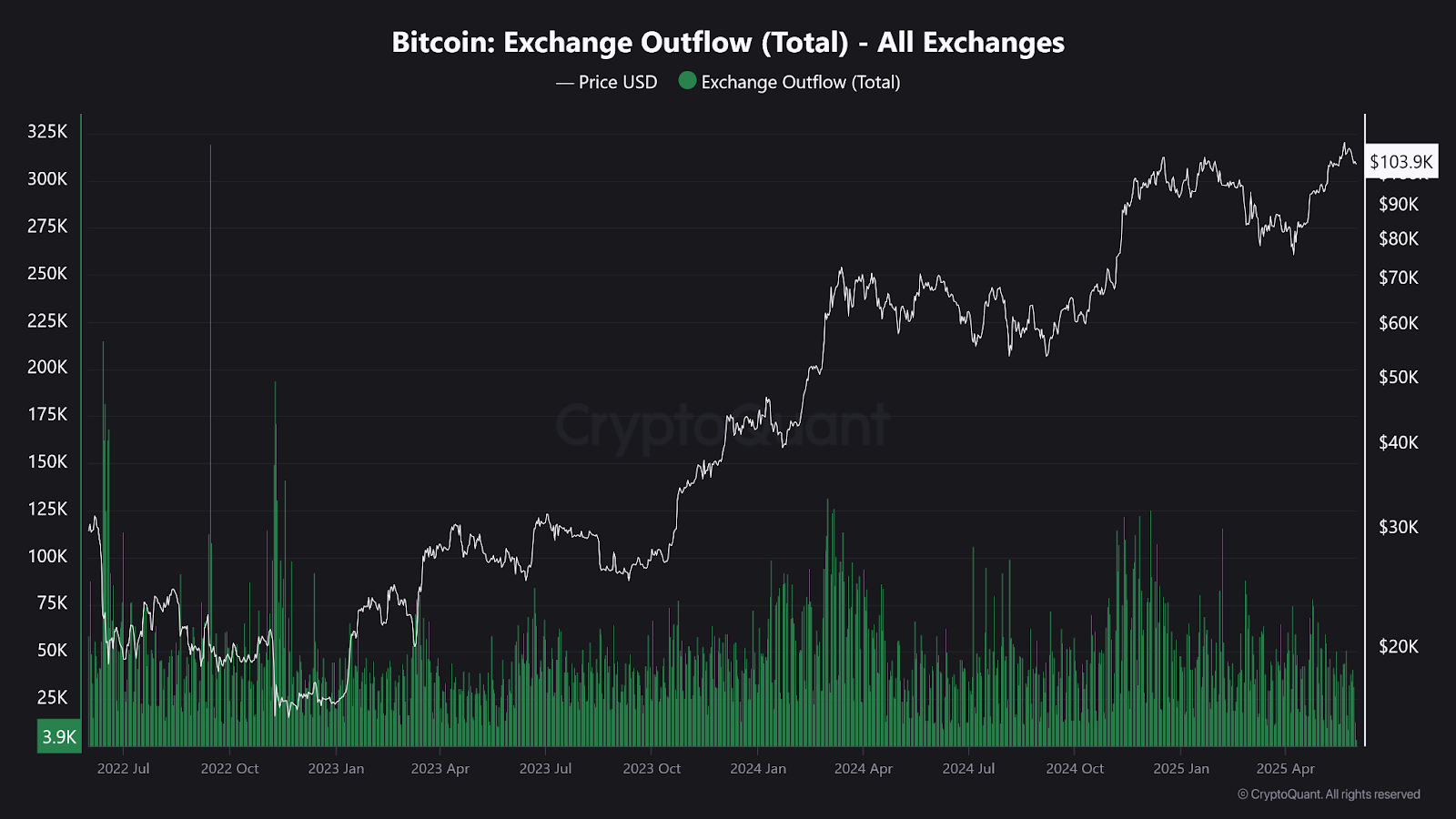

The exchange flow narrative of Bitcoin tends to portray hesitant bulls and accumulating whales. Inflows sputter at an enfeebled 3.8K BTC as Bitcoin holds the $104K mark, but it is the receding aggression of sellers telling the story. The longer-term outflows, at a matched level of 3.9K BTC, feed into the narrative of long HODL players scooping up available coins, sidelining a bullish undertone with a price that cannot rise.

Source: CryptoQuant

Source: CryptoQuant

Bitcoin Wobbles: Is This Just a Pit Stop on the Road to Riches?

The Big Bitcoin’s new tag shows $104,078 after it fell by 2.60% in the last day. Selling pressure might be dying down; daily volumes are also correspondingly taking a breather–down by 2.24%. Are investors actually booking profits here? Or is it just a small pause before the price takes a leap again?

Analyst Commentary: June Rebound Still in Sight

Bitcoin is the curious case of dwindling supplies and a mood-ring kind of market. Crypto-Wizard PattaTrades sees a compelling pattern: Bitcoin gaining 10% in the first week of every month for seven straight months, a streak he bets will continue in June. Could this be the build-up toward a bigger market revival? Stay tuned.

On a deeper analysis, the warning flags waving in the atmosphere are ominous. The MACD has made its way down into bearish territory and has begun painting a negative histogram, while the RSI, after flirting with overbought territory, found itself teetering on an uneasy 50.24. While the long-term uptrend stays intrinsically intact, these signals hint at a potential loss of momentum, asking for a bit of caution.

Source: Trading View

The four-hour timeframe chart of Bitcoin spells sheer rage and ambition. Having exploded through strong resistances at around $83K-$86K, the price selected $93K-$96K to aim for next, then $101K-$105K. The next battlefield being carved looks set to be a tempestuous affair, happening somewhere between $106K and $112K. Price has since retreated to test the lows of this hard-won territory-will it be a breathing symptom before it surges up again, or an ominous symptom for what lies ahead?

Daan Crypto throws down the gauntlet: Bulls must conquer $106,000, or brace for impact. If they fail to reclaim the peak, Daan foresees a plunge into the abyss within weeks. Contrarian voices whisper of bears circling, poised to drag Bitcoin down to a $100K-$102K abyss.

$BTC Noteworthy change in market dynamics. For bulls to seize the momentum, they have to clear the $106K space. Resistance to a move above will suggest a potential window of cooling-off even in the coming weeks. Analyze the chart at: [Link]

Daan Crypto Trades (@DaanCrypto) May 30, 2025

Crypto Controversy Prompts Czech Minister’s Resignation

The political and judicial crisis surrounding Pavel Blažek made his career implode under the billion-crown Bitcoin bombshell. The digital fortune, traced back to a convicted drug offender, started the political crisis that necessitated Blažek’s hasty resignation.

Under suspicion, Blažek alleged ignorance on the donor’s somewhat shadowy past and allegedly unlawful activities attended to the donation. However, to prevent his Government from any further stain on its already battered reputation, he offered his resignation. The decision was accepted promptly by the coalition representatives, underlining the paramount-weighted institution integrity.

Thanks for reading Bitcoin Hits Exchange Reserve Lows as Bulls Eye $106K Rebound