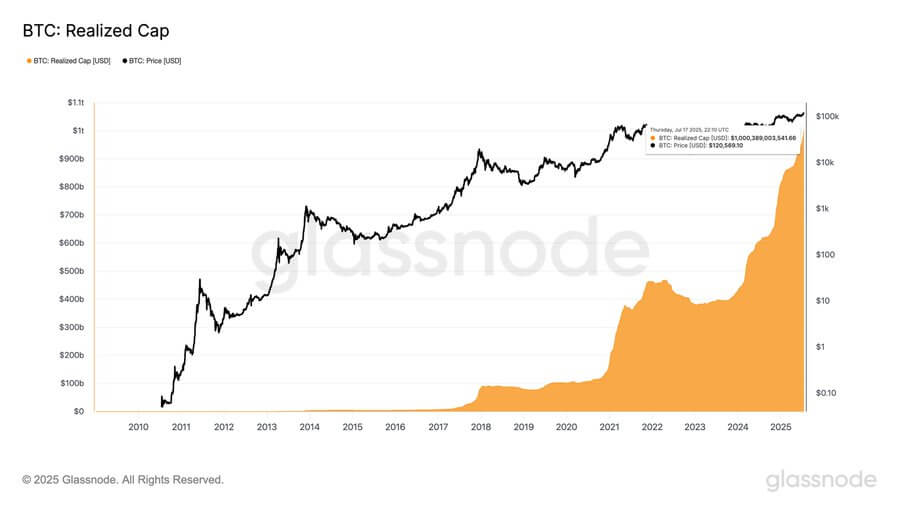

Bitcoin’s gravity just shifted. Glassnode reports its realized capitalization has shattered the $1 trillion ceiling, a cosmic leap signaling more than just a price point. It’s a universe of value, finally recognized.

Barely days after BTC shattered records, soaring past $123,000, a new surge underscores the white-hot investor frenzy gripping the market.

Forget market cap. Want to know Bitcoin’srealvalue? Realized cap cuts through the noise, valuing each Bitcoin based on the price when it last danced across the blockchain. It’s like X-ray vision into the true capital locked within the network, revealing the unwavering faith of its HODLers.

James Check, the on-chain oracle at Checkonchain, calls it the “Bitcoin market’s vital sign” a metric so crucial it could make or break your portfolio.

He explained:

Imagine Bitcoin as a giant, digital piggy bank. This metric tracks exactly how much “real” money Bitcoin holders have stashed away, based ontheirpurchase price, not today’s fluctuating spot price. Bought Bitcoin years ago at $10,000? That value is locked in. Only when those coins move again does their value update, reflecting fresh capital flowing in or out. The headline? Bitcoiners, collectively, have socked away a staggering $1 Trillion of hard-earned capital within the Bitcoin network.

Bitcoin’s magnetic pull on capital is undeniable. Glassnode data reveals a staggering 25% surge in Bitcoin’s realized cap this year alone. This meteoric rise underscores the accelerating influx of funds, fueled by growing institutional appetite and a bullish macro environment.

Bitcoin price faces resistance

“Bitcoin’s ascent has hit a critical juncture. Analysts warn that before setting its sights on uncharted territory, BTC must first shatter the $123,370 barrier – a formidable resistance level standing between the present and future highs.”

Alphractal CEO Joao Wedson sees storm clouds brewing: Bitcoin’s double tap rejection at the “Alpha Price” level spells short-term trouble, flashing a red flag for crypto investors.

Alpha Price: Unlock hidden support and resistance levels on-chain. This innovative model mixes realized price, historical average cap, and more, revealing potential price ceilings and floors like never before.

Wedson said:

Alpha Price isn’t just a number; it’s a battleground. Imagine pressure zones, deep underwater. Lower levels? Unyielding coral reefs of support, teeming with buying activity. Higher levels? Treacherous currents signaling increased selling pressure, like a shark-infested zone where profits become targets. These price thresholds aren’t arbitrary; they’re emotional seismographs, reflecting the shifting tides of investor sentiment. They mark the lines in the sand where bulls and bears clash, defining where buyers rally and sellers unleash their fury.

However, should BTC price overcome the resistance at $123,370, Alphractal forecasts the next major target between $143,000 and $146,000.

Still, the risk of an overheated derivatives market hangs on the horizon.

According to Alphractal, long positions, or traders betting on further price increases, have been dominating in recent months.

This bullish fever, however, ignites the fuse for a potential “Long Squeeze.” Imagine a rug pull – prices plummet, vaporizing over-leveraged positions and unleashing a cascade of selling that amplifies the market’s descent.

Thanks for reading Bitcoin hits $1T realized cap as price aims to break resistance