Bitcoin ETFs Hit Reverse: Billion-Dollar Inflow Streak Snapped

Wall Street braced for storms being whipped up by the Fed: institutional giants are slashing their holdings while counting down to the Fed’s next move, fearful of a roller-coaster ahead.

Institutions Pull Back from BTC ETFs as Fed Decision Looms

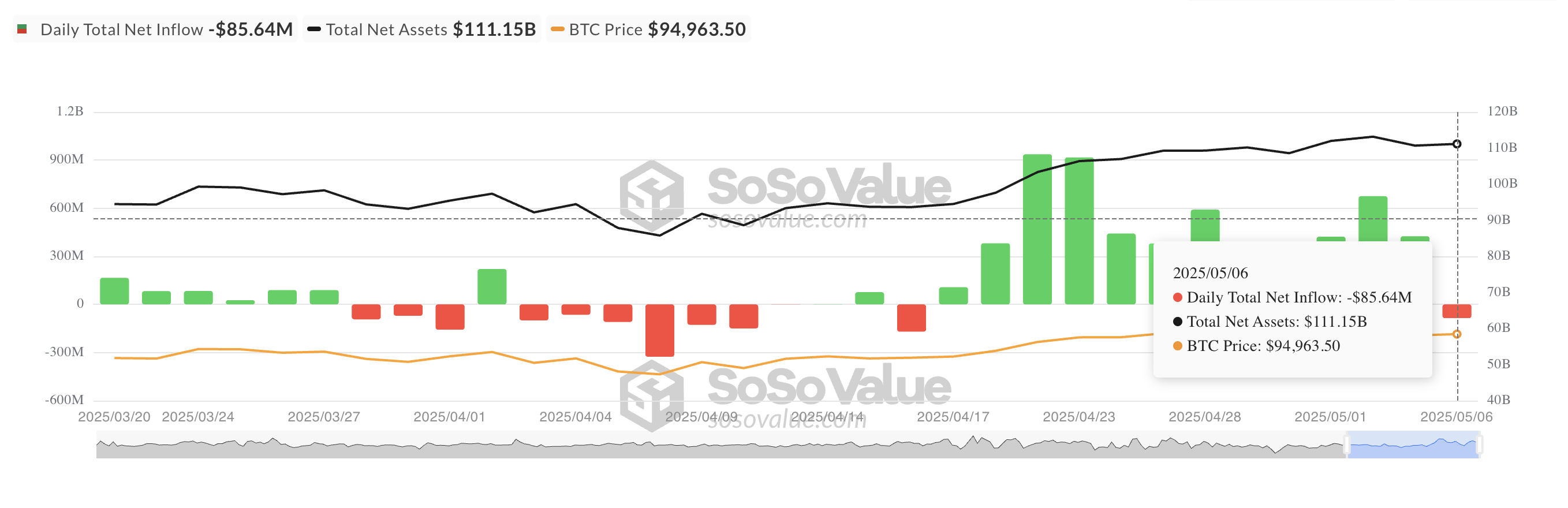

On Tuesday, Bitcoin ETFs played a contrasting role in the market, with a net $85.64 million in outflows. Is this institutional interest waning in the new light of the Fed policy meeting?

Total Bitcoin Spot ETF Net Inflow. Source: SosoValue

Within a span of three days, there was a billion-dollar influx into the BTC fund. And the tide if along with this push, quite suddenly changed. Investors are pulling back to brace themselves for a possible storm of markets spurred by today’s FOMC announcement.

Think of it as a[(calculated) retreat-a defensive-preemptive maneuver to avoid the immediate tantrum of financial blows that policies or markets could have upon the investor.]

ETF exodus? Not so fast. While institutional investors could well be trimming their ETFs, the surge of inflows into on-chain spot paints an extreme case. Are they getting out of ETFs to gain the direct spot exposure? Maybe smart money is playing volatility, while loading on spot positions to cash in on the price frenzy pre- and post-Fed announcement.

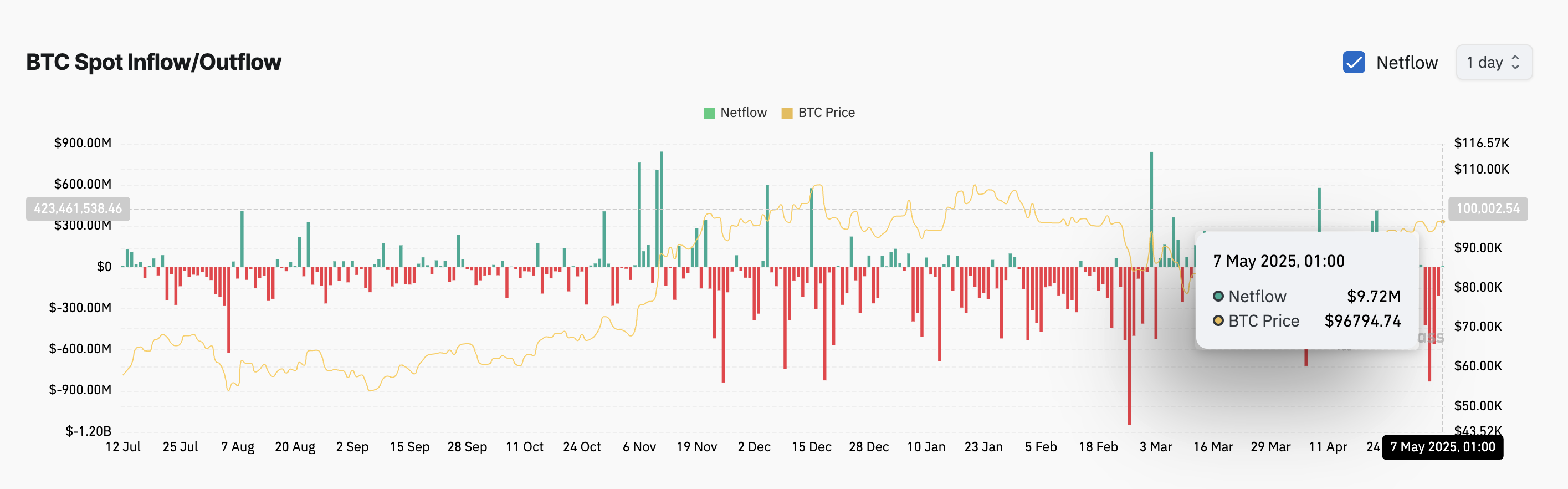

Coinglass notes that BTC has had an influx of $9.72 million into the spot markets. To put it simply, more and more people are taking away BTC in their possession, which indicates growing demand and a bullish sentiment in the air.

BTC Spot Inflow/Outflow. Source: Coinglass

Bitcoin’s spot market is witnessing a buying frenzy, a powerful undercurrent that could propel prices skyward if the pressure holds.

Bitcoin Rises on Buyer Strength

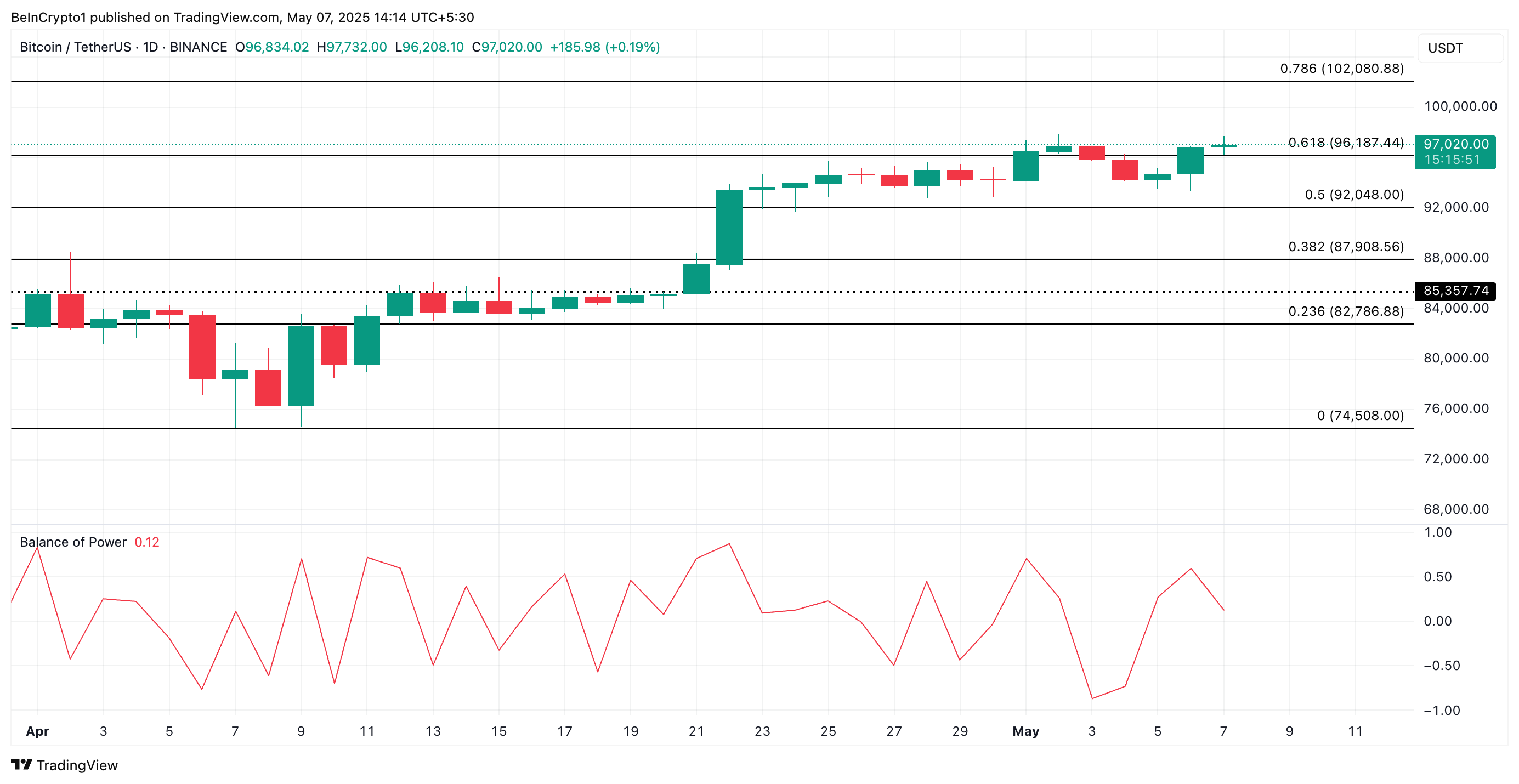

Bitcoin flirts with the $97K mark! Solid 2% gains are today on record, with prices propelled by wholesale spot buying that shows bullish expectations ahead of the FOMC pow-wow. The Balance of Power (BoP), at a positive 0.10, corroborates the fact that bulls are very much in charge.

Imagine a tug-of-war between buyers and sellers. This particular indicator tells who is winning the struggle. Imagine it as a market thermometer trying to gauge the intensity of buying pressure by considering where the price ends within the daily range. Any positive reading will mean the bulls are on a charge, perhaps forcing the asset upwards.

If BTC demand rockets and market conditions remain favorable post-FOMC meeting, it could climb toward $102,080.

BTC Price Analysis. Source: TradingView

The market is currently angry about the unforeseen heights Bitcoin has climbed, a status it has been earning with great effort since inception. If such turbulence should occur, Bitcoin could come crashing down. There are some ominous vibes brewing at around the $96,187 mark. Bitcoin has fallen through this support level, which had looked strong for weeks, and poor BTC is now teetering at the edge of a drop to $92,048.

Thanks for reading Bitcoin Institutional Investors Trim Exposure Ahead of FOMC as BTC ETFs See Outflows