Bitcoin having pierced all-time highs has sent crypto bulls into a frenzy! Yet as the gold rush becomes fiercer, a chilling question rises: Is this a peak for Bitcoin, or merely the eye of the storm? Skepticism builds fast now, even as prices are going upwards.

Is the bull run on Bitcoin getting resisted at this point? A recent rally has turned profit taking, fueling fears that the fuel may be running out soon. The million-dollar question: Will this just be a short-lived interlude, or is it going to set the stage for a much bigger price-affecting plunge?

Bitcoin Investors Remain Uncertain

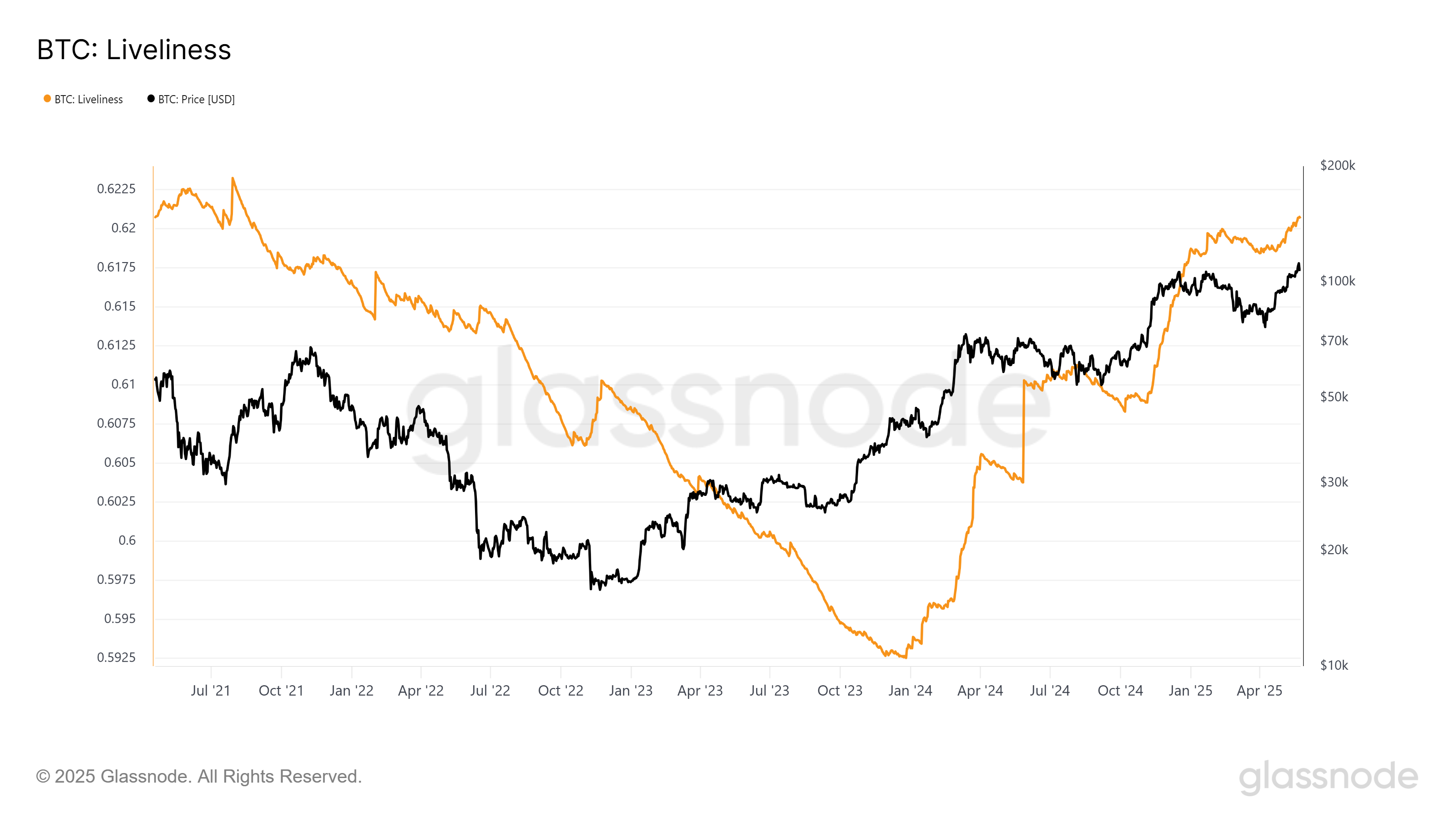

Bitcoin’s usually unshakable HODLers are stirring. Liveliness, a metric whispering tales of long-term holder behavior, just hit a near-four-year high. Is this the sound of ancient Bitcoin wallets awakening? It appears some of these old-timers are cashing out, most likely cashing in some profits after Bitcoin’s awesome bull run. Should they take that step and go, or is this just a short reprieve before the next raging bull?

Long-term Bitcoin holders: constant price stabilizers or doom bringers? Selling activities often tell the tale of fading faith, hinting at a chilling wind on the crypto landscape.

When a whale surfaces, so does the tide. Long-term holders cashing out is not some slim ripple on the pond but more like a tremor that can unsettle an already fragile market floor. Expect turbulence, a sharp drop in price accompanied by chilling selling pressure winds that could halt Bitcoin’s hike. This is no dip; it could be a defining turning point.

Bitcoin Liveliness. Source: Glassnode

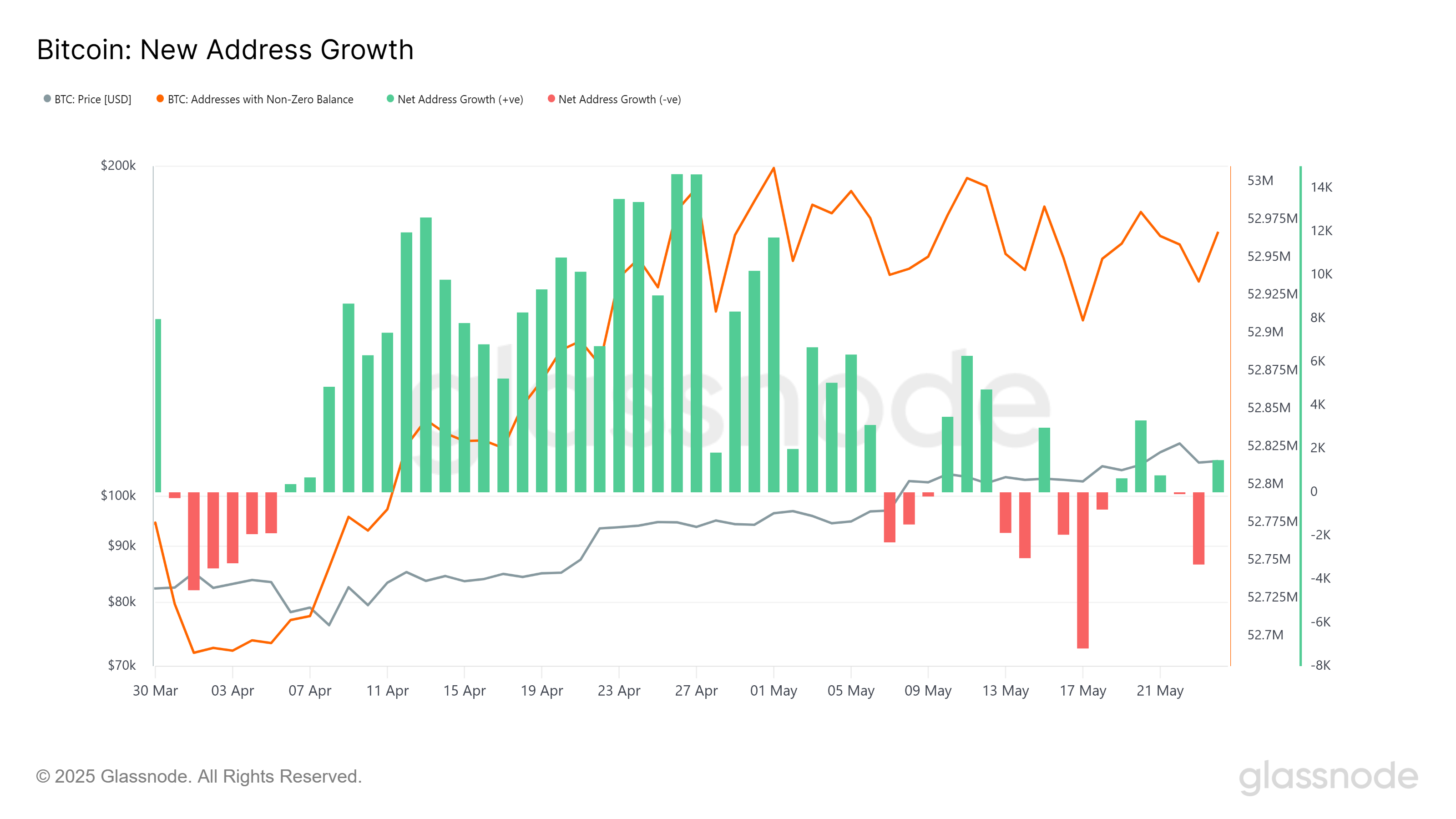

Bitcoin’s pulse this month is very erratic. Creation of new addresses surged to dizzying heights, posing a bullish situation. Now, a sea of red has engulfed the charts, raising the chilling thought of reversal.

A slowed address growth hints at a cooling market: new suppliers are drying up, and the veteran pools are drying up. Are we witnessing a wallet purge, the market’s way of purging doubt in these increasingly doubting times?

Bitcoin’s address growth this month? Rollercoaster, not rocket. Unlike the steady climbs of April, jitters among investors and profit-taking instincts kick in each time Bitcoin makes a new high.

The new Bitcoin address growth trend remains surfaced and subsurface with pending actions. Investors are maybe on that tight, unsure if this rally is just an ephemeral firework or a real change.

Bitcoin New Address Growth. Source: Glassnode

BTC Price Is Not Too Far From ATH

Bitcoin flirts with its all-time high, now trading at $106,708, 5% shy from the $111,980 it hit last week. Will it break above, or will market winds push it down again? For that matter, there needs to be the collective heartbeat of investors reacting, and that will be the key to opening up what happens next with Bitcoin.

If skepticism and selling continue, Bitcoin could face difficulty regaining its bullish momentum.

Bitcoin balances on the edge of a precipice. In case the price continues to decrease, recovery will indeed become thick with challenges. Falling through the $106,265 safety net will truly spell doom for this one. Prepare yourself for possible sudden drops to $105,000; if the bleeding doesn’t stop, then even a chilly scalp to $102,734 might come along in the immediate future.

Bitcoin Price Analysis. Source: TradingView

But the bears are not yet out of the woods. Should Bitcoin really defy the gravity and cling to $106,265, aided by yet another surge of bullish energy, it will be a whole different story. Breaking above $110,000 will release an avalanche of buying interest, pushing it above $111,980 and setting the stage for an all-time high.

Thanks for reading Bitcoin Long-Term Holders Data Hint When the Next All-Time High Might Be