Bitcoin has been in a range or a rut for weeks now; between $100K and $110K. But below the surface, a fight ensues. Traders are on both sides loading up on breakouts and breakdowns. The catch? Bears are gaining the upper hand. Shorts are piling up way faster than bulls can enter. Is this the calm before the storm?

Bitcoin Long Positions Slightly Ahead But Shorts Catching Up

Bitcoin’s Mount Everest moment at $111,814 now remains in archives as the price is experiencing a month-long lateral; a $100K to $110K plateau is a rare thing to find in the crypto world. Will it settle down for a while to set a base camp for a new ascent, or is it just a calm before the intensity will shake the country? The crypto world is watching with bated breath for the next ego clash between Bitcoin and Mini.

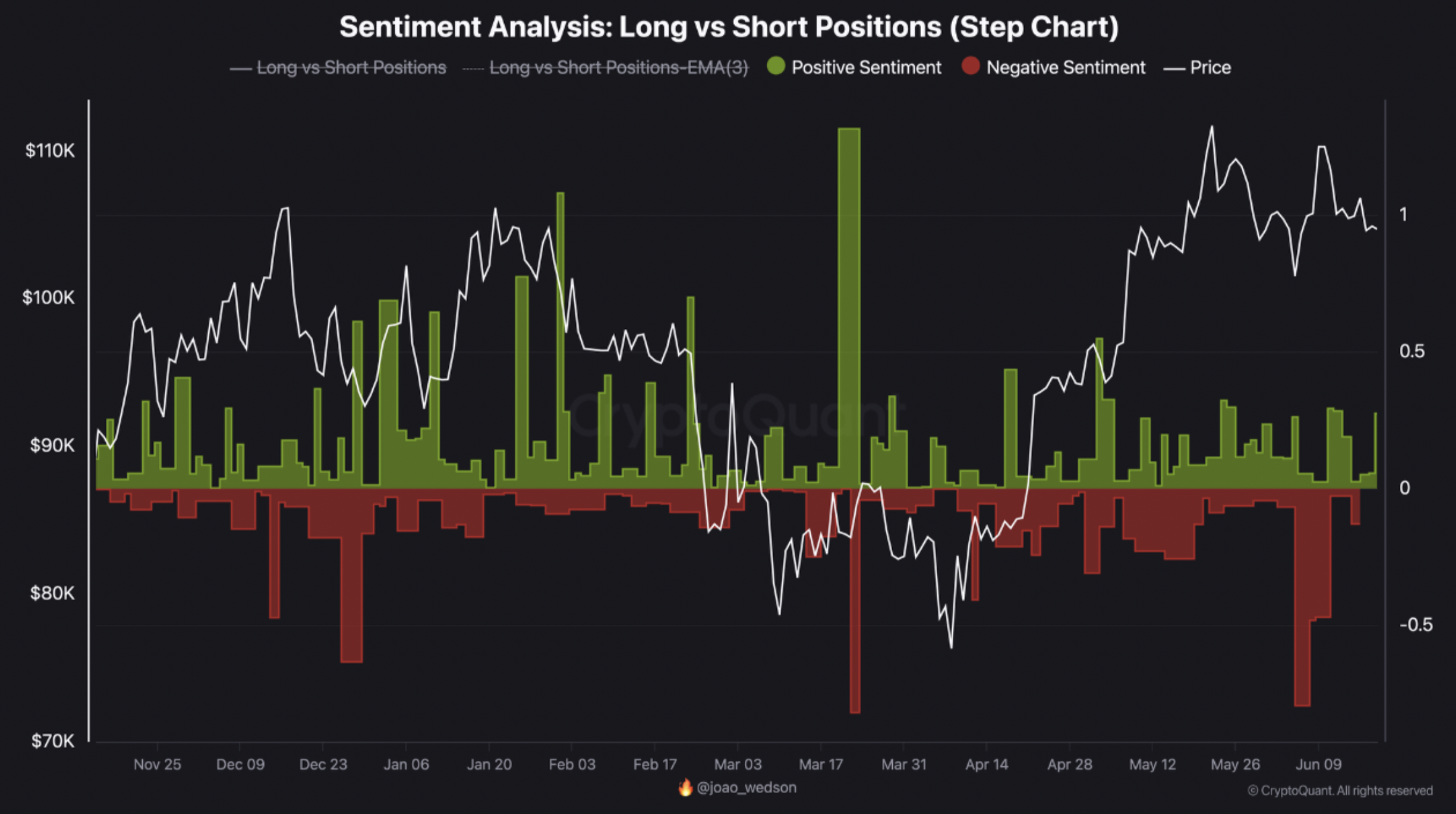

Binance battleground: BorisVest’s CryptoQuant Quicktake reveals a close long versus short battle, perhaps with only a razor’s edge in favor of longs in this crypto arena.

Bitcoin is teetering on the wire. History whispers the cautionary reminder that, most times, huge short positions engender violent short squeezes, while huge long ones may end up in their long squeezes. The present range is much like a coiled spring. A break upward or downward will be the birth of another earth-shattering move for Bitcoin. So which way will it snap?

Binance data shows that the market is at a standstill. Longs barely get the upper hand over shorts, the overall ratio suggesting some sort of tug-of-war instead of either side getting a victory. The funding rate, therefore, further pictured the stalemate: near neutral, bulls and bears engaged in an epic struggle for dominance, yet evenly matched.

Yet this equilibrium often conceals an anxious market trying to settle down. Longs have topped out, while short bets shoot through the roof-a clear sign that investor sentiment is turning bearish, and tensions in the Middle East are flaring-up. Observes BorisVest:

Is the Bitcoin party over? The ominous aspect lies in the negative funding rates that signal a surge of short positions betting on the ongoing rally. The delicate equilibrium therefore hints that we are balancing on a knife’s edge, a crucial zone where bullish expectations face bearish realities.

An uprising for a short squeeze originated with the evidence for low long interest. When bears are in a hard and forceful position, quiet buying from big-money stakeholders can tear apart the bear market by reigniting a sudden and explosive rally.

Is BTC Preparing For A Big Move?

Bitcoin was stuck in the $100K-$110K doldrums for weeks, but whispers of Wall Street keep saying that this sideways shuffle is the calm before a crypto storm. Analysts across the spectrum pluck out a major Bitcoin breakout as imminent.

The buzz about bullish surges is rippling through the crypto sphere. A trader, Josh Olszewics, said that if Bitcoin can keep its solidity in the foundation, a surprise meteoric rise to $150,000 might lie ahead.

The gentlemance Mister Crypto looks toward bullish weather brewing. He sees an inverse-head-and-shoulders pattern forming for Bitcoin on the 3-day charts-a technical signal that could send the BTC flying high.

Bitcoin is still on thin ice. Chain indicators are shouting “overpriced” as the NVT Golden Cross flashes red. Caution is indeed advised. Despite these warning signs, BTC clings to the $105,940 mark, up a nominal 1.1% in the last day. Is it a bull trap or the calm before the haunted storm?

Featured image from Unsplash, charts from CryptoQuant and TradingView.com

Thanks for reading Bitcoin May Surprise Bears: $100K–$110K Range Shows Rising Short Interest