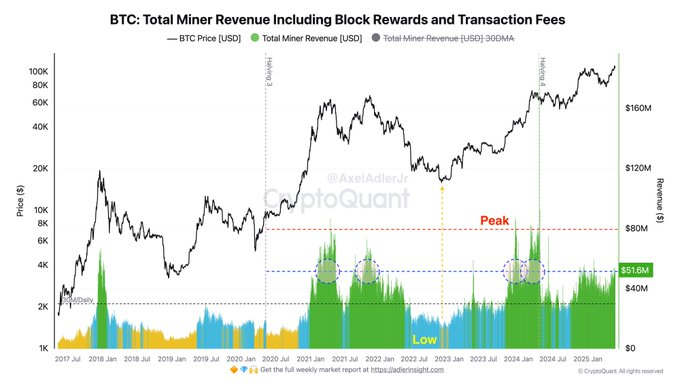

Bitcoin’s pulse remains strong with rising miner revenues and exchange inflows suggesting it is preparing to make the next big move upward. While the groundwork is getting laid and is nowhere near the much-lauded roar that previous peak cycles had reverberated with, market whispers have suggested that there is a big hum right now as Bitcoin miners are raking in $51.6 million daily, highlighting the increased activity.

Miners are now enjoying the frenzy of selling post-a-pumping phase, unloading two times the normal supply onto the exchanges. Daily inflows began to shoot up from 25 BTC on average to about 50 BTC, raising concerns that it might be a sign of profit-taking. Historically, these types of miner sell-offs have topped out at close to 100 BTC, so watch the market closely.

This shows that selling has indeed accelerated though we’re still a long way from peak volumes and the… pic.twitter.com/fTsGLyKovc Axel 💎🙌 Adler Jr (@AxelAdlerJr) May 27, 2025

Definitely, the figure turns some heads, but do you remember the good old days? We’re still catching up to the $80-plus-million-day paydays miners used to get in previous market peaks. That’s like a high score still not quite locked away. This buzzing network has a lot of activity, but certainly, further opportunity awaits where miners can reapmuch biggerpaydays.

Miner Exchange Inflows Double but Market Absorbs Supply; Activity Below Peak Levels

Bitcoin miners are making money. After the rise of Bitcoin to all-time highs, deposits of Bitcoin from miners to exchanges skyrocketed. Daily deposits doubled from 25 BTC to 50 BTC. These peaks, historically, unmasked market turns, with past peaks hitting 100 BTC daily. Is now the beginning of profit-taking, or just a small correction? Keep watching the blockchain.

Source: Axel/X

The squeeze of Bitcoin has been on: put on ample pressure, then all it can do is fall through the market. This surge in demand therefore implies that while selling pressures may have increased, they have not found the market overwhelmed..

Bitcoin is looking healthy as a set of vital signs. Soaring miner revenues, exchange inflows paints a picture of a strong and active network. But this doesn’t mean that the landscape is fully prepared. Quite the contrary, in fact, current metrics point out that the runway is still plenty long. Unless and until these figures exponentially surpass their former glory, this market contains enough room for its rally during this cycle.

Has Bitcoin Topped? What’s Next?

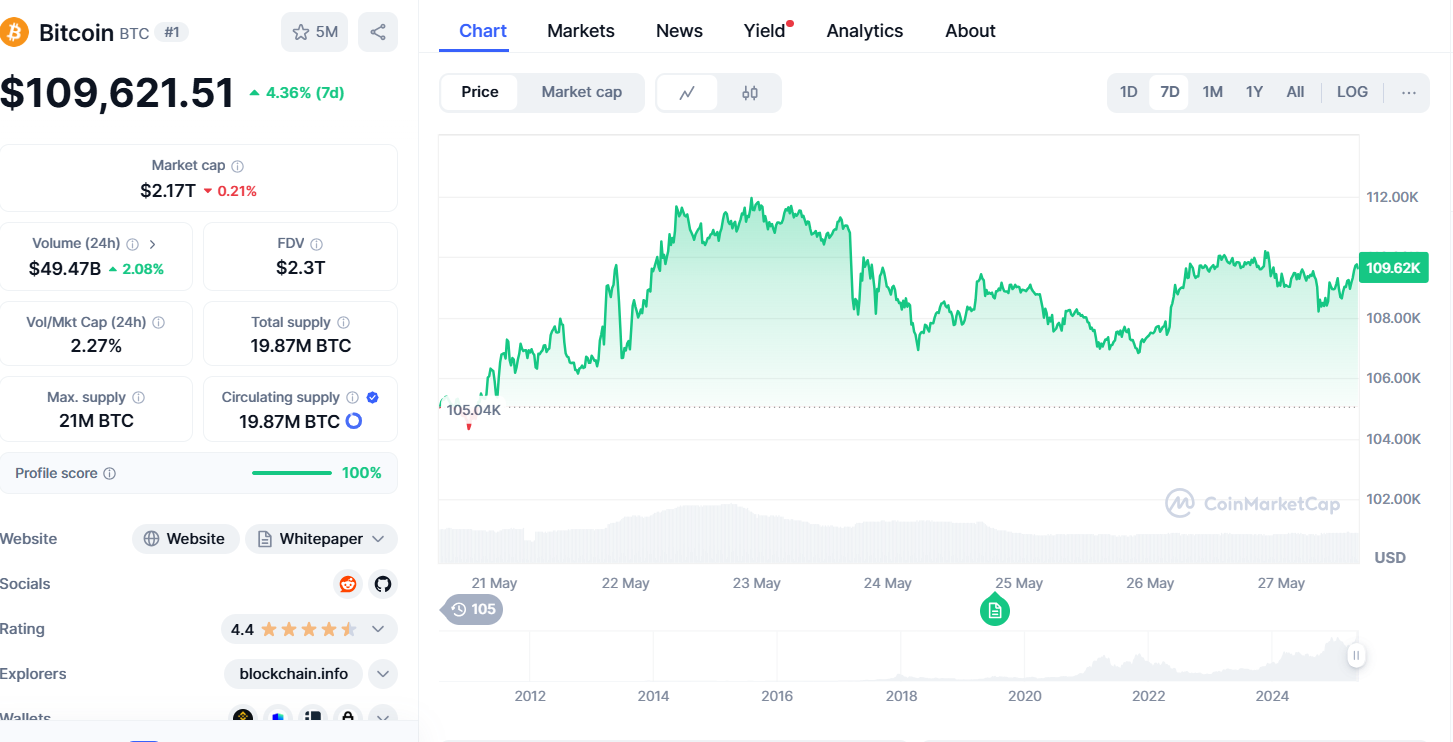

Awesome! One commenter gave a forecast of Bitcoin’s next dizzying peak in the band of $200,000 and $250,000. But what goes up is destined to come down, right? Calm yourself for a possible correction. Suppose Bitcoin skyrockets to $200,000 and then nose-dives by 50%. The rough and tumble history of the market has it landing somewhere about $100,000. Strap yourselves in for one hell of a ride.

Source: CoinMarketCap

Imagine a scenario where the titans of Wall Street, the hedge fund behemoths, utter some new names in their boardrooms: Bitcoin. Not as a risky gamble but as a shelter, a digital fortress from the storms of economic uncertainty. If that shift occurs-if Bitcoin becomes the new gold for the financial elite-then prepare for liftoff. We are probably not talking about just somewhere between $200,000 and $250,000. We are talking about uncharted territory, an explosive price move going on historically fueled by demand from institutions. Buckle up.

High risks are associated with trading and investing in cryptocurrencies; you might end up losing money. This article is exclusively for educational purposes and should not be considered financial advice. Coin Edition will not be responsible for any losses that you may bear whilst applying this information. Do your own research and consult with a qualified financial advisor prior to making any investment decisions.

Thanks for reading Bitcoin Miner Revenues Climb to $516 Million Daily Still Below Record Highs