Bitcoin Bear Market: Is this the closing chapter, or is the new bull rally really hidden in the latest cryptocurrency psychological sentiment?”

The recent dump? A mere sneeze, not a crash. It’s down a measly 6% from its $112,000 high. While some say the RSI raised its red flags, Titan argues that the real party is just beginning. Forget a top – we’re deep in bull market territory.

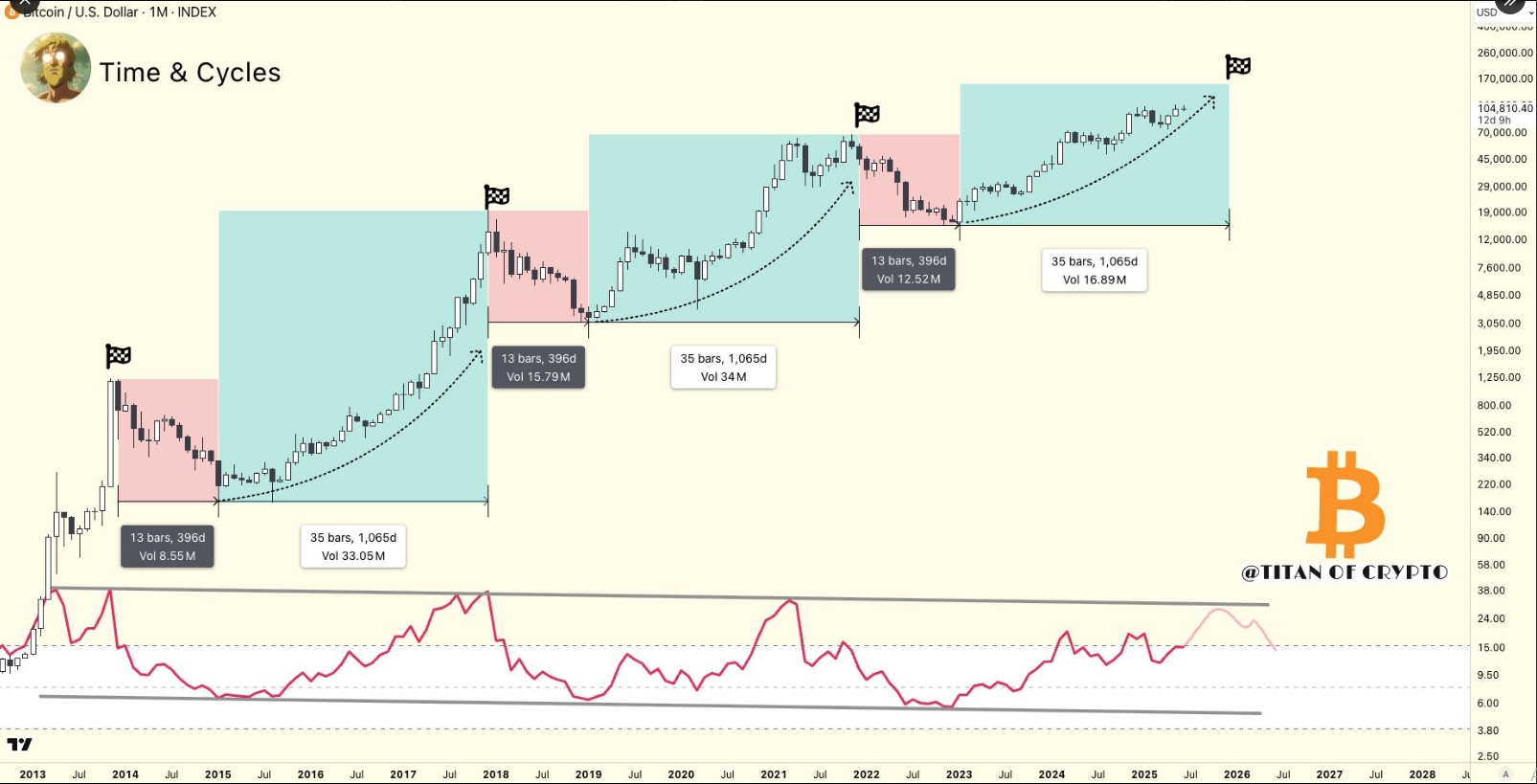

Fractal Cycles Keep Running

Titan caught a fearful echo in Bitcoin history: two cycles could mean two precipitate drops, each preceded by an unrelenting 13 months of free fall approximately 396 days of agonizing fall. Remember 2014-15? Bitcoin went south from a hopeful $1,240 to a despairing $161 during those months.

After bottoming, prices surged for 35 cycles (a whopping 1,065 days), peaking at $19,800 in December 2017. An almost eerie repeat: the market then mirrored its previous behavior. The subsequent 13-cycle dip was followed by another 35-cycle climb, culminating in a breathtaking $69,000 high in 2021.

Bitcoin Bull Market Entering Final Phase 🏁

If the story of Bitcoin had to be repeated, the tensely evocative dramatization would go something like a year-long bearish consolidation, followed by three years of bullish momentum. Was $BTC following the tracks of the previous boom and bust? The final autumn may very well be with us, but hold on tight-the bottom is nowhere near!

Titan of Crypto (@Washigorira) June 18, 2025

Momentum And RSI In Focus

Whispers of a Bitcoin top are becoming increasingly louder, powered by a weakening RSI. Take heed of these warnings as fading momentum often foreshadows a price pullback. Abandon the static-based charts. Think real-time: RSI, volume, on-chain activity-all contribute to the changing demand scenario of Bitcoin.

Bull Run Still Has Room

Bitcoin went on a tear from the opening minute of 2023, with a bull stampede. Its uptrend since then has been at a stupendous 530%. This month will be the 29th consecutive period in an epic climb, showing that this rally is here to stay and not going anywhere very fast.

The past somehow whispers bullishly in the forecasting: pack the soul with assured thoughts of at least five more green months before the rally reaches its zenith in the month of November. Yet, when the charts are talked about, even more spectacular might be in store. We’d have a wedge breakout on our hands. The price could lift off to the stratospheric $137,000 before gravity can bite back.

Big Names See Higher Peaks

Forget incremental gains; Jan3’s CEO Samson Mow is indeed not merely predicting a rally in Bitcoin but is rather envisioning a volcanic eruption. Hold on to your hats, because he foresees Bitcoin shooting into orbit and shattering that $1 million barrier in a furious rush triggered by the adoption of nation-states, the sovereign debt revolutions, and a desperate race for hyperbitcoinization before the dust has even settled.

Raoul Pal, the former Goldman Sachs hotshot behind Real Vision, is doubling down on his meteoric Bitcoin prediction. Hang on now: Pal forecasts Bitcoin over $1 million by 2030, burning an unprecedented monetary bonfire, and supply itself is so beautifully scarce.

Strategy’s Michael Saylor has also said Bitcoin could skyrocket to between $500,000 and $1 million before seeing any real correction.

Crypto Titans Signal: Institutional Tsunami Meets Halving Drought – Buckle Up for the Next Peak.

Skip the replays. This a modern Bitcoin boom; it is not an old-time one. The rally isn’t just hype; it has massive institutional buying power, Trumpet ETF fire, and an army of on-chain analysts cracking the codes of future blocks.

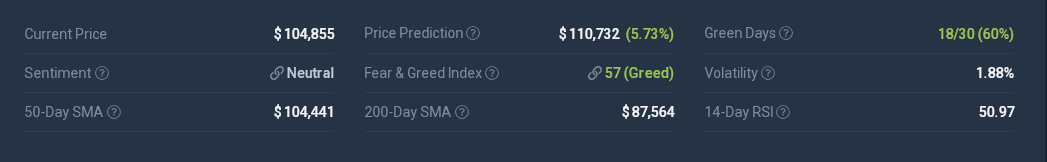

Buckle up for bullish Bitcoin action! CoinCodex’s crystal ball proposes a 5.73% surge, with Bitcoin potentially achieving a kiss with $110,732 by July 19, 2025. The market, meanwhile, is playing it cool with a “Neutral” technical vibe, but the Fear & Greed Index is out there screaming “Greed!” at a feverish 57. Is it cautious optimism or max-FOMO frenzy coming on? Time will prove it.

Featured image from Pexels, chart from TradingView

Thanks for reading Bitcoin Nears Climax But A Twist Awaits—Analyst Reveals Key Insight