Binance Bleeds Bitcoin & Ethereum: Is a Bull Run Brewing?

An hour in which mass exoduses from crypto major Binance were noted was June 23 when investors drilled at least 4,000 BTC and a baffling 61,000 ETH within 24 hours. Would it be the panic for investors or their astute strategic moves? As geopolitical skies start to clear and inflation ebbs, here comes the great crypto volatility game. Has the outflow started his inordinate fuel output for the next bull run?

Bitcoin Likely To Rally As Global Tensions Simmer

Global transformations and certain strategic moves are the lure that would enable Bitcoin to stage a comeback, says Amr Taha of CryptoQuant. Forget it sideways; Taha’s Quicktake has in perspective the oncoming gripped macro tailwinds and geopolitics ready to slingshot Bitcoin back to the peak. Could these be the signs for the brand-new bull run, resuming Bitcoin to the new all-time high?

Once the breakthrough had been achieved, the President announced the ceasefire between Israel and Iran, ending tense moments. With this arrangement, the much-feared closure of the Strait of Hormuz by Iran, a global-lane for oil, is avoided, putting the world economy into shock.

Wall Street breathed a collective sigh of relief. Barely an hour before the ceasefire pact was signed, the S&P had coursed above 6,000 for the first time since February ’25. So starved for risk else were the appetites roaring back into life, leaving huge green strokes all over global equity charts and promising the beginning of a sustained bull run. The storm clouds seem to be parting in the geopolitical realm, and investors are betting on the sun shining through.

“Plummeting by a disastrous 14% into the ayes of disinflation, oil price falls are likely to ripple through the economy by way of lowering production and transportation costs, eventually inducing a much-needed fall in all prices. Taha summed it up nicely:”

Binance is bleeding; the crude oil prices trickle down; Wall Street bears charge on the bulls; and the Middle East simmer away. Dispose of the doomsday clock, for the fading of geopolitical fears, a grip of inflation holding loosens, and the macro markets set their footing, paving the way for Bitcoin to lift off. Prepare for liftoff.

Deep under the choppy waters of Bitcoin’s world, whales are stirring. CryptoQuant data reveal an almost steady accumulation of whalish quantities since April’s price floor-that is, these crypto titans might be positioning themselves for what would-be an imminent surge. Do they feel a seismic shift in the horizon?

A fascinating thing that Mignolet points out: While the market is quiet or in fear, somewhere out there, whales stir. It’s not random. Think of it as the biology behind gorging before the feast. History does indeed reflect this pattern-a massive movement of accumulation by these giants points toward a bullish tsunami.

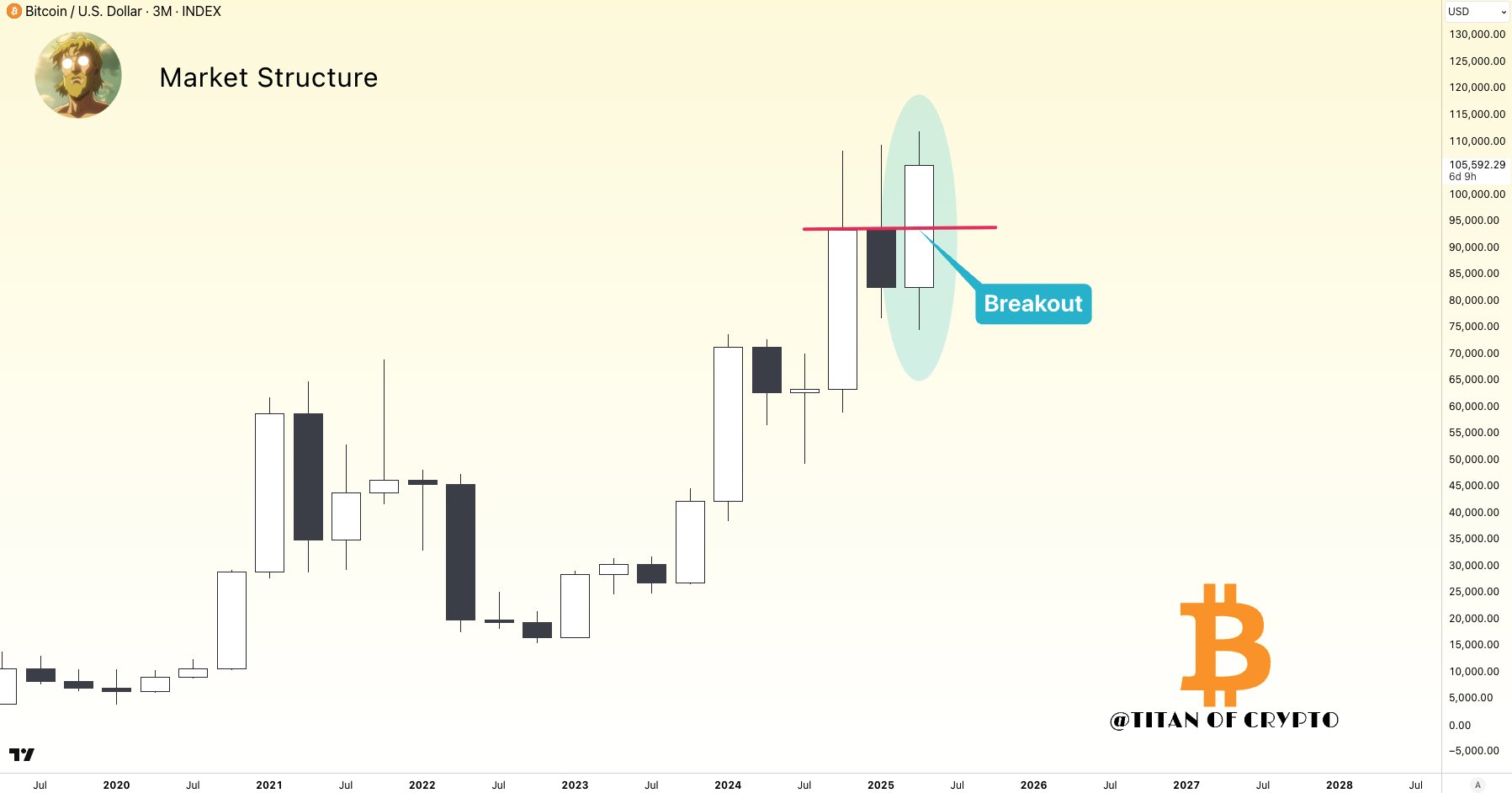

Bullish Quarter For BTC

The new month comes with a bullish expectation on Bitcoin, thereby putting in a bull candle for the monthly chart, which will thereby confirm Bitcoin’s reign as the true king for the ages.

Beyond the very price movement, the undercurrent of blockchain murmurs bullish possibility. The Bitcoin Binary CDD, a mainstay metric of long-term investor behavior, reveals long-term investors’ iron clique on holdings. These veterans aren’t selling; they’re doubling down on their belief in the enduring power of Bitcoin. If anything, this conviction acts as the greatest fuel for growth.

Short positions are stacking up, buyers and sellers tugging each other hard between $100K and $110K. This is the perfect setting for a short squeeze to dramatically send Bitcoin into never-before-seen territory. Bitcoin is currently at $105,408, with a 24h gain of 5.2%, as if waiting for the rockets to be lit.

Featured image from Unsplash, charts from CryptoQuant, X, and TradingView.com

Thanks for reading Bitcoin Poised For Rally As Geopolitical Tensions Ease And Inflation Expectations Fall