Bitcoin’s price action has been a rollercoaster, trapped between $117,000 and $120,000 for the last week. But the ride took a sharp plunge recently, with the cryptocurrency hurtling towards $115,000. The catalyst? A flood of Bitcoin suddenly shifted to centralized exchanges, triggering market jitters.

Buckle up, Bitcoin bulls. A top market guru just dropped a bombshell: the BTC bloodbath is far from over. Brace yourselves – the next few weeks could see Bitcoin spiraling even further down the rabbit hole.

How BTC Price Could Be At Risk Of Extended Decline

Bitcoin’s bull run hit a brick wall. Top market analyst Aksel Kibar issued a stark warning on X, pointing to a potential plunge to $109,000. Friday’s dip to $115,000, according to Kibar, could be the start of a significant downturn for the crypto king. Are darker days ahead for Bitcoin investors?

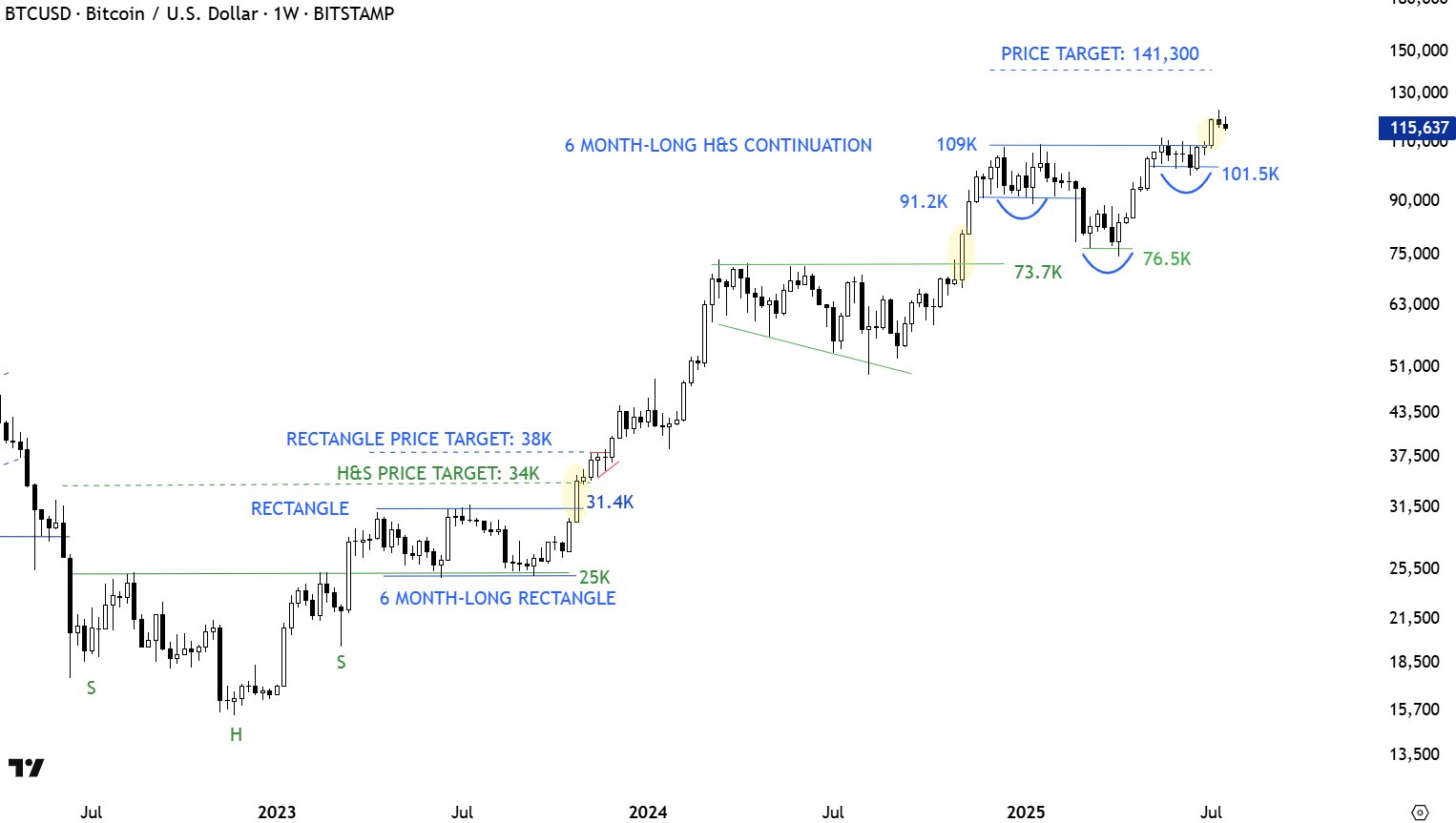

Kibar’s Bitcoin forecast? Buckle up for a potential downturn. He’s eyeing an ominous inverse head-and-shoulders pattern on the weekly chart – a tell-tale sign of trouble brewing. Imagine a price landscape sculpted with three valleys: a deep, central “head” flanked by shallower “shoulders.” This formation, according to Kibar, suggests Bitcoin might be bracing for a bearish storm.

Imagine a phoenix rising from the ashes. That’s the power of the inverse head and shoulders pattern a beacon signaling a potential bullish surge. Picture the “neckline,” a resistance barrier connecting the peaks formed between the pattern’s head. Now, witness Bitcoin shatter that barrier, soaring to unprecedented heights, as shown in the chart. This isn’t just a breakout; it’s a validation of the pattern’s bullish promise, a new dawn for Bitcoin.

Kibar cautioned that Bitcoin’s surge might not follow the script of a classic inverse head-and-shoulders breakout. Forget the textbook – instead of a typical pullback and retest after the initial pop, Bitcoin could be charting its own course, skipping the dip and heading straight for the stars.

Bitcoin’s head-and-shoulders breakouts since May 2017 haven’t exactly signaled smooth sailing. Analyst data reveals a surprising tendency: more often than not, the price action retraces or pulls back (a Type 2 continuation) instead of launching into a sustained rally (a Type 1 continuation). This pattern is why Kibar is bracing for a bearish BTC slide in the coming days.

If Bitcoin falters, brace for a potential slide back to its critical support level – roughly $109,000. This retracement, echoing a type 2 continuation pattern, would translate to a dip of over 5% from where it stands now.

Bitcoin Price At A Glance

After a turbulent dawn, Bitcoin, the undisputed king of crypto, is clawing its way back from a recent dip to $115,000. Currently hovering around $117,323, BTC shows resilience, experiencing a negligible 0.6% drop in the last day – a testament to its enduring power in the face of volatility.

Featured image from iStock, chart from TradingView

Thanks for reading Bitcoin Price Could Still Tumble Down To $109000 — This Chart Pattern Suggests So