- White House report omitted Bitcoin reserve update.

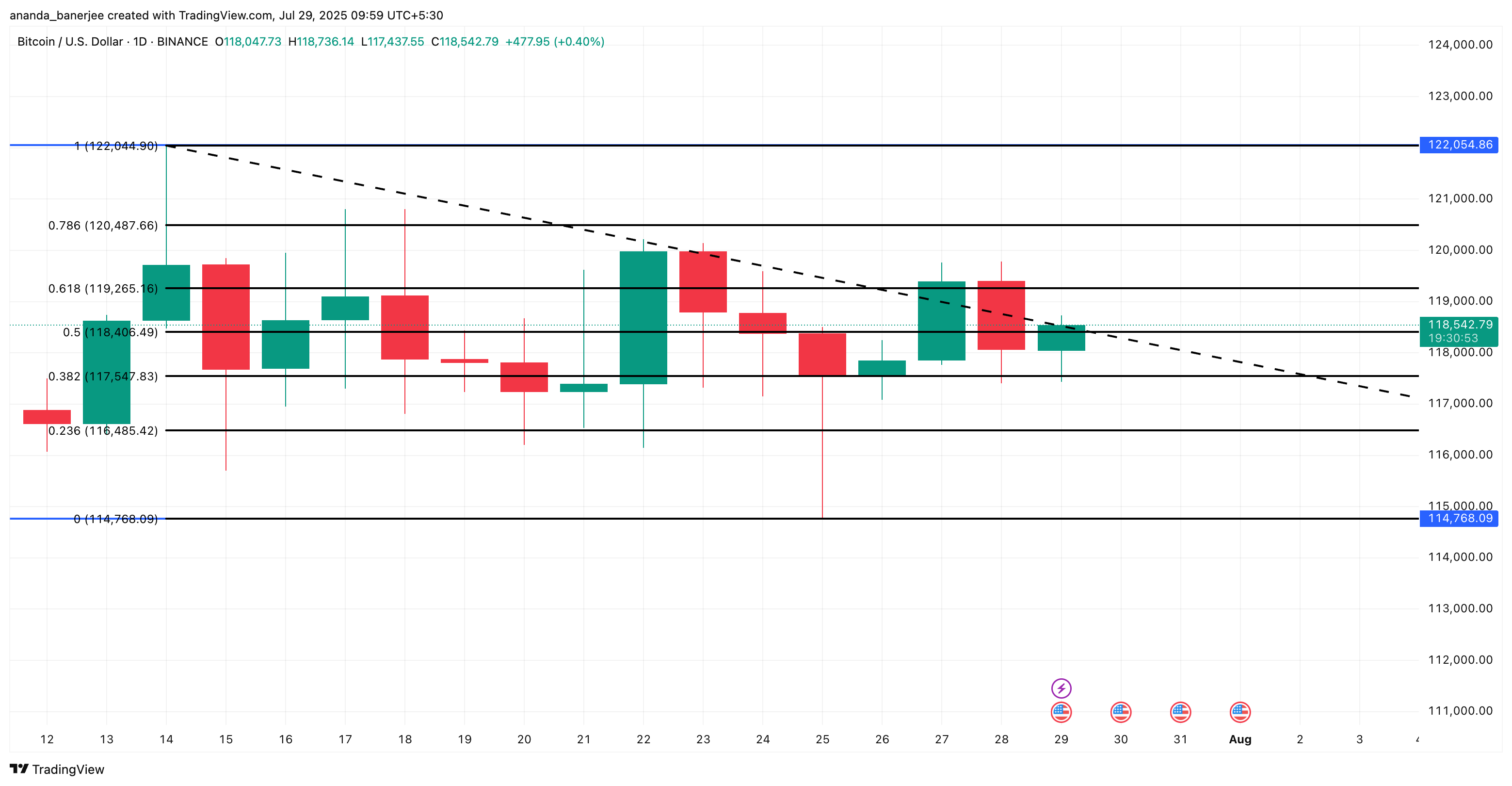

- BTC holds steady near $118k with bullish technical signals.

- ETF inflows and low selling pressure fuel price optimism.

Bitcoin (BTC) is entering August 2025 in a position of strength, despite growing anticipation over a missed opportunity in Washington.

Bitcoin enthusiasts held their breath on July 31st, anticipating a game-changing crypto policy report from the White House. The verdict? A collective sigh. While the report dropped, it was a fizzle for proponents of the Strategic Bitcoin Reserve initiative, a concept first teased back in March, offering no fresh insights or movement on the proposal.

Nevertheless, as the federal silence lingered, market indicators revealed that BTC could be gearing up for another bullish breakout.

This disconnect between regulatory direction and market performance is reshaping sentiment as traders weigh both political cues and on-chain metrics.

White House fails to clarify on BTC reserve

Anticipation had been building for months among Bitcoin enthusiasts, all eyes fixed on July’s crypto policy report – a report carrying the potential weight of a seismic shift, especially given the Trump administration’s earlier, surprisingly pro-Bitcoin murmurings.

In March, an executive order established the Strategic Bitcoin Reserve, drawing comparisons to El Salvador’s bold accumulation strategy.

The financial world held its breath. Would the report unveil a bold expansion of the reserve, a strategic land grab in the digital frontier? Or perhaps detail a new era of US government accumulation of Bitcoin, solidifying its place in the nation’s treasury?

Yet, the 166-page report relegated the reserve initiative to a fleeting cameo. Buried in the concluding section, the mention felt more like an afterthought than a springboard for future growth.

The policy blueprint landed with a thud, outlining regulatory frameworks, banking avenues, and tax overhauls. Yet, a glaring omission sparked whispers: Would the US Treasury dare to embrace Bitcoin as a strategic powerhouse?

A wave of disappointment washed over the crypto community at the glaring omission. Analysts lamented a golden opportunity squandered, particularly as Bitcoin flexes its muscles on the world stage of assets.

On the other hand, some saw a glimmer of progress in the report’s nuanced approach: Bitcoin, finally stepping out of the digital asset shadows, commanding its own spotlight – a testament to its growing legitimacy.

Bitcoin (BTC) is resilient despite political ambiguity

Even without direct government support through reserve accumulation, Bitcoin’s performance remains robust.

The cryptocurrency surged to a new all-time high of approximately $123,000 on July 14.

After a modest correction, it has been consolidating in a tight range between $117,000 and $118,000, currently trading at $118,383.

This steady behaviour comes even as the broader crypto market has experienced more dramatic swings.

Bitcoin’s price teeters on a knife’s edge, a coiled spring ready to unleash. The market’s current calm, a deceptive stillness, hints at a violent eruption. With sellers strangely absent and Wall Street’s gaze intensifying, a bullish spark could ignite a raging inferno.

The GENIUS Act, signed recently into law, also added to Bitcoin’s tailwinds by making stablecoins more accessible.

Forget rate cuts! The Fed held steady, but Bitcoin’s charting its own course, fueled by a surprisingly stable macro landscape.

ETF inflows and technical signals remain bullish

The Bitcoin bulls are flexing. Mid-July witnessed a tidal wave of capital surging into Spot Bitcoin ETFs, a $2 billion stampede in a mere 48 hours. The market’s architecture is clearly leaning bullish.

BlackRock’s IBIT isn’t just playing the Bitcoin game; it’s dominating. Surpassing $80 billion in assets, IBIT and its ETF brethren now hoard a staggering 1.4 million BTC. That’s like owning 6.6% of all the Bitcoin ever destined to exist – a king’s ransom in the digital age.

Technically speaking, the MVRV ratio is hovering around its 365-day average of 2.2 – a launchpad, historically, for explosive upward price movements.

Bollinger Bands are tightening, and the RSI remains neutral at 42.65, suggesting there’s still room for price expansion.

Going by the technical analysis, if BTC breaks above $119,900, a return to its all-time high could be swift.

Trade volume also supports this outlook. In the past 24 hours alone, Bitcoin’s volume rose by 12%, reaching $70.3 billion.

“A potent cocktail of surging activity and steadfast long-term commitment is brewing, suggesting a potential price surge on the horizon.”

Thanks for reading Bitcoin price forecast: White House crypto report omitted BTC reserve update