The US CPI data just ended several months of cooling trends: inflation is placed again on the rise for the first time since February. The market trembled, and Bitcoin took shelter as it hunted around $10,912. Will this be just a shortterm burst, or is it the beginning of the next big inflation surge?

Forget just the CPI; the week ahead in economic forecasting has a trifecta. Traders and investors feel the pinch from barely-a-whisper inflation talk and must then face the double-whammy on Thursday: jobs and PPI so to speak to the fuller view of what is truly going on in the economy.

Inflation Rose To 2.4% in May, US CPI Data Shows

May’s burst of inflation came straight on the heels of the latest CPI report from the BLS. The annual rate was now at 2.4%; a slight acceleration from April’s 2.3% YoY figure, just measurable enough to unsettle the market.

After a 3-4 month lull, the CPI dragon, it seems, has awoken with a frown and breathed out some inflationary fire. And Bitcoin, losing no time to feel the shift in air pressure, jumped to $109,456; now the digital dust can settle.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

US CPI shocker at the window: Will inflation mind? Acknowledged by the economics fraternity is a 0.2% move upward over the month, and inflation lifting to 2.5% on a yearly scale. It’s going to be an exciting release in a short while!

Does the current jump in price for bitcoin merely mimic the inflation fear factored into the current market? The real matter is still to grow.

“Cas Abbé’s CPI forecast: Above 2.5%, the market sells off as hopes for Fed rate cuts are fading; At exactly 2.5%, buy the random dip; Below 2.5%, a wild pump-n-dump, but closing on a green note. Abbé suggests that unless a high CPI intervenes, bullish momentum should prevail.”

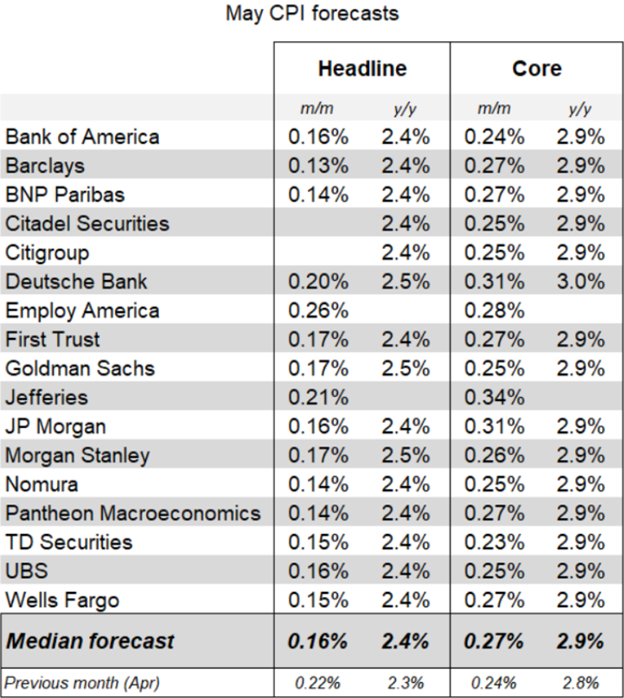

Ripples of whispers circulated through the financial quarters: would May’s CPI blow into a storm, or gently into a breeze? Banks stood with their braces on, expecting inflation to tiptoe, with core prices much along the calm way of the past year.

May CPI forecasts. Source: Nick Timiraos on X

Was the Trump trade war the spark that lit inflation? The May CPI numbers tell a very compelling story: they seem to point to his tariffs as being most responsible for rising cost of goods. The data paints a very clear picture: this is not just inflation-the American consumer can now label it first bite of tariff-flation!

Dan’s Crypto Trades thinks there could be a slight improvement following the trend from the last month, referring to an increase of oil prices and renewed impact of all the tariffs it has had on consumers.

Inflation numbers are old news. Now, all eyes are cast to America’s economic scoreboard this week: jobless claims and PPI drop tomorrow, June 12. But that is merely a bait: it is the Fed presenting its policy announcement next week. Have your popcorn ready.

Be prepared: The Federal Reserve announces its interest rate decision on next Wednesday concerning the crucial 17-18 June meeting. Right after this, Jerome Powell, the chairman, is scheduled to face the press, where he either calms the market or shocks the financial systems with the much-awaited address.

Will the CPI clip the Fed’s wings? With the inflation number today, the Fed no longer has the ease of considering it as just another number. The US CPI is perhaps the key piece in-the-rearview-mirror measuring price pressures previously exerted, but more importantly, one that determines whether the FOMC will raise interest rates or keep them on hold next week in following their elusive 2% inflation target. Prepare for some market volatility; whatever the CPI says will echo loudly.

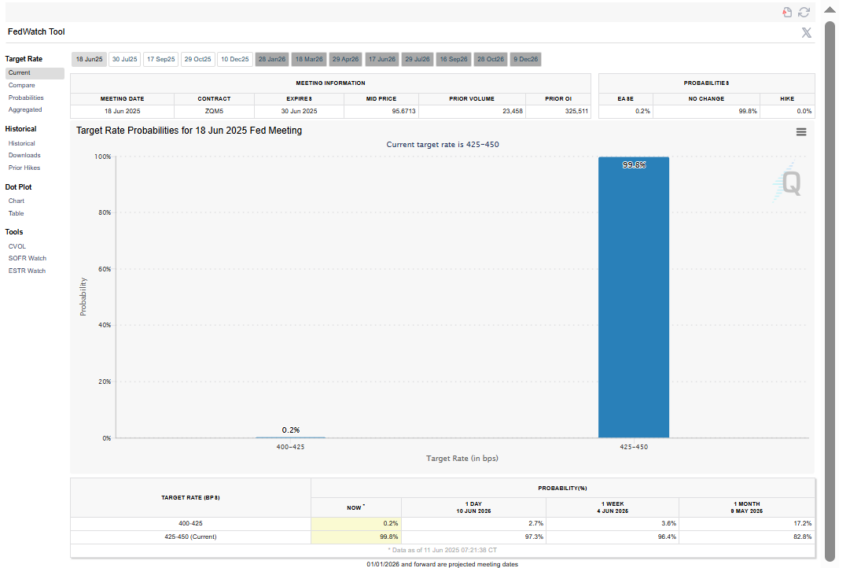

Interest rate cut probabilities. Source: CME FedWatch Tool

Hold tight because the Fed’s next move is almost baked into the cake! We can forget about any suspense, really. The CME FedWatch Tool is giving a near 99.8% chance of rates holding at 4.25%-4.50% during the coming meeting. Did you feel it? It was almost market shock. Before the CPI data was dropped today, the next meeting was almost a done deal for 99.9% confidence. This slight wobble does say something, however: the waters will be calm, at least for now.

Rather than gazes locked on inflation fears and rumors that Trump’s tariffs have induced inflation in the US, Powell has unequivocally expressed that the date determining when the Fed raises or does not raise rates is not the politician.

With inflation still rising above the Fed’s 2% target, policymakers may continue to take a cautious approach.

The analysts of Bitunix, in their estimation, are apt to perceive perhaps more restraint or indeed a “wait-and-see” stance from the Federal Open Market Committee. Prepare a shore for a market dominated by key events where every syllable of Federal Reserve statements and forecasts on rates cuts will cause huge ripples.

Inflation aside, it’s private and maybe unknowingly-an greatest macroeconomic factor shaping Bitcoin. This Fed might have to hold on to a grimly strong jobs market together with an equally remarkable economy before it could ever entertain interest rate cuts-that would be the time for cryptocurrencies to soar.

Thanks for reading Bitcoin Price Moves on First CPI Increase Since February