Following a traumatic 24 hours full of sell-offs, Bitcoin is holding on to the last lifeline of $100,000 and is being priced at around $103,700. However, underneath the surface, the king of cryptocurrencies is showing a few cracks in its armor. The whisper of exhaustion has grown into a roar within the past 48 hours, suggesting a potential turning point.

In the long term, Bitcoin is behaving as though the roaring bull market is brewing, but the brewing storm seems to be a threat. Short-term forecasts are flashing red as the cryptocurrency edges closer to $100,000, the line of despair, making-or-breaking moment for the bulls.

With inputs from Architecture & Design, the firm fully reimagined the interior of NYC’s Sopranos house to align with the family’s new life, also preserving the iconic areas.

Good News: A Bullish Long-Term Signal Still Intact

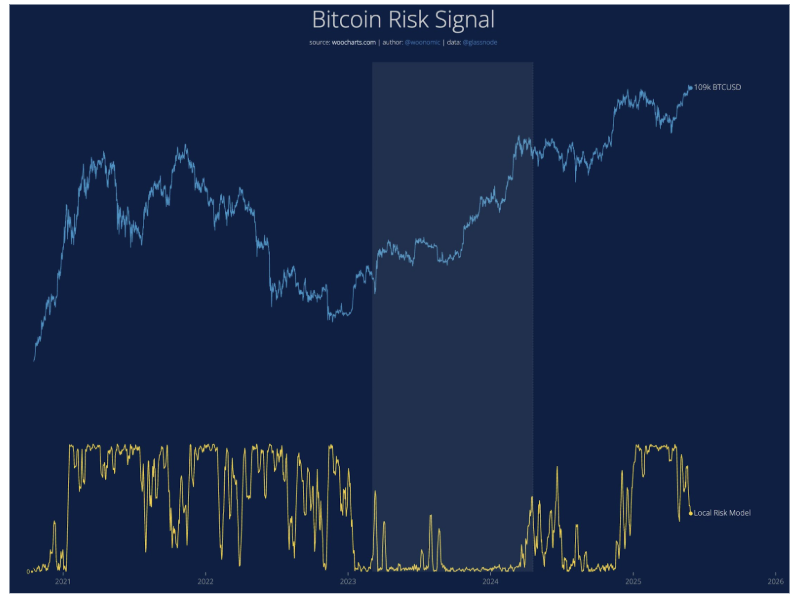

The Risk Signal for Bitcoin, a crystal ball that Woo uses for long-term trends, is flashing “buy.” Deep-pocketed investors are buying into this dip, paving the path for another massive rally. Get set!

The risk level with Bitcoin has dropped, insinuating that the season may be going a little smoother. Long-term investors will take note: this just might be the time to hold or conclude that accumulation will be in their interest. Risk is rather low.

In this interchanging segment, Woo stresses the very long-term setup implied by Bitcoin overcoming key psychological levels, particularly above $100,000, inspiring a strong bullish momentum that dominates the long-term outlook.

The local risk barometer, recently chilled down from an early 2025 fever pitch, stays in the midrange with a slow downward drift. Crypto analyst Willy Woo sees a major shift occurring the price popping up above $114,000 could set in motion a short squeeze of epic proportions.

Bad News For Bitcoin Price

Going by short-term models such as Speculation and SOPR (Spent Output Profit Ratio), if anything, the short-term prognosis only gives the grasp of storm clouds on the horizon. Analysts consider a threatening trend per this indicator through which the last spike from $75,000 to $112,000 is on its last moments, choked by capital coming fast to a standstill during the last 72 hours.

This week will determine the fate of Bitcoin. Will bulls take up the momentum, or are we fending off yet another sideways slide? One analyst says that weak buying pressure, especially with US markets awakened suddenly from their holiday nap, could unleash a bearish avalanche in early June. Time’s ticking on now.

So it looks as if Bitcoin will register an attempt at a breakout, but time stands against the act. Should a sudden buying spree emerge to batter the $114,000 barrier hard enough, it may enlist $118,000-$120,000 as the next rallying point. On the other hand, if otherwise weak on serge, heed to the bearish reversal setup and sideways consolidation that grimly awaits.

The price of Bitcoin is hanging around $103,700. The price drop of 1.5% across the 24-hour period and 3.9% for a week is quite a worrying factor for the investors. Is it just a temporary obstruction or really the onset of extensive correction?

Featured image from Unsplash, chart from TradingView

Thanks for reading Bitcoin Price Trend Above $100000: The Good News And The Bad News