Bitcoin is back in town! After the pause, meaning an episode of breath-taken, the digital gold rush is back on again, on a spur of the moment hitting greater heights of $106,000. Currently at $105,383, there seems to be some steadiness to the Bitcoin price movement as it rises by almost 0.8% in the last 24 hours. The bulls might have just started waking up!

The present rally has not yet ignited fireworks behind; there is, however, much on-chain gossip and market planning under intense scrutiny by analysts, unraveling the fine balance of the landscape.

On-Chain Data Points to Equilibrium, But Demand Wanes

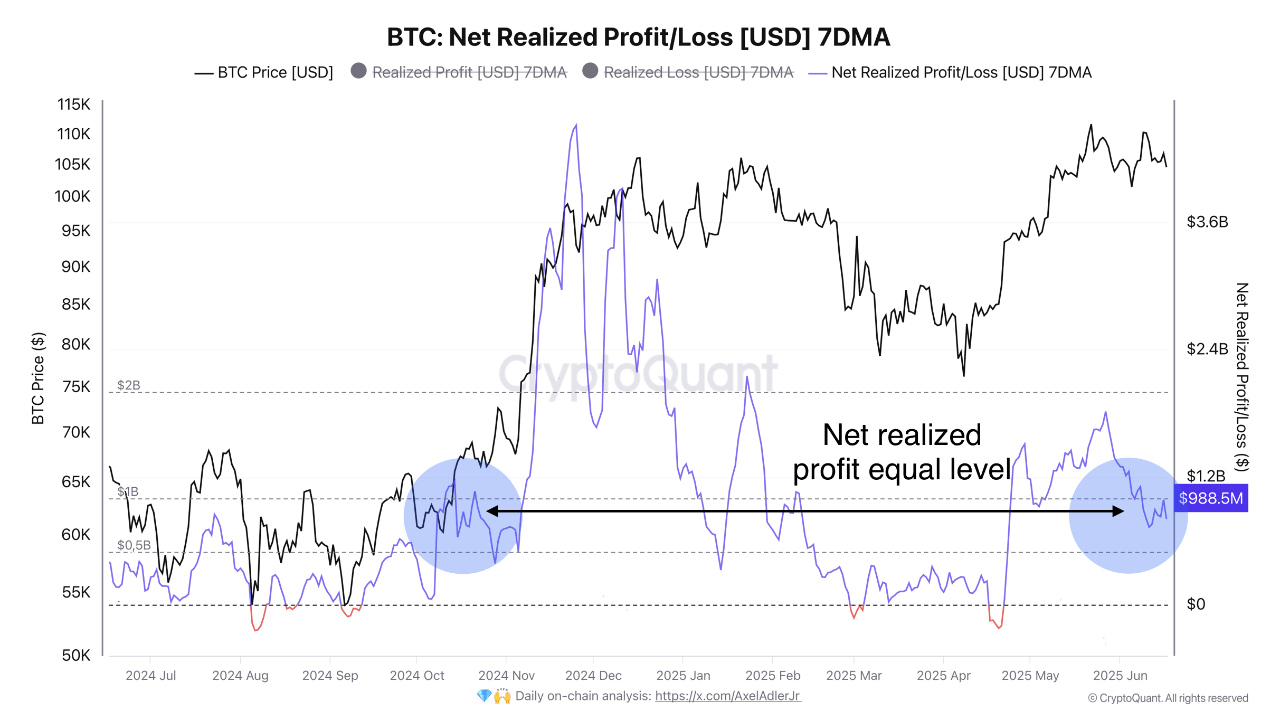

CryptoQuant analyst Darkfost sees a market holding its breath. Forget flashing red panic buttons-characterized by realized profits that in the last week, ironically, have hardly touched one billion dollars. Maybe investors are cautiously optimistic or perhaps they’re just frozen in their steps?

The “arrival of realized profits mirrors the late 2024 correction-the few fading echoes of the exuberant peaks of early 2025. The inference may very well be that the market has borne through the storm and did not see a mass exodus. Hence, investors do not seem to panic sell; rather, they appear to be digging in, supporting a period of consolidation.”

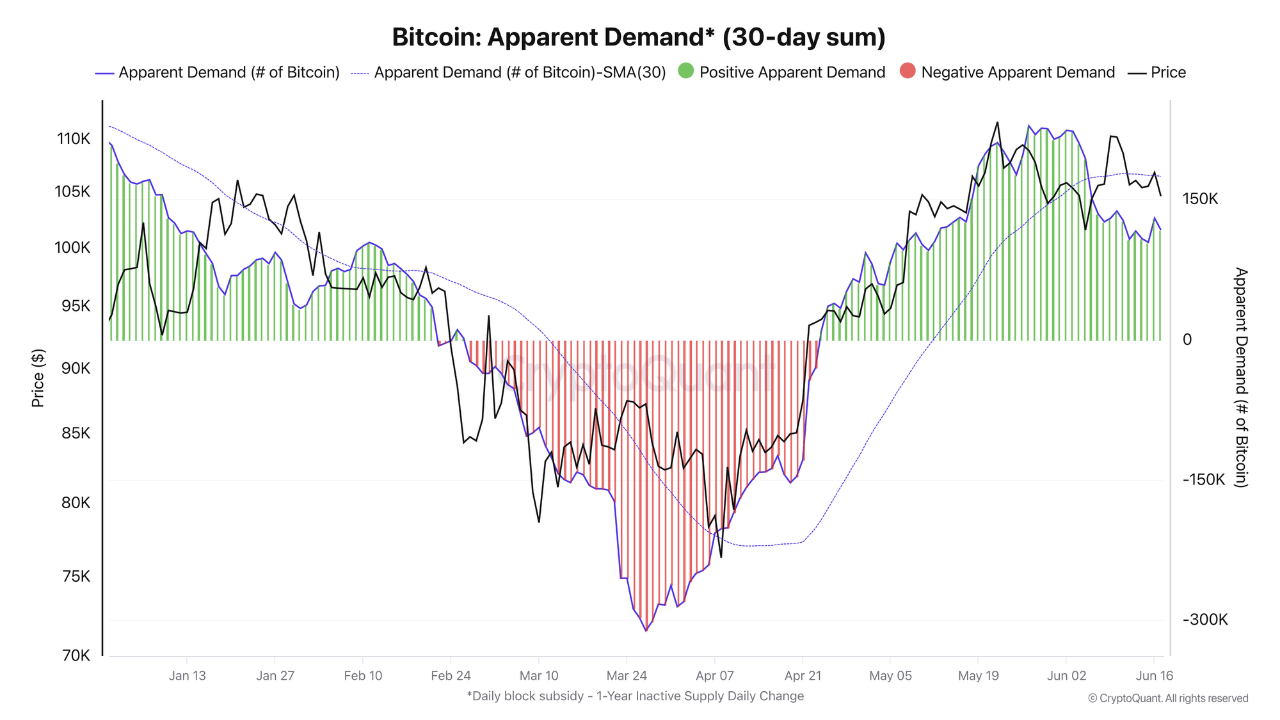

Darkfrost’s report, meanwhile, also highlighted a possible sky limit to Bitcoin’s rise: the softening demand. The study followed the intricate ballet of fresh supply and dormant coins-if more than one year untouched-as a signal of dwindling buyer interest since the May peak even though buyers may still be there.

Bitcoin Traders Brace for Volatility in a Crowded Range

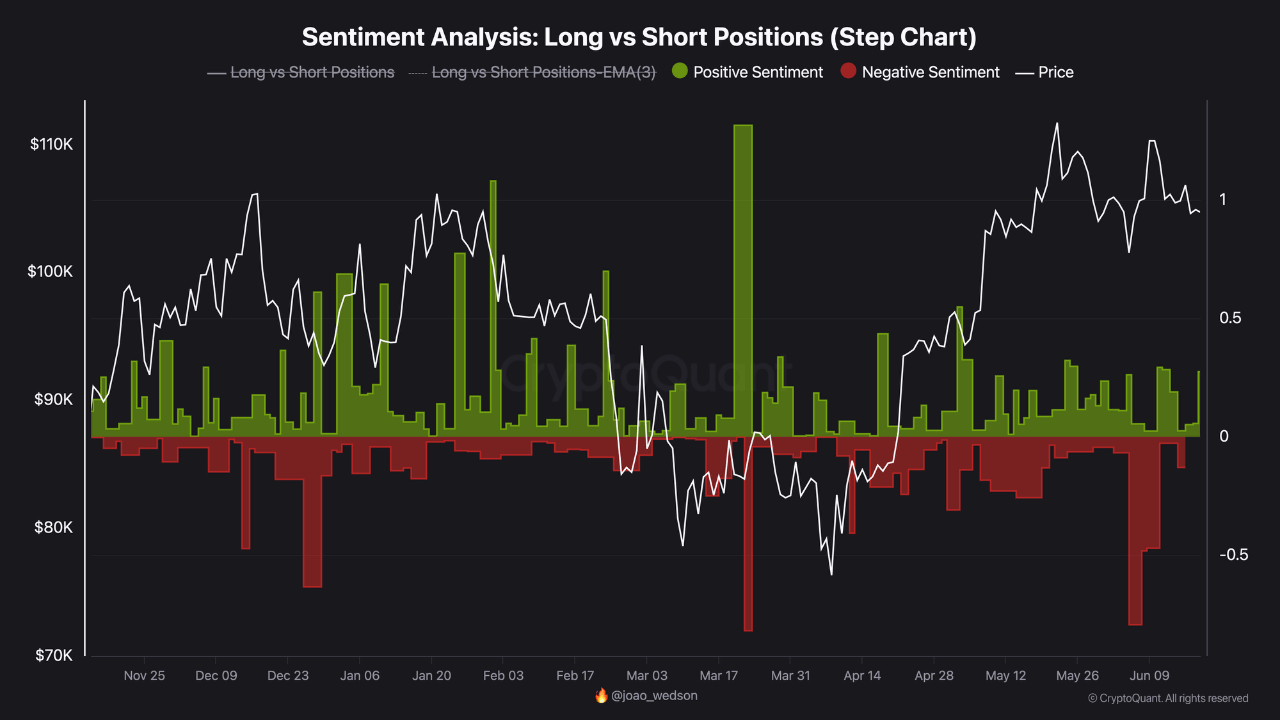

For CryptoQuant analyst BorisVest, a Bitcoin fight is brewing right inside Binance’s order books. Discerning platform’s flow and positions, he points to a month-long stalemate: Bitcoin locked in a $100,000-$110,000 tug-of-war, a cage match for crypto supremacy.

Caught within $100,000 and $110,000, the cryptic price action of Bitcoin has been coiling like a viper prepared to strike. Traders are still staring at this razor’s edge, anticipating the eventual breakout. What warns BorisVest is the hit on $110,000 and ready to lift off. Plunge below $100,000, and prepare for impact. This key level marks the starting point for the next big price run.

The $100K–$110K territory has become a tug-of-war between fortunes being forged or shattered. The bullish optimism clashes with the shadow of bearish expectations-this shadow now somewhat emboldened by the surge in short selling activity, as per BorisVest. Are we looking at the great correction? The market seems to be preparing for that seismic moment.

However, on the flipside, he told the market to beware-the market is a knife’s edge when shorts abound, going down in violent “short squeeze.” Recent funding rates mirror the precarious balance on a tug of war between bullish and bearish positions.

Featured image created with DALL-E, Chart from TradingView

Thanks for reading Bitcoin Sees Modest Gains But Demand Weakness Limits Breakout Potential