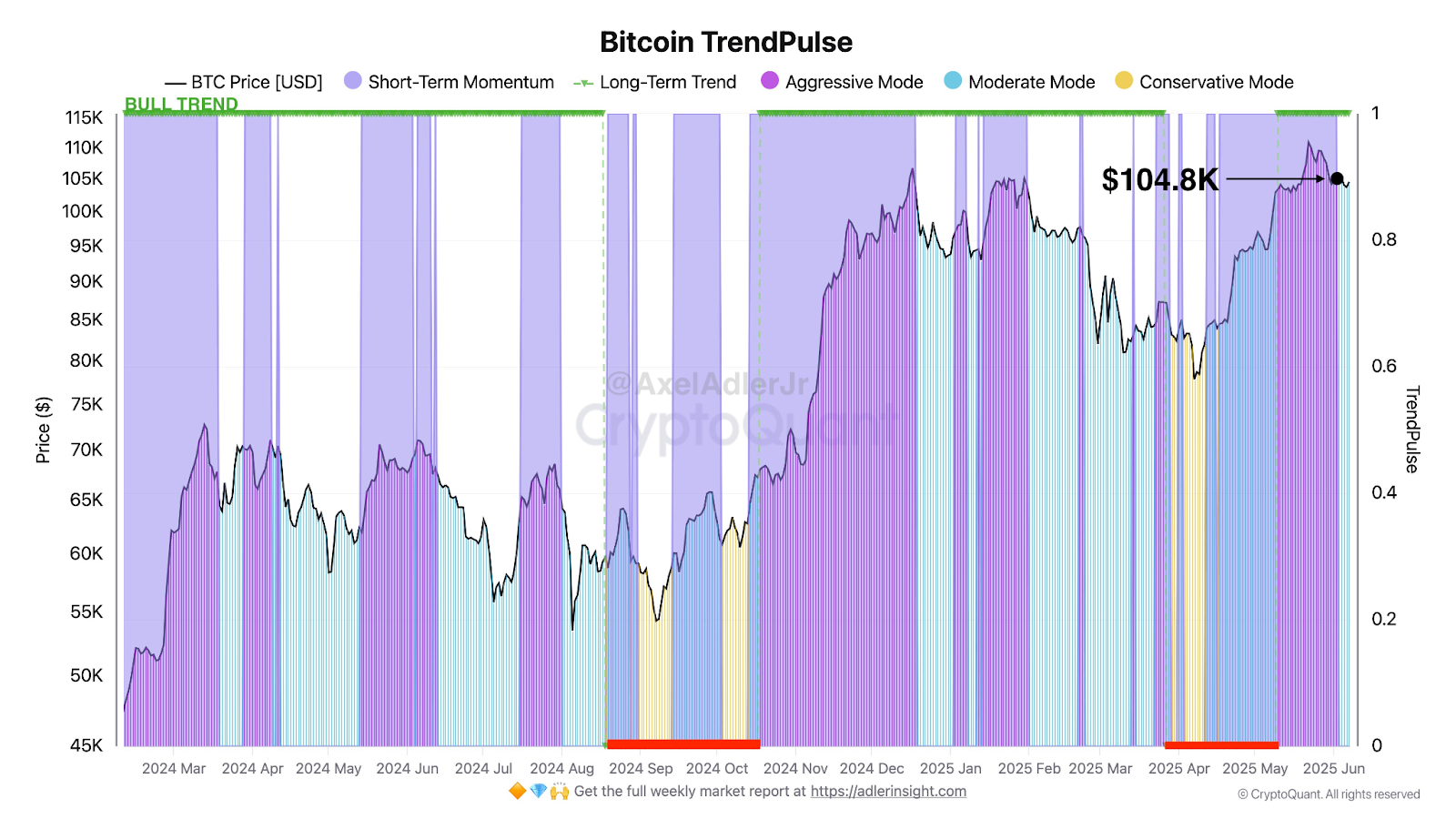

- Bitcoin remains in a confirmed long-term bullish trend with price consistently rising since March 2024.

- A daily close above $104.8K is required to confirm a short-term bullish momentum shift.

- Despite a 29.29% drop in trading volume, price action continues upward, indicating strong market trend.

Bitcoin, on a breakout tease! The cryptocurrency king is not falling but rising, throwing minor glitches en route. Asian markets saw Bitcoin stretching its limbs further higher after having launched at $104,566. Will this uphill run turn into a surge? Eyes are on the charts, whispering that a close above $104,800 may be enough to ignite another wave of buying. Is the very moment to move for Bitcoin?

Bitcoin Current Market Movement Revealed

Bitcoin almost making a new high! With a price tag of $105,210.94 on CoinMarketCap, the crypto king has gained 1.40% in the last 24 hours. The cap is doing the same, climbing to $2.09 trillion, a 1.40% rise. But slightly calming down the dancing floor is the drop in trading volume; by 29.29%, it fell to $44.64 billion. Has the market just stopped to take a breather before going up again, or is it a sign of some softer price action?

Source: CoinMarketCap

Trading of BTC painted a canvas of subtle shifts. The volume-to-market cap ratio whispered of restricted enthusiasm at 2.13%, faint murmurs against the roaring market. Price waltzed in a $1,742 range, with a short-living dip to $103,638 and a quick rally of a few moments to $105,380. Evening surge, quick zoom-bounce, and settle lower, ebbing and flowing with the digital tide.

Before daybreak, the market was stirring, finding footing around $104.5K. With midday soared energy from that bounce and pushed the price up to a fresh peak. It did go down just a bit, yet the upward force simply would not relent. Even with low volumes, prices surged past $105K, steadily climbing throughout the session.

Bitcoin Maintains Bullish Trend: What Next if $104.8K Holds?

Bitcoin has continued its relentless climb with $104.8K now in its sights as the next major battleground. The crypto analyst Axel Adler has indicated that the upward pressure remained active as Bitcoin stubbornly refused to cross over the $110K resistance. While the bigger picture on Bitcoin remains strongly bullish, the short-term bistable-like movement experiences sudden bursts of upwards momentum, as shown by the bullish purple flares of the TrendPulse indicator.

Source: Axel Adler (X)

It was much late in the summer of 2024 when a turning point appeared: “Aggressive mode” had come to the crypto market, sending Bitcoin to soar past $85,000 in October. The ascent continued onwards, thus paving the way for a new all-time high. A temporary correction might have threatened the bull run in March 2025; however, April saw strength return to the market, driving Bitcoin’s price roaring back to $105,000.

Breaking News: $104.8K Barrier Shattered! Are Bulls About to Stampede?

The heat of the market is rising! Prices surged past $104.8K in short bursts, stir-frying the hopes of a short-term bullish run. Should this newly formed price plateau become a base camp for a rally, then expect a rally. TrendPulse is still at 1.0 – a deafening roar of bullish sentiment. Medium-target trades may have quieted down, but the upward spawn of prices just scream it out loud: bull is here!

Thanks for reading Bitcoin Surges Past $105K While TrendPulse Signals 10: Pay Attention to This Threshold