BTC Treads Water as Trump Demands Rate Cut

The Fed just maintained status quo last month, clinging to its 4.25-4.5 percent band for interest rates. Their justification? Inflation, that approbatory economic gremlin, “remains somewhat elevated.” But with the June 17-18 Fed meeting soon to convene, President Trump is going to the mat. It is a rather subtle choice of words, shall we say.

Trump Unleashes Fury: “Powell’s Too Late! Lower Rates NOW!”

In a blistering Truth Social post, the ex-president exploded, demanding Jerome Powell with fury: “ADP NUMBER OUT!!! ‘Too Late’ Powell must now LOWER THE RATE,” Trump raged on. “He is unbelievable!!! Europe has lowered NINE TIMES!” The post suggests more friction between Trump and the Fed as the presidential election gets closer.

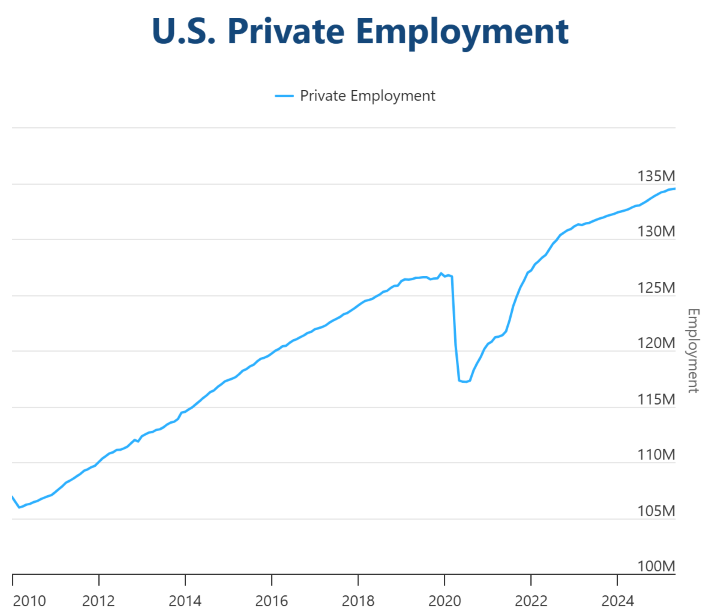

The gloomy hiring figures cast a shadow this morning, as ADP’s data showed a pitiful 37,000 private sector jobs materializing in May-the weakest since 2019. The news from Roseland, NJ barely caused a flicker in Bitcoin’s pulse, with the cryptocurrency impotently circling the $105K mark. On the other hand, Wall Street shrugged off the employment slump, with the S&P 500, Nasdaq, and Dow gaining at 0.23%, 0.35%, and 0.10%, respectively, according to CNBC, all seeming to go against gravity amid economic uncertainty.

(U.S. private sector jobs increased by only 37,000 – from 134,451,000 jobs in April to 134,488,000 in May / ADP)

According to the latest report from ADP, there seems to be a mixture of things going on here: the hiring frenzy that was in full steam at the beginning of the year is going into an abnormal decrease mode. “The hiring engine is sputtering,” ADP Chief Economist Dr. Nela Richardson cautions, “while wages have stubbornly held their ground.”

Overview of Market Metrics

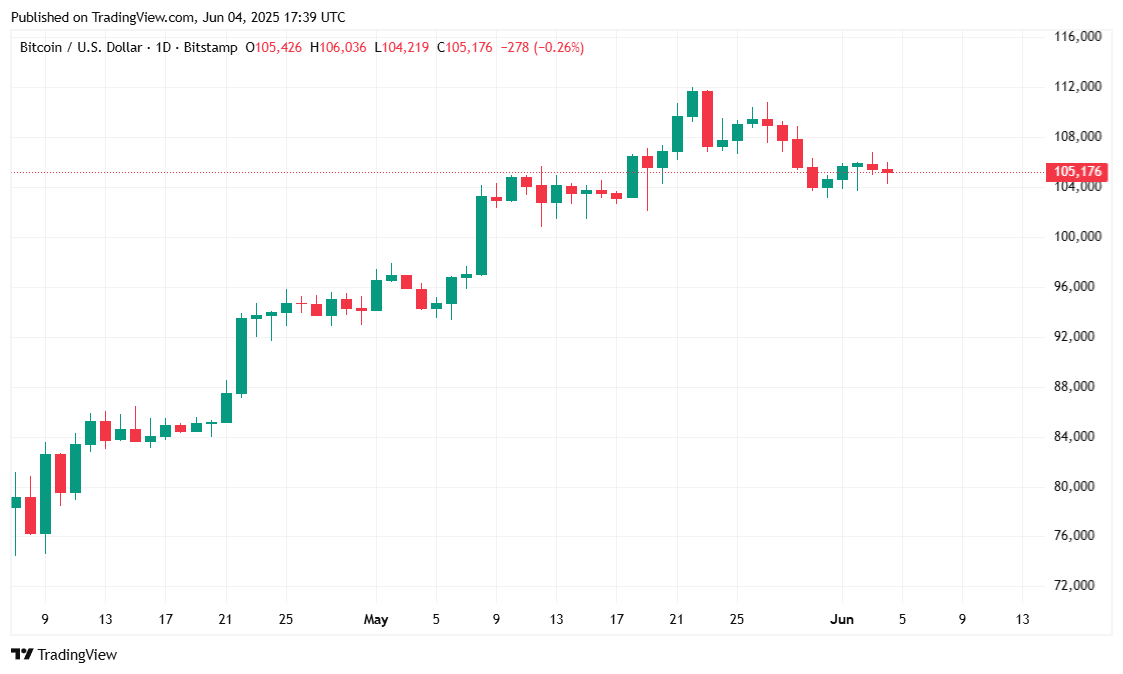

It had been gliding around $105,234.99 today, down slighter by 0.70% since yesterday. Last week, too had not been kind to prices; down by a couple of percentage points to 2.08%. Imagine your Bitcoin trapped in one of those long tight corridors, pacing back and forth all day between $104,232.70 and $106,457.19. The rest of the crypto party felt the chill too, dipping 0.72%, about according to Coinmarketcap.

( BTC price / Trading View)

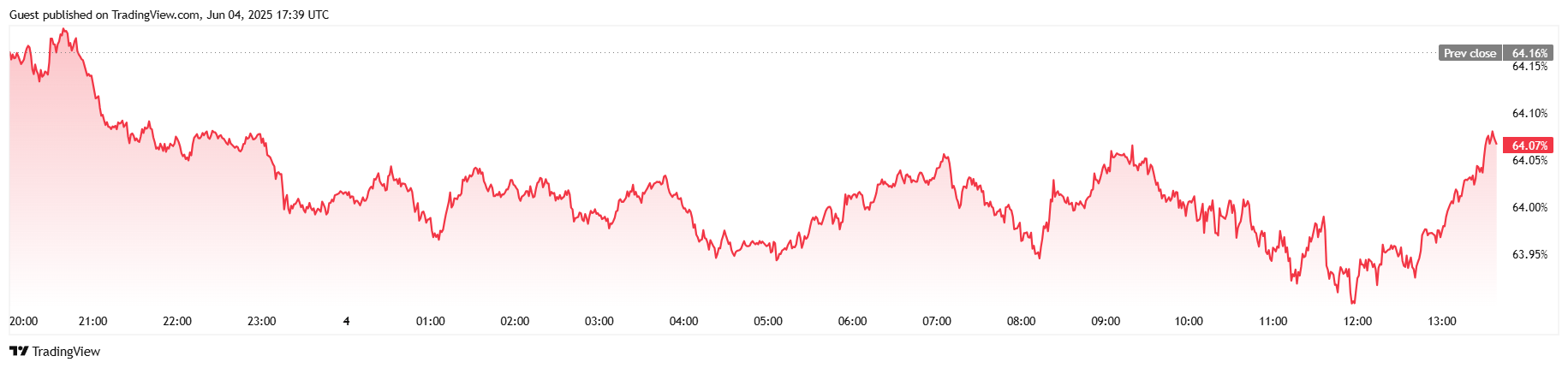

After the continuation of the bullish phase for Bitcoin went on pause for a while, the volumes in trading dropped by 6.15% to $44.48 billion, until the market madness finally ebbed away. The king crypto saw some slight dents in its market capitalization, decreasing by 0.82% to $2.09 trillion. Bitcoin’s dominance, while still huge, also softened a little, falling by 0.16% to 64.06. Even in the usually blazing trails of the futures market, the cold wind of correction blew in, with open interest retreating 2.02% to $70.58 billion as leveraged positions pulled back from the lackluster price action.

( BTC dominance / Trading View)

It had one of the calmest 24 hours in the crypto space, with just about $62,970 liquidated an almost shaft compared with the usual roar in liquidations. But even in calm waters, a loser emerged: the bulls. Liquidations amounted to $56,780 worth of long positions, with shorts being relatively safe and losing only $6,190. A small tide is still high enough for some to wash out those who bet the tide will rise.

Thanks for reading Bitcoin Trades Sideways After Trump Calls Out Powell Again