Bitcoin soaring to a record $111,980 had the feeling of a rocket hitting a short-lived ceiling in the mid $100,000. But do not go ahead to write off the bull run. On-chain whispers suggest that the king of cryptos is only catching its breath for the next surge, with analysts already sharpening their pencils to even loftier price targets.

Bitcoin Rally Far From Over, Data Suggests

Bitcoin’s Bull Run: CryptoQuant Analyst Predicts Continued Ascent

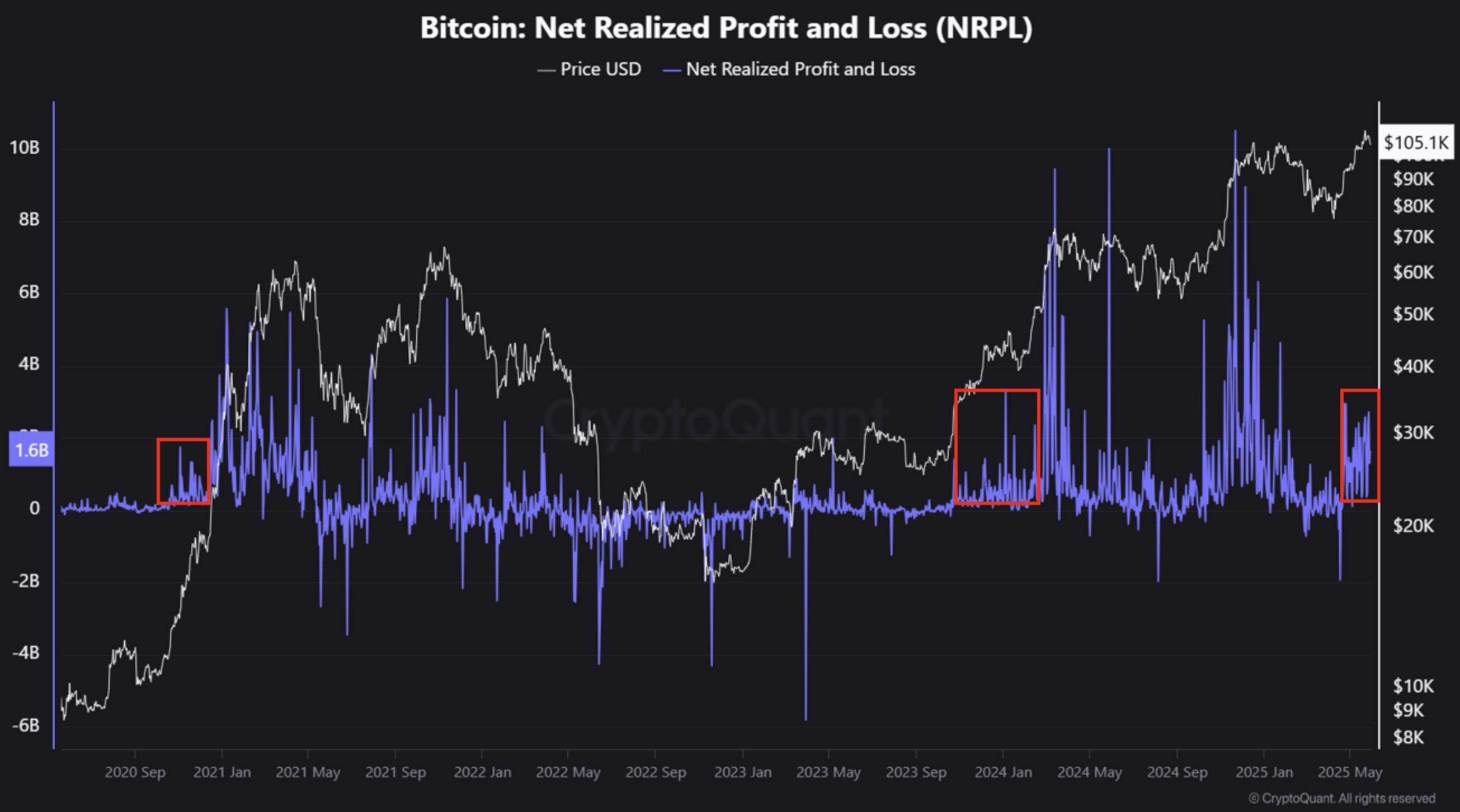

Dan from CryptoQuant sees blue skies for Bitcoin. His analysis, featured recently in a Quicktake article, says that Bitcoin is “highly likely” to continue its bullish momentum. What is the key indicator? It’s the Bitcoin Net Realized Profit/Loss (NRPL) chart that is signaling further buying pressure ahead.

The NRPL chart acts as a heat map of Bitcoin’s profit pulse, revealing the collective financial decisions of sellers. Think of it like this: when the price climbs and the NRPL barely flickers, it’s a green light. Profit-taking is minimal, suggesting bulls are still firmly in control and the rally has legs. A muted NRPL during an uptrend almost whispers to the bulls to hold on; the ride isn’t over yet.

The red box appearing on the right is screaming for profit-taking. But shall this be the end of the surge? Despite a big jump in price, realized gains may not have reached full momentum for a complete reversal. Dan indeed called it the following way:

The profit-taking that was observed is nothing less than a smooth walk compared to the previous market tops in which investors were seen trashing earnings. This almost insipid summer bit of selling barely registers against the climatic shifts of March and November 2024, in that this market is instead behaving more like one in a respectful correction than an incipient collapse.

Forget the trend reversal. Dan sees Bitcoin keep rising, traveling through profit-taking as if through a stopover. Hold on to your brains: $120,000 might be a new landmark on the climb for Bitcoin and higher.

Is the Bitcoin Bull Run Nothing but a Mirage? Crypto analyst Ali Martinez throws some cold water on the celebrations saying that the current rise could well be a bull trap. Buckle up, he says, because a Bitcoin price less than $100,000 might be coming.

Imagine observing the price of a stock climbing and finally smashing through some ceiling it had been unable to breach week after week. Optimism pours out! Traders rush in filling their bags, convinced that this is a genuine breakout. Then, the markets pull the rug from under the buyers: That rise above resistance? A scarring memory meant to fade away. It is a bull trap – that brief tease meant to lure in impatient buyers just before the floor is pulled outfrom under them, leaving them with the bag, as prices come plummeting down.

Bitcoin Selling Pressure Weak, Retail Yet To Arrive

But wait, the Bitcoin story might just be getting started. Forget the peak: some very strong signals from the chains whisper that we are far from the summit. The killer question is: Is your average Joe or Jane willing to make that jump? The rally is led by Uncle Bob and Aunt Jane down the street. Think of what another huge influx would do should the masses join in anytime soon.

Binance data presents the image of steadfast Bitcoin holders, staying adamant during the recent downward dips yet seeming to bet on an upward movement. In fact, despite a 2.5% dip over the past 24 hours that brought the price at around $105,659, these investors go with the bullish outlook for the crypto king.

Featured image from Unsplash, charts from CryptoQuant, X, and TradingView.com

Thanks for reading Bitcoin Upward Momentum ‘Highly Likely’ To Continue On-Chain Data Shows