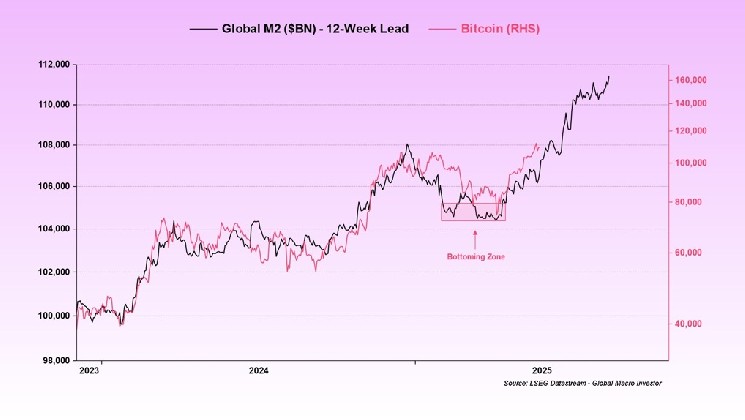

This weekend, the whole Crypto-X went into fireworks, courtesy of Abra and its CEO, Bill Barhydt. He lit the fuse for fireworks by sharing a thought-provoking graphic: a collage that relates the dollar value of worldwide M2 money supply and Bitcoin’s price trajectory. These charts basically began the conversation through the mouths of macro legend Raoul Pal and bit of a researcher, Julien Bittel; Barhydt then came in and said, “I’ve seen a flood of these M2 vs Bitcoin charts, each echoing the same story. Check out the ones I’ve included, courtesy of @RaoulGMI and @BittelJulien – they unearthed a fascinating trend.”

According to it, you can expect a decrease to $100k, ready for its heartwarming rise. August/September? $130k, the new peak coming up, yet really we do not know if it’s a hoax or not. Place your bets.

Will Bitcoin Follow M2?

Barhydt rendered lyrical imagery: “Global liquidity has to surge, and Bitcoin? It is the greatest sponge that absorbs all that devalued fiat.” Imagine it this way: more money is being printed out by the governments; Bitcoin absorbs that, the value explodes, and a splash of that comes down. First to the other fundamental blockchains, and then? Let the altcoin mirth run free – alt season is back.

In his words of caution, Barhydt said, “Manage your risk, take a reality check, and keep it respectful.” He warned the dip coming could be just a breather, or a dizzying plunge to $95,000 before any kind of summer surge takes form.

One follower, with eyes wide and worried, muttered under his breath whether the “positioning” boat was already sinking under its own weight. Barhydt waved his hand uninterestedly. “Trillions of dollars are at stake, billions of people in play,” he said. “Sure, maybe a few thousand are hip to this game, tops. But let’s be real, mainstream retail is still snoozing on crypto.”

One critic sniped that the liquidity data was too slow-moving to call daily shots. Barhydt shrugged, “Totally. Hence the ‘whatever.’ Think of it as a hazy weather vane, good for weekly breezes, not daily gusts. But hey, that’s been enough to point us in the right direction.”

The winds howl with crypto winter just as the ever-popular “liquidity-is-king” aphorism finds its way back into ivory towers of Wall Street. Raoul speaks in whispers to the whispered Real Vision disciples that liquidity is almost everything, attributing 90% of Bitcoin’s crazy gyrations to the swelling of the world’s money supply. However, with an eagle eye, Bittel spots global M2 flirting with the record-breaking $111 trillion mark, arguing that such a massive runway will carry Bitcoin higher. So, the fuel is still there. Will the ignition occur again?

Will the Bitcoin bullet ride a wave of macro tailwinds to $130’K, or as Barhydt puts it with unmitigated candor, will that forecast be “horseshit”? The answer depends on a high-stakes dance: how fast the central banks load liquidity back into the system and how hard traders gear their positions in the weeks to come. With this forecast, Barhydt is not merely issuing a target; he is laying down no uncertain warning. An explosive market move is on the cards; however, remember, the accuracy of this model is tied to the liquidity that keeps changing with the tides.

At press time, BTC traded at $104,625.

Featured image created with DALL.E, chart from TradingView.com

Thanks for reading Bitcoin Vs M2: Abra CEO Sees $130000 As Liquidity Floods In