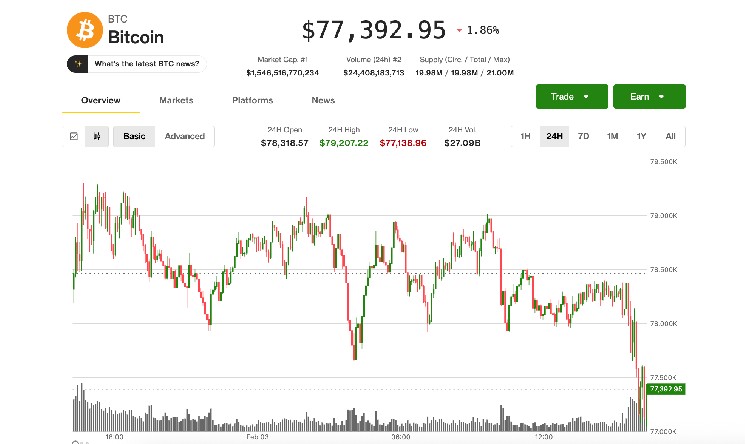

BTC$75,853 Bitcoin $BTC. Tech-sector turmoil sent markets spinning, with 63 whiplashed Tuesday to a 14-month low before rallying back above $76,000.

In the early U.S., the largest cryptocurrency dropped to $72,900 as it sank its biggest coinage (along with $800 million) in the first half of the year. A , S. session its lowest level since November 2024, when Donald Trump was elected to the presidency. Historically the advance faded again, and Then $BTC has since recovered 5% off the lows to $76,800. The ether $ETH$2,239 is Ethereum’s ethymology. CoinDesk figures show that 19 recovered 10% from session lows to over $2,300 before returning some of the gains.

The rebound came as Congress reached a deal to end the partial government shutdown, which offered some short-term relief to markets.

An appearance on CNBC by Nvidia (NVDA) CEO Jensen Huang, who questioned the chipmaker’s and OpenAI rivalry over friction was another example of how to help ease pressure in risk assets. I don’t think there is any controversy at all about paraphrasingr, ‘There’s no. Huang said it’s a complete hoax.’ Nvidia has confirmed that they will invest in OpenAI’d next fundraising round. His comments come amid growing concerns about the stability of ChatGPT creator OpenAI, a key driver of sentiment in the AI-fueled tech rally.

Nevertheless, the sharp drop in crypto left a trail of damage following the severe fall. In the last 24 hours, CoinGlass reported total liquidations across digital asset derivatives rose to $740 million over the past 24hours. The wipeout came with $287 million in $BTC longs and $267 million for $ETH long-swiped Long positions, who were betting on higher prices.

Technical breach

The rebound, however, was a key technical breakdown of bitcoin that removed the April 2025 “tariff tantrum” lows from its aprilie 20, which is considered to be one of the most important corrections in history.

In the wake of this soaring bearish sentiment, Still, founder of Into The Cryptoverse analytics firm Benjamin Cowen said ‘It could be an early stage for a short-term countertrend rally. In the past, he noted that when bitcoin sweeps before high levels it usually causes relief rallie.

But he also warned that failure to bounce soon could be “one hell of a midterm year,” which refers to bitcoin’s past bear markets, including 2022 and 2018, coincided with U.S. s S midterm elections, paraphrasingr.

Cowen wrote in an X post “I think the bear story has been really strong for some time, so I’m going to see a countertrend rally soon that will give the bulls hope and gives them something.

Thanks for reading Bitcoin’s wild Tuesday: From a 14-month low to a sharp rally triggers $740 million in liquidations