Bitcoin and XRP: Discount aisle delights? Santiment reveals on-chain data suggesting savvy traders are eyeing these cryptocurrencies as “buy-low” bargains. Meanwhile, retail interest appears to be blazing a different trail, captivated by Ethereum’s weekend price dance, leaving Bitcoin and XRP somewhat in the shadows.

Friday, Santiment’s X feed dropped a bombshell: a social data chart revealing a startling imbalance in the crypto conversation. Retail traders are buzzing about Bitcoin, Ethereum, and Ripple – but are they buzzing about therightthings? The chart hints at a social sentiment skewed heavily in one direction. Is it hype, fear, or something else driving the narrative?

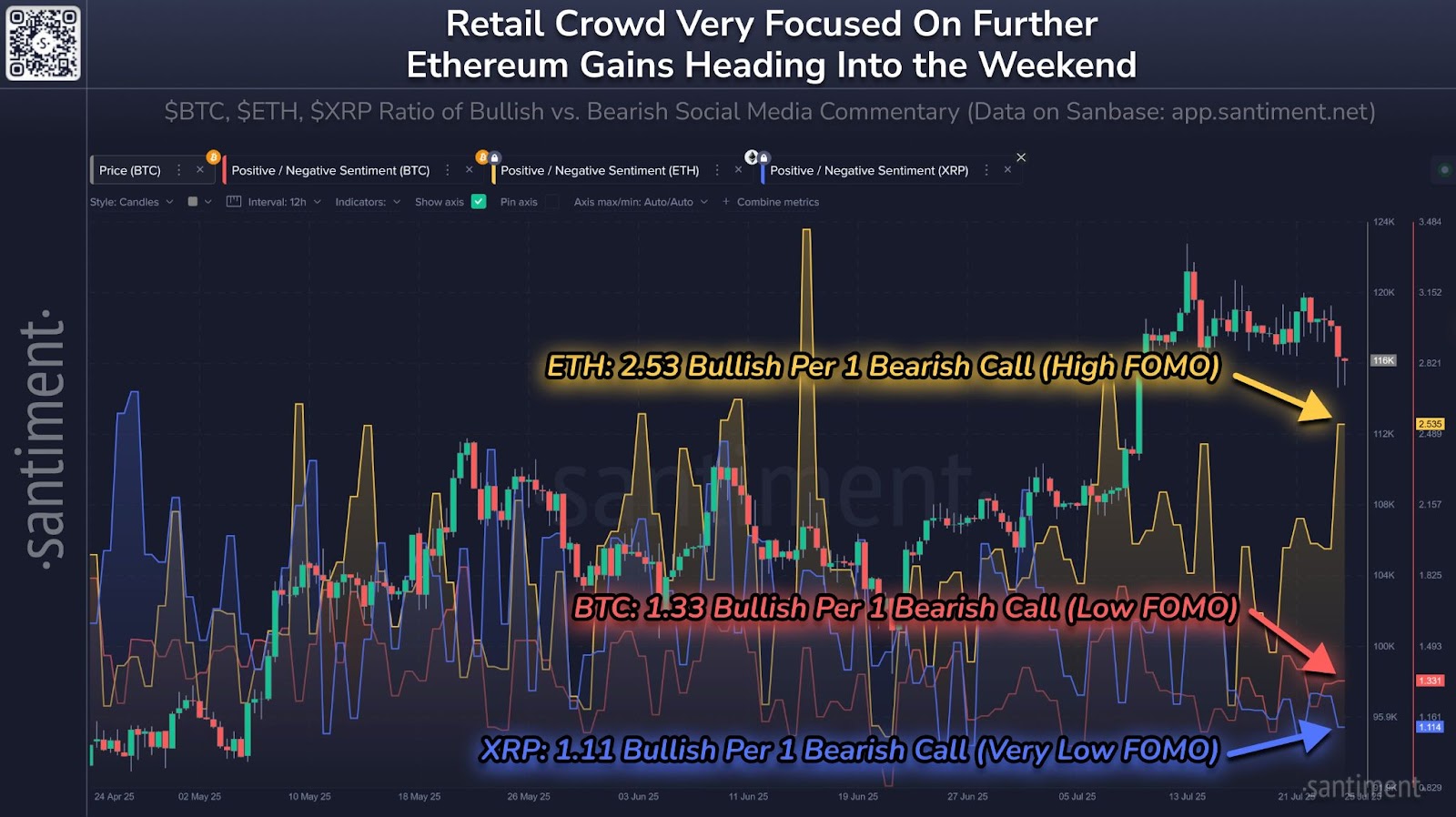

Santiment Feed Retail Crowd Social Mentions chart. Source: Santiment

Ethereum’s sentiment is soaring, with bulls outnumbering bears by a staggering 2.53 to 1. But beware the Icarus effect! This overwhelming optimism screams “FOMO,” a classic precursor to price pullbacks. Is Ether about to learn a painful lesson in gravity?

But hold on, while the altcoin frenzy raged, Bitcoin and XRP barely blinked. Sentiment towards these giants was lukewarm, with bullish-to-bearish ratios hovering around a tepid 1.33:1 and 1.11:1, respectively. Santiment’s sharp eyes suggest opportunity lurks in this apathy. Could this be the calm before the storm, a sign that the market’s about to zig when everyone expects it to zag, potentially offering strategic entry points for savvy investors?

While Ethereum tiptoes on a reversal tightrope, Bitcoin and XRP’s slumbering hype might just be the catalyst for an explosive price surge.

Bitcoin nears all-time highs, could see gains

Bitcoin’s holding its breath near $123,000, a stone’s throw from its all-time high. After a month of bullish fervor, the cryptocurrency king has been pacing within a whisper-thin range of $123,120 and $123,471 for the last week. This calm after the storm suggests Bitcoin, the heavyweight champion of crypto, might be entering a pivotal moment, as Friday’s close hints at a market poised for a potential shift.

Funding rates across major derivatives exchanges, including Binance, OKX, Bybit, Deribit, BitMEX, and HTX, have been neutral to slightly positive.

Traders appear to be playing a cautious game, holding back from aggressive bets and high-risk strategies, suggesting they’re on the sidelines, patiently awaiting a definitive signal to emerge from the market fog.

CryptoQuant’s Nino suggests a market slumber: the “summer doldrums.” But don’t be fooled by the quiet history hints at a volatility storm brewing in Q3 2025.

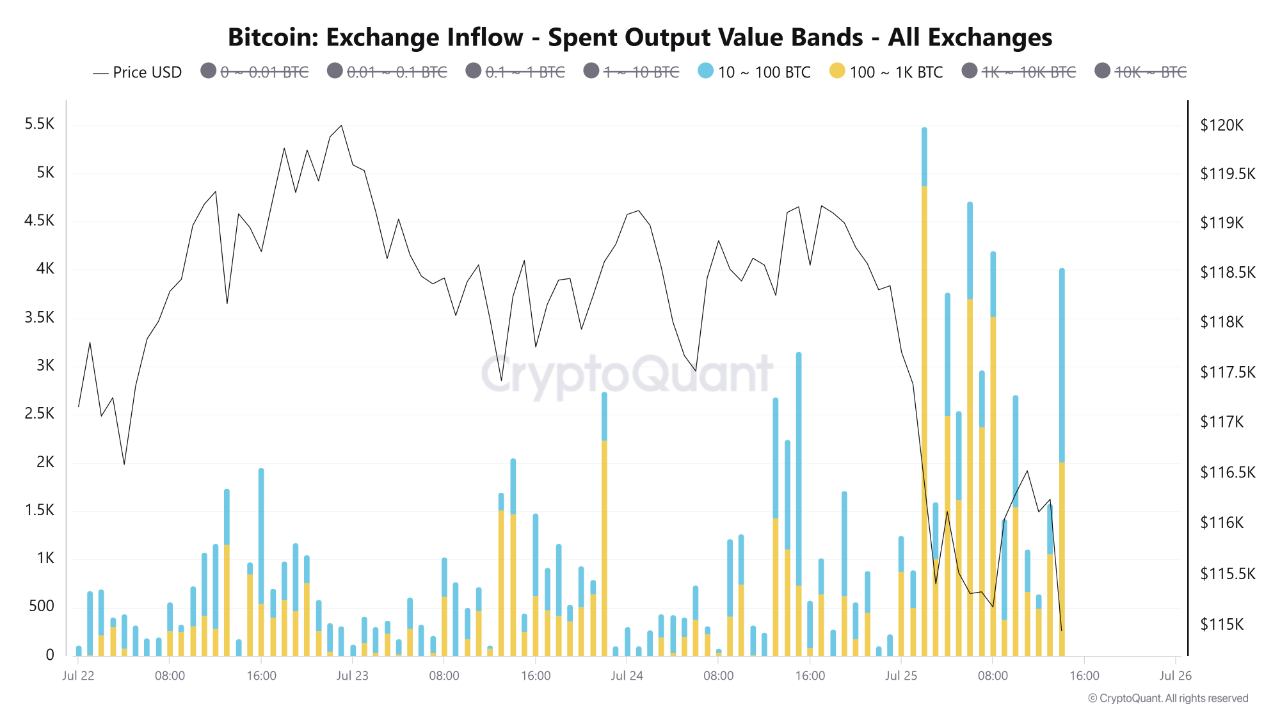

Exchange inflows show institutional activity up during price peaks

Bitcoin’s wild ride between July 22nd and 25th saw fortunes made and lost. The price bounced between $115,000 and nearly $120,000, hitting a fever pitch at 4 PM on July 24th. But the party didn’t last; by the cold light of July 25th morning, Bitcoin was back down to earth around $115,000.

CryptoQuant data paints a picture of whales stirring the crypto waters. Recent exchange inflows show that the July 24th price peak wasn’t fueled by minnows, but by major players. Specifically, wallets bulging with 10 to 100 BTC showed a marked increase in exchange deposits right as the market crested. This suggests larger holders may have been strategically capitalizing on the high.

BTC Exchange Inflow chart. Source: CryptoQuant

Simultaneously, whales holding 100-1,000 and 1,000-10,000 BTC experienced significant influxes. This synchronized movement hints that major players potentially influenced the price, either cashing in profits or strategically reshuffling their assets.

Bitcoin’s smaller deals, the everyday trades of 0.01 to 1 BTC, held firm. But the big whales, wallets with over 10,000 BTC, largely stayed put. A hint of movement surfaced around the July 24 peak, but their massive holdings remained mostly unmoved.

XRP low social interest could spark short-term rally

XRP whispers are barely audible in the crypto-verse, its social buzz a mere blip compared to the roaring conversations around other digital assets. Santiment data paints a stark picture: XRP’s bullish-to-bearish ratio limps along at 1.11 to 1, suggesting traders are largely ignoring what potential lies dormant within. Is this the calm before the storm, or has XRP simply faded into the background noise?

XRP is stuck in neutral. For a week, $2.99 has been its impenetrable floor, and neither bullish nor bearish forces can muster enough momentum to break the stalemate.

Santiment’s analysis suggests XRP’s current obscurity might be its secret weapon. Historically, XRP has defied expectations, rebounding when no one was watching. Could this quiet period be the calm before another explosive surge?

Thanks for reading BTC and XRP show low retail sentiment making them potential buy-low opportunities