Bitcoin miners brace for impact: the next difficulty bomb is set to detonate on December 11. While miners grapple with all-time low hashprice the measure of their blood, sweat, and potential profit the algorithmically-timed difficulty adjustment threatens to squeeze margins even tighter. Will the network weather the storm, or will some miners be forced to unplug?

Tick-tock goes the Bitcoin clock. Brace yourselves, miners! At approximately 12:09:34 AM UTC, block 927,360 will trigger a slight but significant shift: Bitcoin’s mining difficulty nudges up from a formidable 149.30 trillion to an even more Herculean 149.80 trillion. CoinWarz is watching, are you ready for the challenge?

Thursday saw the Bitcoin network breathe a collective sigh of relief. The mining difficulty, previously a Herculean 152.2 trillion, eased back to a still-formidable 149.3 trillion. This subtle shift had an immediate impact: block times, the heartbeat of the blockchain, quickened to an average of 9.97 minutes – a welcome nudge closer to the ideal 10-minute rhythm. Think of it as the network taking a slightly less strenuous path up a very steep mountain.

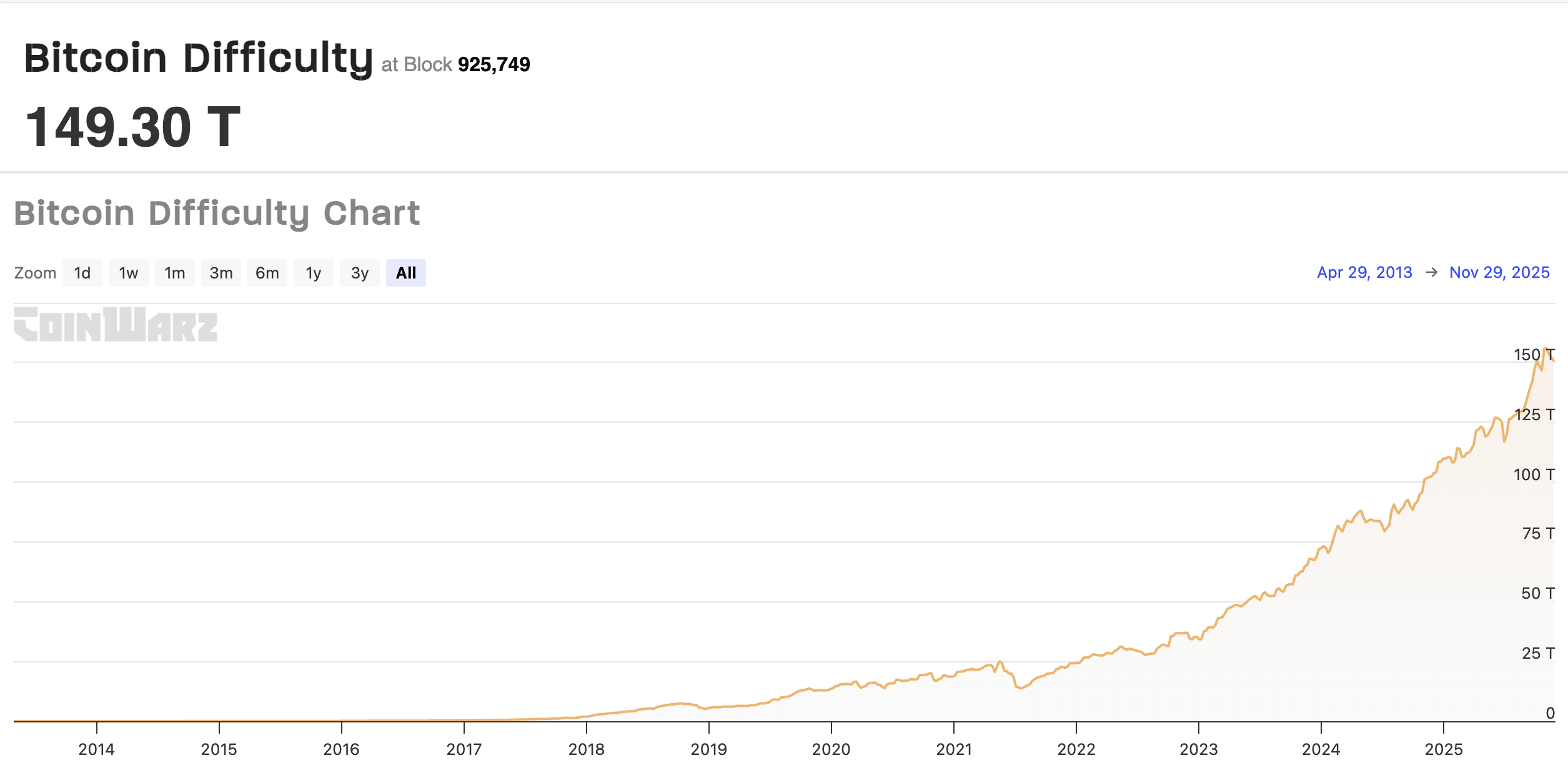

Bitcoin’s mining difficulty from 2014-2025. Source: CoinWarz

Bitcoin miners, are you feeling the squeeze? Even with the welcome dip in mining difficulty, hashprice is barely budging, clinging to around $38.3 per PH/s daily, reports Hashrate Index. While it’s a slight reprieve from the nail-biting lows of $35 PH/s we saw on November 21st, it’s still a tightrope walk for many. Is this a brief moment of calm before another storm, or a sign of slow, steady recovery? Only time – and the blockchain – will tell.

A hashprice of $40 PH/s is the razor’s edge for miners – the point where powering down becomes a more attractive option than pushing on.

Bitcoin miners are feeling the squeeze! Hashprice, the key to their profits, is scraping the bottom of the barrel, currently languishing below $40, according to Hashrate Index. Is this the calm before the storm, or a sign of tougher times ahead for the Bitcoin mining industry?

The mining sector is battling a storm: governments worldwide are slamming down regulatory hammers, energy bills are soaring, and the US-China tug-of-war threatens to snap vital supply chains.

Related: Thirteen years after the first halving, Bitcoin mining looks very different in 2025

US probes the largest manufacturer of crypto mining hardware, triggering fears of shortages

Whispers of cyber espionage swirl around Bitmain, the Chinese mining hardware giant, as the U.S. Department of Homeland Security (DHS) launches a probe. The question on the table: can Bitmain’s powerful machines be turned into unwitting spies, remotely accessed for nefarious purposes, potentially compromising sensitive American data?

“Elizabeth Warren, the crypto world’s public enemy number one, dropped a bombshell in 2024: she believes specialized crypto-mining computers, ASICs, could be Trojan horses lurking near US military bases, secretly gathering intel on national defense installations. Forget digital gold, Warren sees digital spies.”

Bitmain isn’t just a player in the crypto world; it’s the undisputed king of ASIC miners. With a staggering 80% market share – figures crunched by the University of Cambridge – they’re practically synonymous with the hardware powering the proof-of-work revolution. They don’t just make the tools; theyarethe tools, shaping the landscape of Bitcoin and beyond.

The mining industry’s lifeline, heavily dependent on Bitmain, hangs precariously. US restrictions, tariffs, or sanctions could send crippling shockwaves through its supply chain.

Magazine: AI may already use more power than Bitcoin and it threatens Bitcoin mining

Thanks for reading BTC mining difficulty forecast to rise in Dec as hashprice sits near record lows