Cryptocurrency analyst Dan Gambardello discusses Cardano’s potential integration with Bitcoin through treasury proposals and ETF developments.

The analyst examines how Bitcoin DeFi opportunities could attract institutional liquidity while maintaining long-term bullish perspective on ADA price action.

Cardano ETF Approval Odds Climb Amid Institutional Momentum

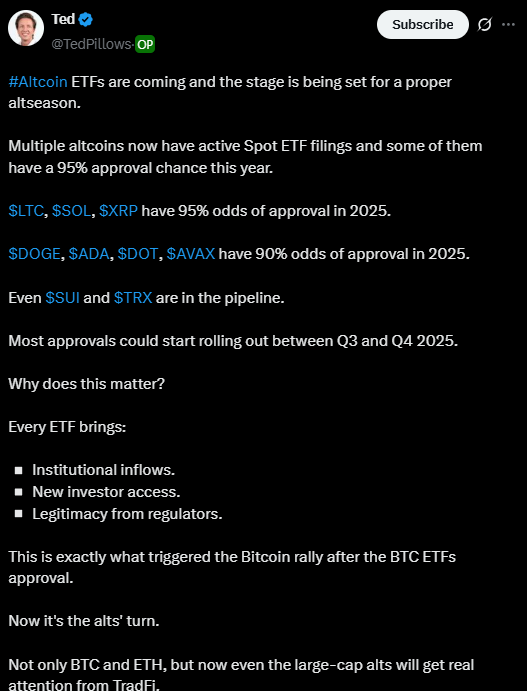

Cardano ETF Approval Odds Skyrocket! Previously a distant chance of 41% on June 8, the chances now receive a bullish upgrade to 70%, with the recent peak of 78%! Bloomberg has placed a chance of almost 90% for approval by 2025, placing ADA in competition with the heavyweights of the crypto world such as Dogecoin, Polkadot, and Avalanche. Is Cardano going to the big leagues now?

Source: Altcoin ETF approval odds from Ted

Ready for a rollercoaster ride? The ETF floodgates could actually open! Forget just about Bitcoin or Ethereum. There’s a whole horde of altcoins waiting in line to get stamped with an SPOT ETF. The whispers go with a 95% green light chance this year for Litecoin, Solana, and XRP. Yet this is only just the beginning. Mark your calendars for 2025, for this is when Doge, ADA, DOT, and AVAX should be making their appearance, with a chunky 90% probability of welcoming into the ETF party. But, as they say, that’s just the beginning… SUI and TRX also seem to be quietly making some moves to grab some ETF spotlight. The altcoin ETF revolution might just be right at your doorstep!

Brace for impact: Crypto ETFs are poised for liftoff! A cascade of approval processes will hopefully go between Q3 and Q4 of 2025 (allowing for dilution of institutional investment) and also for at least some measure of public access and, therefore, credibility in terms of regulation. Gambardello sees history rhyming when he discusses Bitcoin’s rocket to the moon after the green light for its own ETF. Buckle up for the afterburn.

An analyst notes that a seismic shift reflects the present movements: “Are the gyrations just noise, or are they meant to be critical brushstrokes on a blank canvas showcasing a new economic landscape?”” Or perhaps, an upper house said so much more about the stablecoin legislation, under the President’s vigorously surprising embrace of digital assets, as well as the likes of JPMorgan and DTCC partnering with the crypto task force in carving out the future of tokenization. A bigger picture: it is rapidly coming into focus now.

Treasury Proposal Targets Bitcoin DeFi Integration Strategy

Gambardello’s ambitious idea: a $100 million Cardano treasury metamorphosis. He aims to divert a substantial chunk of ADA into Bitcoin and stablecoins, not for holding per se but for yield alchemy. He envisions a 50/50 split in which stablecoins born of Cardano would earn yield alongside Bitcoin. Among the twists is that these yields would not be used for free-wheeling cash. Instead, the proceeds would flow back into ADA purchases and treasury building, perpetually growing by diversification.

Bitcoin Breaks Boundaries: Cardano Beckons with DeFi Dreams

Andrew: the Bitcoin OS content visionary-proposing a bold plan of redirecting treasury funds to spark a Bitcoin and stablecoin revolution in Cardano. The charge: attract Bitcoin hoards into Cardano’s DeFi landscape, promising yields in a secure and stable home. Imagine Bitcoin hodlers earlier on the sidelines getting a bit of return in a trusted setup-a dream come true in DeFi.

Source: Dan Gambardello X post

ADA-Treasury funds must be further unleashed to create a bold Bitcoin play that activates the Cardano ecosystem. What we propose is to deploy an initial $50 million into Bitcoin as an act of goodwill and conceptually an opportunity. Can you envision Bitcoiners generating insane yields in the frontiers of Cardano infrastructure? This is not just about buying Bitcoins; it is about the chain reaction. The $50 million purchase, if successful, could act as a trigger, resulting in a sea of new investors, lifting the total value locked from $50 million to a tremendous $5 billion. Build with us a strong alliance that joins the two giants.

Cardano is not simply another DeFi platform in pursuit of Bitcoin: it is instead building a fortress for it. While others offer yields, Cardano offers what Bitcoin holders desire more than anything: absolute security. This isn’t about yields; it’s about going long on giving Bitcoin first-class treatment, together with a safe harbor and a few earning options. No fleeting gains for Cardano; it’s building something that lasts.

Cardano seems ready to become an important player in the DeFi space. This project forges a powerful link between the Bitcoin and Cardano blockchains that could pose a challenge to Solana in TVL. As momentum builds behind the Midnight protocol and other Cardano ecosystem innovations, this bridge will act as a spark setting off a Cambrian explosion of activity, subsequently lifting Cardano to even greater heights.

Analyst Maintains Bullish Outlook Despite Altcoin Consolidation Patterns

Among the sea of red, Gambardello stands as a steadfast Cardano bull. He argues that ADA’s struggles since the collapse of the crypto bubble are not unique to it, but rather are one of many symptoms of the altcoin winter macabre. He then draws the attention to a prediction that he issued back in January of 2018 about the longer and prolonged beating altcoins have been seeing, since apart from the big boys, Bitcoin and Ethereum, almost every altcoin has been another story altogether.

What transpired in January is precisely what was predicted, with the first month mirroring the fractal blueprint that has been etched since the crash of the markets in April, reverberating with the familiar rhythms of cryptocurrency. Gambardello makes mention of the uncanny similarities to some of the consolidation periods before this-one in particular being August of 2024, June of 2023, and January of 2023-an eerie case of history rhyming.

Cardano (ADA) structures an almost bullish revival! Having created throughout the bear market a strong higher-low trend, ADA is currently in the process of forming what looks like an inverse head and shoulders pattern-well-known from the rich history of rallies. One analyst is paying keen attention, speculating about a continued period of price consolidation before a potential breakout.

ADA’s weekly chart is flashing a potential buy signal. The 20-week moving average is closing in and about to experience a crossover with the 50-week moving average, historically one of the most trusted signals of a market bottom. Past performance is not necessarily an indication of the future, but in the previous occasions, the cross occurred from anywhere between 56 days before a bottom to ADA trading sideways for 84 days following the cross. Will history repeat itself?

Today’s market environment is different from historical bear markets following Federal Reserve balance sheet expansion rather than quantitative tightening.

Going from the balance-sheet bonfire to the crypto bonfire: Gambardello highlights the striking difference between the Fed’s trim of assets in the kicking-off in January of 2022 and the monetary fuel giving rise to the crypto rally today.

Thanks for reading Cardano Bitcoin on a Collision Course: What This Means Imapct On ADA Price