- *Cardano price falls nearly 15% weekly as Middle East tensions escalate following the US’s attack on Iran.*

- *The price drop in ADA wiped out nearly $17 million in long positions last week.*

- *On-chain data indicate that ADA profit-taking and dormant wallet activity are increasing, signaling growing selling pressure.*

Cardano (ADA) is in a deadlock around the $0.54 mark, still trying to recover from a 15% freefall recorded last week. Geopolitical tremors stemming from a massive escalation on the tension front in the Middle-East following the US strike on Iran have reverberated through the crypto domain. The indiscriminate panic selling resulted in leveraged buyers of ADA getting liquidated to the tune of $17 million. On the downside, clearly from the on-chain standpoint, profit-takers are becoming increasingly active, while dormant wallets seem to be waking up from their slumber, which do not bode well for ADA as the impending selling pressure seems set to stamp on it soon.

* Cardano price weakens as the US attacks Iran, rising global tensions *

Cardano falters as turmoil in the Middle East intensifies, a week-long shadow war between Iran and Israel degenerates into open conflict with a U.S. airstrike against Iranian targets late Saturday evening, and uncertainty courses through the ADA market.

US President Donald Trump announced that three nuclear facilities in Iran were attacked.

Global markets recoiled in fear as geopolitical tensions flared, and Bitcoin went down to a stomach-churning $98,200 on Sunday. Cardano registered the panic and crashed to levels not witnessed since the early optimism of February.

Cardano longs felt the grit as Middle Eastern tensions seized the market with jitters, putting the position into liquidation for almost $17 million in one week, stated CoinGlass data.

ADA total liquidation chart. Source: Coinglass

* Cardano’s on-chain metrics show a bearish bias *

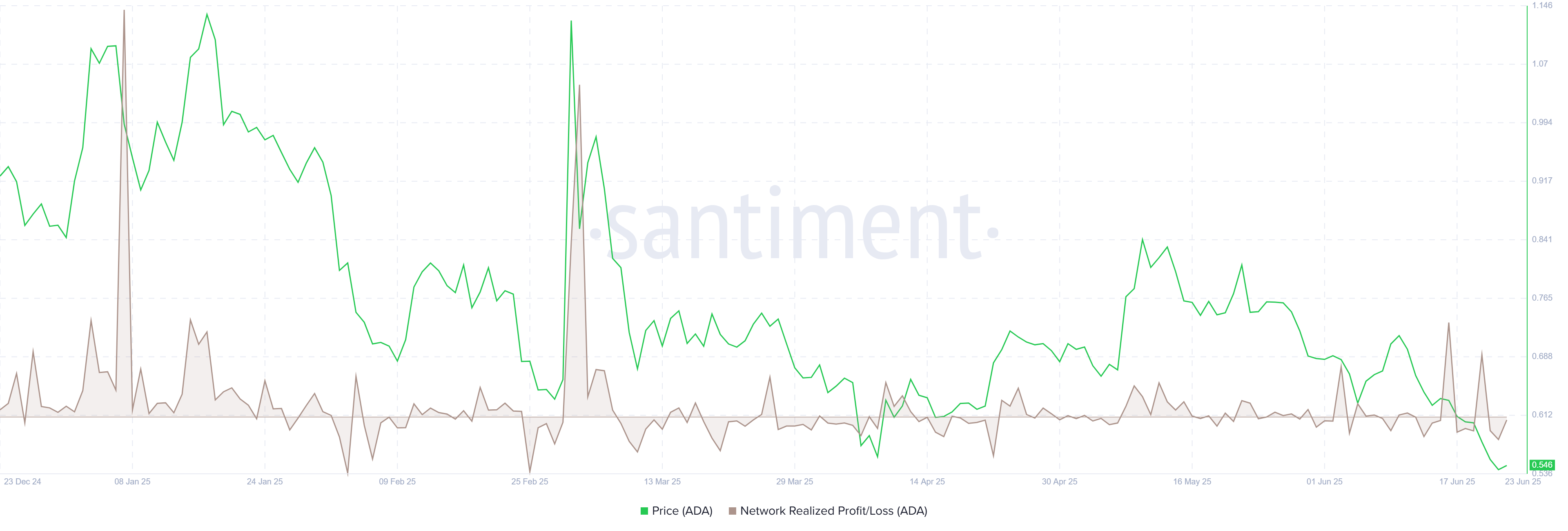

Santiments’ Network Realized Profit/Loss (NPL) metric indicates that ADA holders are booking some profit.

The NPL skydived on June 16th and, I’ve got to tell you, never hit such levels since Early March. Think of it as a huge profit-taking frenzy. A smaller explosion on Friday confirmed the trend: holders are cashing in, and selling pressure is mounting. The chart is a good narrative of all the profits being taken off the table.

Cardano NPL chart. Source: Santiment

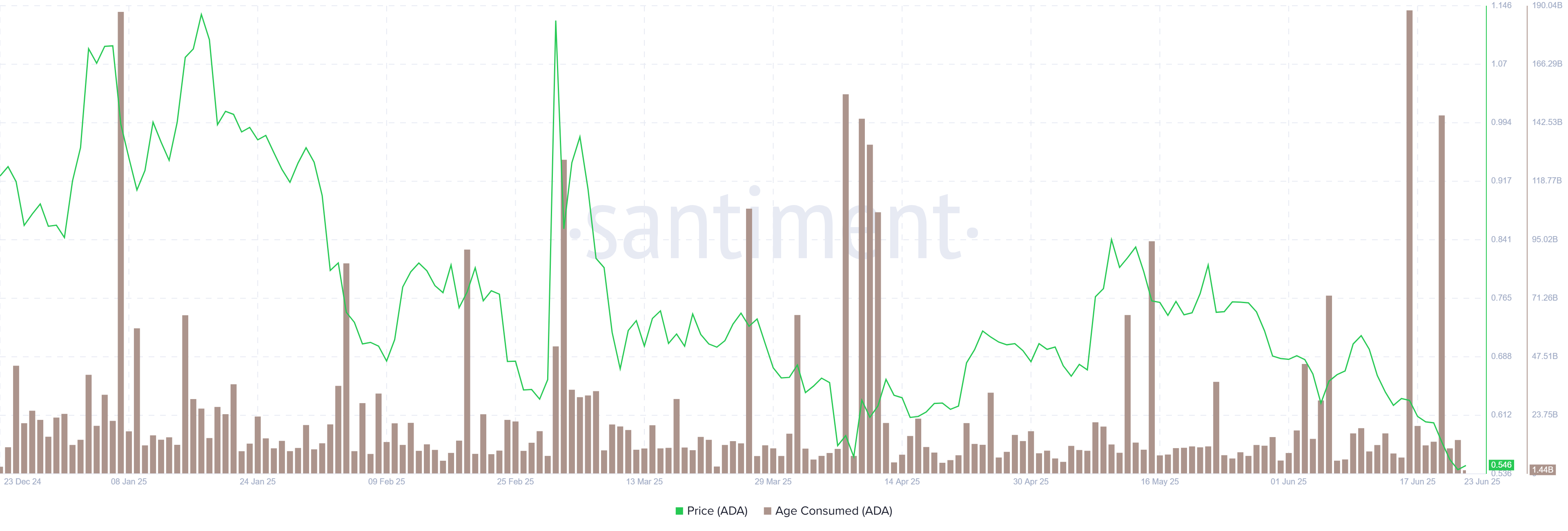

The Cardano Age Consumed index is flashing red. Past trends show that any spikes in this index, highlighting the movement of long-held and dormant ADA tokens, precede a price drop. Like awakening from hibernation, these “zombie tokens” make it to the exchanges and bring along their mountain of selling pressure. The rise in this index on Friday hints at the impending winds of change, maybe toward the end of ADA’s rally or perhaps a downtrend soon to be realized.

Cardano Age Consumed chart. Source: Santiment

* Cardano Price Forecast: ADA hits its lowest level since early February *

Although Cardano barely seemed to have time to entertain its bullish dreams, it crashed against its 200-day EMA on June 11th, opening a precipitous 25% freefall over 11 days. On Sunday, ADA scraped $0.51, chillingly reminiscent of the lows in early February. But there still was more pain to come, with last week’s breakdown beneath a crucial ascending trendline-a lifeline since November-confirming that the bears have indeed taken charge. Sitting at an uneasy $0.54 count (Monday), Cardano certainly faces an uphill struggle.

ADA is just standing on the edge of a cliff. Anything less than $0.49 spells trouble and could open the floodgates to a drop towards $0.45 in a big way. Keep an eye on that level – whenever it breaks, there comes a fast fall.

With a heavy price hit, the Relative Strength Index (RSI) cries “oversold” at a level of 26. Translation: The bears have had a feast. But there is still no need to panic. Oversold conditions mostly indicate a rally. But the MACD has another story to tell: bearish crossover in the daily chart coupled with a steadily growing red histogram below the neutral line means that the bears still might want to bite. This downward momentum may have more distance to cover.

ADA/USDT daily chart

However, if ADA recovers, it could extend the recovery toward its previous broken trendline level at $0.60.

Thanks for reading Cardano Price Forecast: ADA profit-taking and dormant wallet activity rise as BTC dips below $100K