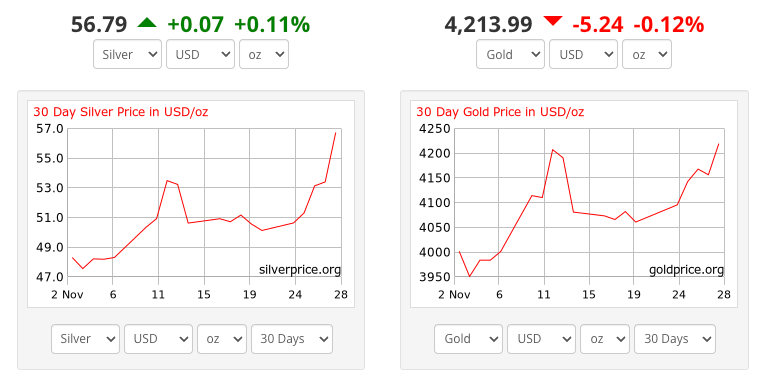

Gold glittered to a six-week peak Monday, while silver blazed to an all-time high, ignited by whispers of impending US interest rate cuts and a sinking dollar.

Silver Shines on Supply Squeeze

Gold blazed past $4,241, reaching heights unseen since October, but silver stole the show. The lustrous metal rocketed to a historic $58.83 before easing back, marking a year of unprecedented growth. Silver’s value has more than doubled this year, leaving gold’s already impressive 60% surge in the dust.

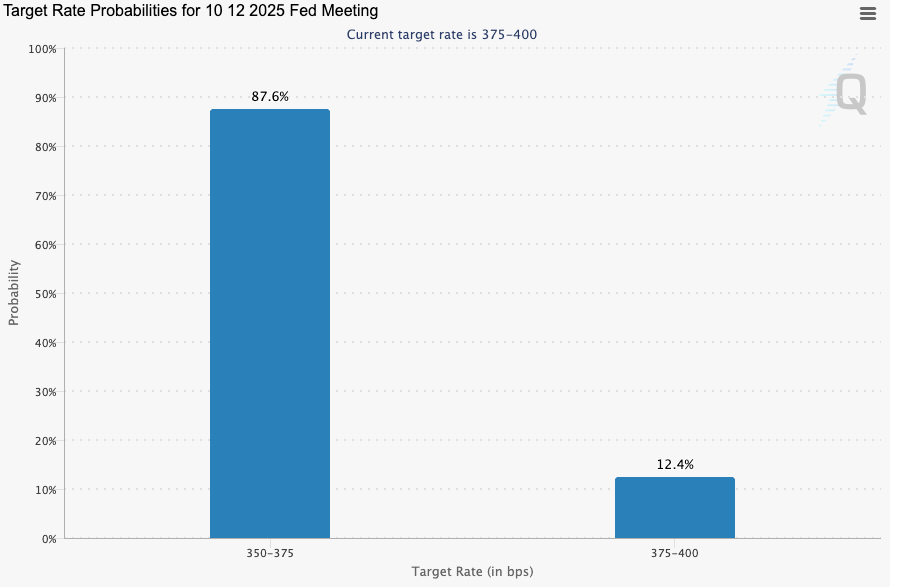

Fueling the market surge? The scent of lower interest rates. Wall Street is betting big on the Federal Reserve, with odds skyrocketing to nearly 90% for a rate cut this December. Forget a lump of coal – traders are dreaming of a festive 25-basis-point present courtesy of the Fed, leaving only a slim chance that rates will remain frozen in place.

Forget interest rates. Silver’s real story is a supply shock. London saw a metal migration in October, sucking in record amounts and leaving other vaults bare. Shanghai’s silver stockpiles? They’re scraping decade lows. And try borrowing silver – those costs are sky-high, a flashing red light for scarcity.

Source: CME FedWatch

The dollar’s recent dip to a two-week nadir has gilded the allure of precious metals, beckoning investors holding alternative currencies. Whispers of continued monetary easing, emanating from dovish pronouncements by Fed luminaries like Governor Christopher Waller and New York Fed President John Williams, are fueling this golden age.

Bitcoin Bucks the Trend

Bitcoin, once hailed as the “digital gold” of the 21st century, is now tarnished. Forget fortunes glittering recent trends paint a starkly different picture. Plunging from an October peak near $126,000, the cryptocurrency king now languishes around $86,000, a dizzying 30% drop that leaves investors reeling.

November’s ETF exodus saw $3.4 billion flee US Bitcoin funds, a stark reversal of fortune. December delivered another blow: a $9 million heist at Yearn Finance, sending shivers down the DeFi spine. But the tremors didn’t stop there. Bank of Japan’s Governor Ueda whispered of rate hikes, igniting fears of a global carry trade implosion. The final hammer? Over $1 billion in leveraged crypto positions vaporized in the recent market bloodbath.

Those who said that the bitcoin chart will follow gold in the future.

sorry, it seems that it is not as expected 😬 pic.twitter.com/7ai1FnNq3e DOMBA.eth 🐺 (@DombaEth27) December 1, 2025

Forget fleeting trends; gold and silver are gleaming amidst supply anxieties. While Bitcoin dances to the tune of ETF whims and leveraged trades, precious metals are propelled by a simpler, more enduring force: scarcity.

Bitcoin’s long-term prospects shine with anticipated rate cuts, yet immediate challenges cast a shadow, dimming its short-term appeal.

Thanks for reading 88% Chance of Rate Cut: Why Is Bitcoin Crashing While Silver Soars?