With Bitcoin stuck below $105,000 on Friday, SEI and KAIA experienced an unexpected surge even as traders seemed determined to be bullish with such a high-stake crypto derivatives expiration looming.

As global markets prepare for a tsunami of geopolitical and economic turbulence, altcoins face a potential witching-hour storm of quadruple magnitude. The storm clouds are brewing, but hope stays: Bitcoin can remain above the magical $104,000 level, and SEI and KAIA could win at long odds.

Table of Contents

- SEI and KAIA price analysis

- Market volatility in response to quadruple witching

- Trump-era optimism

SEI and KAIA price analysis

The SEI token bled more into thin air! Early trading on Friday, it flirted with a 20-cent mark $0.1948. The crypto market scene, though a roller coaster-type scene; with quiet stamina, SEI rose over $0.19 by a 6% in the past week, hinting at growing momentum. Will SEI just be another momentary blip with an upward motion, or could this finally be it for a big-time run?

SEI’s price oscillates between the potential downside and possible upside. Will it plunge below the bedrock of $0.1582 set during the June 17 lows? Or shall it break the resistance set at $0.2494, annihilating the huge “Fair Value Gap” signified on the daily charts? The war between SEI’s direction is being waged on.

If the price action of SEI is any hint, it could well be racing ahead soon with several bullish signals flashing across major technical indicators. The Relative Strength Index (RSI) is bouncing at the important 50 level, suggesting that renewed buying forces are at play. Adding to the optimism, the Moving Average Convergence Divergence (MACD) is showing increasing bullish momentum under the surface of SEI’s daily price trend, setting conditions for a probable breakout.

Eager SEI bulls have their eyes set on a daily close above R1, which would ideally trigger a surge towards $0.2750, the farthest high the SEI last touched on May 11. Will they be able to push on through?

SEI/USDT daily price chart | Source: Crypto.news

The SEI Wild Ride could pull a sharp correction into the market. Buckle for a potential liquidity grab near the support of $0.1303, as the SEI/USDT chart suggests a possible price correction.

KAIA: Is $0.20 the Next Stop?

The bullish momentum has been at play for KAIA, as it trades just above $0.19. Friday gained more than 2%, marking the end of an almost week-long rally that has so far seen the token climb just a little less than 9%. On the other hand, the KAIA/USDT chart is suggesting there is even more upside potential in store for the token. Will we, therefore, be seeing KAIA breaching $0.20 soon?

While back then, the RSI was considered to sell, since the level was comfortably over 70, the price courageously lingered above it. This prevented massive sell-offs. Also, the MACD showed growing green bars, which indicated strength on the buy and a latent upward movement underneath the surface.

At $0.2053, R1 appears to be the immediate gatekeeper, sitting at the upper edge of a Daily Fair Value Gap (FVG). Once that level is cleared, the pathway is open for a run towards the 2025 peak of $0.2665. Butcher, a warning to all the traders: R2 stands at $0.2525, equally pressure-packed before that final summit.

KAIA/USDT daily price chart | Source: Crypto.news

The knife edge is kept on the price of KAIA. A break below $0.08, recorded as its February 3 low, may plunge the price into liquidation cascade. Bulls, hold your horses: the lower boundary of the FVG at $0.1077 is the price’s last meaningful defense.

You might also like:

Here’s why the Kaia price has gone parabolic

Market volatility in response to quadruple witching

The crypto streets bleed, but the question is if the witching hour is truly over. In a 24-hour span, the market cap lost 2.3% due to that dreaded quadruple witching day that rocked the chairs. Traders got tight, thinking of value spasticity in Bitcoin and altcoins. But itseemsthat after-the-storm scenario was, a bulk of altcoins actually closed the week on a positive note! Well, hold your victory dance. From afar, a geopolitical storm is brewing, ready to suck up liquidity from the market and send trader sentiment into decline. The weekend could change the entire script.

Crypto markets shrugged off innumerable tariffs, wars, and indeed even missiles. Now, can this resilience come to stay through the callous floods of volatility expected this weekend? The clamorous response from the market remains a cliffhanger with world consequences.

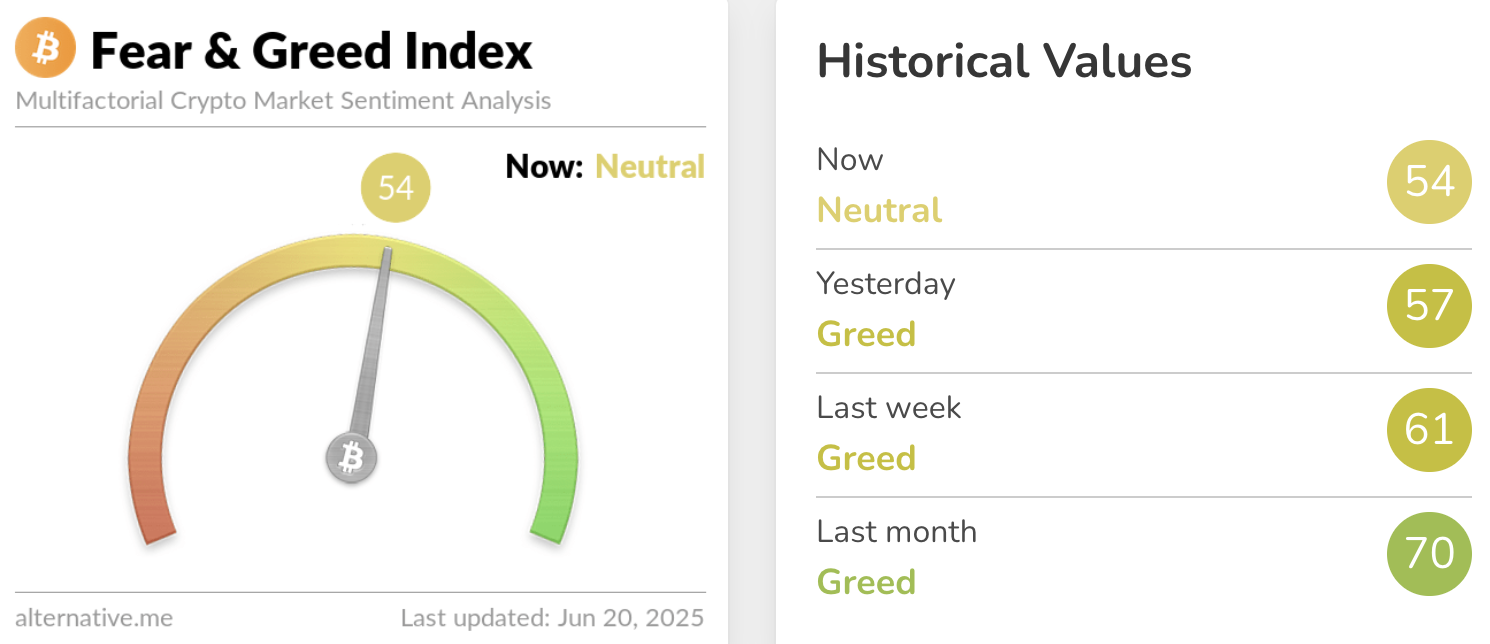

Friday’s market mood? A perfect fifty-four. Traders are sitting on the fence, not charging ahead into bullish frenzy nor running scared. This paints the picture of a market holding its breath in anticipation of the next big catalyst.

Crypto Fear & Greed Index | Source: Alternative

You might also like:

Best crypto to buy ahead of Friday’s $6.5b triple witching

Trump-era optimism

Trump winning and Bitcoin highs could fill in the life raft for the altcoins in times of storm; the wave of optimism was going out. Terror envelops the traders as Bitcoin defies the $100,000 level, standing against the ever-rising tension between Israel and Iran.

Despite a brewing storm in global macroeconomic areas, the crypto traders seem to remain calm. Is this because of the GENIUS Act of the Senate? Has Ripple’s victory against the SEC restored faith? Or is it something as thinly veiled as going easy on crypto?

Altcoins are walking the thin tightrope in this $1.09-trillion market cap region that serves up much crucial support. Can they defy this gravity? If the bulls hold onto this level, SEI and KAIA might emerge victorious from this fleeting storm, intact with their hard-earned gains. The fate of the altcoin kingdom remains on the scale.

Listen up! We exist to enlighten, not dictate your journey in issues of money. These messages are purely for informational purposes and should not be mistaken for investment advice.

Thanks for reading Chart of the week: SEI and KAIA eye potential bullish breakout