A heavy bloodbath came through the crypto market: Bitcoin and some other digital assets nosedived, emitting huge waves of long-liquidations that took their fair share of leveraged traders.

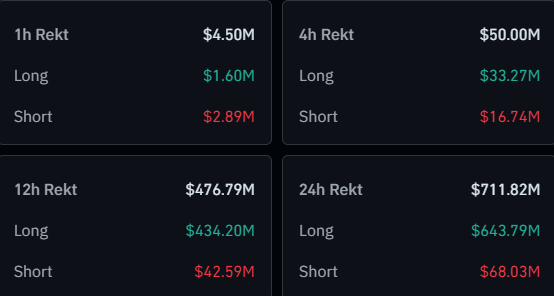

Crypto Liquidations Have Surpassed $712 Million Over The Past Day

Bitcoin’s wild ride in the last 24 hours unleashed a tsunami of liquidations on the derivatives market, CoinGlass data reveals.

Below is a table that shows how the liquidations have looked for the cryptocurrency sector within this window.

Overnight, $712 million worth of crypto futures were wiped out, liquidated on only one platform. That is to say, the massacre in the last twelve hours alone saw liquidations of an enormous $477 million towards that $712 million wipeout.

Bitcoin along with its altcoin brethren is bleeding. Long positions are in for a massacre. Buyers are destroyed, that is, over 90% have been liquidated in the recent carnage.

Picture it: the opposite of dominoes falling in the crypto market, with seismic waves bringing down the mountain of leverage. That’s a “squeeze,” and this recent massacre? A textbook “long squeeze.” Consider it a rug pull-cartel style. The immediate panic buyers getting sold off results in cascading liquidations, which you might call a mountain of finance. Every liquidation feeds on the downward spiral and more volatility gets sucked in by anyone who dared to short the price. Buckle up for a thrilling ride.

As for which of the individual tokens contributed the most to the long squeeze, the heatmap below shows it.

The harsh crypto winter affected Bitcoin and Ethereum, with a total $337 million in liquidations. Bitcoin alone was responsible for a staggering $221 million, and Ethereum faced $116 million in liquidations.

Rather than XRP, SOL picked the bronze medal! With its smaller market cap, $32 million liquidation cascade possibly came into being by a marginally steeper price fall than that faced by the rival.

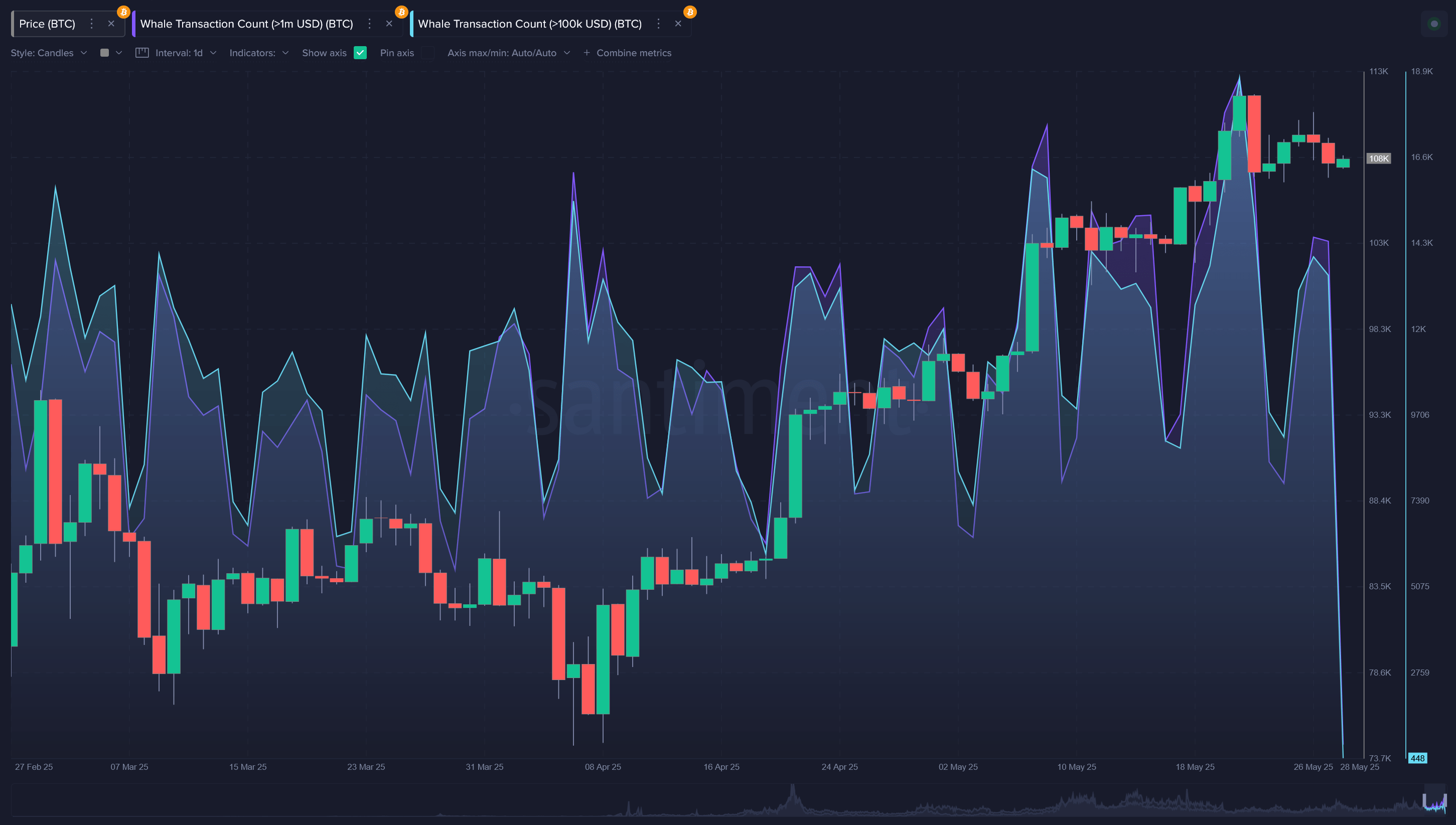

Bitcoin’s current slide has not been an overnight tumble but rather a descending slide, starting weeks ago. That $112,000 high on May 22nd is never a number; it stands for the pinnacle before the downward thrust. An on-chain study by Santiment revealed that the story went downhill from that apex as whale activities spiked.

Ever think about what the major players do with these Bitcoins? The “Whale Transaction Count” indicator shows this and goes further, presenting the daily rhythm of monster Bitcoin transfers occurring somewhere on the network. It literally goes behind the scenes at the movements of crypto’s top holders.

Bitcoin bulls, hence, might encounter some difficulty. Moving big whale transactions, those that exceed $100,000 and even $1 million, picked up momentum earlier this month. This surge means the heavy players were cashing out, potentially establishing a price ceiling for Bitcoin.

Bitcoin Price

Earlier today, Bitcoin flirted with danger by falling briefly below $105,000. But do not yet sound the alarms, please! As the king of crypto, it then made a small comeback, trading currently at around $105,800. Will it be a dead cat bounce, or have we seen the start of an upswing? Time will tell.

Featured image from Dall-E, Santiment.net, CoinGlass.com, chart from TradingView.com

Thanks for reading Crypto Bulls See $644M Bloodbath As Bitcoin Dips Below $105000